In my prior article on Citigroup (NYSE:C), I set out my thesis where I anticipated the stock would be up by 100% by the end of 2024. This article is an update to my bull thesis on Citigroup. I still believe that the thesis will still play out broadly as expected, however, now I expect the timelines to be by the end of 2025 as opposed to 2024, given recent setbacks.

In my prior article, I also set out the key risks to my thesis being (1) higher than expected capital requirements and (2) delay in the sale of Banamex Mexico.

The second key risk is the target capital ratio. A key part of the thesis is the ability of Citi to return capital to shareholders. The risk of a higher capital ratio for Citi may manifest if it doesn’t perform as expected in the Fed’s stress tests and/or regulators will increase the capital requirements of the large U.S. banks. Additionally, a suspension or major delay in the sale of Banamex Mexico will also be negative for Citi.

Unfortunately, both risks have manifested and these are material short-term setbacks for the stock but more on this later.

The Fed Stress Test (otherwise known as “CCAR”)

Citigroup’s CCAR results were disappointing especially when compared to peers and Citi’s CEO Jane also expressed her frustration. As a result of the 2023 CCAR, Citi’s Stress Capital Buffer (“SCB”) has increased by 30 basis points translating to a higher (13.3%) target capital ratio for Citi. Whilst not a worst-case scenario (i.e. capital ratios could have increased more than 0.3%), it dashed hopes of outsized share buybacks in the near term.

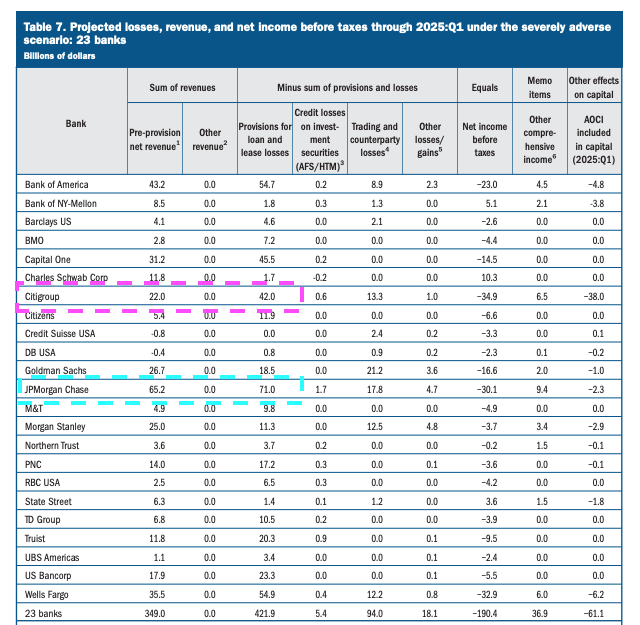

As can be seen below, the culprit for the underperformance has been Pre Provision Net Revenue projections:

Federal Reserve Website

As can be seen from above, Citigroup’s PPNR to Provisions for loan losses is ~52%, whereas JPMorgan (JPM), as an example is 91%.

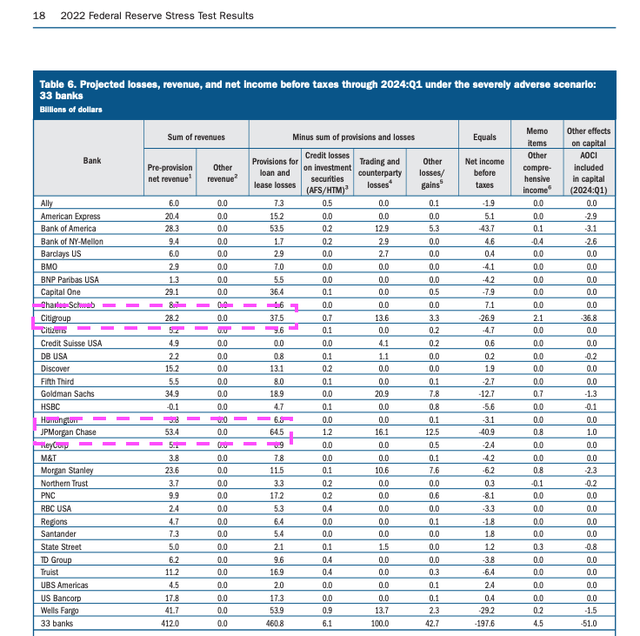

In the 2022 CCAR results, Citi performed much better on a relative basis where the above ratio was 75% compared to JPM with a ratio of ~83%.

Federal Reserve Website

It is unclear what has driven the divergence between the 2023 and 2022 CCAR results, as always, the Fed’s model tends to literally be a “black box”. Evidently, Citigroup was also puzzled by the low PPNR and especially the non-interest-line as disclosed in its CCAR press release:

Citi also announced that it has initiated dialogue with the Federal Reserve to understand differences in Non-Interest Income (Non-Interest Revenue per Citi’s Financial Reporting presentation) over the nine-quarter stress period between the Federal Reserve’s CCAR results and Citi’s Dodd-Frank Act Stress Test results.

It appears that the underperformance, under the Fed’s 2023 CCAR models, is largely attributed to fee income in Citi’s FICC trading businesses.

Proposal To Increase Large Banks’ Capital Buffers

Another headwind is the proposed rules by the Fed, led by the Federal Reserve’s top banking regulator, Michael Barrett is estimated to increase capital requirements by a massive 19%. The proposals were released in July and include increases to risk-weighted assets to products such as mortgages and government bonds. The Fed is proposing a standardized approach to assess a “floor” for the credit, operational, and trading risks of large banks, rather than allowing the large banks to rely on internal models. The proposal is out for consultation and is expected to be implemented in 2025.

There are several potential mitigants, however, including:

- phasing out of the implementation until 2028;

- consultation and lobbying by various banking associations. In other words, the shape of the rules may still change;

- large banks are accustomed to quickly adapting the business model (including the pricing of products) to mitigate the outcome. Based on the European banks’ disclosures, I would ultimately expect an increase in the capital ratios to be a much more modest 5% to 10% as opposed to the current 20% being telegraphed.

Citigroup’s Medium-Term Capital Trajectory

In spite of the above headwinds, in the medium-term Citigroup’s capital requirements should decrease on an absolute and relative basis. Citi is in the process of simplifying and shrinking the firm, in turn, this should reduce both its G-SIB score and projected stress losses in the CCAR stress tests.

Importantly, as the profit mix shifts to more stable and accrual businesses such as Services, Citi’s PPNR to Loan Losses should materially increase as well. Once Citi completes the Banamex Mexico disposal, additional capital is likely to be released.

Whilst it is too early to tell whether Citi will be able to sustain a capital target of 11.5% to 12% CET1 as communicated on Investor Day, the capital requirements trajectory should certainly reduce from the current high levels. In my models going forward, I pencil down a target capital ratio of between 12% and 12.5% (slightly higher than what the management team has provided).

The Mexico Setback

After prolonged negotiations, Citi finally announced in late May 2023, that it will now pursue an IPO as opposed to an expected straight sale of the business. It appears that Citi was caught in a political mire and crosscurrents and we will probably never know the full story.

Ultimately though, this results in an additional delay to 2025, and consequently the benefits of selling Banamex Mexico (lower G-SIB score, capital requirements, and release of capital) are delayed by at least 12 months.

This is another unfortunate and material setback but still a temporary one.

Final Thoughts

Citi’s strategic transformation is facing several unexpected setbacks. This delays but does not abort the bull thesis. I now expect the stock to roughly double by the end of 2025 (as opposed to my prior expectation by the end of 2024).

Citi still has multiple levers to achieve its medium-term target of 11% to 12% ROE (medium target defined as 2024 to 2026). Whilst the capital return narrative is more subdued due to the CCAR setback and Mexico delays, I do still expect it to play out in 2024 and 2025.

On the positive side, the Services division is exceeding all expectations and delivering astounding growth in the mid-30s year on year. Importantly, Citi is guiding for bending the cost curve (i.e. reducing absolute costs) by the 2H of 2024 and cost-cutting is clearly within the management team’s control.

I remain very bullish and believe that patient investors will be handsomely rewarded.

Read the full article here