Introduction

After the initial downturn during the pandemic times, the electronics boom happened. The demand for both consumer and enterprise electronics exploded as the world attempted to shift digitally. This has created a massive opportunity for Best Buy (NYSE:BBY) to capitalize on the favorable environment boosting the company’s stock price. However, today, the market demand for electronics and investors’ sentiment toward Best Buy is not favorable.

Yet, despite a rather bearish sentiment, I am bullish on Best Buy for a few reasons. One, the company has impressive dividends and share repurchase programs. I view these, especially reinvested dividends and share repurchases, as piling potential energy in preparation for the next favorable demand environment. Two, I believe the trough in consumer electronics demand has been reached, and the market is slowly moving toward a sequential demand growth phase toward the end of 2023 and the beginning of 2024. Finally, I view Best Buy’s valuation to be attractive. Therefore, Best Buy is a buy.

Dividends and Share Repurchases

Best Buy offers impressive dividends and shares repurchases for investors creating a potential energy to be released when the market environment turns in favor of the company once again.

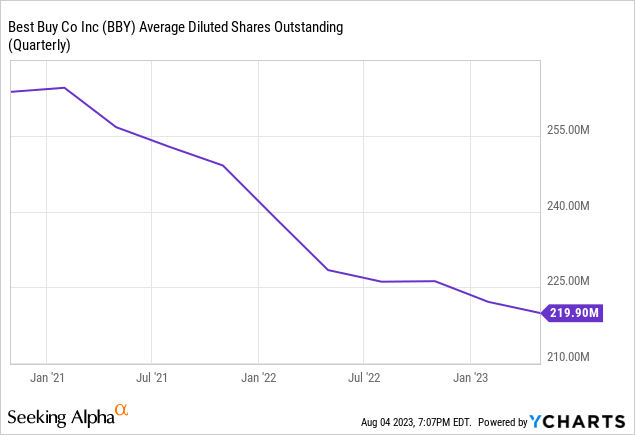

Starting with share repurchases, in fiscal 2024Q1, the company repurchased a total of $79 million. This follows a total share repurchase of $1 billion in fiscal 2023 showing the management team’s intent to maximize shareholder value.

As the chart above shows, as a result of the massive share repurchases during the pandemic boom, the company was able to reduce its outstanding shares from over 255 million to 219 million.

I view this as similar to potential energy. By buying up outstanding shares through the good and bad economic cycle, the company is preparing for a future economic cycle. Thus, when the next phase of an increased demand environment comes, shareholders will be able to reap higher highs and potentially lower lows in times of decreased demand environment.

Moving on to dividends, Best Buy has a dividend rate of about 4.53%. The high dividend rate could have been attractive if the federal funds rate was not so high. However, even in the current high-interest rate environment, I view this level of dividend for Best Buy investors to be fairly attractive.

Obviously, if one reinvests all the dividends in times of lower stock prices, one can amplify the potential energy, but beyond this potential, due to the future growth potential, I believe the current dividend is attractive relative to CDs or short-term treasury bonds that yield slightly above 5%.

Future Growth

Best Buy operates in a cyclical industry that is experiencing a downturn today. However, I believe the industry has already tested the trough and will start to see sequential growth unfold toward the end of 2023 and in 2024.

During the most recent, fiscal 2024Q1, earnings call, Best Buy already stated that the company is expecting demand pressure throughout 2023 by saying that the company “assumes the consumer electronics industry would continue to feel the pressure of the broader macro environment and the high degree of uncertainty as it relates to the consumer.” Thus, it is likely that the reduced demand expectation is already baked into Best Buy’s press release.

Since the announcement of this base case scenario, the overall consumer electronics industry has shown signs that the trough in the reduced demand has passed. Micron (MU), a memory chip maker, has said that the company expects “stronger industry bit shipments…in the second half of the calendar year” although the overall expectation for the full year is slightly lower. Then, in the calendar year 2024, the company’s views were more optimistic than in 2023 as the company is starting to see sequential growth. Further, International Data Corporation, IDC, an external research firm, has forecasted a consumer electronic recovery in 2024 after a slow 2023. Therefore, the overall expectation is for consumer electronics demand to return in the following few months, which will likely create a favorable tailwind environment for Best Buy.

Valuation

Best Buy has a reasonable valuation today. The company has a market capitalization of about $18.3 billion with a forward price-to-earnings ratio of about 13.3. Looking at historical valuation multiples data from Macrotrends, it is evident that the company’s valuation multiples oscillate between around 10 to 20. Due to the cyclical nature of the industry Best Buy operates in, I believe it is reasonable for the company to be trading around the lower end of the historical range given that the current industry environment is weak. But, looking toward the calendar year 2024, given the return of a positive industry environment, there could be further expansion of Best Buy’s valuation.

Risk to Thesis

The biggest risk to my bullish thesis is a potential delay in consumer electronics demand recovery. As the world moves on from the easy monetary and fiscal policy from the pandemic times, there have been numerous risks to the economy. Inflation has not been conquered, delinquency rates have been on the rise, and economic growth projections have been rocky. Consumers’ desire to spend on experiences, travel, or services over durable goods has also had a significant influence. Thus, if the industry headwind is prolonged for these reasons, sizeable dividends and stock repurchases will have minimal effect on shareholders in the short to medium term as the headwind will likely dwarf these positive factors.

Summary

Best Buy is an attractive stock. The company offers sizeable dividends and massive stock repurchases creating a potential energy to be released in the future. Since Starting in the fiscal year 2023, the company has repurchased over $1 billion likely creating higher highs and lower lows. Further, as investors accumulate dividends, the consumer electronics industry has started to show signs of revival. From a significant industry headwind, Best Buy may be seeing sequential growth or an industry tailwind going into the end of the 2023 calendar year or into 2024 releasing the built-on potentials from dividends and share repurchases. Therefore, I am bullish, and Best Buy is a buy.

Read the full article here