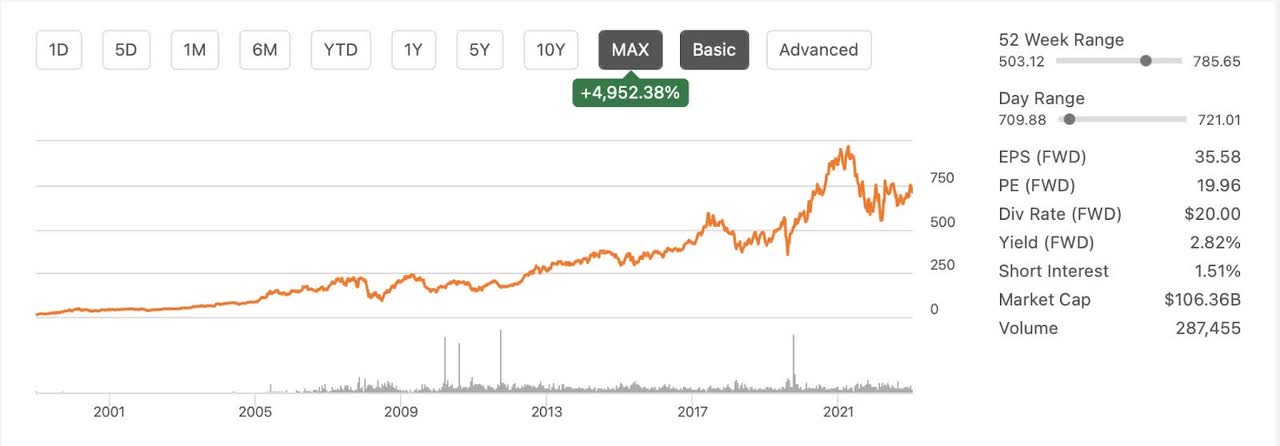

BlackRock (NYSE:BLK), one of the world’s best asset management companies, has been an excellent investment over most time frames as the chart below demonstrates.

Seeking Alpha

BlackRock stands tall as a global leader, offering an extensive range of investment products and services that cater to a diverse clientele, spanning from individual investors to institutional giants worldwide. Their consistent growth in assets under management (AUM) showcases their ability to attract and retain clients, a testament to the market’s unwavering trust in their investment strategies and expertise, providing a stable revenue stream that fuels their long-term financial performance.

With an impressive track record of delivering competitive investment returns across various asset classes, BlackRock’s team of skilled portfolio managers and analysts, coupled with their robust risk management practices, navigate diverse market conditions with finesse, earning admiration from investors. Embracing environmental, social, and governance (ESG) principles, BlackRock’s commitment to sustainability resonates with the growing demand for responsible investing, further positioning them for opportunities in the ever-evolving investment landscape.

Unyielding in their pursuit of innovation, BlackRock continuously invests in cutting-edge technology and groundbreaking solutions to meet clients’ ever-changing needs, ensuring their relevance in a dynamic financial landscape. Diversifying their revenue streams across iShares ETFs, active management, and Aladdin risk management platform adds resilience, safeguarding against market volatility and economic fluctuations.

As a prudent value investor, I find solace in BlackRock’s robust risk management approach, prioritizing the protection of investors’ capital and mitigating potential downside risks. Their shareholder-friendly policies, exemplified by returning capital to shareholders through dividends and share buybacks, underscore their dedication to rewarding long-term investors, making BlackRock an appealing choice for value-focused investors like myself.

There is a lot to like about BlackRock and their recent earnings call provided more evidence that the past growth will be reflected in the future.

Earnings Highlights

-

Clients entrusted BlackRock with an industry-leading $190 billion of net inflows in the first half of 2023, reflecting ongoing client confidence and strong organic growth.

-

BlackRock’s assets under management (AUM) reached an impressive $9.4 trillion, an increase of over $830 billion since year-end, indicating the company’s ability to attract and retain clients.

-

The company’s strong investment performance and comprehensive, high-quality investment products contributed to durable long-term investment performance, attracting investors and asset owners.

-

BlackRock’s platform as a service approach, combining investment technology and portfolio servicing capabilities, has been a driving force behind the company’s differentiated industry-leading organic growth.

-

Second-quarter net inflows of $80 billion demonstrated 4% annualized organic asset growth and 2% annualized organic base fee growth, indicating the company’s continued momentum.

-

Despite a 1% decrease in second-quarter revenue year-over-year due to market movements, earnings per share increased by 26%, reflecting higher non-operating income compared to the previous year.

-

The company’s technology platform remained strong, with clients increasingly turning to Aladdin for business transformation and scale enablement, driving demand for technology services.

-

BlackRock’s capital management strategy focuses on prudent investment to support organic growth, with occasional inorganic investments to accelerate growth and support strategic initiatives.

Out of all of these impressive highlights, one thing stands out to me more than anything else. Even though revenue decreased by 1%, Earnings per share increased by 26%. This is the way a company dedicated to shareholder returns shows their commitment to their values.

Dividend

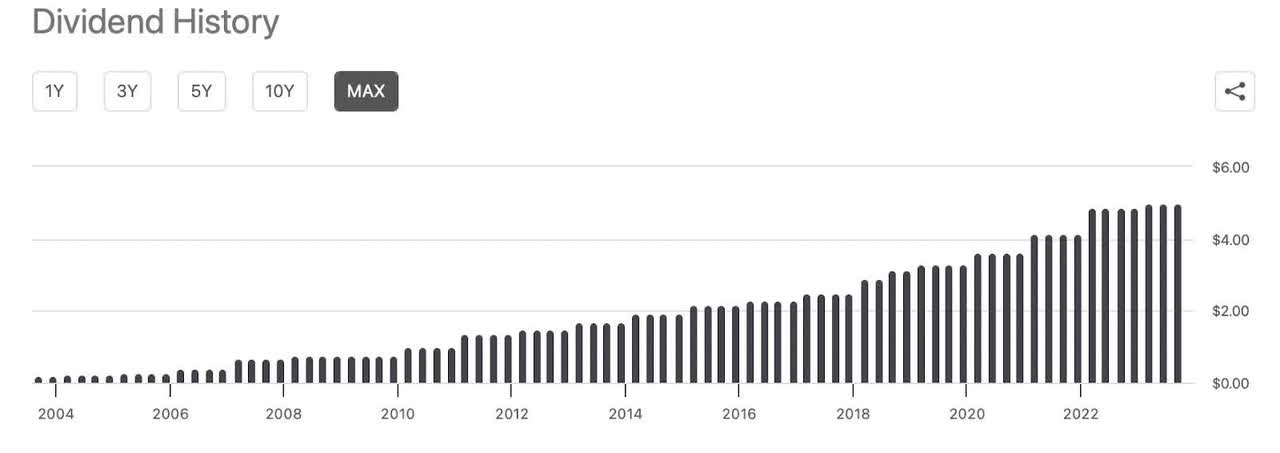

Seeking Alpha

BlackRock’s impressive dividend growth spans two decades. They maintained and grew the dividend throughout the financial crisis of 2008.The current payout ratio of 55% is high. I would not expect another dividend raise in the short to midterm.

Valuation

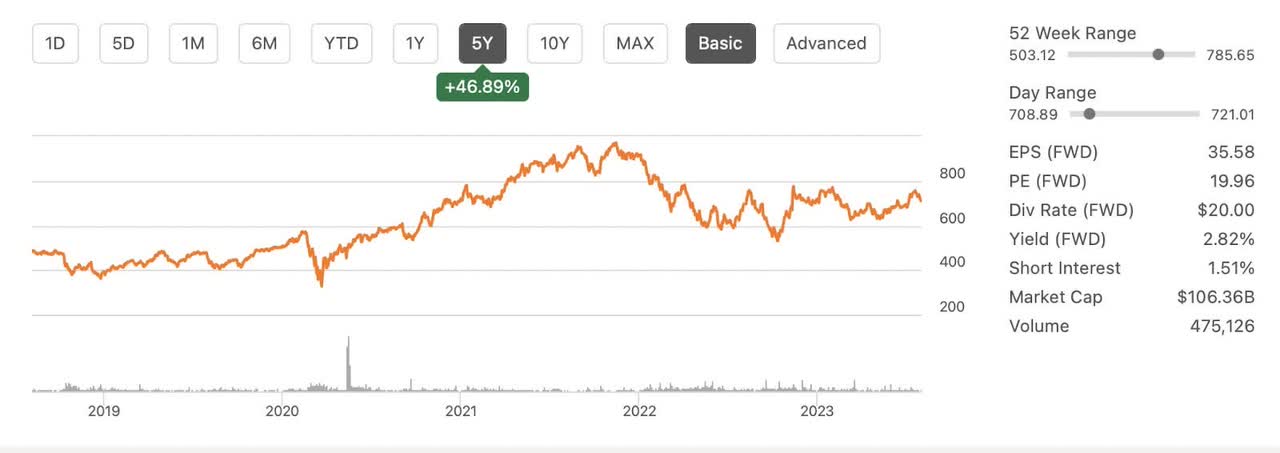

Over the past five years, BlackRock’s stellar growth has begun to slow down and since the end of 2021 the stock price has languished.

Seeking Alpha

I don’t see any reason that anyone should expect significant earnings growth in the near future. The recent acquisition of Kreos discussed here provides BlackRock with depth in their European debt platform. This acquisition will take years to pay off. While we like BlackRock’s long term plans. I would not currently be interested in buying any shares above $630. BlackRock has basically become a safe dividend play. The current margin of safety for me to consider purchasing is just not there. I consider BlackRock to be near the high end of its fair value range.

Risks and Recent Negatives

BlackRock will soon face a congressional probe for allegedly facilitating Chinese Investments and circumventing restrictions on U.S. investments in certain companies. This recent event discussed here highlights how the current geopolitical climate could negatively impact a global investment company such as BlackRock. Any restrictions on future investment activities could really hurt BlackRock.

These concerns combined with the more typical risks of higher borrowing costs, market volatility, investment performance and BlackRock’s real estate investment all could be a drag on performance.

The performance of real estate really concerns me in regards to BlackRock. Their investments in real estate and their real estate investment trusts could all face headwinds if current market dynamics and higher interest rates persist.

In other potentially bad news, in July 2023 CEO Larry Fink sold off $15 million dollars worth of stock. Now he could have sold shares for any reason and it is less than 5% of his overall shares, but it does concern me that this is not his only sale in 2023. Fink also sold 35,799 shares in April of 2023 which could signal that this is not an isolated event but indicative of a new pattern of behavior.

I also note that since February of 2023, there have been twelve different sales of stock by executives at BlackRock as reported by Nasdaq here. During this period, only one buy of 101 shares was made at market values; all other shares were vested at zero cost.

I don’t always put too much emphasis on insider selling, but the pattern and general consensus amongst executives at BlackRock can only be construed as a potential negative.

Conclusion

BlackRock has established itself as a world-class asset management company, delivering impressive financial performance and growth over the years. Their ability to attract and retain clients through a wide range of investment products and services, coupled with their strong investment performance and commitment to ESG principles, positions them well for continued success in the future.

Despite a slight decrease in revenue this quarter, BlackRock’s focus on maximizing earnings per share is truly commendable. The company’s history of consistent dividend growth adds further appeal for income-oriented investors, although the current payout ratio may limit near-term dividend increases. If I was a dividend growth investor, I would consider buying at lower levels.

At this current time, the risks and recent challenges that BlackRock faces give me reason to be skeptical. The impending congressional probe into their alleged facilitating of Chinese investments could lead to potential restrictions on future activities, impacting their global operations. Additionally, concerns about higher borrowing costs, market volatility, and their real estate investments pose potential risks to performance. I would want some more clarification on these issues before buying.

The recent insider selling activity also gives me reason to question insider sentiment. I will definitely monitor this closely in the coming months. If I was a current shareholder I would consider some downside protection. As a value investor, I remain cautious of BlackRock and would look for a more favorable entry point before considering purchasing BlackRock’s shares.

I currently rate BlackRock a hold, as the current valuation appears to be near the high end of its fair value range. As always, please do your own due diligence before purchasing any equities. Thanks for reading and good luck investing.

Read the full article here