We just finished the Volkswagen Q1 Analyst Conference Call (OTCPK:VLKAF) (OTCPK:VWAPY, OTCPK:VWAGY). Here at the Lab, we recently initiated to follow Dr. Ing. h.c. F. Porsche AG’s result, and provided a neutral rating target on twelve-month estimates with a supportive publication called ‘Racing Towards 20% ROS‘. Indeed, our Volkswagen buy rating was backed by a sum-of-the-part valuation which included P911 and Traton (both listed) as well as potential IPO upside from Lamborghini and Bentley. In our Q3 comment, we reiterated that the company “has not benefited yet from the recent P911 share placement, and this was also confirmed by Volkswagen’s CEO during the Q3 Q&A call”. Before commenting on the latest company results, once again, we confirmed our Volkswagen investment thesis with a target price of €202 per share (i.e. our previous valuation titled Volkswagen Is Really Undervalued).

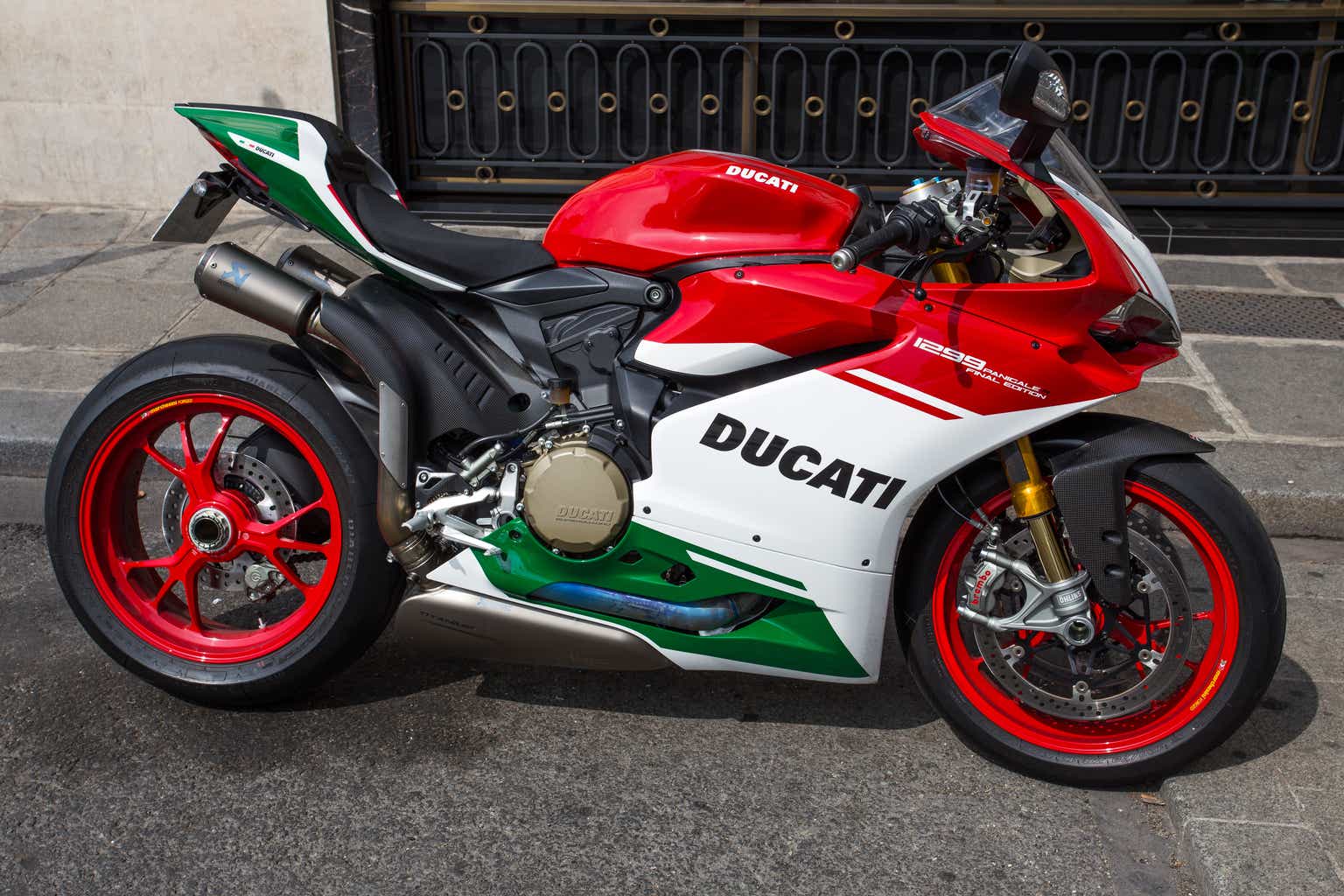

Starting with Traton, the company increased unit sales by 25% with a turnover up of 31% thanks to a positive price MIX (Fig 1). The operating profit margin reached 8% compared to the 4% recorded in Q1 2022, this was due to better utilization rates, positive volumes, and as already mentioned higher prices. The company’s net cash flow significantly increased despite further investment in working capital requirements, this was also supported by Scania Finance Russia proceeds. However, thanks to a solid Q1, Traton decided to increase its 2023 outlook with a return on sales between 7% and 8% (it was previously set between 6% to 7%. As a reminder, we should inform our readers that Traton’s stock price was recently up, and Volkswagen has an equity stake of 89.72%. At the current price, Volkswagen’s investment is valued approximately €8.9 billion.

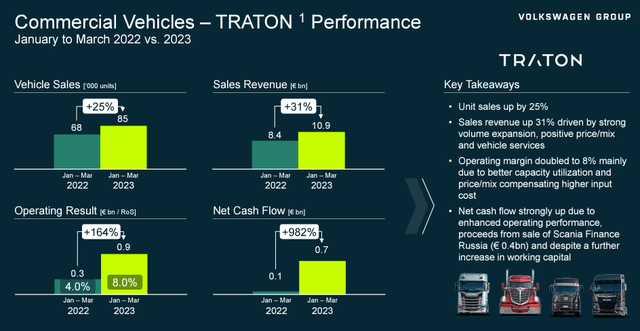

Related to Porsche (P911), the company turnover increased by 28% and was backed by solid volume growth. The operating margin remained stable and the automotive cash flow is significantly up versus the Q1 2022. The company maintained an excellent RoS and BEV share now represented 11% of the total company’s deliveries (Fig 2). At the current price, Volkswagen’s investment is valued approximately €84.5 billion.

Traton Q1 performance

Source: Volkswagen Q1 results presentation Fig 1

P911 Q1 performance

Fig 2

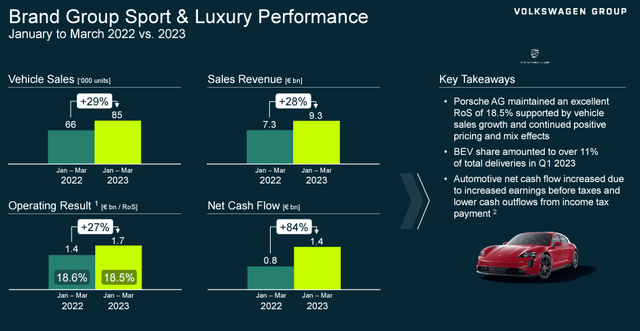

Q1 update

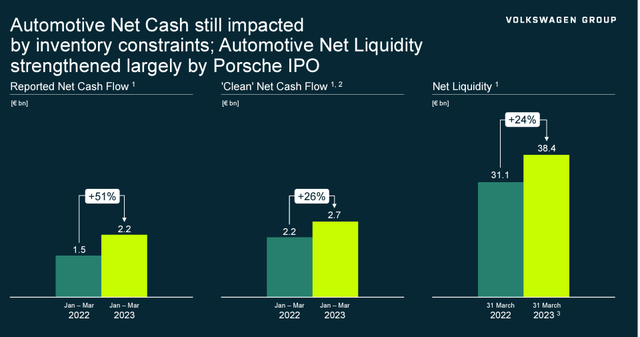

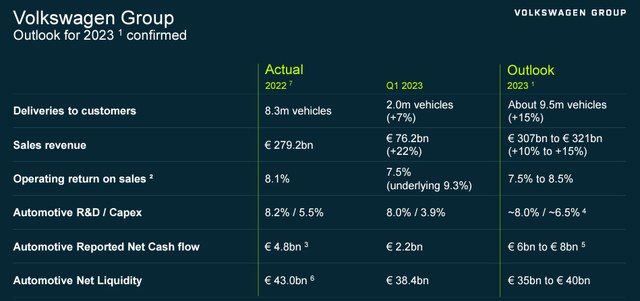

With our thesis still to perform, it is also important to report the latest Volkswagen figures. The company delivered a plus 22% in top-line sales and was driven by a volume recovery (+6%) and the rest thanks to higher selling prices. Excluding the commodity hedging effect, operating profit reached €7.1 billion with an operating RoS of around 9%. Adjusting from the hedges, the core operating margin was at 7.5% with an EBIT profit in abs value at €5.7 billion (Fig 3). CEO’s words supported the results and explained how “Volkswagen Group has made an encouraging start to 2023 with strong growth in revenues and operating profit, confirming our financial outlook for 2023”. Automotive cash flow was at €2.2 billion at the Q1 end and the group net liquidity remains at a very high level of €38.4 billion (Fig 4). As expected, Q1 was impacted by a special dividend payment in connection with P911 IPO.

Volkswagen Financials in a Snap

Fig 3

Volkswagen liquidity

Fig 4

Conclusion and Valuation

One of the negative feedback from the Q&A call was the Chinese performance which is the largest automotive market in the world. China is making great strides towards electric power and local producers are conquering greater market shares to the detriment of the global automotive giants such as Volkswagen and Toyota.

In Q1, electric and plug-in hybrid vehicles increased by 22%, while those of internal combustion engine vehicles decreased by a similar percentage. Results that represent a double blow for Volkswagen, whose sales in the Asian country are declining as are its market shares. Chinese manufacturer brands are becoming leaders in key segments and their rise has been fueled by the continued launch of new electric-powered models, which are gaining share at home but also abroad. The Chinese BYD has so far benefited the most. In detail, BYD’s sales in China have increased by nearly 69% since 2023 start, a figure that translates into an 11% share of the overall car market, more than Volkswagen and Toyota. To counterbalance this negative performance, Volkswagen announced the creation of an automotive hub in China dedicated to research & development for BEV production with an investment of around €1 billion. This project aims to involve local suppliers from the early stages of product development, to integrate new technologies and the most innovative application concepts into new products. This investment will accelerate car development by about 30%, providing also a clear upside in productivity. More importantly to report, in the Q&A call, the CEO confirmed that Chinese sales strongly rebound in April. Back to the conclusion, here are our main takeaways:

- The company has ample liquidity for the dividend payment and confirmed its 2023 guidance (Fig 5);

- In our sum-of-the-part valuation, we should also include Gotion High Tech and Quantumscape Corp. Compared to Traton and P911 are relatively small equity listed investments; however, Volkswagen has a stake of 24.77% and 18.26% respectively (for a value in the US dollar of 1.9 billion and 558 million);

- In Q1, BEV deliveries increased by 42% to 141,000 units;

- Volkswagen continues to see a solid demand and has an order book of 1.8 million vehicles in the EU alone with 260,000 BEV units. For this reason, as already mentioned, Volkswagen’s valuation discrepancy continues to increase. Therefore, we reaffirmed our target price.

Volkswagen 2023 guidance

Fig 5

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here