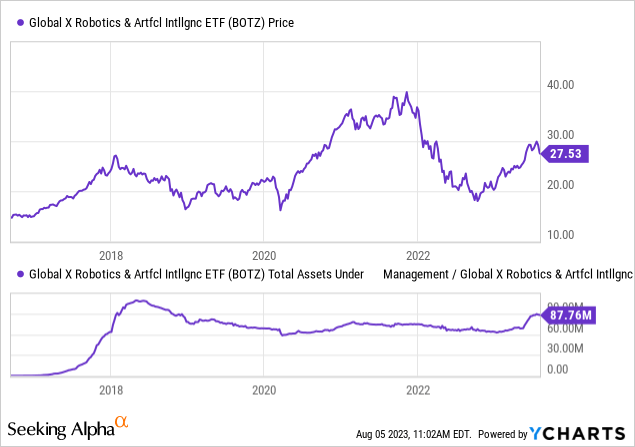

Recent months have seen immense media and investors focus on the rapid developments of artificial intelligence technologies. Following the deployment of ChatGPT, the “AI revolution” has become a far more tangible trend in public awareness. Accordingly, many stocks directly or vaguely associated with artificial intelligence technologies have risen dramatically. For example, the famous “AI” ETF (NASDAQ:BOTZ) has risen by roughly 33% this year, recovering much, but not all, of its losses from 2022.

Interestingly, the fund’s total outstanding shares (as measured by AUM/price) spiked in recent months near its 2018 peak. In my view, that spike is likely associated with the recent “AI trade” seen across retail and commercial investors. See below:

In recent weeks, the fund’s outstanding shares increase has flattened, implying a general decline in investment demand. For now, the “AI trade” appears to have reached its end, meaning a close revelation of the fundamentals of BOTZ and the robotics & AI industry is necessary. Looking forward, I expect BOTZ to reverse unless its holdings can prove an increase in profit outlook associated with the AI wave.

BOTZ owns a large mixture of companies associated with the AI and robotics industries, with considerable exposure to Nvidia (NVDA), Intuitive Surgical (ISRG) (an AI & robotics surgical company), and ABB (OTCPK:ABBNY) (a Swiss robotics company, collectively accounting for ~30% of the fund. The rest of the fund is distributed between robotics and AI software companies, with no notable exposure to technology giants excluding Nvidia. Most of the companies in the fund are larger, with only half being situated in the US (Japan at 28% and Switzerland at 10%); however, most are much smaller than the large US technology giants.

The fund’s weighted average “P/E” is exceptionally high at 37X, meaning immense earnings growth is expected of these firms or simply overvalued. In my view, while AI advancements have opened the door to tremendous technological innovation, investors should not necessarily expect all those potential profits to be found in the innovators. Indeed, AI advances will force many companies in BOTZ to invest heavily in the technology before potentially finding earnings from it. In an era where money is far more expensive (interest rates are high), many harmful cash flow firms in BOTZ may deteriorate unless they can grow profits quickly. As such, BOTZ may offer long-term potential, but I believe it carries significant immediate overvaluation risks as investor exuberance pushes expectations beyond reality.

Who Will Truly Benefit From AI and Robotics?

Investors are often looking for the “next big thing,” indeed, the development and deployment of AI technologies are likely to change the economy over the coming decades dramatically. As AI technology becomes more accessible outside of large corporations, I expect development will occur rapidly over the coming years. In 2023 alone, AI went from being mainly theoretical to operationally utilized among 10-15% of sales, product development, and customer service workers. As the technology continues to accelerate, it is expected to be used in risk, HR, finance, supply chain management, and manufacturing. Fundamentally, AI is likely to dramatically lower human labor needs in many managerial white-collar settings, particularly those that already utilize some algorithmic decision-making (as opposed to those in more creative fields).

Over the coming years and decades, it is virtually certain that a significant number of jobs, particularly higher-paying managerial “white collar” jobs, will be partially replaced by AI technology. Further, many “blue collar” jobs, such as transportation, will likely see greater competition from AI and robotics; however, I expect the most significant immediate changes in non-physical work. While this reality is uncomfortable for many, if not most people, it should also lower household costs. Indeed, we’re already seeing many customers prefer AI customer service over humans due to lower wait times and improved customer engagement. The reality is that, in many settings, AI already is (and is becoming) both cheaper and more functional than human workers. While there are apparent moral dilemmas that AI worker replacement brings, it is virtually impossible to stop the trend in a free market setting, particularly given the open-source nature of many newer AI technologies.

From an investment standpoint, the fact that most new AI technology is open source and that AI can now re-code itself makes it difficult to predict which companies will benefit the most from the technology. It is easy to assume that large technology giants like Google (GOOGL), Apple (AAPL), and others will reap the most significant rewards. However, we must remember that before the development of the smartphone (and iPods, etc.), the largest technology giants were IBM (IBM), Intel (INTC), Dell (DELL), and similar companies that have largely been overshadowed by the younger generation of innovative companies, many of which were private before reaching maturity.

Specifically regarding AI, but not necessarily robotics, I expect the greatest innovations will not occur in most publicly traded companies today. As in past innovative ways, the greatest inventions (see Apple and Microsoft) may be created by a smaller team of people who are currently totally unknown. Indeed, the immense advancement in open-source idea sharing across the internet has made it easier for individuals to create significant advances, potentially creating a competitive risk for larger companies, which can struggle to keep up due to their bureaucratic nature.

The second issue, which is also relevant for robotics companies, is that private investment markets have become far more fruitful over the past two decades. Both AI and robotics have become immensely popular venture capital investments in recent years, despite an overall decline in the VC market. Decades ago, it was far more difficult for smaller innovators to get significant capital investments without a public market launch. Today, I would argue that the best companies remain private until they’re huge, as private investment channels are cash-rich and private investors are generally more willing to allow startups to drain cash than public companies. Problematically, that implies the best robotics and AI investments today are likely unaccessible on the general market.

Of course, the greatest benefactors of AI and robotics technologies will likely be the companies that adopt them, such as FedEx and many others. In the US industrials sector, many older companies greatly need to expand their manufacturing base but lack the skilled labor force and efficiency to do so. As such, the cost and efficiency growth associated with AI and robotics may tremendously improve their profitability, albeit constrained by competitive pressures from peers following the same approach. On the flip side, the innovative firms in BOTZ will need to invest tremendous capital and research to be the few who will likely provide the most significant innovations, meaning only a small number of companies in BOTZ (or any) may be the leading innovator.

What is BOTZ Truly Worth Today?

In my opinion, BOTZ is likely overvalued today due to the irrational exuberance surrounding the AI trade. While it is true that AI and robotics promise immense economic and social change, it is not necessarily the case that many of the firms in BOTZ will be the companies that accomplish it. The leading companies in BOTZ, Nvidia, and Intuitive Surgical should benefit to an extent by providing the necessary hardware (for Nvidia) and leading hardware advances in the healthcare industry (for ISRG). However, both trade at forward “P/E” ratios around 55X and are very established; at their level of maturity, I highly doubt they can achieve the EPS growth necessary for their current valuations to be sensible today. The third largest US company in BOTZ, Dynatrace (DT), trades at a ~96X TTM “P/E” and carries the previously mentioned competitive risks associated with software AI firms.

BOTZ’s US-based holdings generally trade at extremely high valuations similar to NVDA and ISRG. Most are already mature firms that do not necessarily carry the tremendous growth potential found in smaller private innovative companies. However, the international companies in BOTZ trade at far more sensible valuations. The average TTM “P/E” ratio of ABB (OTCPK:ABLZF), Keyence (OTCPK:KYCCF), Fanuc (OTCPK:FANUF), Yaskawa (OTCPK:YASKY), and SMC Corp (OTCPK:SMCAY) is currently around 26X. In my view, that is a far more sensible valuation for high-growth firms that could allow investors the opportunity to buy into a “growth at a reasonable price” company.

If BOTZ were an ex-US ETF, I believe it could be a great investment opportunity today. Private venture capital markets outside the US are less developed, so more significant growth opportunities may be found in public markets. Further, most international public markets today do not draw the same speculative trend-following media attention that plagues the US technology stock market. Since there is less hype and speculation in Japanese and European markets today, their valuations are generally far more sensible. Given the tremendous uncertainty regarding which firms will benefit from AI and robotics, I would avoid the US “growth at a very unreasonable price” companies in BOTZ.

The Bottom Line

Overall, I am moderately bearish on BOTZ due to the irrational exuberance surrounding recent innovations that have pushed valuations far too high. While the US companies in BOTZ trade at a lower valuation today than in 2021, interest rates are much higher, meaning their access to capital (to offset negative cash flows) is much lower. Further, higher interest rates lower the present value of future cash flows, encouraging lower valuations. Adjusting for interest rates, I believe BOTZ is trading at a higher premium to discounted future cash flows today than in 2021; however, that is impossible to prove concretely (since future cash flows are unknown).

Specifically regarding the US firms in BOTZ, I believe most are best avoided today due to overvaluation and misplaced expectations. While it is true that AI and robotics are huge developments and that many of these firms may benefit from them, the innovation also spurs competitive risks that could cause larger firms to struggle to compete with more nimble innovators. That said, many of the Japanese robotics companies in BOTZ may be of great value today due to their high growth, low valuations, and immediate positive cash flows. I prefer that segment of BOTZ because there is far less speculation on those companies, despite their strong fundamental performance in recent years.

While I would not bet against BOTZ (due to speculative-rally risks), I believe it has likely reached its top and is headed back to its 2022 lows or lower. That coincides with the moderation in BOTZ fund flows, indicating a general end to the AI speculation trade. Further, the recent bond market declines imply another potentially significant increase in long-term interest rates; generally, higher long-term interest rates harm high-valuation growth stocks such as those in BOTZ. Overall, I believe this fundamental and technical setup dramatically lowers its upside potential while giving it ample downside risk.

Read the full article here