Introduction

I’m not sure if the relationship is linear or exponential, but the higher the yield on a stock, the more nervous it makes me, as I’ve witnessed so many people buy into high-yield investments only to figure out that most of these companies come with horrible long-term total returns.

However, as I wrote in a recent article covering Enbridge’s (ENB) 7% yield, some investors will require a high yield as the retirement outlook for America (and most other nations) is dire. Very dire.

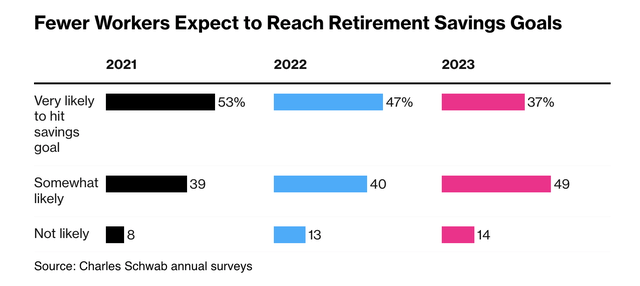

In that article, I used Bloomberg data that showed that an increasing number of people believe they are unlikely to hit their retirement goals.

Bloomberg

According to their research, the percentage of participants who considered it very likely to achieve their retirement savings target fell from 47% in 2022 to 37%, which is a significant decline from 53% reported in 2021.

To make things worse, the article also included a recent study conducted by Vanguard which revealed that the average balance for participants in Vanguard’s defined contribution plans stood at $112,572 by the end of 2022.

The median balance was significantly lower, at $27,376, showing that the median American isn’t even anywhere close to his/her retirement goal.

These numbers are dire and indicative of significant retirement funding shortages in the future.

While I won’t be able to change this trend, it does help to focus on stocks that come with a decent income. After all, if we assume that most people won’t be able to end up with multi-million dollar nest eggs, the key is to make the most out of every dollar without taking unnecessary risks.

The key here is aiming for high yields without buying stocks that will blow up in your face.

That’s where the Ares Capital Corporation (NASDAQ:ARCC) comes in.

This stock boasts a 10% yield with a terrific track record of outperformance supported by a top-tier portfolio and healthy financials.

Right now, everything seems to go right. Rates are elevated, allowing the company to benefit from its variable rate structure. Meanwhile, the economy is strong enough to allow companies to service their debt.

In this article, we’ll dive into the details and figure out if ARCC might be right for you.

So, let’s get to it!

A Fat Yield & Outperformance

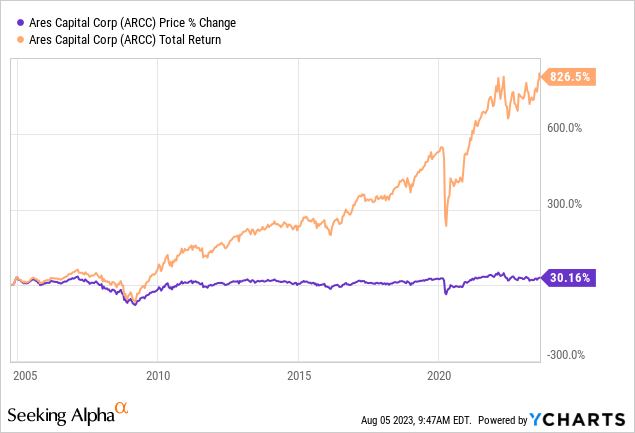

Let’s start with the best news: ARCC is an outperformer.

While this business development company has only seen a 30% increase in its stock price since 2005, the total return picture is much better. Since 2005, investors who have reinvested every penny they received in dividends have returned close to 830%.

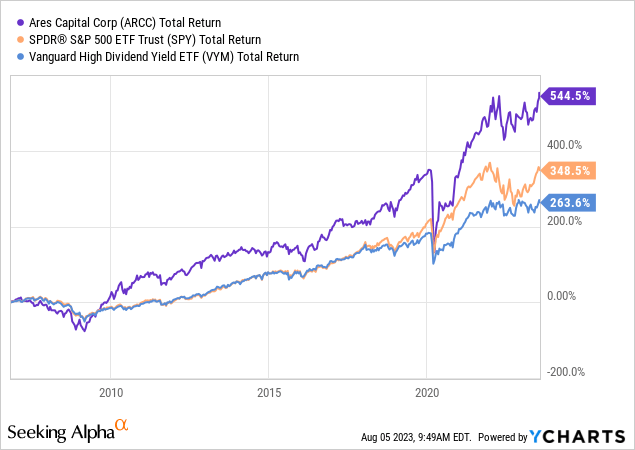

Even better, this performance has been rather consistent and allowed investors to outperform high-yield ETFs like (VYM).

Also, compared to pre-Great Financial Crisis levels, ARCC has outperformed the S&P 500 on a total return basis.

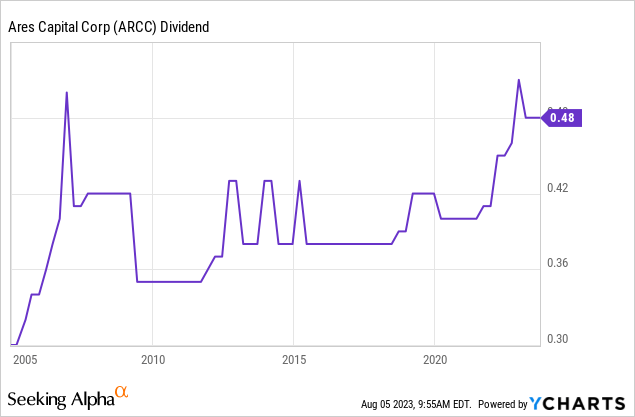

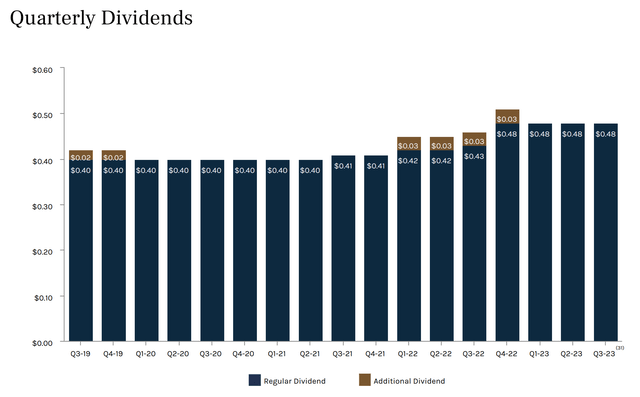

On top of that, the company has 56 consecutive quarters of steady or increasing dividends, which is 14 years.

Please be aware that the dividend declines in the past 14 years were not dividend cuts but the effect of special dividends.

Since 2019, the company has paid six special dividends. In 2022, investors received a special dividend every single quarter.

Ares Capital Corporation

Based on the current quarterly dividend of $0.48, we’re dealing with a 9.8% dividend yield.

How Strong Is ARCC?

As I already briefly stated in the introduction, Ares Capital benefits from the current environment of elevated rates.

With a portfolio of more than $20 billion in assets, the company is the largest business development company in the United States.

The company is externally managed by Ares Capital Management LLC, which is a subsidiary of the Ares Management Corporation (ARES).

This affiliation aligns with the company’s investment goal of achieving both current income and capital appreciation through a blend of debt and equity investments. This obviously includes having the benefit of Ares Management’s size and expertise.

With regard to its investments, ARCC predominantly invests in US middle-market companies, typically those with annual EBITDA ranging between $10 million and $250 million. This strategic approach involves a focus on first and second-lien senior secured loans alongside subordinated debt and preferred equity.

This strategy significantly lowers default risks.

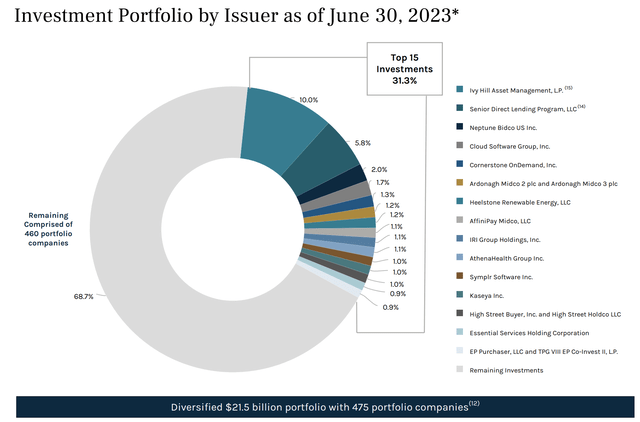

Speaking of its portfolio, ARCC’s total portfolio at fair value closed at $21.5 billion at the end of the second quarter, which is up from $21.1 billion in the prior quarter. Growth was mainly driven by net funding.

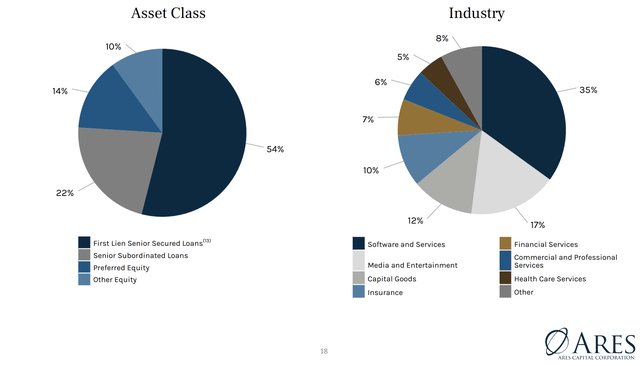

This portfolio currently consists of 475 portfolio companies. The biggest one accounts for 10% of the total portfolio value. The second-largest weighting is 5.8%. All other companies account for 2% or less. The majority of companies account for less than 1% of the total portfolio value. The average weighting is just 0.2%.

Ares Capital Corporation

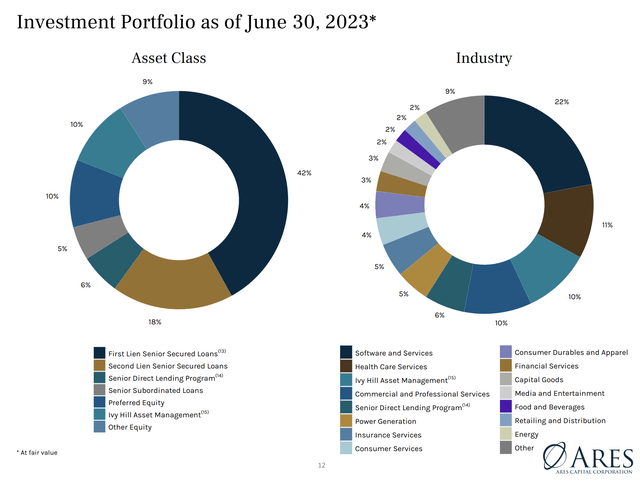

42% of total debt was first-lien senior secured debt.

Software and healthcare companies accounted for a third of total loans.

Ares Capital Corporation

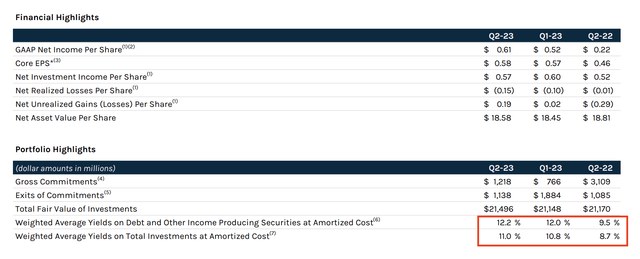

The weighted average yield on debt and other income-producing securities at amortized cost was 12.2% as of June 30, 2023, a slight increase from the 12% recorded on March 31, 2023, and a substantial increase from the 9.5% reported on June 30, 2022.

Similarly, the weighted average yield on total investments at amortized cost was 11.0%, showing an improvement from 10.8% on March 31, 2023, and 8.7% on June 30, 2022.

These yield improvements were attributed to the ongoing increases in interest rates. Note that 68% of the company’s loans carry a floating rate.

I highlighted the yields in the overview below.

Ares Capital Corporation

So far, so good.

What is important to monitor is the health of portfolio companies. After all, higher rates are good for ARCC but not so much for the companies that need to pay these rates.

According to Ares, the companies in its portfolio are doing just fine.

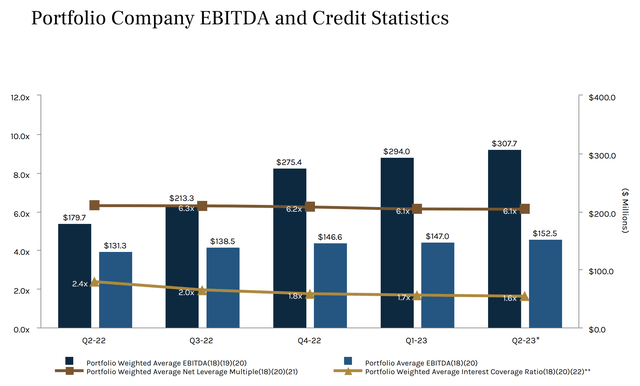

During the second quarter, the portfolio companies saw a healthy annual growth rate of 7% in their EBITDA.

The borrowers’ portfolio grade at cost remained stable at 3.1, and there was a slight improvement in non-accrual rates from the previous quarter. Non-accruals at fair value decreased from 1.3% to 1.1%, and non-accrual rates at cost dropped from 2.3% to 2.1%. The company credits this positive trend to careful monitoring of inflation impacts.

The percentage of the portfolio highly impacted by inflation risk also saw a modest improvement and is moving towards the lower end of their estimated range of 5% to 10%.

Furthermore, the weighted average net leverage ratio of portfolio companies remained at 6.1x. Interest coverage continued to decline to 1.6x, albeit at a subdued rate, which indicates satisfying interest coverage.

Ares Capital Corporation

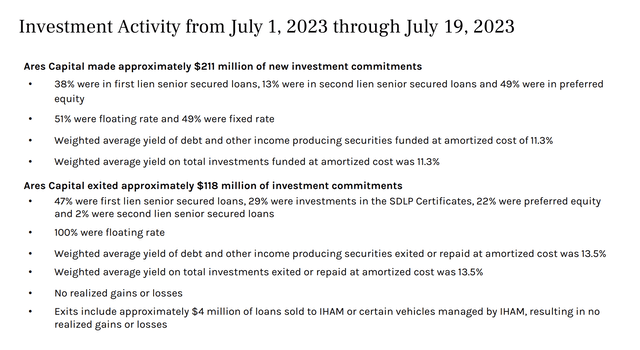

Moreover, the company is obviously not sitting idle but looking for new opportunities.

Following the second quarter, the company’s investment activity continued, with new commitments totaling $211 million, $119 million of which were funded.

Ares Capital Corporation

An exit or repayment of $118 million in investment commitments was also achieved.

The company’s backlog and pipeline, as of July 19, 2023, were roughly $470 million, pending approvals and documentation.

According to the company:

We continue to find compelling value in today’s market. This is demonstrated by the first lien investments we originated in the quarter, which had a weighted average yield in excess of 11.5%, but leverage of only 4.5x debt to EBITDA. Underscoring Kipp’s earlier point about the historically attractive relative value we are able to achieve on our new investments, the weighted average LTV of our second quarter commitments, including our junior capital investments was below 40%.

Regarding the first-lien comments, more than half of its new debt was first-lien loans.

Ares Capital Corporation

With regard to the direction of the economy, ARCC isn’t sure where the economy is headed.

It does not expect sudden interest rate cuts and is closely monitoring the free cash flow of its portfolio companies as EBITDA continues to grow nicely.

A worst-case scenario would be a situation where inflation remains sticky despite a steeper deterioration in economic growth. A hard-landing scenario would be bad news for both rates and growth, which could put pressure on ARCC.

I am not making the case that this will happen, but it is the biggest risk right now – especially because ARCC is now in a great situation of high rates and solid growth. It doesn’t get much better than this.

Balance Sheet & Valuation

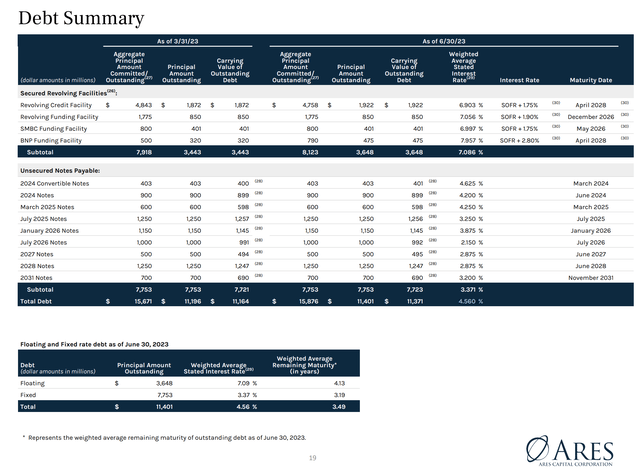

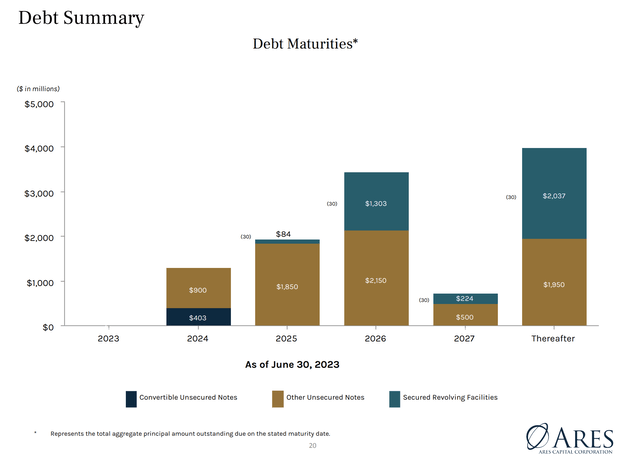

ARCC also has a healthy balance sheet. The debt-to-equity ratio net of available cash decreased slightly from 1.09x in the first quarter to 1.07x in the second quarter.

During its earnings call, the company emphasizes its strong liquidity position, consisting of roughly $4.7 billion in total available liquidity, which includes available cash.

As we can see in the overview below, the company has a weighted average interest rate of 4.6%. Its unsecured notes have a weighted rate of just 3.4%.

Ares Capital Corporation

Roughly 70% of its debt has a fixed rate, which is one of the reasons why the surge in rates turned out to be so bullish for the company.

It has no maturities in 2023, which is great for liquidity, and it means no refinancing is needed in this high-rate environment.

Ares Capital Corporation

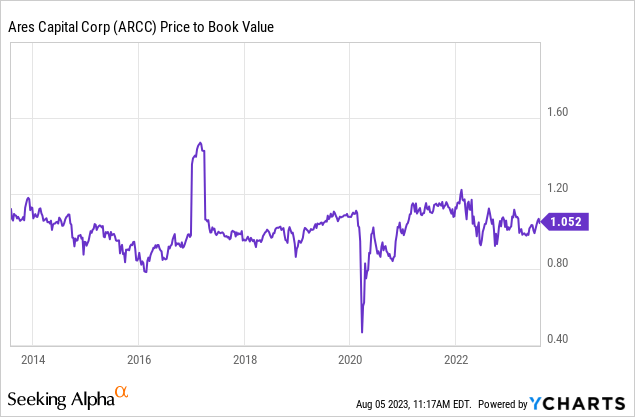

With regard to the valuation, the company is now trading 5% above its book value after its stock price added 11% over the past three months.

I believe this is a fair valuation, which will allow for more upside if rates remain elevated without more weakness in the economy.

Analysts seem to agree, as the company’s consensus price target is $21, which is roughly 7% above the current price.

Hence, I will maintain a buy rating.

However, I do not advise investors to jump in and start buying with both hands.

In general, I advise keeping BDC exposure limited. As much as I like the elevated yield and believe that ARCC is a top 3 high-yield player in its industry, this is a cyclical industry with elevated risks – especially if the economy weakens.

If you decide that ARCC is right for you, please buy in intervals to spread the entry risk. I do not rule out a scenario where rates remain elevated despite elevated economic risks.

That could trigger some selling.

It probably won’t endanger the base dividend, but it wouldn’t do investors any favors.

So, please be careful. Keep BDC exposure limited and buy in intervals, especially after an 11% rally.

Takeaway

The key to successful investing in high-yield stocks is finding the right balance between income and risk. While many investors may need higher yields for retirement, it’s crucial to avoid stocks with poor long-term returns. Ares Capital presents an attractive option with its 10% yield, impressive track record, and robust financials.

ARCC’s consistent outperformance and 56 consecutive quarters of dividends demonstrate its reliability. The company’s strategic investment approach in US middle-market companies lowers default risks.

Furthermore, ARCC’s portfolio companies have shown healthy growth and resilience even in an environment of elevated rates.

However, caution is advised, as this is a cyclical industry with elevated risks, especially if the economy weakens. Spreading the entry risk by buying in intervals is a wise approach. While ARCC may be a top high-yield player, limited exposure to the BDC sector is recommended to avoid potential downsides. So, proceed with careful consideration, keeping a long-term perspective in mind.

Overall, Ares Capital Corporation could be a beneficial addition to an income-focused portfolio, provided one remains vigilant in monitoring economic trends and risks.

Reasons To Be Bullish

- High Yield for Retirement: ARCC offers a compelling 10% yield, making it an appealing choice for income-focused investors.

- Consistent Outperformance: ARCC has delivered impressive total returns, outpacing high-yield ETFs and the S&P 500 on a total return basis since 2005.

- Steady Dividend Growth: With 56 consecutive quarters of steady or increasing dividends, ARCC demonstrates a strong commitment to providing reliable returns to shareholders.

- Robust Portfolio and Financials: ARCC’s strategic investment approach, focus on secured loans, and solid financials reduce default risks and enhance its stability.

- Optimized for Current Environment: ARCC benefits from elevated interest rates and the fact that the economy remains resilient.

Read the full article here