Investment Thesis

Magellan Midstream Partners (NYSE:MMP) deals in crude oil and refined petroleum products. The company has a remarkable history of consistent dividend payouts which makes it an attractive stock to hold in a portfolio to reduce the recessionary impacts on the portfolio. It has also delivered its financial results and performed well in terms of revenue.

About MMP

MMP is a partnership firm that mainly engages in the storage, transportation, and distribution of crude oil & refined petroleum products in Tulsa, Okla. The company conducts its business in two operating segments: Refined Products and Crude Oil. The Refined Products segment consists of a pipeline system of around 9,800-mile refined petroleum products including 54 terminals and 2 marine storage terminals. This pipeline covers a 15-state area starting from the Texas Gulf Coast and also linked with other interstate pipelines which makes the system strong to access about 50% of U.S. refining volume. This segment contributes 74.8% to the company’s total revenues. The Crude Oil segment consisted of crude oil pipelines of approximately 2,200 miles and a condensate splitter. It also includes storage facilities comprising a storage capacity of approximately 39 barrels. The joint ventures in this segment are HoustonLink Pipeline Company, BridgeTex Pipeline Company, Saddlehorn Pipeline Company, Seabrook Logistics, and Double Eagle Pipeline. This segment generates 25.2% of the company’s total revenues.

Financials

MMP has recently reported its financial results for the second quarter. The company reported revenue of $877.2 million which is increase of 11.23% from $788.6 million in Q2FY22. This growth was mainly fueled by a decent increase in both transportation and product sales revenues. Refined Products segment revenues surged by 11.65% and Crude Oil segment revenues declined by 5.02% compared to the previous year’s same period. MMP reported net income of $238.7 million which is dramatic decrease of 32.55% compared to $353.9 million in the Q2FY22. Decreased net income resulted in diluted net income per share of $1.18 compared to $1.67 in the same quarter of the previous year. It reported distributable cash flows of $312 million, up 36.84% compared to $228 million in Q2FY22. Free cash flows stood at $271 million. The firm reported cash and cash equivalents of $128.4 million.

The energy industry experienced a significant downturn during the pandemic and the growth was later hampered by the supply chain obstacles arising from the geo-political issues of Russia and Ukraine. However, it is observed that the industry is rebounding significantly and experiencing rapid growth in demand. Refinery crude throughput estimates for 2023 and 2024 have been raised by 130 kb/d and 90 kb/d, respectively, to 82.5 mb/d and 83.5 mb/d which reflects a positive growth factor for the participants operating in this industry. Identifying these growth opportunities, the company is highly focused on expanding its refined products pipeline which can significantly help it to cater to the rapidly growing demand and capture the additional market share by expanding its profit margins. The company is working extensively to complete the 30,000 barrel-per-day expansion of its refined products pipeline to El Paso, Texas. The new 16-inch, 30-mile pipe between Odessa and Crane, Texas, has been completed, with enhanced operational storage to meet incremental shipments presently under construction. I think that this development can considerably assist the firm in establishing a strong position in a competitive market and increasing its access to the country’s refining capacity. I believe these expansions can potentially help the company to increase its cash flows and further increase its dividend payout. The company’s future growth may be anticipated to be stable due to favorable industry trends and its expansion plans. It has also provided its guidance for the third quarter and FY23, which represents an optimistic outlook for the company’s growth. It forecasts the annual EPS to be around $5.05. In addition, it projects the third quarter can be $1.15 per share. Distributable cash flow is estimated to reach $1.26 billion in the current fiscal year. I think the company’s estimates are correct looking at the current growth factors.

Dividend Yield

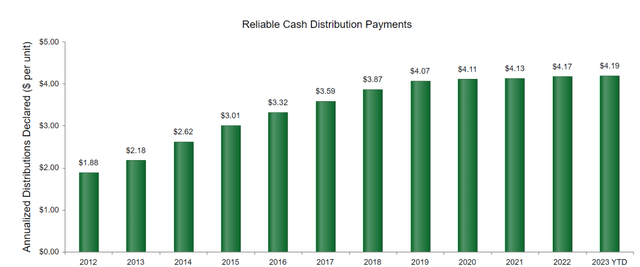

The firm has experienced 21 years of continuous dividend growth which indicates its healthy market position. The company paid a cash dividend of $1.0375 in each of the first three quarters of 2022 and $1.0475 in the fourth, which accounted for a total annual payout of $4.16 per share and a dividend yield of 6.48%. It distributed a $1.0475 dividend in each of the first three quarters of the current fiscal year, and given the company’s strong cash positions and growth prospects, I believe it can maintain its quarterly dividend of $1.0475 in the last quarter as well, representing a high dividend yield of 6.53%. I think this attractive dividend can help investors to mitigate the risk arising from recessionary pressures.

Dividend Payment History of MMP (Investor Relations of Magellan Midstream Partners)

What is the Main Risk Faced by MMP?

The company highly depends on refineries, gathering systems, and petroleum pipelines owned by third parties to supply its assets. If the quantity or quality of this crude oil production changes or if there are any disruptions in the throughput on these pipelines and gathering systems due to reasons such as line repair, testing, competitive forces, and other weather-related causes, it can negatively affect the company’s operations and reduce its shipments. These disruptions might also limit its cash flows by further contracting its profit margins.

Valuation

The demand has rebounded in the industry in the current year and I believe the company is also well-position to cater to the growing demand as it is constantly focused on expanding its pipeline system. After considering all the above factors, I am estimating EPS of $5.07 for FY2023 which gives the forward P/E ratio of 12.64x (share price: $64.10). After comparing the forward P/E ratio of 12.64x with the sector median of 11.50x, we can say that the company is overvalued. However, the company’s impressive dividend payout makes it an attractive opportunity for investors to protect their portfolios in these recessionary times.

Conclusion

The company has tremendous growth potential due to favorable industry trends and its vigorous expansion activities. It is exposed to the risk of supply chain disruptions which can further contract its profit margins. The stock is overvalued at the current share price, however, its attractive dividend yield makes it an attractive stock to hold in the portfolio to mitigate the recessionary impacts on the portfolio. After considering, all the above factors, I assign a hold rating to MMP.

Read the full article here