Earnings season can be a great time to validate one’s investment thesis, especially when it comes pharmaceutical companies that have always have something interesting to share when it comes to new drug performance and development.

Like all sectors, the pharma segment comes with unique risks, considering that drugs have limited patent timelines, thereby spurring the need for a healthy and robust pipeline. That’s why it pays to stick with big names like Amgen (NASDAQ:AMGN), which has the resources and built-up knowledge platform to continue evolving.

I last covered AMGN here back in May, highlighting its well-rounded portfolio and record high dividend yield. It appears my bullish take has paid off, with the stock giving investors a 13% return since then, far outpacing the 6% return of the S&P 500 (SPY) over the same time. In this piece, I discuss recent business developments and why the stock remains undervalued for value and income, so let’s get started.

Why AMGN?

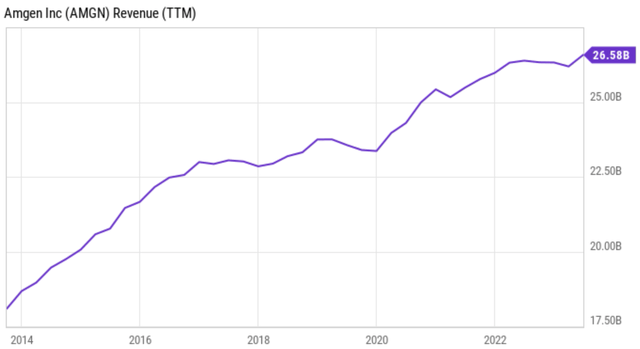

Amgen is a pioneer in the biotechnology space, having been founded in 1980, and carries a portfolio of medicines that reaches millions of patients worldwide. It’s also a member of the prestigious Dow Jones Industrial Average and a member of the Nasdaq-100 index. AMGN has a strong record of revenue growth across economic cycles. As shown below, it’s grown revenue by 47% over the past 10 years, generating $26.6 billion over the trailing 12 months.

YCharts

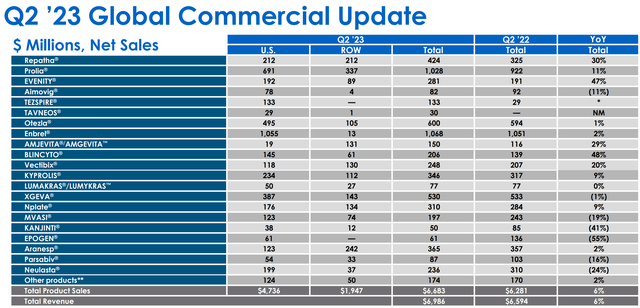

AMGN continued this trend during the second quarter, producing total revenue growth of 6% YoY to ~$7.0 billion. This was driven by robust 11% growth in product volumes, partially offset by 2% lower net selling price, 1% lower inventory levels, and 1% negative impact from currency exchange.

Notably, nine of AMGN’s medicines generated record sales in the quarter, and volume growth included double-digit growth from blockbuster drugs EVENITY, BLINCYTO, Repatha, and LUMAKRAS, among others. It’s also worth mentioning that AMGN’s answer to Humira, AbbVie’s (ABBV) blockbuster plaque psoriasis drug, is gaining strong traction, with AMJEVITA seeing strong 29% YoY growth to $150 million in Q2 sales.

Investor Presentation

Moreover, Prolia, AMGN’s osteoporosis treatment, hit quarterly sales of $1 billion for the first time (up 11% YoY), and management sees plenty of potential for this drug going forward, as noted during the recent earnings call:

Prolia is one of the first biologics to be widely prescribed by primary care physicians to treat a chronic disease, something we expect to see replicated over time in other categories like cardiovascular disease. For all of Prolia success though we know that osteoporosis remains an underdiagnosed and undertreated disease placing millions of elderly women at risk for life-changing fractures. With recently generated real world data, we’ve established that Prolia is superior to alendronate, the most frequently prescribed bisphosphonate treatment in the U.S. in reducing fractures, and not by a little, but by a lot.

Also encouraging, AMGN is seeing very strong growth internationally, as ex-U.S. volume grew by 16% YOY, including a stellar 46% volume growth in Asia. This could be further bolstered by AMGN’s proposed acquisition of Horizon Therapeutics which has a growing practice of treating rare diseases. This proposal has been approved by regulators around the world with the exception of the Federal Trade Commission of the U.S. Nonetheless, management expects the deal to close by mid-December.

Risks to AMGN include potential for the development pipeline to not work out as expected, particularly due to the high cost of drug development. In addition, drug price legislation in the U.S. may result in price caps on drugs, by giving Medicare more negotiation leverage. The full impacts are yet to be known considering that Medicare is set to announce the first 10 drugs that will be subject to price negotiations.

Also, there’s no guarantee that the Horizon Therapeutics acquisition will close, and if denied by the FTC, could have ramification for future consolidations in the drug industry. However, management believes the FTC’s arguments are without merit, noting that there are no competitive overlaps and no incentives to bundle its drugs with that of Horizon’s.

Meanwhile, AMGN carries a strong balance sheet with a BBB+ credit rating from S&P. This includes $34.2 billion in cash on hand, and a reasonably low net debt to EBITDA ratio of 1.98x. This lends support to the 3.5% dividend yield that’s well covered by a 46% payout ratio.

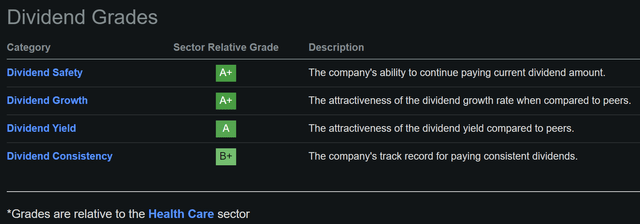

While AMGN’s dividend yield isn’t particularly high, it does sit well above the 1.45% yield of the S&P 500, while also coming with a higher 5-year CAGR of 10.5% and 11-years of consecutive growth. This compares favorably to the 5.8% 5-year dividend CAGR of the S&P 500. As shown below, AMGN scores mostly ‘A’ Dividend grades for safety, growth, yield, and consistency.

Seeking Alpha

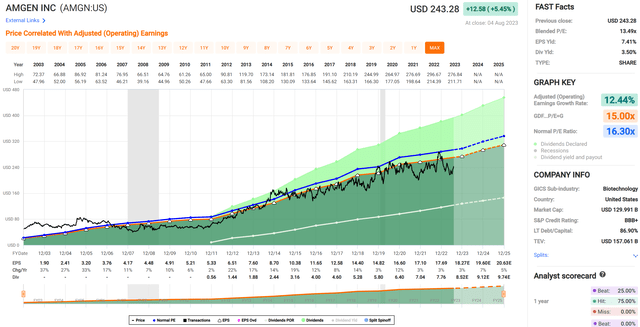

Lastly, I continue to see value in AMGN at the current price of $143 with a forward PE of 13.5, sitting well below its normal PE of 16.3. This is considering AMGN’s track record of strong growth and the 5-10% annual EPS growth that analysts expect over the next 2 years. As shown below, AMGN has had consistent EPS growth over the past 20 years that’s supported its growing share price and is currently priced below its historical norm, as mentioned earlier. As such, AMGN could deliver double-digit total returns simply by returning to its mean valuation.

FAST Graphs

Investor Takeaway

In conclusion, Amgen appears to remain undervalued for value and income investors. Its recent business developments have been positive, as evidenced by strong sales growth in the second quarter from both existing drugs and new ones. It’s also seeing strong performance internationally, particularly in Asia, and its drug, Prolia, shows plenty of promise in the osteoporosis segment. Meanwhile, its balance sheet remains with plenty of cash on hand and a reasonable leverage ratio, enabling it to continue its strong track record of capital returns to shareholders. As such, AMGN presents solid value for potentially strong total returns from here.

Read the full article here