Since my last article, SoFi Technologies (NASDAQ:SOFI) has climbed more than 45%. I still believe the second half of the year will be the pivotal point for the digital bank due to the return of student loan payments next October. While the Q2 earnings were a mixed bag for me, the company still had a pretty decent quarter with a revenue beat, adding members at an above-average rate, and impressive growth in loan originations. Looking at the bigger picture, the digital bank quadrupling its market share of new checking accounts opened is a great indicator of its future growth, especially since it outpaced other digital banks, which is why I’m reiterating my SoFi strong buy rating.

SoFi’s Growth

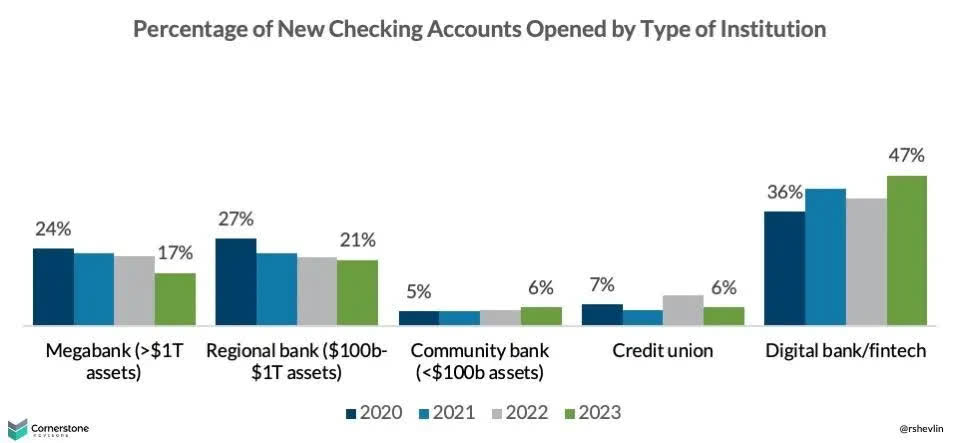

According to a study released by Cornerstone Advisors, American digital banks have increased their share of new checking accounts opened in 2023 to 47%, while regional banks and megabanks have declined to 21% and 17% respectively.

Cornerstone Advisors

While this by itself would be a great indication of the future of SoFi and digital banking, what is more impressive is SoFi quadrupling its market share from 1% in 2020 to 4% in 2023. With that, SoFi would’ve bypassed Wells Fargo (NYSE:WFC), which has seen its share of accounts opened drop from 8.1% to 3.5%.

While this doesn’t necessarily mean that people are ditching mega banks in favor of digital banks since you can have an account in more than one bank, it indicates that people are more open to the idea of digital banks. That is probably due to the bulk of new accounts belonging to relatively young customers, with 72% of new checking accounts belonging to Gen Z and Millennials. With more than 28.87 million Gen Z Americans under the age of 18, this number will further increase since 4 million Gen Z-ers open bank accounts per year.

Q2 Overview

|

Q2 2023 |

|

|

Members Added |

584 |

|

Members |

6,240 |

|

Adjusted Net Revenue |

$488 |

|

Revenue/Member |

0.080 |

|

Operating Expenses |

$547 |

|

Net Income |

-$48 |

|

EPS |

-0.06 |

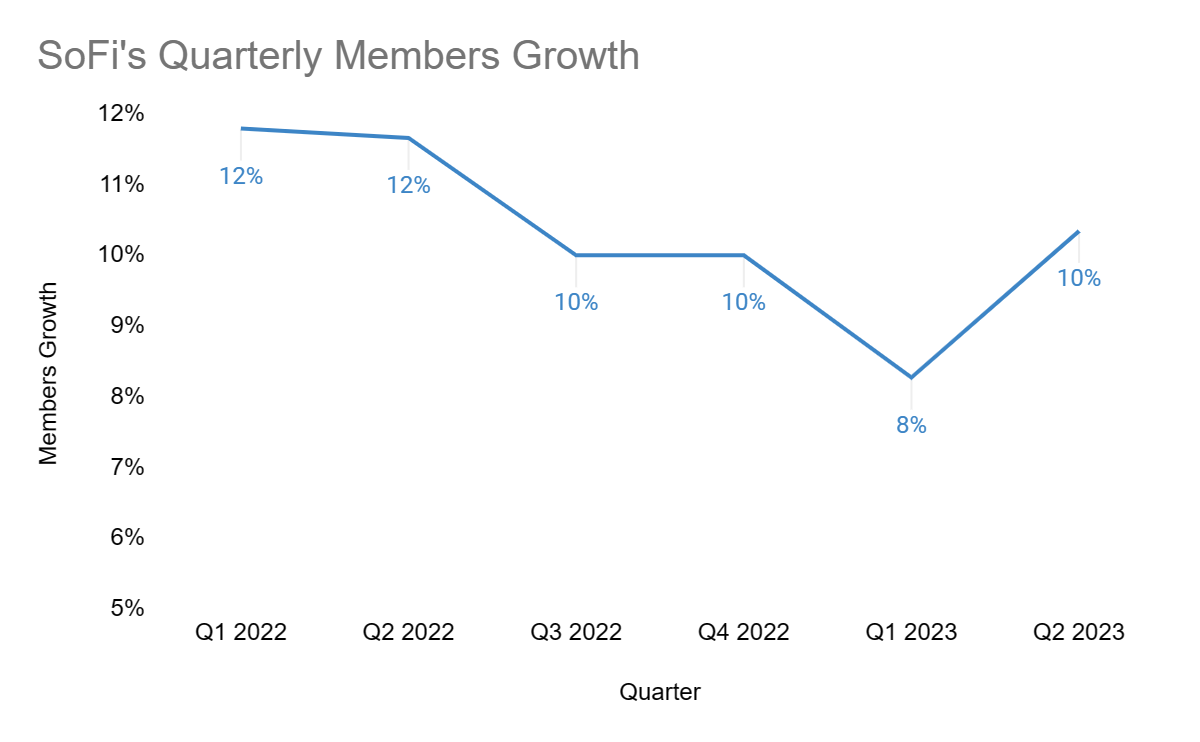

SoFi achieved $488 million in adjusted revenue, added 584 thousand new members in Q2 2023 and met analysts EPS estimate of -$0.06. The $488 million adjusted net revenue came more than $8 million above the management’s high end forecast of $480 million. At the same time, the 580 thousand added members stopped a starting trend of a slower sequential members growth that the digital bank was suffering from since Q1 2022.

SEC Filings

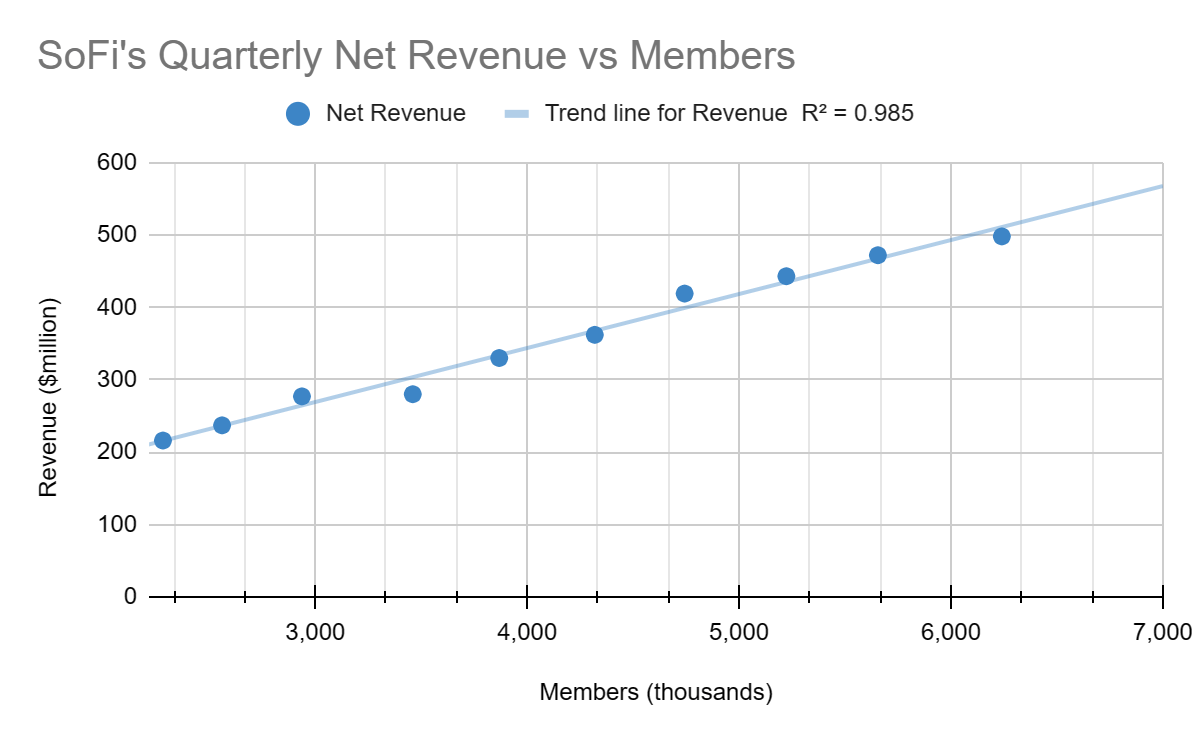

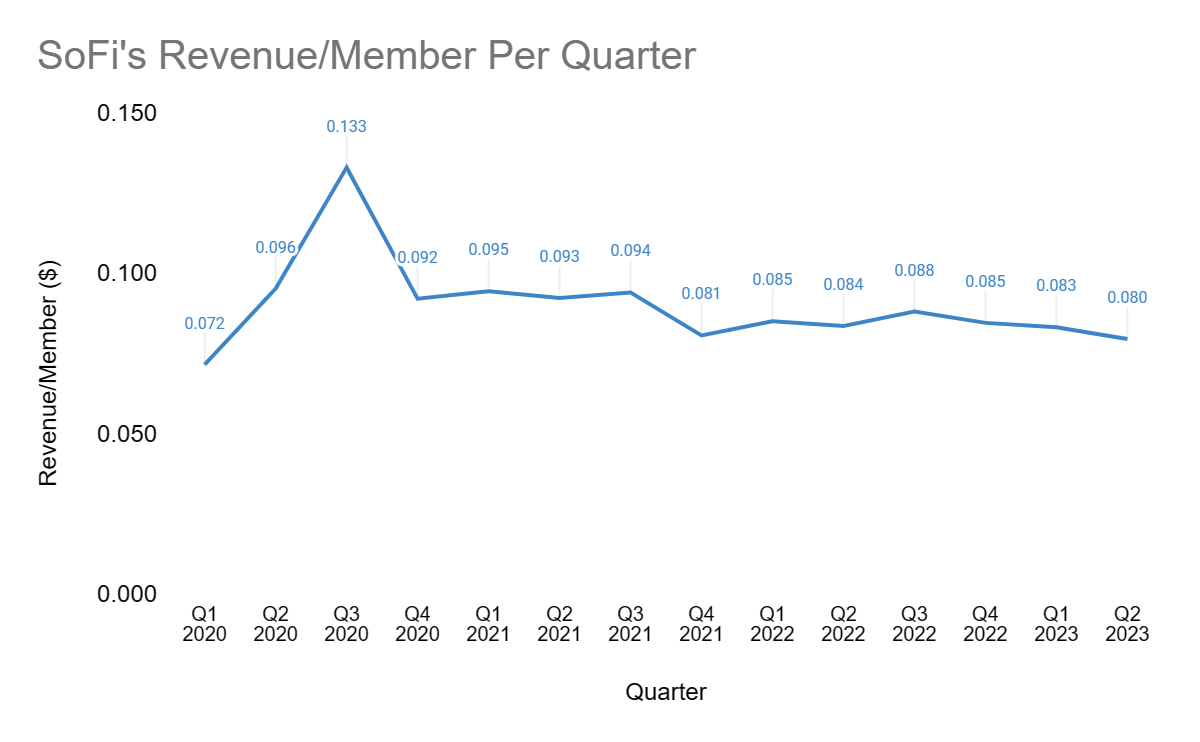

While the revenue beat is good news for SoFi, I believe it should’ve realized more revenue based on the 580 thousand members added, since there’s a strong correlation between its total members and its revenue.

SEC filings

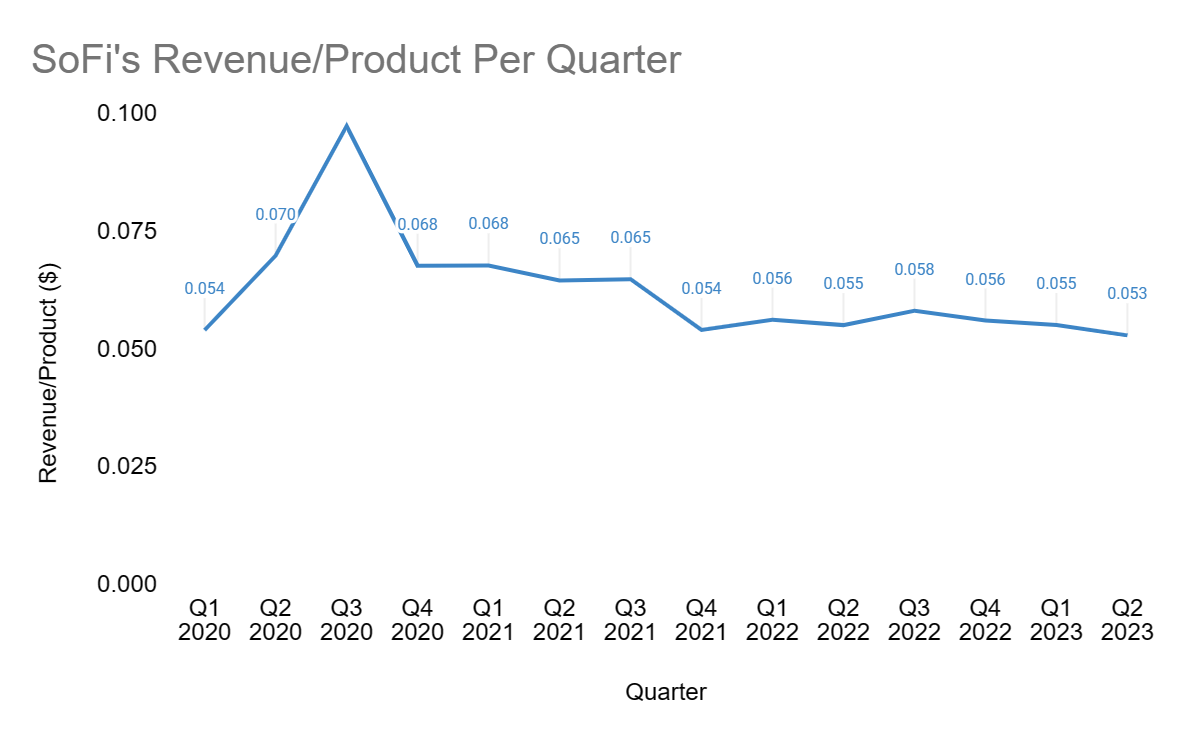

Furthermore, In Q2 2023 SoFi recorded its lowest revenue per member since Q1 2020 and it represents the third consecutive quarter of decline in revenue per member. A similar trend can be seen in the revenue per product chart.

SEC Filings

SEC Filings

That said, I believe that the decline can be attributed to the rising interest rates, from 3.25% at the start of Q4 2022 to 5.25% at the end of the second quarter. So I believe the revenue per product or member should start improving again if the Fed starts to cut interest rates in the future.

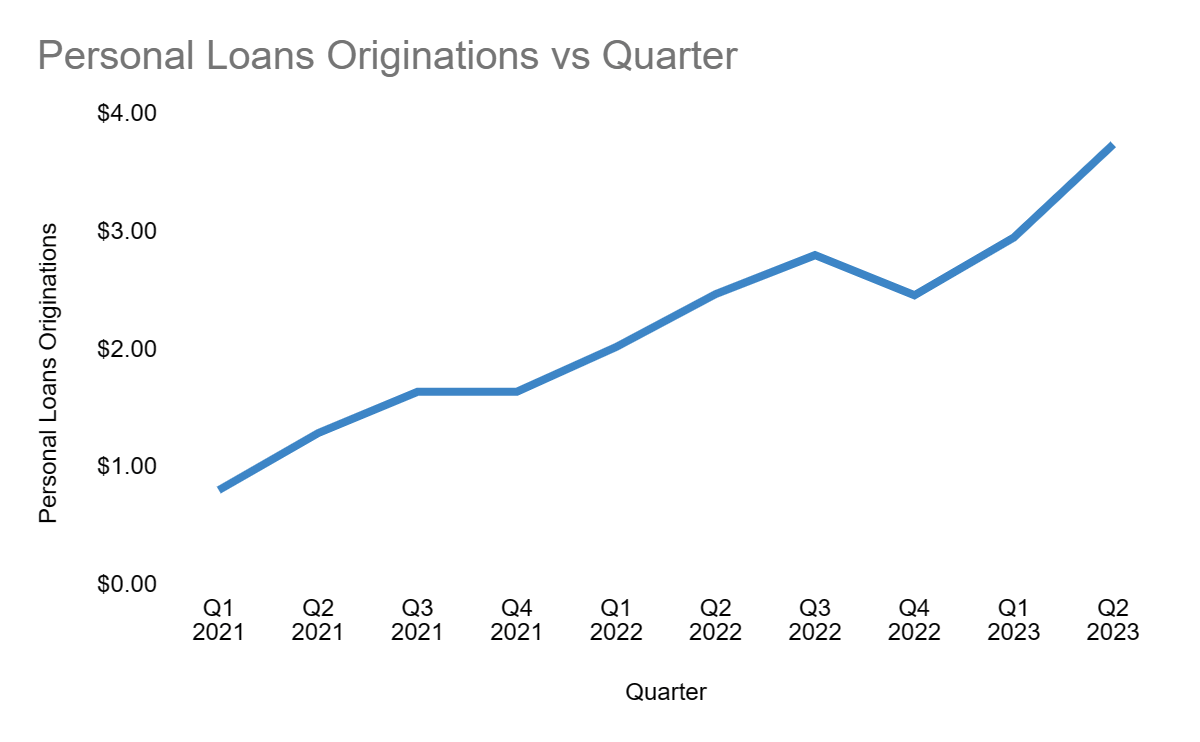

With that out of the way, we can talk about SoFi’s loan originations for the quarter which for me is one of the quarter’s highlights. SoFi grew its total loan originations YoY by a whopping 37%. While home loan originations declined by 37%, it isn’t really a big deal since it only makes around 5% of its loan originations. What is impressive is the digital bank maintaining the 50% growth in personal loan originations for the third consecutive quarter now and reaching a record personal loan originations of $3.7 billion.

SEC Filings

Student loan originations remained relatively flat at $395 million, which makes sense as student loan payments are yet to resume and we should see its effects starting from Q3 2023, since people should start refinancing their student loans in late Q3 with payments starting in October.

Second Half Surprise?

I believe the second half could bring a surprise for SoFi with the return of student loan payments. I project SoFi’s member growth numbers to stay relatively flat due to the natural YoY deceleration being offset by the possible increase in members due to the return of student loan payments.

A 44% YoY growth would see SoFi’s members at 6.8 million. Since we already established that there’s a strong correlation between SoFi’s members and its net revenue, we can project its Q3 net revenue to be around $555 million.

Furthermore, SoFi has maintained its noninterest expenses growth in the low 20s for the past three quarters, so we can project Q3 noninterest expenses growth to be around 22.16%, which would make the noninterest expenses projection around $589 million.

|

Quarter |

Noninterest expense(million) |

Noninterest expense growth |

|

Q4 2022 |

$480 |

23.71% |

|

Q1 2023 |

$500 |

21.95% |

|

Q2 2023 |

$547 |

22.37% |

|

Q3 2023 |

$589 |

22.16% |

With these numbers, we can then project SoFi’s net loss to be around -$34 million or an EPS of -$0.05.

|

All in millions except EPS |

|

|

Members |

6.83 |

|

Net Revenue |

$555 |

|

Revenue/Member |

0.081 |

|

Operating Expenses |

$589 |

|

Net Income |

-$34 |

|

EPS |

-$0.035 |

I believe SoFi will reach profitability in Q4 as the student loan payments will resume in October with Q3 providing a nice setup for this goal.

Risks

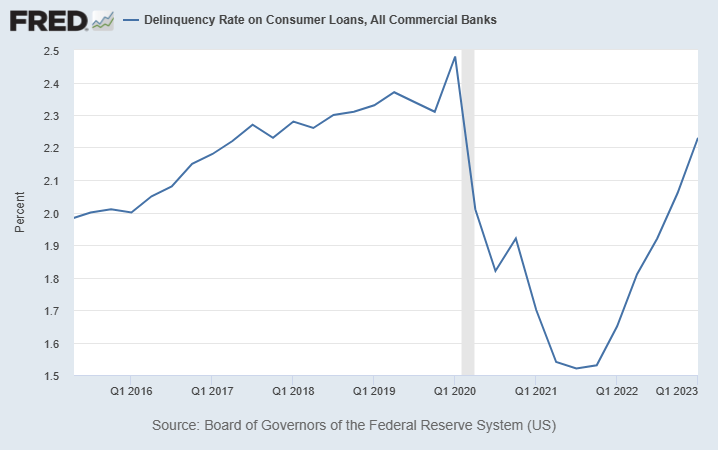

One of the biggest risks facing any bank is the delinquency rate of its customers. Delinquency rates have been climbing since the start of 2022 and are approaching pre-pandemic levels; if that continues, it will put banks’ revenue at risk. While SoFi’s personal loan borrowers have a pretty high average income of $164,000 and a high weighted average FICO score of 769, delinquency is still a risk to take into consideration.

Fred

Another risk is the Fed’s Chair Jerome Powell saying that he doesn’t see inflation reaching 2% before 2025. This may imply that the Fed won’t cut interest rates before 2025 meaning that SoFi’s revenue per member could continue to slide even further.

Technical Analysis

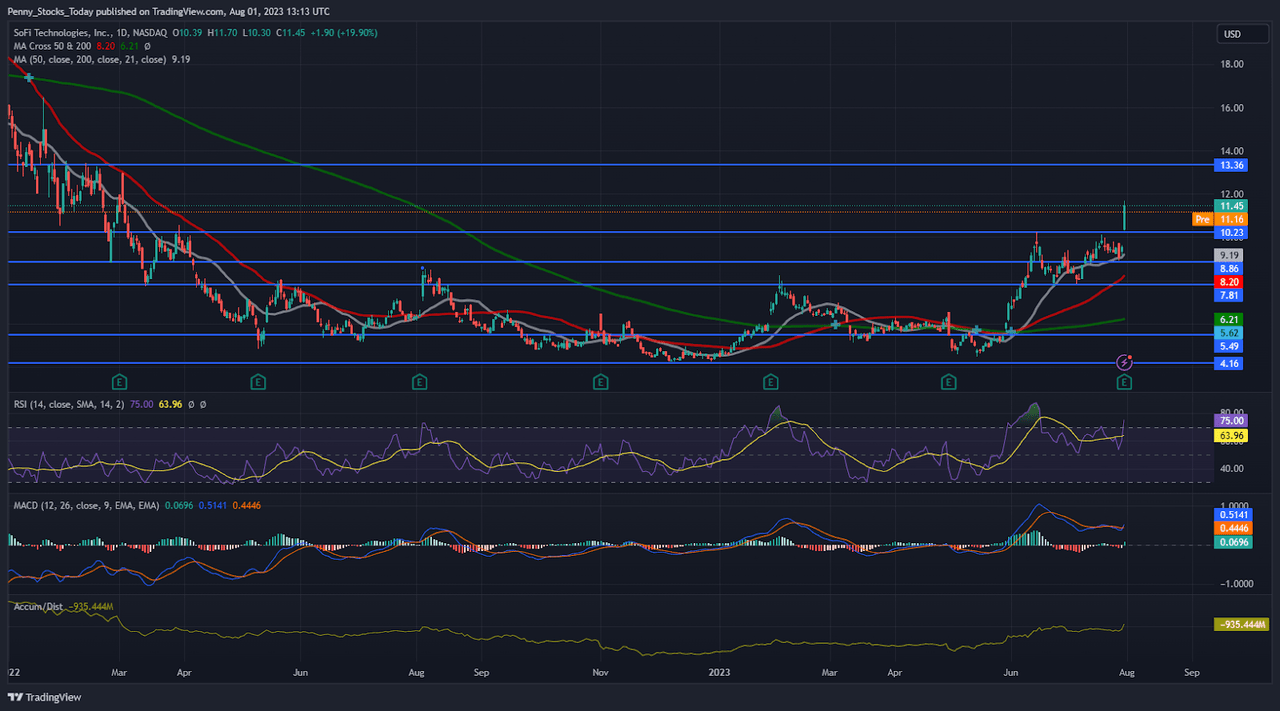

Tradingview Chart

Looking at the daily chart, SoFi’s trend is neutral, with the stock trading in a sideways channel between $7.81 and $10.23. As for the indicators, the stock is trading above the 21, 50, and 200 MAs, which is a bullish indication. Meanwhile, the RSI is overbought at 75 and the MACD is bullish. It is also worth noting that SOFI has broken its $10.23 resistance after the release of its Q2 earnings.

Since I expect SoFi to have a decent Q3 and turn profitable in Q4, retests of the 21 MA and the $8.86 support would be good entry points ahead of Q3 earnings.

Conclusion

I believe SoFi can increase its market share as more young people become able to open checking accounts. Furthermore, SoFi had decent Q2 earnings with revenue beat and breaking the deceleration in members growth. While the lower revenue per member can be concerning, I believe it is a temporary decline and the revenue per member numbers will start normalizing if the Fed starts rate cuts. That said, I still believe the second half of the year will be the true turning point for the digital bank since I think it will achieve profitability in Q4 with the resumption of student loan payments. The decent Q2 SoFi had and my projection of it reaching profitability in Q4 due to the resumption of student loan payments in October make it hard to see SoFi stock as anything but a strong buy.

Read the full article here