Investment Thesis

Enovix (NASDAQ:ENVX) continues to be an impressive company. And yet, it’s a highly shorted company. The bear case is the doubt over whether Enovix can, in actuality, gain enough scale to be a meaningful battery producer.

This quarter cements my view that this company should be taken seriously. Readers are not too late to buy this stock.

Rapid Recap

In my previous analysis, I stated that,

Enovix is a pre-revenue business. That means that it’s not yet generating revenues and isn’t expected to start reporting revenues until 2024.

[…] The business is running at full speed, while raising funds, to produce millions of batteries for top tier 1 tech businesses. Presently, leading global OEMs’ (original equipment manufacturer) customers are trialing the batteries and their rollout is expected to start slowly.

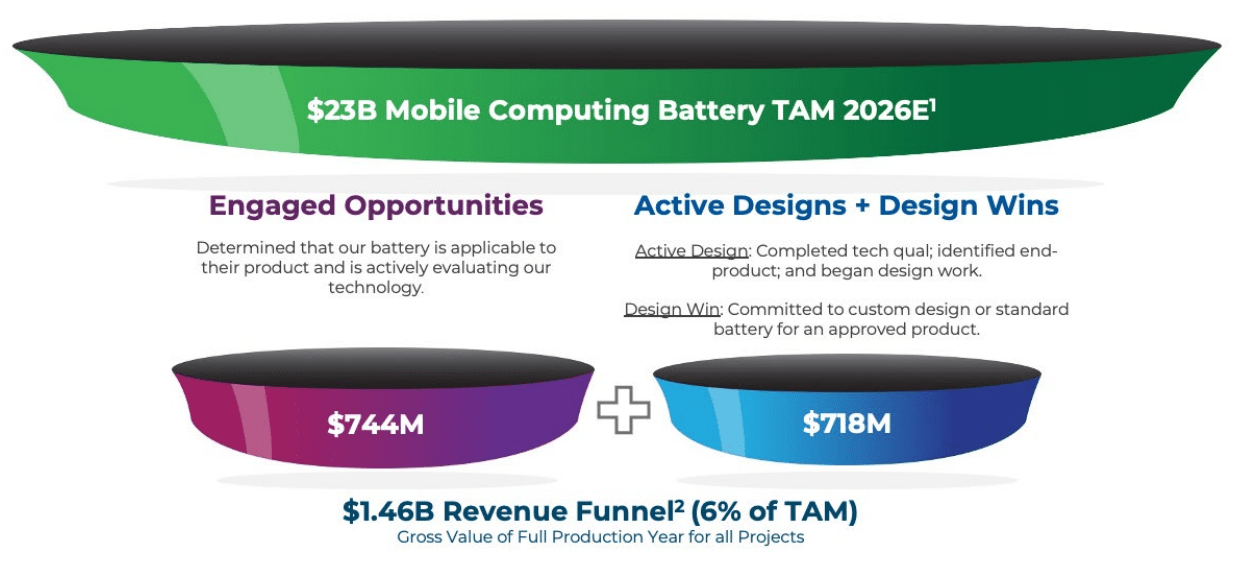

ENVX Investor Presentation

The graphic above speaks of the Total Addressable Market that Enovix is targeting in the very near term.

Why Enovix?

To repeat, this business is not generating any revenues at this moment in time. Enovix’s BrakeFlow batteries provide more energy capacity than traditional lithium-ion batteries.

In plain English, this means that Enovix is one of the leading players in the world to make wearable batteries that heat up significantly less than conventional batteries.

Wearable devices are extremely powerful, but it’s the batteries on wearables that stand in the way of them being maximally productive. And that’s what Enovix is seeking to solve.

Why Enovix Now?

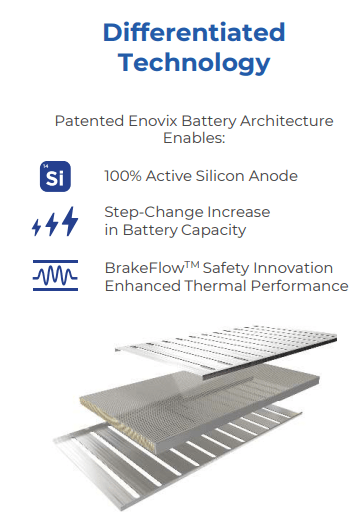

The graphic below highlights what makes Enovix’s batteries different.

ENVX Q2 2023

Enovix’s BrakeFlow technology prevents the battery from overheating. This allows the batteries to deliver more capacity. Why would you need more capacity? See below.

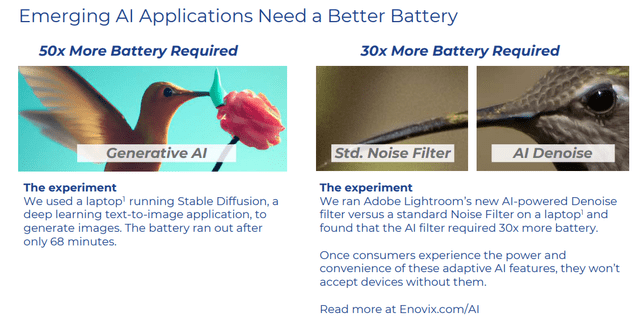

ENVX Q2 2023

As my followers will know, AI is extremely power-hungry. Everyone wants AI technology, but few are willing to admit the rapidly rising costs associated with this technology.

The only way to tackle the rising costs of AI is through better technology.

Quarterly Update, Rapid Progress

Enovix continues to deliver rapid progress. Here’s a quote that gets to the heart of my bullish thesis on Enovix,

I am happy to share that Enovix has established engagements for smartphones with leading OEMs like Xiaomi, Vivo, and Lenovo. Xiaomi and Vivo were both top 5 OEMs globally in smartphone shipments in 2022, according to IDC. And Lenovo’s Motorola brand held the No. 3 market share spot among mobile vendors in the U.S. during the second quarter, according to StatCounter Global Stats

Enovix has consistently maintained that every quarter of 2023 it would double the number of batteries it produces. Here’s their progress.

- Q4 2022: 4.4K units

- Q1 2023: 12.5K units

- Q2 2023: 22.5K units

- Q3 2023 guidance: 36K units

I believe that when Q3 2023 ultimately gets reported, they’ll probably end up making closer to 45K units. Nonetheless, Enovix is leaving themselves ample room to positively impress investors later.

If indeed Enovix continues at the cadence of doubling their production units each quarter as they set out to do back in Q4 2022, it’s possible that Q4 2023 would see Enovix qualifying 100K units. That would mean that the company is running at high speed. The advantage of running at high speed is that the operating costs start to fall precipitously.

As reference points, this is a jump of 2,500% in batteries produced compared with H1 2023.

Profitability Profile in 2026

ENVX remains on track for the first production at its Fab2 facility of the Gen2 Autoline in April ’24. From that point, there will be rapid growth in revenues.

Enovix’s long-term prospects aim for 50% gross margins and 30% EBIT margins.

More specifically, Enovix should get to around $380 million of revenues in 2026 and see about 30% EBIT margins, meaning around $100 million and more in operating profits.

The stock is now priced at 35x forward (hypothetical) operating profits. Not sales, but actual profits. That being said, these profits are still 3 years out.

Meaning that between now and then, investors should continue to look toward different milestones. The big one is at the start of 2024 when its Malaysian production ramps up.

The Bottom Line

Enovix continues to impress me as a company, despite facing significant short interest. This quarter’s performance solidifies my belief that Enovix deserves serious consideration as an investment opportunity.

The company’s BrakeFlow batteries offer superior energy capacity compared to traditional lithium-ion batteries, making them a leader in wearable battery technology.

With engagements established with top OEMs like Xiaomi, Vivo, and Lenovo, Enovix’s progress in producing batteries is rapid, and the growth trajectory is promising.

I am confident in the potential for Enovix to achieve profitability in the future, with its long-term prospects aiming for robust margins and substantial operating profits.

Considering these factors, I believe this is an opportune time to invest in Enovix and support its journey to becoming a major battery producer.

Read the full article here