Just over two weeks ago, I wrote on First Majestic Silver (NYSE:AG), warning that the stock’s Q2 results weren’t likely to be very easy on the eyes given the recent strength in the Mexican Peso which had charged to a new 7-year high vs. the US Dollar (UUP). And just as importantly, its per share growth was set to continue to decline because of its Jerritt Canyon Mine being placed in care & maintenance. Unfortunately, the results were worse than I expected, with all-in sustaining costs [AISC] spiking to $21.52/oz, margins sliding to $3.43/oz despite higher metals prices, and the company having another quarter of free cash outflows. Worse, we saw additional share dilution with heavy share sales under its ATM. Let’s take a look at the results in a little more detail below, and why First Majestic remains an inferior way to buy the sector-wide dip.

San Dimas Operations (Company Website)

All figures are in United States Dollars unless otherwise noted.

Q2 Production & Sales

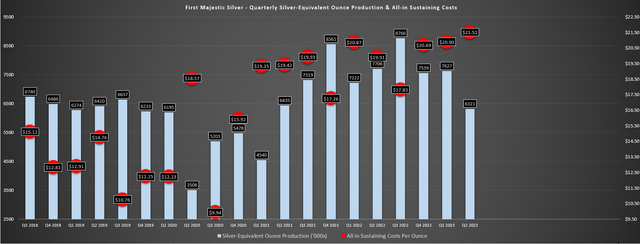

First Majestic Silver released its Q2 results last week, reporting quarterly production of ~2.63 million ounces of silver and ~45,000 ounces of gold, a 5% and 24% decline over the year-ago period. On a silver-equivalent ounce [SEO] basis, production slid by 18% year-over-year to ~6.32 million ounces, miles short of the ~33 million ounce SEO goal discussed as recently as Q1 2023, with Q2 production coming in at an annualized rate of barely 25 million SEOs. However, while the production results were satisfactory given that the company had only a partial quarter of operations at Jerritt Canyon before shutting down, it was the margins, financial results and per share declines that were even more disappointing. And while Santa Elena’s production will improve in H2, First Majestic’s company-wide production is likely to decline at least 16% year-over-year to ~26.0 million SEOs, even assuming it hits the top end of its revised guidance range.

First Majestic – Quarterly SEO Production & AISC (Company Filings, Author’s Chart)

As for the company’s Q2 sales, despite the benefit of a higher average realized silver price ($24.95/oz), revenue came in at just $146.7 million, an 8% decline from the year-ago period. The decline in year-over-year revenue was related to the lower sales volumes at its Jerritt Canyon Mine, which produced just ~4,400 ounces of gold in the period at all-in sustaining costs of $4,205/oz, offsetting the better quarter at its flagship San Dimas Mine. Unfortunately, this trend in declining revenues is likely to continue unless we see a significant leg higher in precious metals prices, given that First Majestic will no longer benefit from a regular ~$34 million in revenue from its Jerritt Canyon Mine (average quarterly production of ~18,000 ounces per quarter since the asset was acquired by First Majestic), with little hope of this asset restarting before significant optimization work is complete given the impact of inflationary pressures on an already high-cost asset.

Costs & Margins

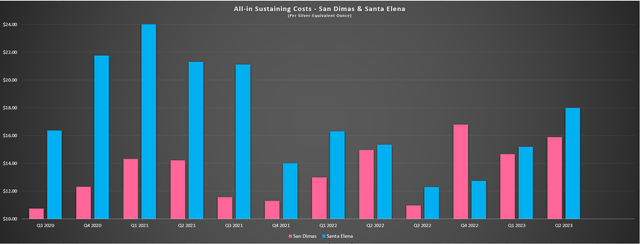

Moving over to costs and margins, First Majestic reported cash costs of $15.58/oz in Q2 2023 and all-in sustaining costs [AISC] of $21.52/oz, representing 10% and 8% increases from the year-ago period. And while Jerritt Canyon dragged up costs for the company in a shortened quarter where it processed stockpiles, all-in sustaining costs still came in above $19.70/oz per silver-equivalent ounce excluding Jerritt Canyon, well above the industry average. And if we look at the company’s two primary mines (San Dimas and Santa Elena), costs soared to $15.89/oz and $18.00/oz vs. $14.97/oz and $15.34/oz, respectively, in Q2 2022. This can be attributed to the strength in the Mexican Peso and the increase in costs at San Dimas were despite the benefit of lower sustaining capital in the period ($7.3 million vs. $9.8 million).

San Dimas & Santa Elena AISC (Company Filings, Author’s Chart)

Not surprisingly, this increase in costs took a toll on First Majestic’s margins, which have slid over 70% from a peak of $12.64/oz in Q3 2020 to just $3.43/oz in the most recent quarter. Notably, this was despite a tailwind from a higher silver-equivalent price vs. Q2 2022 levels, with AISC margins down 14% year-over-year. And while First Majestic noted that it generated free cash flow in the period, its definition of free cash flow is operating cash flow minus sustaining capital but does not include total capex which is the more accurate calculation. Under this calculation, we saw a free cash outflow of $10.6 million (vs. First Majestic’s reported positive free cash flow of $7.4 million), while operating cash flow slid from $33.0 million in Q2 2022 to $26.9 million in the year-ago period.

Although First Majestic has done a decent job investing to improve efficiencies at its Mexican operations, the bad news is that the Mexican Peso saw the majority of its recent declines in the back half of Q2, and we are likely to see a further impact on costs in Q3. In fact, the Mexican Peso exchange rate was ~$17.80 MXN/USD in Q2 and could come in below $17.00 in Q3, a further headwind for the company. Some investors might note that while this will be a rough year, the company should be able to improve costs to sub $17.00/oz next year, a step in the right direction. And while this may be the case which will help it to generate free cash flow, the valuation is still unpalatable as I’ll explain later, and per share metrics continue to go in the wrong direction with more share dilution in the most recent quarter.

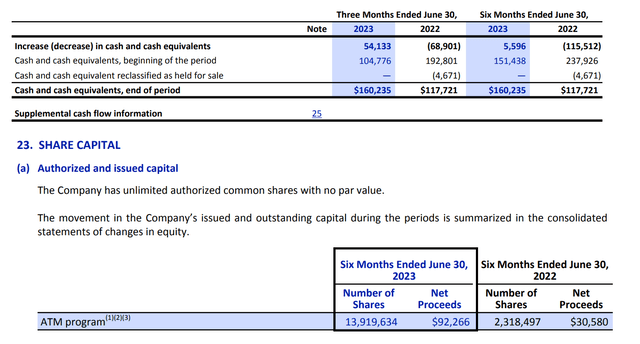

Continued Share Dilution

While some investors might have been pleased to see First Majestic’s cash balance increase to $160 million at quarter-end, it was for the wrong reasons. This is because it came at the expense of significant share dilution (~4%). And while last year’s sales under the company’s At-The-Market Equity Facility [ATM] were excusable and arguably a smart way to raise capital with it trading above 4.5x P/NAV when it sat at US$13.00, the recent ~13.9 million in shares sales came at a price of US$6.63, This has resulted in more dilution for shareholders in a period when many producers have been busy hoovering up shares like SSR Mining (SSRM). The result? First Majetic’s outstanding share count is now nearing ~290 million, up over 38% from year-end 2019 levels.

Cash Position & ATM Sales (Company Filings)

So, why is this important?

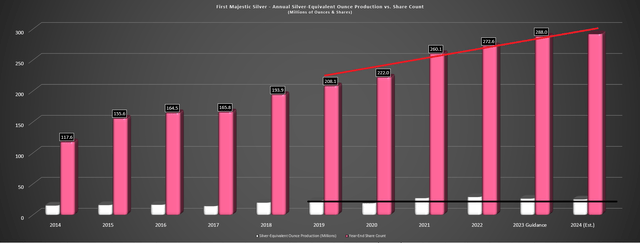

If you are investing in precious metals, it’s likely because you don’t want to see your purchasing power erode, which is why holding gold and silver bullion makes sense. And if one wants leverage on that thesis, the logical step is to own gold and silver producers. However, the latter thesis only works if a producer is holding the line or growing their per share metrics, meaning that production, reserves (or resources), net asset value and ideally cash flow per share (though this is more dependent on metals prices) are growing. And while Agnico Eagle (AEM) and Alamos Gold (AGI) excel in this department and continuously grow their per share metrics, this is not the case for First Majestic and it’s not even close. In fact, its share count is likely to increase ~40% from year-end 2019 to year-end 2024 while silver-equivalent production will be up barely 8% (~25.4 million SEOs vs. ~23.2 million SEOs).

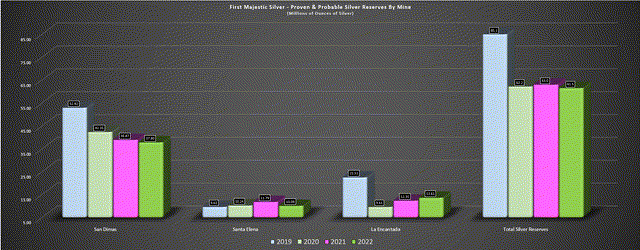

First Majestic Silver – Annual SEO Production vs. Share Count (Company Filings, Author’s Chart) First Majestic Silver – Silver Reserves (Company Filings, Author’s Chart)

This is not what you want to see in a precious metals miner, and the reserves per share figures aren’t any better. Hence, if one wants to own First Majestic to get leverage to the price of silver, that is fine, but they should know their share of reserves and production have been in steady decline over the past few years, making owning bullion itself the more attractive bet (or simply other miners with better track records).

Valuation

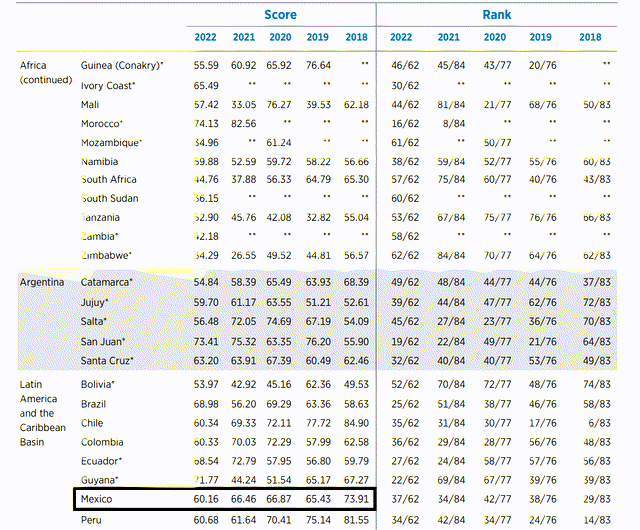

Based on ~302 million fully diluted shares and a share price of US$6.10, First Majestic trades at a market cap of ~$1.84 billion and an enterprise value of ~$1.90 billion, making it one of the highest valued silver producers globally. This is despite the fact that the company has been unable to consistently generate free cash flow (Q2 2023: free cash outflow of $10.6 million), and that it has razor-thin margins on an all-in cost basis. Plus, unlike most other silver producers, First Majestic carries elevated risk because of unrelated tax disputes in Mexico with SAT. And according to filings, if First Majestic is required to pay tax on its silver revenues based on spot market prices with no mitigating adjustments, it would result ~$300 million in incremental income tax. Notably, this applies only to San Dimas (one of its mines), with tax assessments issued for three other mines: La Encantada, San Martin, and La Parilla. And while the company looks to be in the right here and working to defend this, it creates added uncertainty.

As for First Majestic’s valuation, the stock may be down ~70% from its highs, but it’s still not offering any margin of safety, trading at ~21.1x FY2024 free cash flow estimates of $87 million, one of the steepest free cash flow multiples sector-wide. In fact, investors today can buy a much stronger and diversified company like Barrick Gold (GOLD) at less than 15x FY2024 free cash flow estimates, and a far cheaper P/NAV multiple. This is because Barrick trades at less than 1.1x P/NAV vs. First Majestic at over 3.0x P/NAV, one of the highest P/NAV multiples sector-wide that’s hardly justified by its low-margin and Mexico-concentrated silver business. So, using what I believe to be a more conservative multiple of 14x forward free cash flow for First Majestic, I continue to see a fair value for the stock of US$4.00 per share.

Mexico Investment Attractiveness Rankings (Fraser Institute Annual Survey of Mining Companies)

This doesn’t mean that the stock must drop in a straight line, and as we’ve seen over the past few years, First Majestic has consistently traded at a premium, meaning that it may never trade down to what I believe to be its fair value (US$4.00). That said, with its per share metrics plunging following significant share dilution (ATM sales and purchase of Jerritt Canyon) with little to show for the Jerritt Canyon acquisition combined with continued tax dispute risk and a souring sentiment for Mexican producers, I don’t see any way to justify owning the stock at current levels. Hence, if we were to see any rallies above US$7.30 before October, I would view these as profit-taking opportunities.

Summary

First Majestic Silver delivered one of the weakest Q2 reports among its peer group of small-cap producers, reporting razor-thin AISC margins below 20%, another quarter with free cash outflows, and we’ve seen over 5% share dilution year-to-date. Worse, tax dispute uncertainty continues to loom over the stock, the strong Mexican Peso will make it difficult to improve margins for its Mexican business in Q3, and it still trades at a steep valuation despite its continued underperformance. And while this doesn’t mean that the stock must continue its decline, I don’t see any way to justify owning the stock from an investment standpoint, especially with several stronger buy-the-dip candidates elsewhere in the sector. In summary, I continue to see AG as an Avoid, and a name I would trim or liquidate on sharp rallies.

Read the full article here