Investment Thesis

Since its foundation in 2015, Li Auto (NASDAQ:LI) has swiftly positioned itself as a leader in the Chinese EV market. The company adopts a unique approach to tackling range anxiety and charging inconvenience through ‘range extenders’, which are small gasoline engines that generate electricity to power its SUV’s battery when an EV charging station is unavailable.

Critics argue that Li’s vehicles are not purely electric. Despite these criticisms, the company’s marketing strategy is remarkably successful, reporting impressive sales growth, which is notable, particularly in the competitive Chinese market where Li outpaced its peers and even took market share from Tesla (TSLA). This success demonstrates that Li’s unique vehicle design and technology approach has resonated with customers, regardless of whether it aligns with traditional definitions of EVs or hybrids. Moreover, Li Auto completed the development of an all-electric manufacturing facility, with the first model expected to roll out next month.

Investors looking to capitalize on the burgeoning Chinese EV market should take note of Li Auto’s distinct competitive advantage in range extender technology and tried and tested direct marketing strategy across China.

Market Potential

China is the largest EV market in the world, accounting for about 50% of global EV sales, thanks to a supportive regulatory environment and government subsidies that strengthened supply chains, reduced prices, and increased demand.

The Asian nation is also rich in minerals used in battery production, including lithium, cobalt, nickel, and manganese reserves, enhancing the EV sector’s supply chain and, by extension, private companies aligning their operations with the CCP’s emission reduction goals.

This tremendous potential hasn’t gone unnoticed by institutional investors. Warren Buffett’s investment in BYD (OTCPK:BYDDF) has already returned more than 2200%. Last week Volkswagen bought a stake in XPENG (XPEV), while the Abu Dhabi sovereign fund recognized potential in NIO (NIO), with a 7% equity stake in June 2023. This international investment activity signifies an escalating global recognition of the market’s robust potential.

Crowded Market?

Critics of the Chinese EV market argue that the sector is overpopulated, a claim that holds some water considering the presence of over 300 EV manufacturers in the country. These are primarily smaller local producers hoping to reap benefits from the CCP’s liberal subsidies.

Nonetheless, the landscape is changing in light of the recent adjustments in subsidy policies that now prioritize merit. The new subsidies now exclude smaller manufacturers with limited technological advantages. This will open up greater market share to those with superior, innovative engines, longer vehicle ranges, and faster battery charging capabilities.

For example, earlier this year, Lentin Motors, which is known for its budget, low-speed hatchback EVs, filed for bankruptcy. Thus, I believe that Li Auto will benefit from this subsidy shift as unsustainable manufacturers exit the market.

Market Strategy

Most of us can relate to the anxiety of seeing our phone battery levels low when we’re out and about with no charging source in sight. This same phenomenon, termed range anxiety, also affects EV users who worry about their vehicle battery depleting before reaching a charging station. Li Auto, with its range-extender technology, addresses this concern. When needed, a small gasoline-powered motor in Li’s SUV models can be fueled to generate electricity, charging its lithium-ion batteries on the go, alleviating range anxiety, and setting it apart from the competition.

Compared to NIO’s ‘Battery as a Service’ model, which allows car owners to swap their empty batteries with a fully-charged ones, Li Auto’s approach offers a seamless solution that doesn’t rely on battery swapping. This makes the company’s vehicles more convenient for users in areas where battery swap stations are sparse. For investors, this means Li Auto has the potential to cater to a wider market demographics driving its solid growth.

XPENG focuses heavily on the integration of autonomous driving technology. Although this is certainly promising for the future of transport, the technology is still nascent, making Li Auto’s tried-and-tested practical approach to the market an appealing alternative.

Lastly, compared to BYDDF, Li Auto offers a focused strategy and exposure to passenger EV vehicles, as opposed to the comprehensive eco-system that BYDDF offers. This is not to say that Li has a better market position, but merely that the two offer different risk/reward profiles. It is worth noting that BYDDF is exploring options to spin-off its non-EV operations, including its battery manufacturing and electronics subsidies to streamline operations, a characteristic that Li Auto already enjoys.

Growth

Looking at the year-over-year growth shows that Li Auto is the only emerging premium EV business to report an increase in the number of vehicles sold in Q2 2023. While both NIO and XPENG registered a decline in vehicle sales in Q2 2023, Li Auto marked a significant leap, with the company delivering 86,533 vehicles, more than triple the 26,085 vehicles sold in the same period of last year. This is notable, given that Li is not only the youngest of the trio, but it also has a narrower product range, with only three models, all of which are SUVs.

Among the top five EV manufacturers in China, Li Auto is the only one to maintain its pricing strategy, while its rivals, NIO, TSLA, XPENG, and BYD, have succumbed to a price-cutting war. This price war was ignited by Tesla, with XPENG responding by cutting the prices of its vehicles by 12.5%. NIO followed suit in June, cutting prices by $4,500. According to Reuters, BYD reduced the price of its most popular sedan by nearly 10%.

Li’s decision to hold steady despite this pricing turmoil while maintaining a strong growth momentum indicates a robust market position.

Valuation

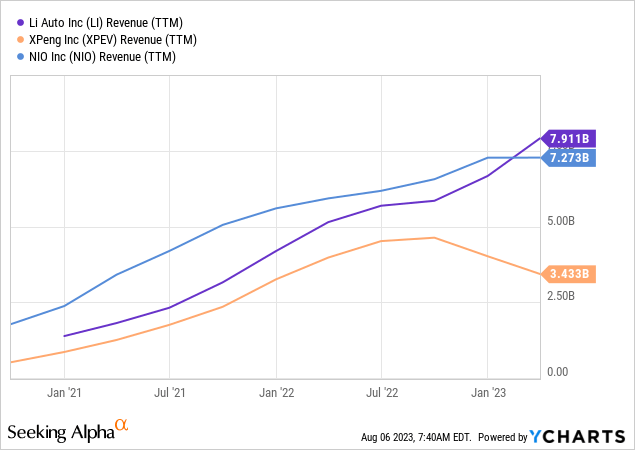

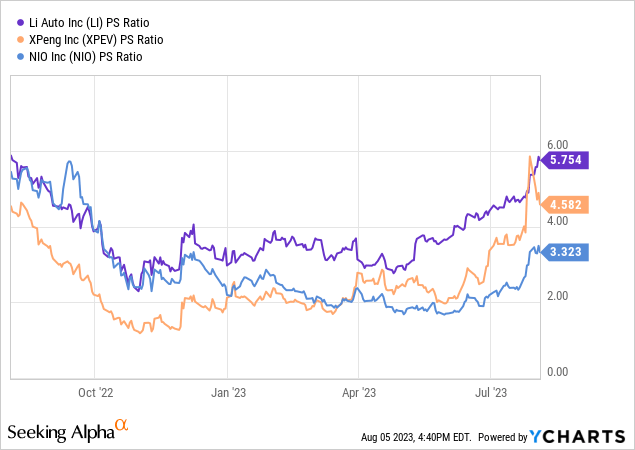

Li Auto has the highest market cap compared to its other two rivals in the New Generation Premium EV market, with a market cap of $44 billion, nearly double that of NIO’s $26 billion and three times XPENG’s $15 billion.

It is also the most expensive in terms of Price to Sales ‘PS’ ratio, mirroring growth expectations for Li Auto.

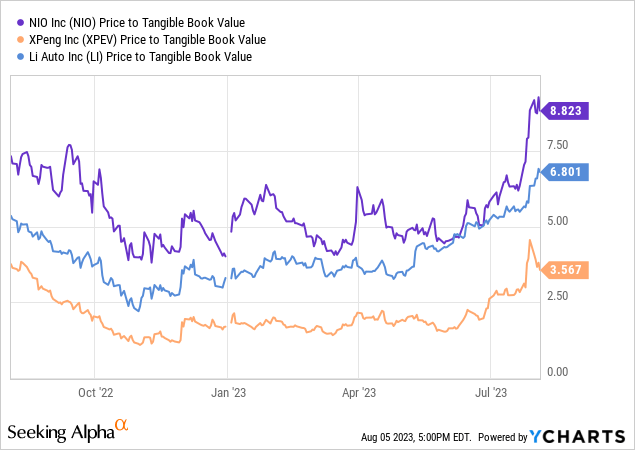

However, when looking at how the market values Li, NIO, and XPENG tangible assets, NIO emerges as the winner. This could be due to NIO’s brand reputation and more robust user base, given it has been longer in the market compared to Li Auto, which only started production late in 2019.

Risks

Investing in Li Auto, like any tech-centered company, comes with its fair share of risks. The company’s unique ranger-extender technology might become less appealing as battery technology improves and charging infrastructure becomes more available. As pure electric vehicles become more convenient to use with longer ranges and shorter charging times, customers might shift away from Li Auto’s range-extended vehicles, impacting its market position. This underscores the importance of the successful launch of Li’s anticipated all-electric vehicle, scheduled to roll out next month.

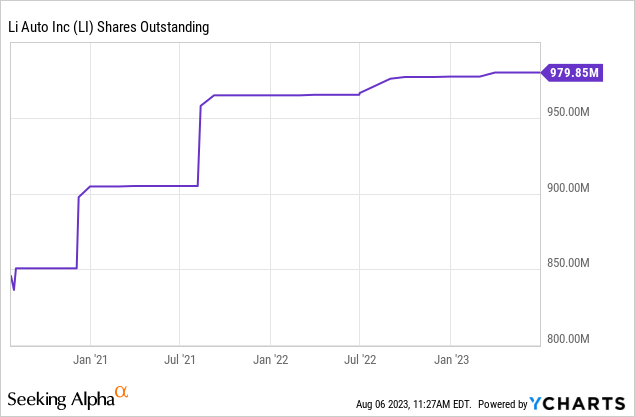

Moreover, as a relatively young company, Li Auto’s financial stability is not as well-tested as older, more established car manufacturers. Its ability to manage future economic downturns and industry slowdowns remains to be seen. Li ended Q1 2023 with roughly $5 billion in net current assets, weighed against an operating cash burn of $2 billion. Gross margins are attractive at roughly 20%, but Li will likely issue more shares to fund its growth strategy. Thus, for investors, putting capital in Li is a bet that the company’s value will increase at a rate that outpaces any potential dilution.

Summary

Li Auto has quickly established a prominent standing in the expansive Chinese EV market. By introducing a unique solution to address range anxiety with their ‘range extenders’, the company has successfully differentiated itself from its competitors, resulting in impressive sales growth.

While critics argue that the Chinese EV market is overcrowded, recent shifts in government subsidies are likely to weed out smaller, less technologically advanced manufacturers, leaving more room for innovative companies like Li Auto to grow.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here