All eyes were on Warner Bros. Discovery’s (NASDAQ:WBD) Direct-to-Consumer segment performance heading into earnings, after the company recently introduced the rebranded streaming platform “Max”, which will be launching later this month in the U.S., and other regions later this year and the next. Management had earlier promised big things for the emerging growth driver, critical to offsetting maturity at its legacy Studio and Network segments, as well as longer-term secular declines in traditional media distribution and advertising. The promises included a rapid trajectory to U.S. DTC and segment-wide breakeven this year and next, with profitability north of $1 billion beginning mid-decade when the company expects to reach 130 million paying subscribers globally. And WBD appears to be delivering consistent progress on this front, kicking off a strong start to its “year of building” for the DTC segment, though results remain subdued elsewhere.

The company delivered disappointing results for the first quarter, despite DTC being a relative bright spot with subscription gains and ad demand growth in solid double-digits to drive a $704 million y/y improvement on adjusted EBITDA for the segment. For now, the DTC segment accounts for the smallest portion of revenue mix (23%), but is rapidly becoming the company’s fastest-growing segment. We expect the continued expansion of DTC’s mix in consolidated revenues to be driven by acceleration primarily in both subscription gains and ad sales, with the continued ramp up of its new Max offering deployment to drive margin expansion over time and offset secular headwinds to WBD’s legacy media businesses. Looking ahead, WBD’s continued progress on the realization of its $4 billion annualized cost-savings target, as well as consistent deleveraging of its balance sheet will also be key accretive drivers to its valuation prospects over the longer-term.

In the meantime, despite signs of stabilizing and improving demand at its core advertising vertical, macroeconomic uncertainties that remain in flux continue to bring forth multiple compression risks. This is consistent with accelerating declines at WBD’s Studio and Network segments during the first quarter due to secular weakness in linear TV subscriptions and, inadvertently, softer ad demand for the related formats. Taken together with ongoing execution risks pertaining to the underlying business’ ability in achieving its longer-term post-merger financial targets, investors’ confidence remains fragile, keeping the stock susceptible to the volatile market climate.

It is likely that potential near-term respites to the WBD stock – counting modest stability to its core advertising sales, alongside gradual ramp up of its new DTC offering and realization of its current year annualized cost-savings target of $3 billion ($1 billion achieved in 2022, with incremental $2 billion cost capture for 2023) – have already been reflected in the stock at current levels. Investors’ next focus likely remains on WBD’s ability to realize said near-term transformation targets, with anticipation for cyclical tailwinds to return, before pricing in a reduction to execution risks and incremental value attributable to the broader company’s longer-term growth and synergy prospects.

1Q23 Performance Overview

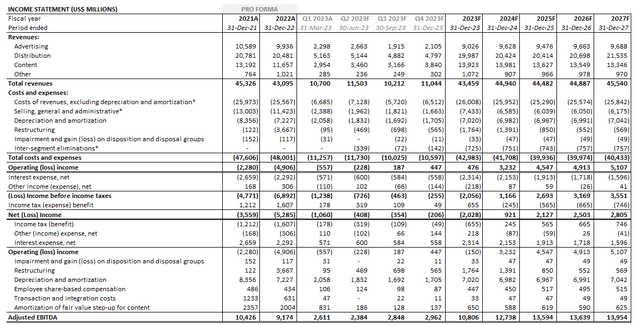

WBD reported revenue growth of -5% y/y ex-FX (pro-forma basis) to $10.7 billion, underperforming the average analyst estimate of $10.77 billion slightly. Earnings came in at -$0.44 per share, missing the average analyst estimate of -$0.21 per share by a wide margin. Despite the wide earnings miss, the narrowing losses – particularly in the DTC segment – were a particular bright spot, implying gradual progress in WBD’s ongoing efforts aimed at realizing post-merger transformation targets that include $3 billion in annualized cost-savings this year, which will blossom into $4 billion over time.

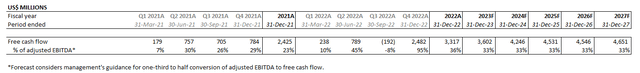

Taken together, the company reported adjusted EBITDA of $2.6 billion for the first quarter, alongside negative free cash flow of $930 million driven primarily by the “timing of sports rights payments, timing of content outlays and cash interest payments on a large portion of the acquisition debt”, alongside other non-recurring restructuring costs, which management had warned of earlier this year. However, with major cash outflows accounted for early on in the year, WBD’s free cash flows are likely to improve from the low point over coming quarters as management reiterates an EBITDA conversion ratio target of one-third to half, which would equate to approximately $6 billion by the end of the year on guided adjusted EBITDA of low to mid $11 billion.

Looking ahead management’s continued cautious optimism is in line with ongoing macroeconomic uncertainties, considering visibility into possibilities of a second half recovery remains blighted by elevated risks of recession and deteriorating consumer environment. But reaffirmation on its full year guidance for low to mid $11 billion in adjusted EBITDA, supported by annualized cost capture totaling $3 billion, alongside a conversion to free cash flow ratio between one-third and half has likely assuaged some of investors’ concerns over the looming near-term impact of tightening economic conditions.

Building DTC

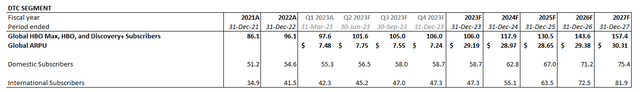

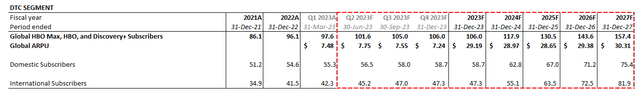

Zeroing-in on DTC, the segment gained 1.6 million paying subscribers globally during the first quarter, taking the total count to 97.6 million. This puts management’s long-term target for global paying subscribers to reach 130 million by mid-decade about 32.4 million subscriptions out – or about 3 million on average per quarter, which we view as reasonable considering the anticipated ramp up of Max demand, buoyed by a robust content roadmap recently shared during the new streaming platform’s launch event in April. Global ARPU also expanded from $7.39 in the fourth quarter to $7.48 during the first quarter, driven primarily by accelerating growth of higher-paying domestic subscribers, as well as gradual ARPU expansion for international subscribers.

WBD DTC Subscriptions (WBD 1Q23 Results)

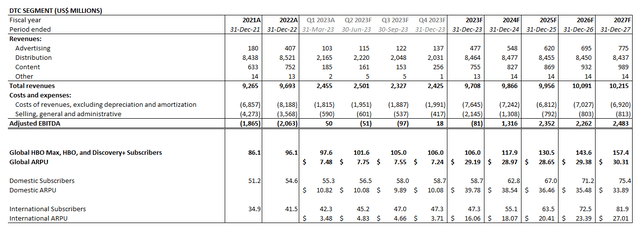

Subscription ARPU expansion, as well as aggressive cost optimization efforts undertaken by WBD over the past year, have been key to narrowing the segment’s losses despite weaker DTC wholesale distribution and third-party content licensing sales during the first quarter. Specifically, robust double-digit growth in DTC advertising revenues continue to underscore the appeal of WBD’s DTC ad distribution formats as subscriptions increase to support reach and optimized returns on ad spending (“ROAS”) for advertisers amid an uncertain macroeconomic backdrop. The trends are also consistent with signs of stabilizing ad demand observed across the broader industry, despite the deteriorating economy. Taken together, the DTC segment reported adjusted EBITDA of $50 million for the first quarter, improving by $704 million from -$654 million in the same period last year and $267 million from -$217 million during the fourth quarter. This continues to reinforce management’s expectations to achieve breakeven for U.S. DTC this year – a year ahead of the previously guided timeline – and breakeven for the broader segment next year, alongside at least $1 billion in earnings beginning 2025.

Despite signs of meaningful improvement for the DTC segment in recent quarters, the segment’s near-term performance is likely to stay mixed in the coming months, with rising competition and lingering macroeconomic headwinds being primary challenges. Specifically, DTC performance is primarily driven by two fronts – subscriptions and advertising – which operate within an increasingly saturated market while also inherently sensitive to the macroeconomic environment.

Subscriptions

On the subscription front, management has set a target to reach 130 million paid sign-ups by mid-decade. Persistent macroeconomic uncertainties within the foreseeable future, alongside rising competition and subsiding pandemic-era tailwinds are likely to weigh on progress in growing subscribers, adding pressure on the back-end of the target timeline and inadvertently dialing up execution risks. Although the quarterly run-rate required to reach 130 million subscribers by the end 2025 remains reasonably achievable as discussed in the earlier section, continued economic deterioration and consumer weakness over the near-term could limit visibility on how the dynamics will impact WBD’s market share gains in streaming.

Specifically, retail sales have been on a consistent decline in recent months, while the labour market is also showing consistent signs of a cooldown. The latest JOLTS report indicated a decelerated pace of hiring, with available positions declining for the third consecutive month to 959 million in March – the lowest since the onset of the pandemic. While the trends point to a rebalancing in labour supply and demand that will ease pressure on wage growth, they remain far from levels needed to place a meaningful impact on stemming inflation – a factor that, combined with rising borrowing costs, has been eroding household savings. For now, the labour market still remains “very tight” with the unemployment rate staying near all-time lows of 3.5% in March.

But ensuing declines in employment and income are not completely out of the picture – specifically, nominal wage growth has eased in recent months with the ratio of vacant positions to unemployed at 1.6 in March, a level not seen since October 2021. This risks further pressure on consumption over the coming months, which could be a transient headwind facing WBD’s DTC subscription growth aspirations. The bleak near-term consumption outlook is further corroborated by the Fed’s latest Beige Book report, which showed consumer spending had been “flat to down slightly” in recent months, adding to uncertainties over WBD’s DTC demand environment over the near-term. First Republic Bank’s (OTCPK:FRCB) failure last week is also stoking renewed concerns over instability within the U.S. financial system amid tightening credit conditions, dialing up risks of further economic deterioration which could be an acute challenge to the recession-prone streaming business.

And industry data paints a similar picture on the macroeconomic environment that remains in flux. Despite a robust earnings beat averaging 6.9% observed across half of the S&P 500 companies that have reported March quarter results so far, many have opted for a conservative forward guidance, acknowledging limited visibility on the near-term macroeconomic outlook given the expansive slate of developments spanning persistent inflation, rising interest rates, and instability in the banking sector which together have increased recession risks. And we view WBD management’s cautious optimism on the near-term business environment prudent considering uncertainties ahead.

Looking ahead, the ramp up of Max on its new pricing model introduced earlier in the year will be a positive for mitigating some of the DTC segment’s exposure to near-term macroeconomic headwinds. Despite being rolled out into a weak consumer backdrop, Max’s upcoming debut in the U.S. later this month will likely drive incremental demand, nonetheless, especially on the “Max Ultimate Ad Free” plan that was not available previously. Specifically, the Max Ultimate Ad Free plan would cost $19.99/month or $199.99/year, and allow four users to stream simultaneously at up to 4K UHD resolution and Dolby Atmos sound quality. Users on the Ultimate Ad Free plan will also be allowed up to 100 offline downloads. The premium tier’s pricing and features are competitive against similar offerings by key rivals, including Netflix (NFLX).

We view WBD’s pricing strategy for Max as a prudent one to minimize subscription churn amid a shaky macroeconomic environment alongside stiffening competition. Recall that the existing streaming platform, HBO Max, had already been integrating Discovery content since last year with positive reception.

A second example around content, we’ve begun experimenting with bringing [Discovery+] content onto HBO Max. Starting with select Magnolia Network shows such as Fixer Upper: The Castle, which was a top five show after only its first few days on the service. These early green shoots bolster our strategic thesis that the two content offerings work well together and when combined, should drive greater engagement, lower churn and higher customer lifetime value.

Source: WBD 3Q22 Earnings Call Transcript

Hence, the rebrand itself is unlikely to drive significant incremental demand, with new content release doing the heavy lifting instead. So by keeping pricing on the standard ad-lite (rebranded as “Max Ad-Lite”) and ad-free (rebranded as “Max Ad Free”) unchanged at $9.99/month ($99.99/year) and $15.99/month ($199.99/year), respectively, the potential for churn induced directly by the rebrand would be minimized. If anything, changes to subscription incentives directly from the rebrand would be positive, with the pricing strategy encouraging migration to the higher-priced Max Ultimate Ad Free tier – a new subscription option with the relaunch of Max. The Max Ultimate Ad Free tier is also offered at a same annual subscription rate as the Max Ad Free tier despite promising additional premium features, providing prospective subscribers with an incentive to lock-in on the deal and help WBD mitigate quarterly churn as it works on ramping up demand on the new service.

WBD DTC Subscription Forecast (Author)

Advertising

Meanwhile, on the advertising front, the vertical is inherently sensitive to macroeconomic headwinds. Despite continued strength in DTC advertising sales, we view management’s cautious commentary on the consolidated ad revenue stream’s near-term outlook, with acknowledgement of WBD’s exposure to secular declines in linear TV viewership, as prudently conservative.

WBD management’s commentary is also consistent with the broader advertising industry’s acknowledgement of a still-cautious ad spending environment amid ongoing macroeconomic uncertainties, despite relatively stable demand trends observed during the first quarter.

Global macroeconomic uncertainty, which negatively impacted the advertising industry throughout 2022, has continued to drive challenges for Tremor, its global customers, and its partners to this point in 2023. We saw the advertising environment significantly soften during the months of December and January and into early February, but we have observed potential signs of recovery and stability in the market since that time.

Source: Tremor International 4Q22 Earnings Call Transcript

On the macro side, while the macro environment appears to have stabilized, it’s stabilized at a much weaker level compared to where we were, for example, a year ago.

Source: Snap 1Q23 Earnings Call Transcript

We saw the ongoing pullback in advertiser spend, and I would contrast that – last quarter we talked about both pullback in YouTube and Network and we were pleased that we saw the stabilization in ad spend.

Source: Google 1Q23 Earnings Call Transcript

…it remains a volatile macro environment. The market has absorbed a lot of new developments over the last year with inflation, higher interest rates, banking instability, etc. And it’s hard to have perfect visibility on how those dynamics will impact the broader economy and specifically the advertising markets for Q2 and for the rest of the year.

Source: Meta Platforms 1Q23 Earnings Call Transcript

Uncertainty remains a common theme across the advertising industry, both over the coming months and entering the second half of 2023. This is consistent with Magna Global’s forecast for ad demand trends this year to stay muted given “mixed macroeconomic signals”.

The media intelligence firm estimates U.S. ad demand to grow at a decelerated pace of 3.4% y/y in 2023, with the market to stay relatively subdued in the first half of the year at sub-3% y/y growth, and slightly pickup in the second half of the year at sub-7% y/y growth. Digital advertising formats will be a core driver with estimated growth at 8.4% y/y, led primarily by demand for digital video/AVOD ad formats which is estimated to grow at more than 11% y/y in 2023. This remains in line with the DTC segment’s robust double-digit ad revenue growth in recent quarters, despite cautious optimism on the broader ad demand environment given macroeconomic headwinds. The trends will also be critical to offsetting continued declines in linear TV ad demand, which is estimated at -3.6% y/y in 2023, in line with weakness observed in WBD’s Studio and Network ad sales performance in recent quarters.

While the second half of the year has historically been a strong period for ad demand given the seasonal boost in consumption trends (e.g. back-to-school and holiday season consumption activity), related trends will likely be subdued this year due to lapping of incremental demand in the same period last year driven by the mid-term elections and the World Cup – similar to lapping headwinds experienced in first quarter ad sales due to the absence of 2022 Winter Olympic Games demand in the current year. And considering uncertainties on whether macro headwinds are easing sufficiently to sustain continued durability in ad demand, WBD’s consolidated advertising sales – including within its budding DTC segment – remains susceptible to weakness.

But over the longer-term, advertising sales will likely be doing most of the heavy lifting on DTC segment ARPU over time. Specifically AVOD will be the fastest growing format in digital advertising given secular declines in linear TV / traditional media advertising, which is corroborated by maturing growth at WBD’s Studio and Network segment ad sales in recent quarters. And the DTC segment remains well positioned to capture the transition of ad dollars from linear to digital over the longer-term by leveraging WBD’s expansive advertising clientele, given its reputation as one of the largest linear ad distribution formats in media and entertainment.

Continued ramp up of Max and Discovery+’s ad lite streaming tier will also be critical to reinforcing longer-term DTC advertising sales growth. And consumer preferences appear supportive of said efforts. Specifically, household income appears to play a nominal role in determining ad tolerance, with recent industry surveys showing “no significant correlation around pricing or preference for subscription over advertisements.” In fact, American households with annual income over $100,000 are only willing to pay $6.40 per month on average for streaming without ads, slightly less than the $7.10 per month that those with annual income under the $100,000 threshold are willing to pay. The favourable ad tolerance trends among streaming platform subscribers reinforce a robust longer-term demand environment for the DTC segment’s ad-supported offerings. This would inadvertently bolster engagement and reach on WBD’s DTC ad formats over the longer-term and optimize ROAS for advertisers. Ensuing incremental ad dollar allocation to WBD’s streaming platforms will also reinforce expectations for long-term ARPU expansion and overall DTC segment profitability.

WBD DTC Financial Forecast (Author)

Valuation Analysis

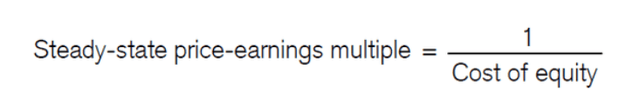

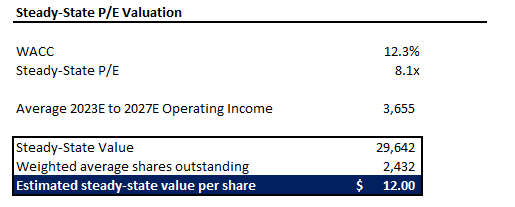

Drawing on our fundamental forecast for WBD, taking into consideration the company’s actual first quarter performance and near-term outlook, we believe the stock is currently trading close to its steady-state value, which reflects the underlying business’ worth when “NOPAT (net operating profit after tax) is sustainable indefinitely and incremental investments will neither add, nor subtract, value”. One way to derive the steady-state value is through the “steady-state P/E multiple” which is denoted by 1 divided by cost of equity:

Steady-State P/E Multiple (Valuation Theory)

A company can continue to grow earnings as it invests at the cost of capital. It will just fail to create value, and hence should trade at its steady-state worth. We can readily translate from the steady-state value to a steady-state price-earnings multiple, which is the reciprocal of the cost of [capital].

Source: Credit Suisse

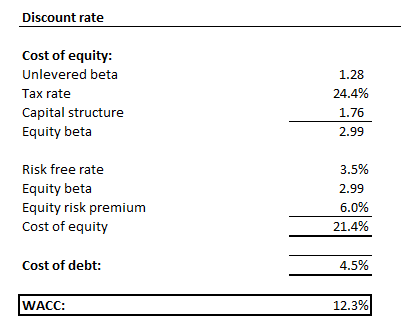

At a WACC around 12% to reflect WBD’s risk profile and capital structure, a steady-state P/E multiple would be approximately 8.1x. Applying the multiple on the average estimated operating income at WBD over the discrete five-year forecast period would yield a steady-state value of about $29.6 billion, or about $12 apiece, in line with the stock’s current share price.

WBD Financial Forecast (Author) WBD Steady-State Valuation Analysis (Author)

WBD_-_Forecasted_Financial_Information.pdf

While WBD’s transformational and synergy targets following its blockbuster merger last year underscores renewed growth prospects over the longer-term, which would warrant an incremental premium, the estimated steady-state value in which the stock approximates at current levels potentially implies market’s expectations for elevated execution risks ahead still.

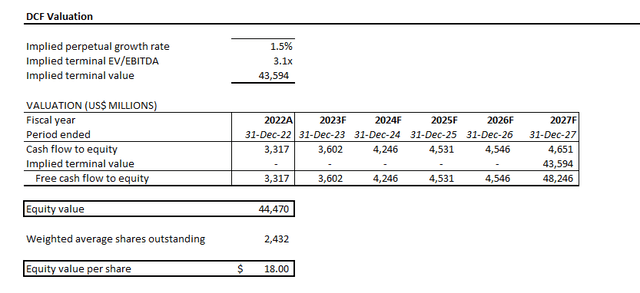

However, the stock could benefit from upside potential towards $18 apiece if the underlying business’ near-term transformational and synergy targets (e.g. one-third to half adjusted EBITDA conversion to free cash flow, low to mid $11 billion adjusted EBITDA and annualized cost-savings of $3 billion achieved by year-end) are reached, effectively alleviating execution-driven multiple compression risks weighing on the stock. Easing macro-driven valuation multiple compression risks would also be accretive to the stock’s upside potential to reflect greater visibility into WBD’s longer-term fundamental prospects when cyclical tailwinds return.

WBD FCF Forecast (Author) WBD DCF Analysis (Author) WBD Discount Rate Computation (Author)

The Bottom Line

WBD’s stock continues to be valued at a low multiple range due to the overwhelming weight of its slow-growing legacy business segments despite the appeal of their profitability. Execution risks on WBD’s DTC strategy, compounded by transient macroeconomic challenges spanning rising borrowing costs, inflation, and consumer weakness amid a looming recession are also weighing on its demand and profitability environment.

This accordingly makes consistent positive progress on achieving the post-merger financial targets – including DTC market share gains as well as a trajectory supportive of sustained growth and free cash flow expansion – key for WBD to restore investors’ confidence in the stock. Despite WBD’s robust first quarter results, there is much work to be done still to prove that the business is on a durable trajectory towards renewed growth and profitability. Execution risks remain on the company’s growth strategy, leaving the stock – which currently trades close to what we view as a steady-state value – vulnerable to the volatile market climate still. We view consistent positive progress supportive of WBD’s ability in achieving its near-term financial and long-term transformational targets discussed in the foregoing analysis as value accretive factors to bolstering investors’ confidence and unlocking further upside potential over the longer-term. Structural evidence supportive of WBD’s ability in achieving its 2023 financial targets over the coming months will be a favourable first step. Until then, the stock lacks support for a durable rally and remains vulnerable to the volatile market climate.

Read the full article here