Introduction

Holding PayPal (NASDAQ:PYPL) stock has not been easy for investors.

If you bought the stock in late 2021, you’re 80% in the red.

If you bought the stock 5 years ago, you’re probably slightly down on your investment.

And if you bought the stock a year ago, you must be frustrated to see that PayPal gave you zero returns while you watch the broader markets rally off their bear market lows.

For those who have been holding tightly or buying recently, I salute you.

And for those who are considering selling, don’t be too short-sighted.

Here’s the main takeaway from today’s article (and Q2 results):

While everyone focuses their attention on declining transaction margins… EPS is growing at double digits, TPV growth is accelerating, unbranded processing is gaining massive traction, Operating Margins continue to expand, and the company is buying back shares even more aggressively.

Poor investor sentiment also pushed PayPal’s valuation into deep value territory, providing investors a wide margin of safety.

Growth

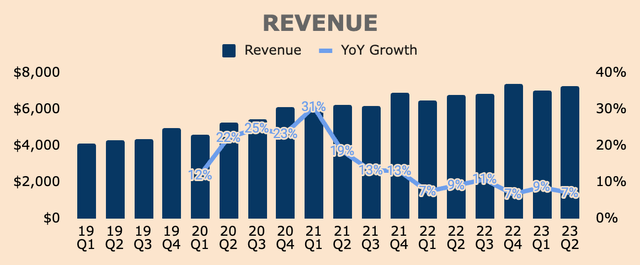

Q2 Revenue was $7.3b, which is up 7% YoY. Despite the slight beat on analyst estimates, you can see that growth has slowed down to a level that really threatened the company’s growth story – blame competition, slowing e-commerce growth, and tough macro conditions.

Years of growth have been pulled forward due to the pandemic, and now, PayPal is behaving like a maturing company. Gone are the days when investors regarded PayPal as the fast-growing fintech darling disrupting the payments industry.

Author’s Analysis

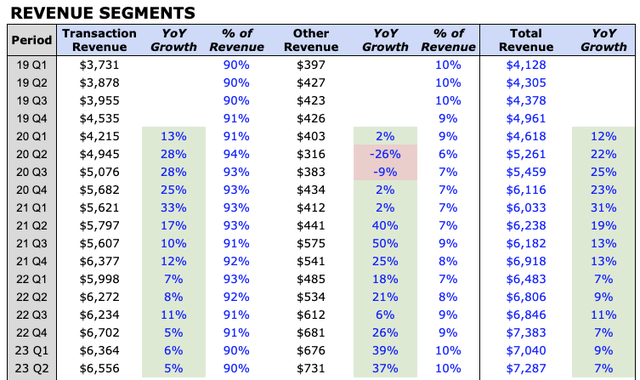

Breaking it down by segment, Transaction Revenue, which makes up the bulk of PayPal’s revenue, was $6.6b, which is only up by 5% YoY.

Transaction Revenue growth was mainly driven by an increase in Total Payment Volume and the growth of Braintree, which is a full-stack payments processing platform, offset by a slowdown in PayPal’s core products and services.

Author’s Analysis

On the other hand, Other Revenue which consists of only 10% of Revenue, grew by 37% YoY, mainly due to increased interest income on customer store balances.

The concern here is that PayPal’s primary Revenue generator has not been picking up over the last few quarters.

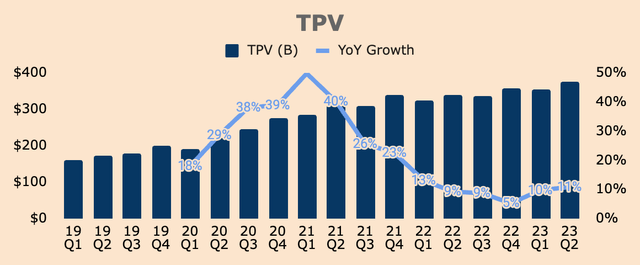

That being said, overall Revenue growth was due to the growth of Total Payment Volume, or TPV, which was $377b in Q2, which is up 11% YoY.

TPV growth continued to accelerate in Q2 driven by PayPal branded checkout, Venmo, and Braintree.

- PayPal branded checkout – grew “mid-single digits” with “acceleration throughout the quarter”

- Venmo – grew 8% YoY, to $67b

- Braintree (unbranded checkout) – grew 30% YoY

Author’s Analysis

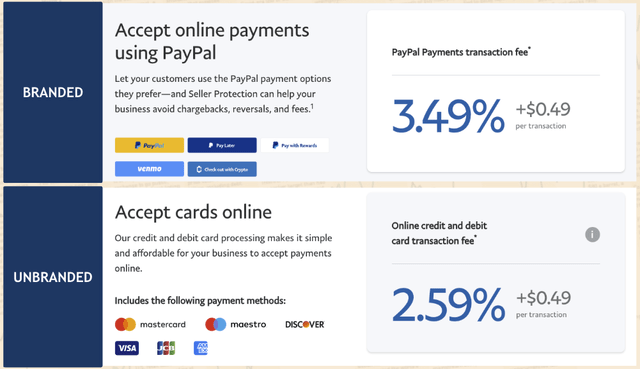

On the other hand, you may have noticed that TPV growth of 11% actually outpaced Transaction Revenue growth of just 5% in Q2. This is due to the massive growth of 30% for unbranded processing, which typically has lower take rates than branded checkouts.

Below, you can see the difference in take rates for branded and unbranded processing. With PayPal-branded transactions like PayPal, Pay Later, and Venmo, merchants get charged a fee of 3.49% + 49 cents per transaction, while unbranded transactions only cost 2.59% + 49 cents per transaction.

PayPal Website, Compiled by Author

So as unbranded processing volume outpaces branded processing volume, take rates and margins naturally take a hit.

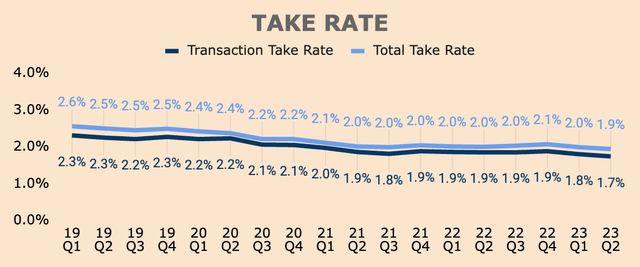

As shown below, PayPal’s Take Rate has been trending down over the last few quarters, and recently in Q2, PayPal recorded the lowest Transaction Take Rate and Total Take Rate ever, at only 1.7% and 1.9%, respectively.

Author’s Analysis

Management explained further why Take Rates were down in Q2:

Transaction take rate was down ~11bps vs. Q2-22, with approximately two-thirds of the decline driven by lower FX fees, lower gains from FX hedges and lapping elevated contractual compensation from merchants last year.

(Source: PayPal FY2023 Q2 Investor Update)

In other words, without the items mentioned above, Take Rates would have been stable sequentially.

Nonetheless, the declining Take Rate may be a symptom of poor monetization within the business, and this is one of the main reasons why investors were not happy with PayPal’s Q2 earnings results, causing the stock to sell off.

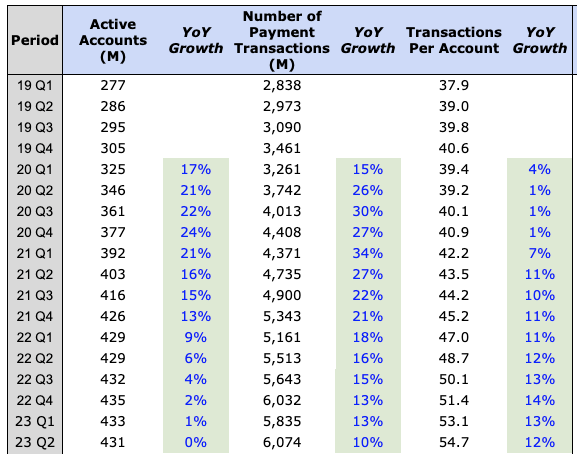

Turning to engagement, Active Accounts continued to decline. On a QoQ basis, PayPal lost about 2.5m Active Accounts.

I think it was back in early 2021 when management laid out an ambitious plan to grow active accounts to 750m accounts by 2025. However, management abandoned that goal as they’re seeing a significant slowdown in account growth.

As you can see, Active Accounts grew 20%+ in 2020 but have pretty much lost momentum, which is probably why management is now focusing on driving engagement, instead of account growth. The reasoning behind this is due to the fact that management sees little ROI from less-engaged customers.

Author’s Analysis

Consequently, management’s priority will be improving the Number of Payment Transactions and Transactions per Account, and as you can see, these two metrics have been growing nicely.

In Q2, the Number of Payment Transactions grew 10% YoY to about 6.1b, and Transactions per Account grew 12% YoY to 54.7.

So despite the slight drop in active accounts, the robust growth in these two metrics shows that PayPal is retaining higher-quality customers and these customers are transacting more and more within PayPal’s platform, which is great to see.

All in all, it’s obvious that PayPal is no longer a rapidly growing fintech company, but I think PayPal is still a high-quality business capable of posting consistent growth of around 8 to 10% over the next few years.

With that said, the greatest concerns for PayPal are that the company’s growth is slowing down and the company seems to be losing market share to competitors as seen from the sequential drop in Active Accounts.

However, in my opinion, the most important metric to look at is TPV. As long as TPV continues to grow, more dollars can be converted to Revenue for PayPal, and we saw that PayPal grew TPV by 11% in Q2.

The issue, of course, is that Take Rates continue to fall. Only time will tell if PayPal can increase monetization by introducing higher-margin, valued-added services that consumers and merchants will actually use.

Profitability

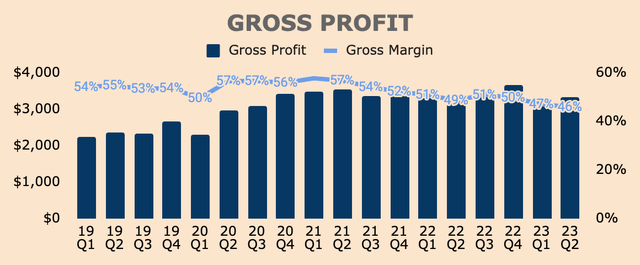

Turning to profitability, Transaction Profit or Gross Profit was $3.3b in Q2, representing a 46% Gross Margin.

Author’s Analysis

As you can see Gross Margins have been decreasing over the last few quarters due to unfavorable product mix with more TPV generated from unbranded card processing, which typically has higher expense rates than PayPal’s branded processing products.

And given the rapid growth in PayPal’s unbranded payment processing business, I expect Gross Margins to continue to decrease in the short term.

Nonetheless, this is the part that most investors are worried about as a decline in Gross Margins means lower earnings potential.

On the bright side, it seems that Q2 could be the trough, and we could see Gross Margins improve in the next few quarters:

We expect to exit the year in a much stronger position from a TM (Transaction Margin) trajectory than where we are right now.

(CFO Gabrielle Rabinovitch – PayPal FY2023 Q2 Earnings Call)

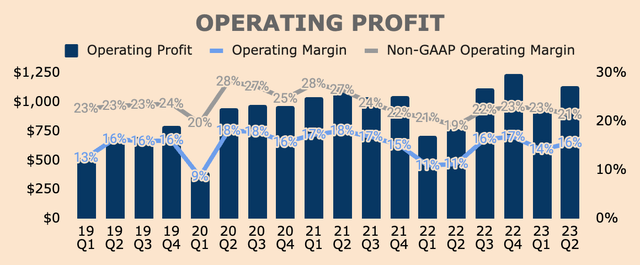

Moving on to Operating Profit, I’ve included both GAAP operating margins as well as Non-GAAP Operating Margins, which adds back share-based compensation and restructuring expenses.

In Q2, GAAP Operating Income was $1.1b, which represents a 16% GAAP Margin and a 21% Non-GAAP Margin.

Despite Gross Margins declining YoY, Operating Margins actually improved YoY, showing operating leverage and the reason for this improvement is due to non-transaction related expenses declining 11% YoY.

Author’s Analysis

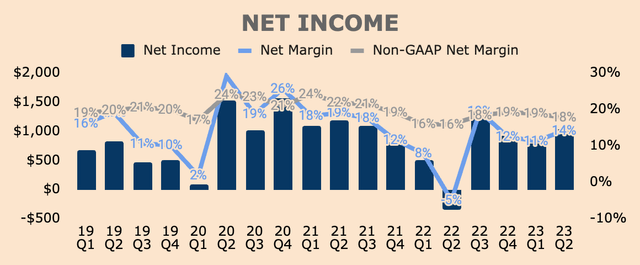

Moving on, Net Profit for Q2 was $1.0b, which represents a 14% GAAP Margin or an 18% Non-GAAP Margin.

That said, the bottom line looks better and I expect these to improve as the company gains operating leverage from increased focus on cost control as well as a recovery of transaction margins.

Author’s Analysis

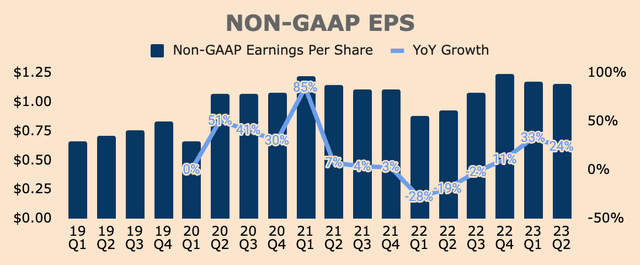

As a result of improved profitability, Earnings Per Share is showing robust growth.

Non-GAAP EPS was down by 10% in 2022 but the company turned it around and produced 33% and 24% Non-GAAP EPS growth in Q1 and Q2, respectively, which means PayPal is still generating shareholder value.

Hopefully, the company keeps this up, and if they do, the stock price should eventually follow EPS growth.

Author’s Analysis

With that being said, the concern is that PayPal’s Gross Margins are declining due to unfavorable product mix, showing diseconomies of scale. On the other hand, Operating Margins are improving due to cost reductions, which shows operating leverage, so it’s a mixed bag for me.

Clearly, the markets didn’t like that margins are compressing and growth is slowing down, which is why PayPal has been selling off like crazy.

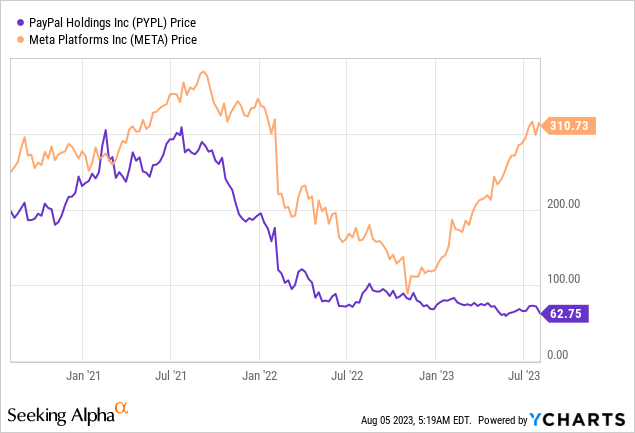

But PayPal’s selloff feels awfully similar to what Meta (META) experienced a year ago.

As you may know, Meta sold off more than 75% due to the same reasons as PayPal. Macro conditions aside, Meta sold off because of slowing account growth and declining margins, which is what PayPal is experiencing right now.

And then Meta announced the year of the efficiency and the stock took off, and I think we could see the same thing in PayPal stock when growth returns to normal and when margins improve.

Then again, we need to see an improvement in Gross Margins before we see a flip in sentiment.

Financial Health

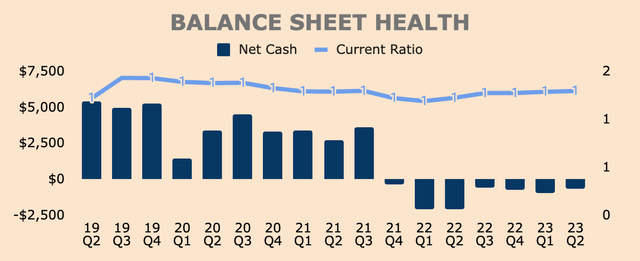

Turning to the balance sheet, PayPal ended the quarter with $9.9b of Cash and Short-term Investments, with a Total Debt of about $10.5b, which brings its Net Cash position to about negative $0.6b.

Ideally, I’d like to see positive Net Cash Balance but PayPal is still in a strong financial position given its strong Free Cash Flow profile.

Author’s Analysis

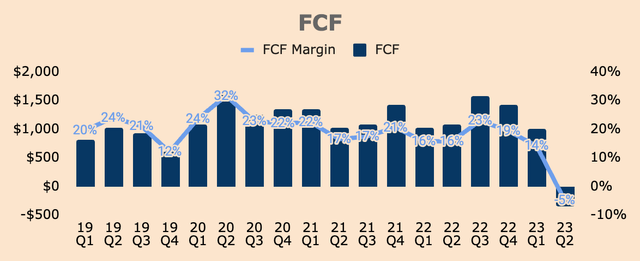

Well, that may not be the case because FCF turned negative in Q2, burning $350m of Cash.

Author’s Analysis

Yes, after years of consistent positive FCF, PayPal is now burning cash and destroying shareholder value.

Way to go PayPal.

Jokes aside, the negative FCF that you see in Q2 is due to a $1.2b negative impact from European buy now, pay later loans originated as Held for sale, which is expected to be sold in the second half of the year.

Back in June, PayPal signed an agreement with KKR, a leading global investment firm. Under the agreement, KKR will purchase up to $40b of BNPL loan receivables originated by PayPal.

This transaction will derisk PayPal’s balance sheet as well as generate $1.8b of proceeds, which will be recognized in Cash Flow from Operations upon closing.

So while there are a lot of moving parts in its Cash Flow Statement, there are no material changes in PayPal’s FCF outlook in 2023.

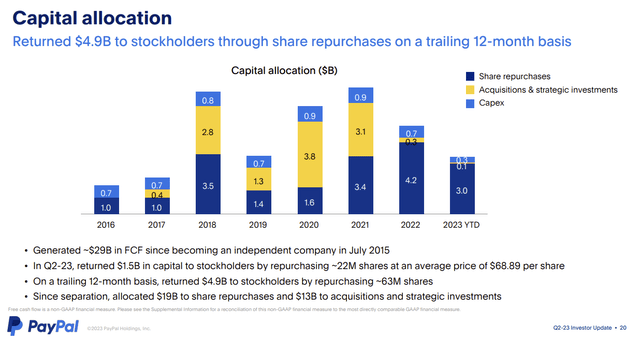

With the cash proceeds, PayPal intends to allocate them for additional buybacks. As you can see, PayPal has been buying back shares aggressively.

On a trailing 12-month basis, PayPal has bought back 63m shares worth $4.9b. In Q2 alone, the company bought back $1.5b worth of shares.

PayPal FY2023 Q2 Investor Update

I’ve never seen a company buying back shares this aggressively, and I think it’s a really good use of capital now given that PayPal’s stock is trading at depressed valuations. And last June, the board of directors also authorized a $15b stock repurchase program, and as of Q2, PayPal still has $12.9b left available for future repurchases, which is roughly 18% of its market cap today.

As PayPal continues to buy back shares on the cheap, we can expect EPS growth to accelerate because of lower shares outstanding, which should reward shareholders in the long run.

Again, this is very similar to Meta, which was also buying back shares like crazy when the stock sold off.

Outlook

In terms of outlook, management provided the following guidance for Q3:

- Revenue of ~$7.4b, which is up by ~8% YoY. Management also pointed out that Revenue is already accelerating in July, growing ~9% YoY. TPV is also growing in the mid-teens with branded checkout TPV growing by ~8% in July.

- Non-GAAP EPS of ~$1.23, which is up ~13.5% YoY. This is also faster than Revenue growth so I’m assuming margins will improve and the share buyback program will have a sizeable impact on EPS growth as well.

And here’s guidance for the FY2023:

- Revenue growth in the second half of the year is at least in line with the first half of the year.

- Non-GAAP EPS to grow by ~20% YoY to ~$4.95, which is impressive.

- Non-GAAP Operating Margin to expand by at least 100 basis points, which means a Non-GAAP Operating Margin of at least 22%.

- FCF of ~$5b and all of it will be used for share repurchases, which was expanded by $1b to ~$5b.

- Capex consisting ~3% of Revenue.

All in all, there’s nothing that particularly caught my attention from the guidance – management basically reiterated their full-year guidance.

That said, guidance looks okay. Revenue growth seems lackluster. On the other hand, margins are set to improve, FCF remains robust, and PayPal is accelerating share repurchases, which altogether, would result in double-digit EPS growth.

In other news, CEO Dan Schulman gave an update on the CEO succession plan. No names yet but it’s about time to bring fresh management to really turn this company around.

I’d like to end my remarks talking about our CEO succession plan. We are in the very final stages of the process with several outstanding candidates, all of whom are highly qualified and excited to lead PayPal as we go into our next chapter of growth.

(CEO Daniel Schulman – PayPal FY2023 Q2 Earnings Call)

Whatever it is, I think PayPal’s growth story is far from over.

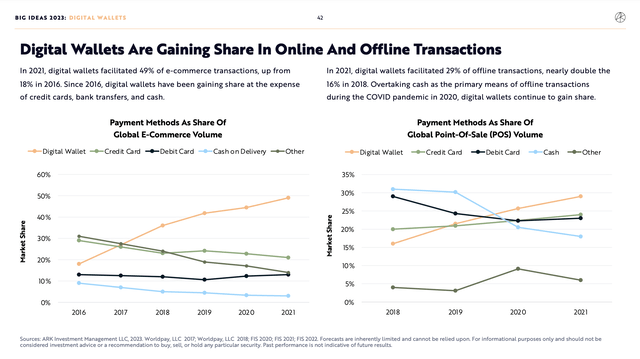

The biggest tailwind for PayPal, by far, is the increasing adoption of digital wallets. As shown in the chart by Ark Invest, digital wallets are gaining market share in both online and offline transactions.

Digital wallets are now the most common form of payment method and are increasing with each passing day. I believe this trend is likely to persist and this should be a major tailwind for digital wallets like PayPal.

Ark Invest Big Ideas 2023

PayPal also still has room to take market share in core markets such as the US and parts of Europe, and the growth of sectors like e-commerce and BNPL should also support PayPal’s growth.

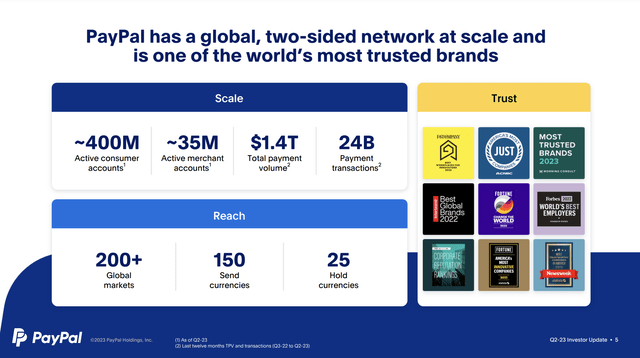

In addition, Gross Payment Volume processed by payment facilitators such as PayPal, Square, and Stripe is set to expand to $4 trillion by the end of 2025, which should boost PayPal’s topline numbers. Being the largest and most trusted two-sided payment network positions PayPal well to capture this market opportunity.

PayPal FY2023 Q2 Investor Update

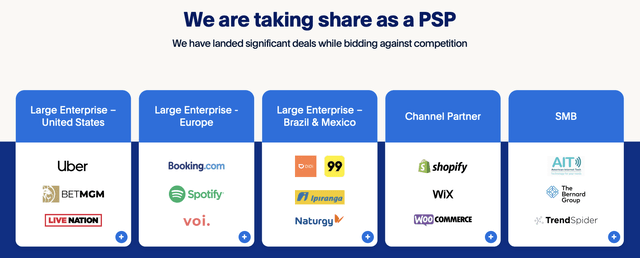

In addition, PayPal’s payment service provider (PSP) business is rapidly growing at nearly 30%. This includes services such as Braintree for large enterprises as well as PayPal Complete Payments (PPCP) for channel partners and SMBs.

As mentioned during the earnings call, many of the largest tech companies are expanding their integrations with Braintree and the deal pipeline for PPCP remains robust. In fact, PPCP is now implemented with leading channel partners like Adobe, Shopify, and WooCommerce, with 25 additional partners expected to be live by the end of the year.

PayPal FY2023 June Management Meeting

I think the markets fail to notice the potential of PayPal’s PSP business. While the rapid growth of PayPal’s PSP is putting pressure on Take Rates and margins, PayPal is in the process of rolling out higher-margin, value-added services, which should boost PayPal’s overall growth and margin profile in the future.

Valuation

After losing 80% of its value from its all-time highs, PayPal looks like an interesting buy at $63 a share.

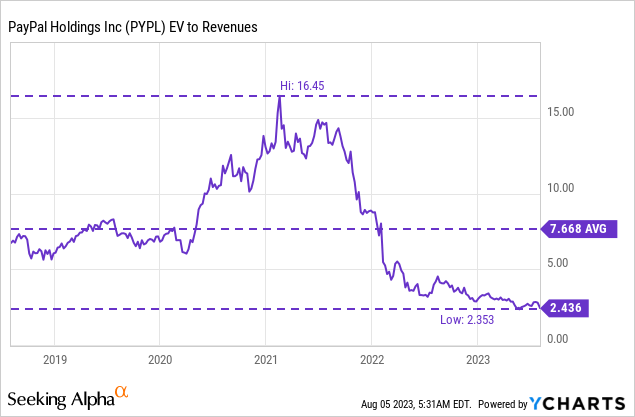

By all valuation multiples, PayPal is trading at the lowest valuation ever since it went public in 2015.

In terms of EV to Revenue multiples, PayPal is trading at the lowest multiple ever, at a multiple of just 2.4x, which is well below its 5-year average of 7.7x and its peak of 16.5x.

I think it’s reasonable for PayPal to trade at about 5x its sales, which is still below its average, but that’s a 100% upside from today’s prices.

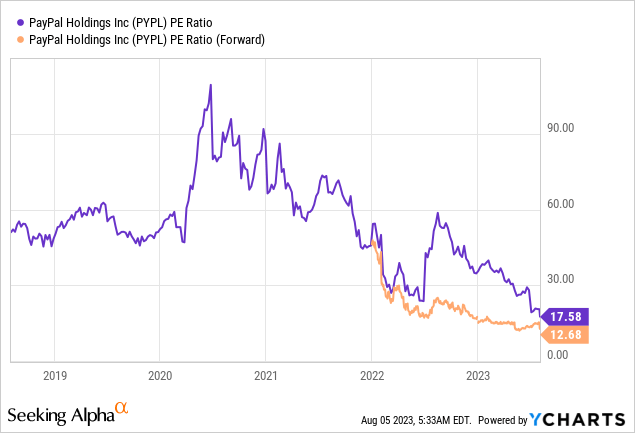

And in terms of PE ratios, PayPal is also trading at very low multiples, at just 17.6x its last twelve months’ Earnings.

For forward PE ratio, it’s much lower, trading at just 11x, which indicates rapid Earnings growth in the next twelve months.

So based on historical multiples, PayPal has never been cheaper.

Of course, the markets are discounting PayPal’s slowing growth as well as the deteriorating macroeconomic environment, but PayPal’s fundamentals remain solid and the growth story of the company remains intact.

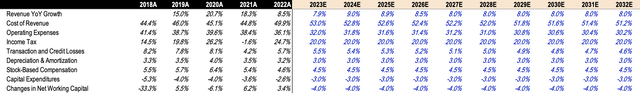

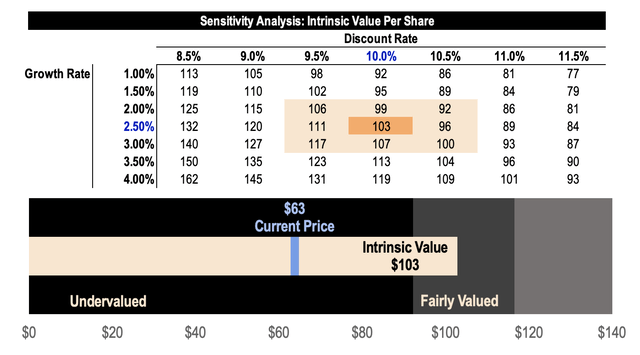

On another note, I did a DCF analysis on PayPal. Here are my key assumptions:

- Revenue: For the first three years, I’ll follow YoY growth rates based on analyst estimates. For the remaining years, I’ll keep it at a modest growth rate of just 8% per year.

-

Cost of Revenue and Operating Expenses: I’ve set them in such a way that we achieve an Operating Margin of 15% in 2023, which is in line with margins for the first half of this year. Over the next decade, I expect Operating Margins to improve to 18.6% by 2032 as the company achieves operating leverage.

-

Transaction and Credit Losses: As for the calculation of Free Cash Flow, I will be adding back Transaction and Credit Losses, which PayPal adds back to calculate its Cash flow from Operations since this is a non-cash expense. As a % of Revenue, PayPal’s Transaction and Credit Losses is about 5 to 8% in the last five years, so I will use 5.5% as the starting point in 2023 and then improves to 4.6% by 2032 as the company develops better technology for the provision for Transaction and Credit Losses.

- Capex: Set at 3% of Revenue based on management’s guidance.

Author’s Analysis

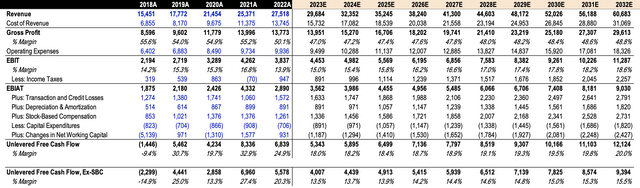

Based on these assumptions, I arrive at a Revenue of ~ $60b by 2032 with an FCF Margin of about 20%.

Author’s Analysis

Assuming a discount rate of 10% and a perpetual growth rate of 2.5%, I arrive at an intrinsic value per share of $103 for PayPal. This is slightly higher than the average analyst price target of $90.

Author’s Analysis

So based on my DCF model, the risk to reward on PayPal stock seems attractive with an upside potential of 64% based on the current price of $63 a share.

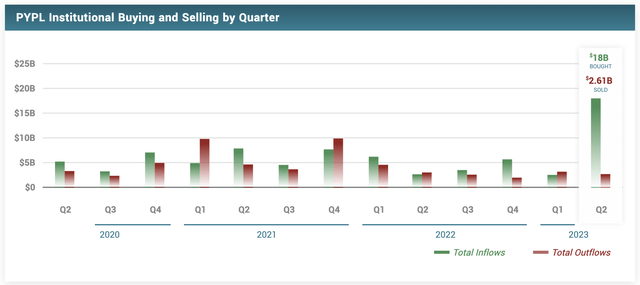

It’s also worth mentioning that institutions have been net buyers of PayPal stock. As you can see, there’s a sudden influx of institutional inflow in Q2, which could signify bullishness among institutions.

MarketBeat

Just for fun, I want to compare PayPal’s price action with Meta as well.

Here, we can see that PayPal’s and Meta’s stock price began their collapse in late 2021, but the difference is, Meta bottomed in November 2022, while PayPal continued to trade sideways.

If you’ve been following Meta in the past two years, you’ll know that there has been so much negativity on Meta stock as it sold off, due to reasons such as slowing user growth, margins declining, increasing competition, and so on.

Then Meta posted Q3 results which saw the stock dropping 25% the next day due to weak guidance, but within a few days, there was a change in sentiment as the company announced layoffs as well as turned its focus on delivering the year of efficiency.

And before you know it, the stock is up 200%+.

That said, I think it might happen to PayPal as well. It’s going through very similar challenges like slowing account growth, margin compression, and increased competition.

I think there’s a great opportunity to accumulate shares now, given that there’s a large margin of safety. And I think the best time to buy is when the outlook is awful, as we’ve seen in the case of Meta. If we wait for conditions to improve, the stock would have been significantly higher, and we would have missed most of the gains.

That said, I reiterate that PayPal is trading in deep value territory.

Risks

Competition

There are many big tech companies out there that are expanding aggressively into the payments space. This includes Google Pay and Apple Pay, and we know how large their consumer and partner network is.

Then there are other fintech platforms like Adyen, Block, Affirm, SoFi, Chime, M1 Finance, Acorns, Coinbase, and many more. These platforms are growing fast and they can take market share away from PayPal.

Management Changes

As you may know, there have been some management changes lately.

First, CFO John Rainey left the company to join Walmart, after 7 years with PayPal.

Then, the Chief Product Officer was also replaced in September last year.

Next, replacement CFO Blake Jorgensen also stepped down in less than a year due to medical reasons.

And finally, CEO Dan Schulman is expected to retire by the end of the year after 9 years with the company. In addition, uncertainty remains as to who and when the new CEO will take over.

That said, lots of management uncertainties for PayPal, which could make or break the company.

Growth Slowdown

And the last risk would be that PayPal never returned to growth mode and instead continued its downward spiral of slowing growth and eventually, to negative growth – this will be a thesis breaker for me.

When things don’t improve, PayPal’s valuation may be rerated to lower multiples, which could pressure the stock for years.

Thesis

To sum it all up, Q2 results show that growth is decelerating and margins are declining. In addition, management provided subpar guidance without any raises.

As such, investor sentiment is at an all-time low, which is why the stock sold off after earnings.

And this creates a great opportunity for investors.

As seen in the case of Meta, the best investments come when there’s a high-quality company trading at a large margin of safety to intrinsic value as well as when the future looks like doom and gloom for the company.

I’m confident that PayPal has the scale, brand, and network effects moats to weather the storm and continue growing as the leader in the fintech space.

While everyone focuses their attention on declining margins, EPS is growing at double digits, TPV growth is accelerating, unbranded processing is gaining massive traction, Operating Margins continue to expand, and the company is buying back shares aggressively.

Don’t be too short-sighted. Look ahead. The future still looks bright for PayPal.

Read the full article here