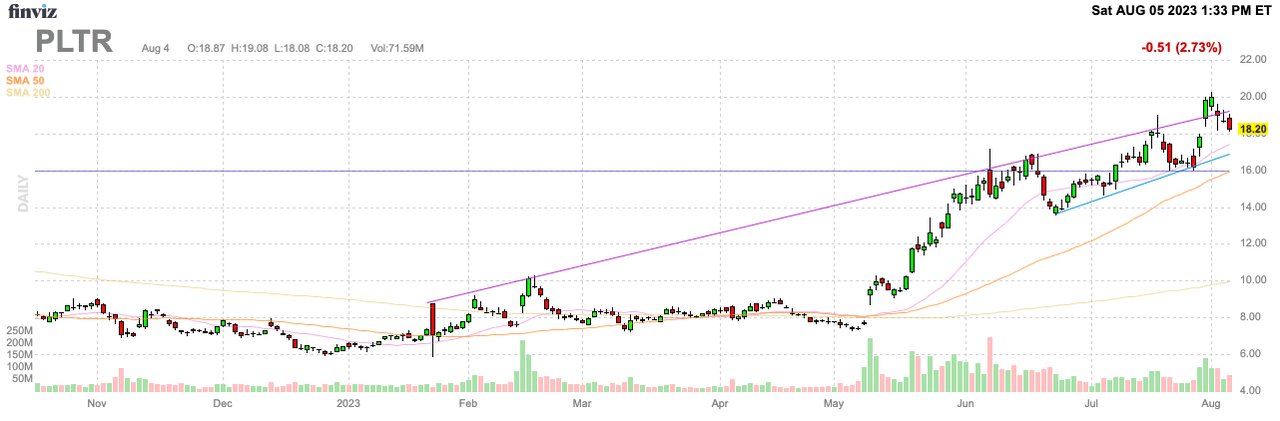

Palantir Technologies (NYSE:PLTR) is suddenly one of the most over-hyped AI software plays around. The unliked enterprise software data play was so hated the stock traded below $8 back in early May. My investment thesis is Bearish on the stock heading in Q2’23 numbers after the close on Monday with the stock trading up to $20.

Source: Finviz Source: Finviz

Over Hyped

Palantir guided to Q2 revenue growth of only 12% when reporting Q1 numbers with a revenue target of $530 million trailing the analyst targets of $536 million at the time. The consensus analysts are as follows:

- Consensus EPS estimate is $0.05

- Consensus revenue estimate is $533.57 million (12.8% YoY)

Clearly, enterprise AI software isn’t ready for prime time with this guidance. While OpenAI with Microsoft (MSFT) and Google (GOOG, GOOGL) are spending billions on generative AI programs, corporations still need to verify solutions from the likes of Palantir and implement them. Larger enterprises might have interest in AI software tools, but a company spending more money on AI isn’t necessarily a fast process.

Back on the Q1 earnings call in May, Palantir discussed a high level of interest in the new Artificial Intelligence Platform (AIP) product, but the company also discussed how working with external large language models and generative AI programs wasn’t exactly new. The key is that customer engagement isn’t the same as immediate customer demand.

On the Q1’23 earnings call back in May, Palantir highlighted how harnessing all of the AI power might be difficult for corporations:

…the accelerating pace of AI development is awe inspiring and exhilarating, but there are many challenges customers will encounter as they attempt to leverage this technology operationally at any scale. From managing the mismatch between the ever-growing big data scale of the enterprise and the bottlenecks and choke points of smaller context windows of LLM’s, to product design challenges of constructively embedding these models and workflows, and safety and trust challenges in governing the AI in an operational and decision-making context..

The news of Chat GPT-4 results degrading over time could further cause executives to pause aggressive implementation of AI software tools. The worse possible outcome is an AI chatbot providing customers with invalid results from a hallucinating chatbot.

The Stock Needs AI Boost

Palantir has already rallied back to $20 on the AI hype train. Wedbush analyst Dan Ives called the stock on the ‘golden track to success’ and slapped a $25 price target on Palantir.

After falling back to $18, the stock still trades at nearly 18x analyst sales targets. Without a massive AI boost, Palantir can’t justify the current stock valuation.

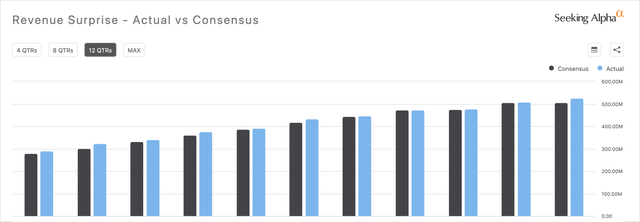

As the below chart highlights, the company has a history of slightly beating guidance. Palantir guided Q2 revenues of $530 million, though this comes after a quarter where the company did beat estimates by nearly $20 million.

Source: Seeking Alpha

Remember though, without the big beat, Palantir would have again faced decelerating growth rates. The guidance for Q2 shows revenue growth hitting the lowest levels at only 12% with the company reporting a similar beat this quarter unlikely.

Even though analysts appear very bullish on the AI aspect, Palantir is only forecast to barely top a 20% growth rate in 2025. The forecast is for sales to reach just $3.2 billion in 2 years.

The stock already has a market cap of $38.5 billion and the high focus on government contracts is likely to curtail the ability to achieve accelerating growth rates. The Federal government is not an early adopter or fast to aggressively expand into new technologies.

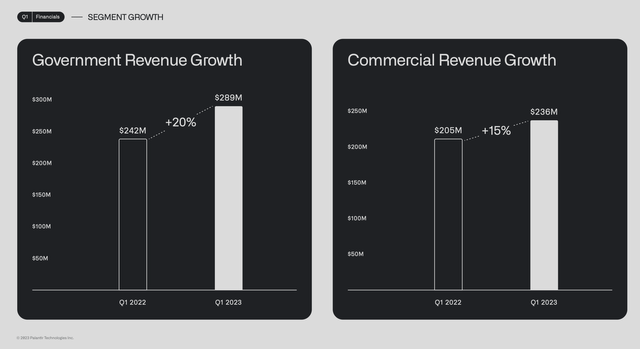

Government revenue grew 20% in Q1 to $289 million. The company has ~55% of the revenue base from the government sector

Source: Palantir Tech. Q1’23 presentation

A big focus in Q2 is whether the government sector works as a throttle to accelerating growth due to AI. What was originally a benefit to their advanced data platform is now a potential choke point with

Palantir needs to return to 30%+ growth to warrant higher stock prices. A stock is typically seen as expensive trading at over 10x forward sales and the AI software company needs the demand cycle to surge in order to reach the target in 2025 as follows:

- 2023E – $2.2B

- 2024 @ 30% – $2.86B

- 2025 @ 30% – $3.72B

Even under this scenario, Palantir is still trading at over 10x forward sales estimates. Investors are currently expecting sales to surge far beyond a 30% growth rate while analysts are only down at 20%.

Takeaway

The key investor takeaway is that Palantir may very well be the best company positioned for enterprise AI software demand. The issue here is the time to market for new AI software options and the time customers take to implement those new software options.

The stock already factors in tons of upside potential that just isn’t guaranteed. Investors should continue looking at $20 as an opportunity to sell Palantir, not load up.

Read the full article here