Darling Ingredients (NYSE:DAR) is dependent on government subsidies to drive profits. If the government subsidies continue flowing, the company will have a bright future for its renewable diesel business. The company operates under three segments: Feed Ingredients, Food Ingredients, and Fuel Ingredients, with all three segments growing nicely y/y. But the crown jewel of Darling Ingredients is its Fuel Ingredients business with its 50/50 joint venture with Valero (VLO) to produce renewable diesel.

The company has three capital allocation priorities: invest in its fuel business to expand production of procurement and processing of animal fat and used cooking oil to produce renewable diesel, make acquisitions to drive growth in its food and feed ingredients, and make share repurchases. If the regulatory environment continues to favor Darling Ingredients, the company could vastly expand renewable diesel production and thus generate much profit.

Darling Ingredients promises years of growth in its Fuel Ingredients segment, but there is always the risk that government policies might change, reducing subsidies and the company’s profitability. Existing shareholders may benefit from continuing to own the shares. At the same time, new investors should be opportunistic in acquiring the stock in the face of further weakness. I rated it a hold in December and would stick with that rating and buy the stock closer to $60.

Massive revenue growth rate

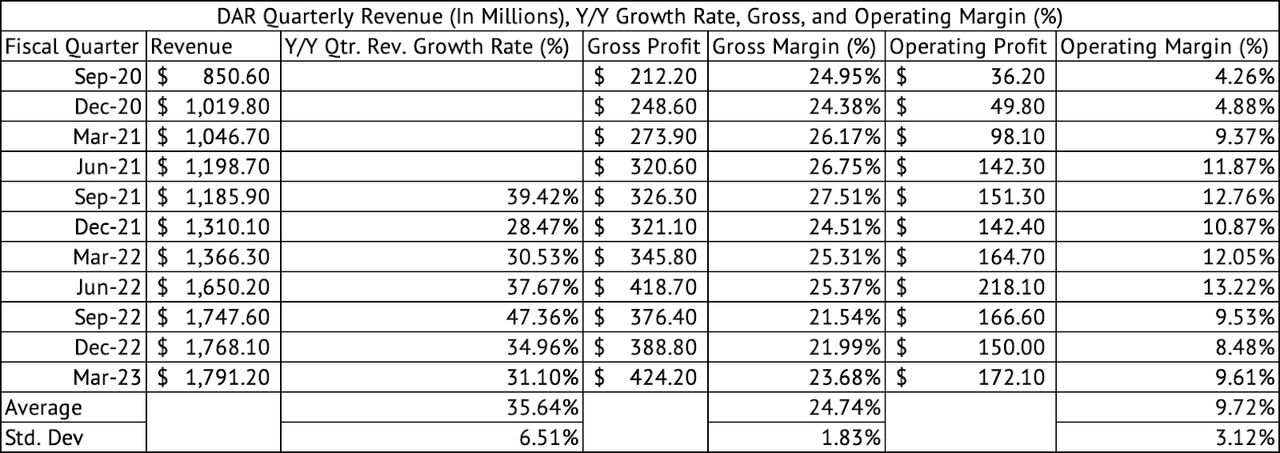

The company has been growing its quarterly revenue and profits at a double-digit pace y/y since September 2020 (Exhibit 1). Given the enthusiasm for renewable diesel, the company should show stellar growth for the foreseeable future. If the economy slows down in the U.S. or globally or enters a recession, revenue and profits may come under pressure, potentially giving long-term investors an opportunity to buy the stock at a low valuation. The energy mix powering the planet is changing rapidly. Renewable diesel may have a small but vital role in reducing emissions and thus slowing down the impact of global warming.

Exhibit 1:

Darling Ingredients Quarterly Revenue (Seeking Alpha, Author Compilation)

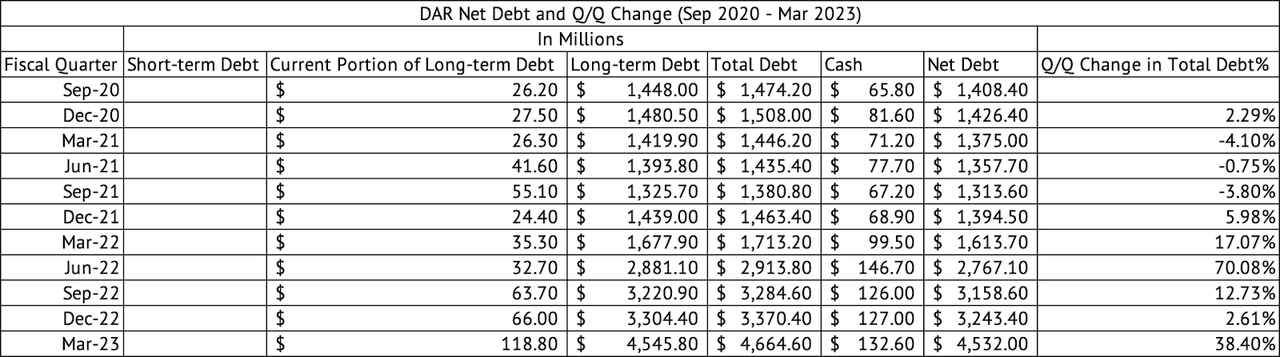

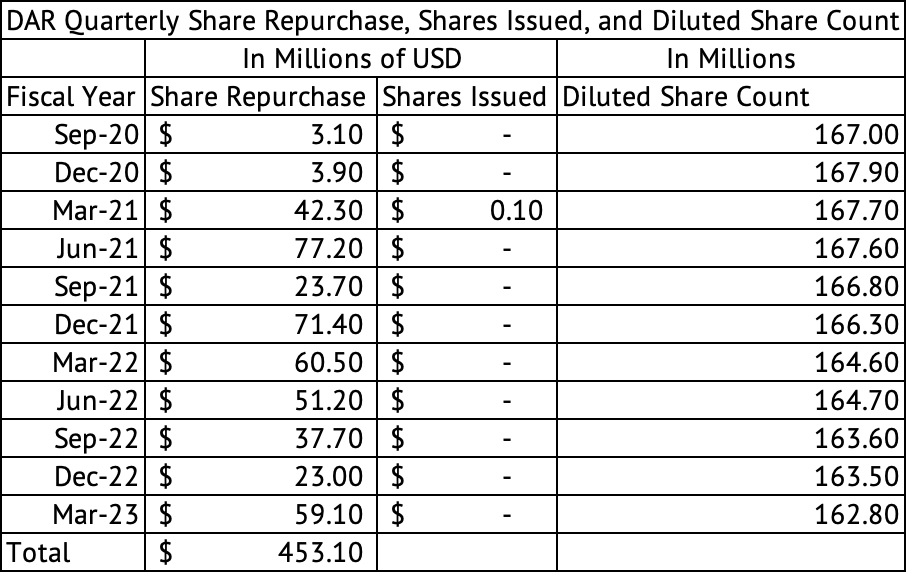

Watch the debt

The company’s debt increased q/q in March 2023, with its total debt of $4.6 billion (Exhibit 2). The company’s interest rate has continued to increase. It issued Senior Notes in 2018 at 3.6%. In 2019, it issued notes at 5.2%; in 2022, it sold $750 million in Senior Notes at 6%. Interest rates may continue to stay higher for longer and thus constrain the company’s ability to refinance or raise new debt. The company has spent $450 million on share repurchases since September 2020 and has reduced its diluted share count from 167 million to 162.8 million, amounting to an average repurchase price of $107.8 (Exhibit 3). The company must watch its debt load and acquisition strategy, especially if the economy slows.

Exhibit 2:

Darling Ingredients Debt (Seeking Alpha, Author Compilation)

Exhibit 3:

Darling Ingredients Share Repurchase (Seeking Alpha, Author Compilation)

Renewable diesel is essential to combat the effects of climate change.

The adverse effects of climate change are already affecting every aspect of human life and every human on the planet. From soccer games in England interrupted with water breaks to help players cope with extreme heat to Royal Soldiers fainting in the heat, adverse effects of climate change are already here. Many places on Earth may become unbearable or unlivable due to the heat. We need to move faster to reduce emissions and combat the effects of climate change. Even if all greenhouse gas emissions were stopped today, an unlikely scenario, the Earth would likely continue to get warmer before temperatures plateau or drop.

The predictions made by United Nation’s Intergovernmental Panel on Climate Change in 1990 have proven true. Even predictions made by the scientists at Exxon Mobil in the 1970s about the effects of climate change have been shockingly accurate, although the company has sowed doubt on climate change for decades. I own shares in oil majors from Exxon Mobil to Shell. Still, the sweltering heat across the globe, with July being the hottest month in recorded history, has made me rethink my energy mix and focus more on my conservation efforts. We can point to many other climate events just this year, from wildfires in Canada to searing heat causing burns in Phoenix. Daniel Yergin, the Pulitzer-winning author of the Prize, has long discussed the need for an energy mix with multiple energy sources to help humans transition to a cleaner future.

Investors need to assess the demand for each energy source against this backdrop. Consumers, especially the ones with financial means, are already migrating to cleaner energy sources. But, not all consumers are sold on battery electric vehicles. Ford recently reported seeing record demand for its Maverick Hybrid trucks. Japan Airlines saw massive oversubscription for its transition bonds, which would invest in fuel-efficient jets and alternative fuels. The world consumes 100 million barrels of oil per day. There are 42 gallons of oil in a barrel, which amounts to 4.2 billion gallons of oil used daily. It would be challenging for a single energy source, battery electric vehicles or renewable fuels, to replace oil fully. The world consumes about 30 million barrels of diesel, 1.26 billion gallons daily.

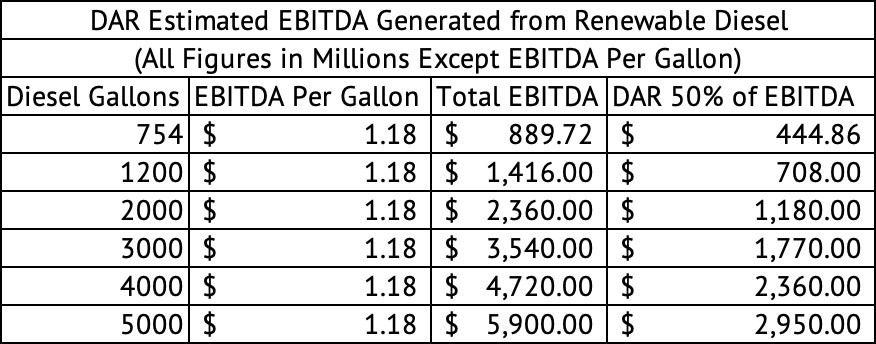

Darling Ingredients can produce 1.2 billion gallons of renewable diesel annually. That amounts to 3.2 million gallons daily, about 0.07% of the planet’s daily oil consumption or 0.25% of global diesel consumption. The company processed about 10% of the animal by-products in 2019. If investors assume Darling Ingredients can quadruple green diesel production over the next decade, the company would produce over four million gallons annually. In 2022, the company sold 754 million gallons of renewable diesel in its joint venture with Valero, generating $1.18 in EBITDA per gallon. That amounts to a total EBITDA of $889 million.

The 50/50 joint venture with Valero gives Darling Ingredients about $444 million in EBITDA. If the company sells between 3 billion and 4 billion gallons of renewable diesel annually, it could generate $1.7 billion and $2.3 billion in EBITDA (Exhibit 4). If the company achieves this scale and EBITDA, its joint venture with Valero could be worth more than the entire company combined. In the future, a 10x EBITDA would value Darling’s share of the joint venture at nearly $17 billion. The company has a long growth runway ahead of it, assuming the tax credits continue flowing for renewable diesel.

Exhibit 4:

Darling Ingredients Estimated Share of EBITDA from the Joint Venture With Valero (Author Assumptions and Calculations)

Over the long run, the company’s primary challenge may be on the supply side for procuring its raw materials. There is only so much animal fat, inedible corn oil, and used cooking oil to be transformed annually. The U.S. produced 2.6 billion gallons of renewable diesel in 2022. The company should have comfortable access to raw materials to help it achieve 3 billion gallons of green diesel production over the next decade and expand the overall production of renewable diesel.

Politics can stand in the way of the company. Much of the cost of renewable diesel is borne by consumers in California, where the Low Carbon Fuel Standard administered by the California Air Resources Board sets strict standards for the carbon intensity of various fuels. Californians pay one of the highest gas prices in the country. In this period of high inflation, these high gas prices put a lot of fiscal pressure on economically burdened consumers. Most of the burden of high gas prices is borne by the low-income consumers in the state.

The consumers earning more than one hundred thousand annually, many working from home, are less impacted than the low-income ones. Most consumers care about the environment as long as it does not come at the expense of their wallet. If consumers perceive these tax credits benefitting corporations, they may turn against it. Darling Ingredients has the potential to grow its renewable diesel business in the coming years but also faces the prospect of a political backlash, especially if inflation remains sticky. Given the risk factors, investors should build a reasonable margin of safety in buying the company.

Valuation

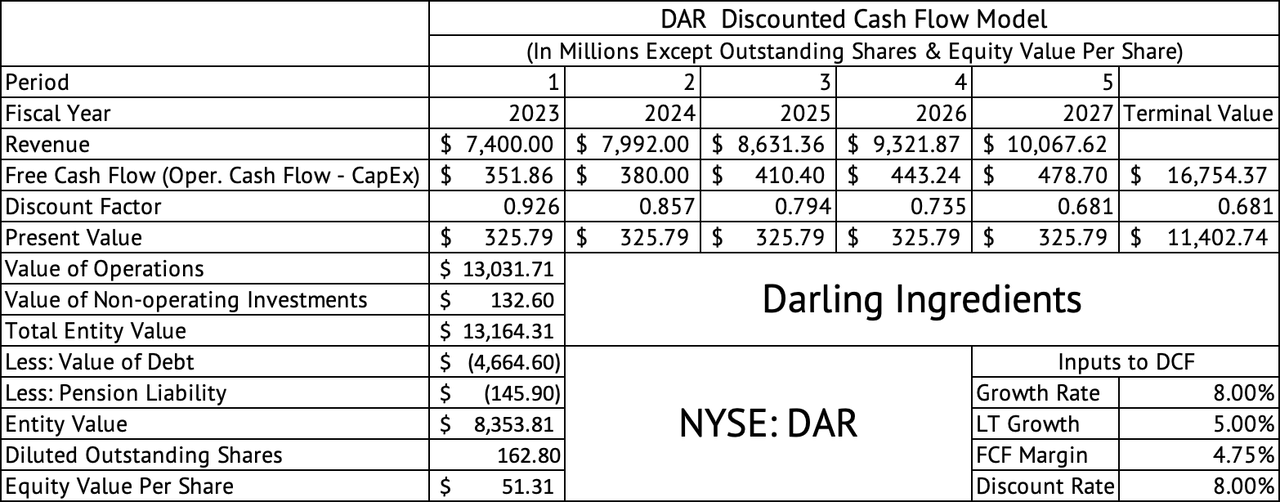

The company is valued at a forward PE of 12x and an EV to EBITDA multiple of 8x; both measures are well below its average over the past five years. The company is trading at a forward non-GAAP PEG ratio of 1x, a cheap valuation given the company’s prospects. A discounted cash flow model values the company at $51 (Exhibit 5). This model assumes a reasonably modest growth rate of 8% over the next few years and 5% over the long-term.

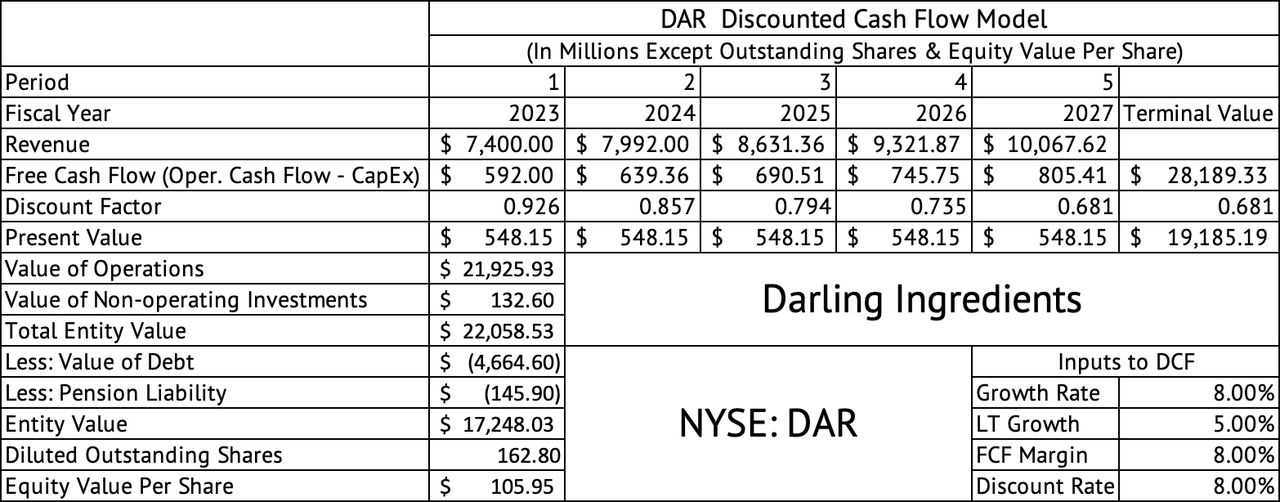

This model also assumes a free cash flow margin of 4.7%, its average over the past decade. However, the company has averaged an 8% quarterly free cash flow margin since September 2020, with a standard deviation of 4%. An 8% free cash flow margin would put the per share equity value at $105 (Exhibit 6), compared to its current price of $68. The question remains whether the company can consistently deliver an 8% free cash flow margin.

Exhibit 5:

Darling Ingredients Discounted Cash Flow Model with 4.75% Free Cash Flow Margin (Seeking Alpha, Author Calculations)

Exhibit 6:

Darling Ingredients Discounted Cash Flow Model with 8% Free Cash Flow Margin (Seeking Alpha, Author Calculations)

Some investors may prefer Darling Ingredients’ exposure to the renewable fuels business, but must be aware of the regulatory risks that come with it. But, climate disasters and severe weather events across the globe may force governments to speed up the adoption of clean energy, benefitting Darling Ingredients. The company looks undervalued, and the current investors may be better off owning the shares for the long term. However, new investors should be opportunistic to acquire shares closer to $60 or below and own them for the long term.

Read the full article here