Beyond Meat’s (NASDAQ:BYND) second quarter results were extremely weak, with a reduction in operating expenses the only bright spot. While management remains upbeat about the company’s prospects, the balance sheet is deteriorating and there are questions regarding consumer demand. If margins do not improve dramatically in the coming quarters, the stock is likely to face ongoing downward pressure.

Revenue was down significantly YoY in the second quarter and Beyond Meat’s gross profit margin was once again near zero. Management attributed much of this to category headwinds and one-time hits to margins. This has been a repeating pattern over the last few years, though, and it is not clear why investors should expect Beyond Meat’s prospects to turn around in the second half of the year. Operating expenses were down significantly both sequentially and YoY though as cost-cutting initiatives are beginning to yield benefits. While cash burn has improved significantly over the past year, Beyond Meat faces the unenviable task of trying to improve margins while prices are declining rapidly, costs are elevated, and volumes are fairly stagnant.

Consumer Demand

While Beyond Meat’s financials are poor, the most concerning aspect of recent earnings could be the time that management allocates on each earnings call to discuss consumer perceptions of the plant-based meat category and the health benefits of its products. This is a clear indication that sales are struggling in the face of negative consumer sentiment, and the situation does not appear to be improving.

Beyond Meat believes that interest groups have seeded doubt about the ingredients and processes used to produce plant-based meats. The company also continues to insist that its products offer health benefits over comparable meat products. It is difficult to see Beyond Meat succeeding if health concerns are genuinely a problem at this point. Adoption is currently low, and early adopters are more likely to overlook product issues if they have ethical or environmental concerns about consuming meat.

Consumers who are purchasing burgers, sausages, and chicken nuggets are unlikely to be overly health conscious and many products succeed despite being bad for consumers, like soda. Taste and price are likely to be far more important considerations for most consumers. Beyond Meat continues to iterate on its products, but it is not clear how much more room for improvement there is. The company is also struggling to bring production costs down, which is essential for wider adoption.

Consumer Spending Power

Beyond Meat has also suggested that inflation and higher interest rates are pressuring consumer spending. This seems likely, but it also suggests that Beyond Meat’s problems could get worse going forward.

Costco (COST) recently stated that its customers were trading down from beef to chicken and pork, which has been a common trend during past recessions. Consumers have also been switching from fresh meat to canned products, and the portion of sales coming from private label brands has increased. It would be reasonable to expect consumers to switch from plant-based meats to other proteins in response to the same pressures.

Coming out of the pandemic consumers generally had extremely strong balance sheets (high savings and low debt) but this situation has been reversing rapidly. Either wage growth will need to outpace inflation for an extended period of time, or spending will need to fall from current levels. This situation is likely to be exacerbated when student loan repayments recommence, and this is something that could disproportionately impact Beyond Meat’s customer base.

Financial Analysis

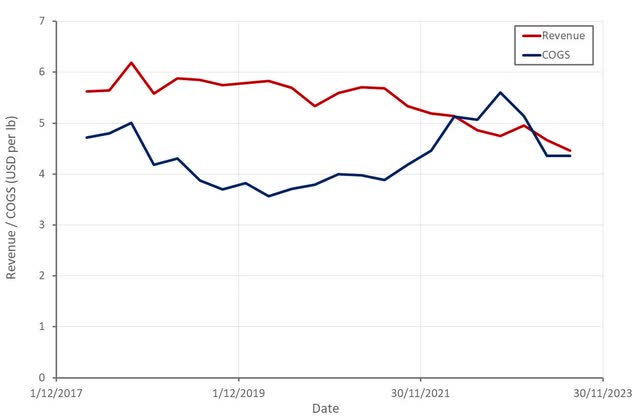

Beyond Meat’s revenues declined by roughly 30% YoY in the second quarter, driven by a combination of lower volumes and less revenue per pound. Beyond Meat attributed the volume decline to category weakness and the cycling of a difficult comparable period in 2022. The decrease in revenue per pound was due to changes in the product sales mix and increased discounts, partially offset by pricing changes.

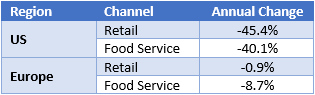

The US was particularly weak across channels for Beyond Meat in the second quarter, reflecting weak demand and the impact of elevated retail sales in 2022 on the back of the launch of Beyond Meat Jerky. Beyond Meat also suggested that increased competition contributed to weakness but the impact of this was relatively minor.

Table 1: Beyond Meat Sales Growth by Channel (Created by author using data from Beyond Meat)

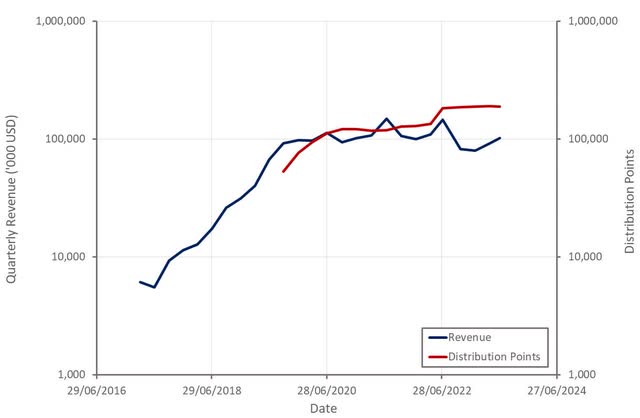

Beyond Meat’s performance continues to disappoint, and the company continues to put forward reasons for weakness. While the macro environment has been difficult over the past few years, Beyond Meat’s revenue has been fairly flat for three years. At some point, the company needs to take ownership of the fact that it hasn’t been performing, even if the macro environment has been difficult.

Figure 1: Beyond Meat Revenue (Created by author using data from Beyond Meat)

Lower material costs, lower inventory reserves, and lower logistics costs aided Beyond Meat’s gross profit margins in the second quarter. This was offset by higher manufacturing costs, which included the impact of higher cost inventory produced in the fourth quarter of 2022 flowing through the income statement. A reduction in tolling fees was offset by underutilization fees on the back of soft demand and delays to the ramp-up of production lines at a new co-manufacturing site.

COGS benefitted from a change in the estimated useful life of manufacturing equipment in the second quarter, which reduced depreciation by 5.1 million USD. This doesn’t impact cash flows, though, and hence is not really relevant to Beyond Meat’s current predicament.

Beyond Meat also appears set to lean on pricing more to try and restore margins going forward. Management suggested that based on pricing exercises over the past 12 months, they now have a better understanding of demand elasticity, which will enable them to price more aggressively. This seems questionable though given the competition and demand issues Beyond Meat has faced over the past few years.

Figure 3: Beyond Meat Revenue and COGS per Pound (Created by author using data from Beyond Meat)

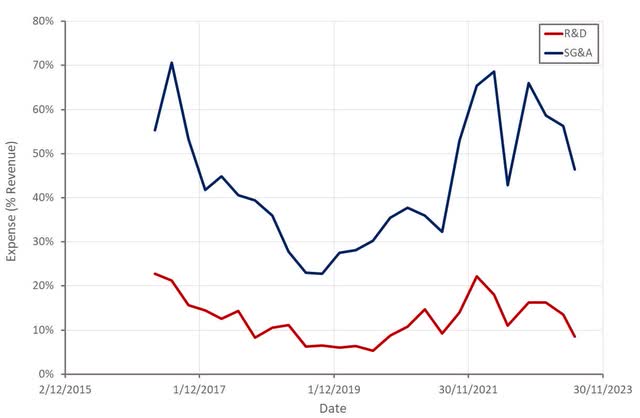

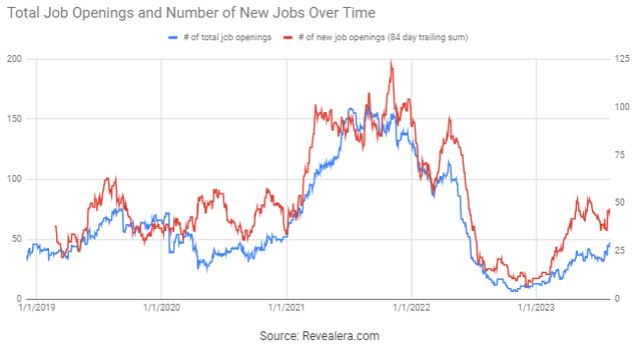

Beyond Meat continues to make solid progress on reducing the burden of operating expenses. This is impressive given that the company is trying to do this while revenues are flat/declining. Beyond Meat still has a way to go before operating expenses reach a point where breakeven is a legitimate possibility, though. Hiring appears to have picked up again in recent months, which could pressure margins if sales remain weak in the second half of the year.

Cash consumption should be significantly less than operating losses in the second half of the year though as Beyond Meat continues to draw down inventory levels. Management has also suggested that some CapEx projects could be deferred to help preserve cash.

Figure 4: Beyond Meat Operating Expenses (Created by author using data from Beyond Meat) Figure 5: Beyond Meat Job Openings (Revealera.com)

Beyond Meat now expects 360-380 million USD net revenue in 2023, which will require a significant improvement in growth in the second half of the year. Gross margins are expected to be in the mid to high single-digit range for the full year. This implies that gross margins will return to double digits in the second half of the year. This seems feasible given the recent shift in accounting policy and the flow of lower cost inventory through the income statement. Operating expenses are expected to be under 245 million USD in 2023, which probably means that operating expenses will be flat or could even begin to rise in the second half of the year.

Conclusion

Trying to reduce losses with stagnant volumes and falling revenue per pound is a tough ask. Some of this may be due to a soft macro environment, but there also appears to be category-wide demand issues and a high level of competition.

Beyond Meat’s balance sheet means that it only has a limited runway in which to turn its fortunes around. The company has only made modest progress so far, though, with revenues continuing to fall and gross profit margins still near zero. Operating expenses have fallen significantly though, and Beyond Meat’s elevated inventory levels are helping the company to preserve cash. Unless the company can begin to reduce COGS per pound significantly, it is hard to see the company succeeding long-term.

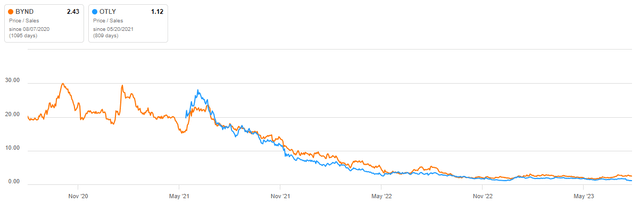

In terms of valuation, Beyond Meat is far from cheap given the uncertainty around the company’s viability. Given ongoing pricing pressure and an inability to drive more widespread adoption, Beyond Meat is only deserving of a low multiple, even if bankruptcy is avoided. Oatly (OTLY) is a company facing similar issues to Beyond Meat but appears to be better off in terms of growth, profitability, balance sheet strength, and competitive positioning. Despite this, Oatly trades at a significant discount to Beyond Meat.

Figure 6: Beyond Meat Relative Valuation (Seeking Alpha)

Read the full article here