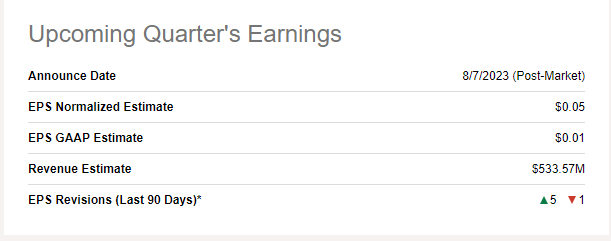

Palantir Technologies Inc. (NYSE:PLTR) is expected to report results for its Q2 that ended June 30th, 2023, post-market on Monday, August 7th. Analysts expect Palantir to report a GAAP EPS of 1 cent on revenue of $533.57 million. Should Palantir meet these numbers, this would mark the third consecutive profitable quarter for the company and keep it on track to meet its guidance of each quarter in 2023 being profitable.

PLTR Upcoming Earnings (Seekingalpha.com)

In my last coverage on Palantir, I suggested investors to use Covered Calls to avoid selling their shares too early, while rating the stock a “Hold”. Since then, the stock has gained about 20% compared to the market’s 4%.

With that background out of the way, let’s preview Palantir’s Q2 without any further ado.

Enormous Expectations

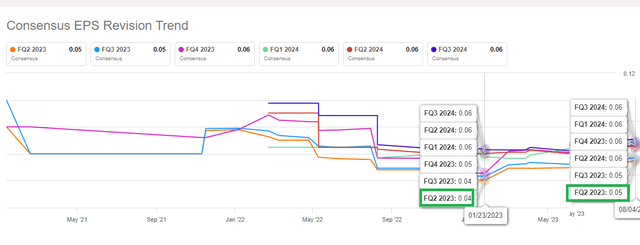

Beyond the 20% increase in expected EPS shown below, Palantir is generally going into Q2 earnings with massive expectations. Analysts have been pounding the table on AI’s prospects in general for about two quarters now. Things have gone on to a fever pitch with some calling it the 4th industrial revolution and that Palantir is the thick of actions. There is an element of truth to this but I am not sure the time to pound the table was after the stock has risen 200% YTD. More than mere numbers, the market may be looking for more magical product updates, especially on leveraging AI.

When expectations are enormous, even if a company meets the numbers, it leads to what’s called “sell the news” because the rumors may have already played their part in the stock’s runup. I agree with this cautious tone from another analyst who seems to opine that while AI is potentially lucrative, the hype may have gone too far and could end up overpowering the actual impressive growth story that Palantir is. As an example of how far Palantir’s stock has travelled thanks to the AI hype, the stock is trading at 4 times 2032’s projected revenue. While a totally different company at a different stage of its life-cycle, Apple Inc. (AAPL) is trading at 7 times 2022’s actual revenue.

PLTR EPS Revisions (Seekingalpha.com) PLTR EPS Revisions (Seekingalpha.com)

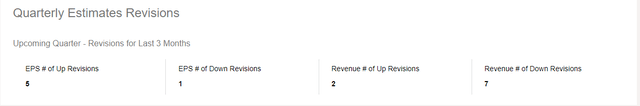

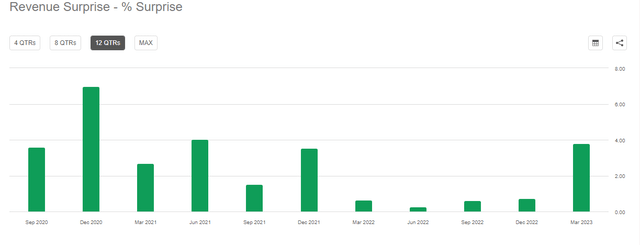

Beat or Miss? I Say A Small Beat on Both

In the last 11 quarters, Palantir has beaten EPS estimates 7times and revenue estimates 11 times. While the revenue streak sounds impressive, the beats have ranged between 0.27% and 7%, which suggests analysts already have a firm grasp of reality when it comes to the company’s ability to sell. The EPS beats (or misses) have been by a much wider margin ranging from -45% to as high as 145%. This tells me the company’s profit margin and operational capabilities still have an element of surprise in them, in addition to the law of small numbers (prone to wider fluctuations).

This quarter’s EPS could be a different story however, given that Palantir has already committed to each quarter in 2023 being profitable. I expect a small beat on revenue given the momentum in new products like AIP and a meet on EPS given the company’s public commitment to a profitable quarter.

PLTR EPS Surprise (Seekingalpha.com) PLTR Revenue Surprise (Seekingalpha.com)

Main Stories – AI and Continuing Profitability

From a financial perspective, one of the main stories will be whether the company can report a third consecutive (GAAP) profitable quarter and stay on track to meet its guidance for each of the quarters in 2023 being profitable. Another item of note will be the gross margin, which has consistently remained in the early 80s for the last 5 quarters at least.

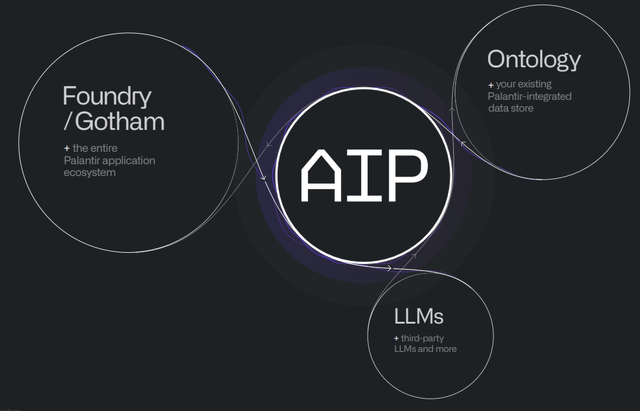

From a business perspective, there is no prize for guessing what will be getting the most attention from investors. AI. In Q1’s report, the company highlighted its Artificial Intelligence Platform (“AIP”). In that presentation, AIP was intelligently slotted right in the middle of the company’s existing ecosystem, suggesting that Palantir customers will be able to leverage AIP’s language models, automation and data foundations within their existing ecosystem. Since then, the company had its first AIPCon, where C-Suites from Palantir’s current and potential customers participated. It will be interesting to hear if the company gained real business traction with deals directly related to AIP.

Finally, the company has been awarded quite a few contracts since the last earnings report. It will be interesting to see whether Palantir sheds more light on the profitability of these contracts. Expected revenue from these contracts range from $25 million to as much as $463 million.

AIP PLTR (investors.palantir.com)

Valuation – The Multi-Billion Dollar Question

The biggest conundrum here is how do you value a trend-setter. Palantir has an early-mover, if not first-mover, advantage when it comes to leveraging AI across enterprise data analytics applications. While AI’s market-size is projected to reach nearly $2 trillion by 2030, this space is already filled with many players ranging from energetic start-ups with ideas all the way up to the likes of Apple and Microsoft Corporation (MSFT) with the deepest resources possible.

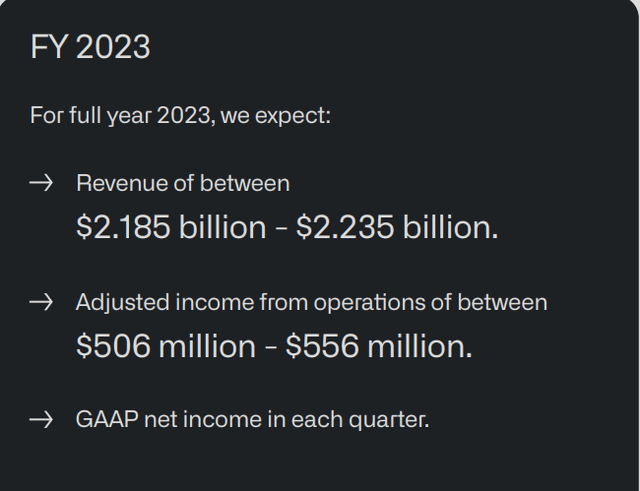

Everything said and done about the future prospects, it is undeniable that the stock is way ahead of itself based on current business reality. In the company’s own words, it expects to make a maximum revenue of $2.235 billion in 2023. That means, the stock is trading at a revenue multiple of 17, which just spins my head.

PLTR FY 2023 Guidance (investors.palantir.com)

Technical Strength – Strong But Be Wary

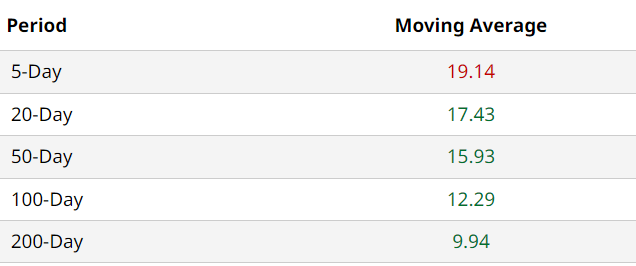

Palantir’s stock is solidly above all the commonly used moving averages as shown below. Especially impressive is the fact that the current price is almost 100% above the 200-Day moving average, which shows super strong overall uptrend. However, in such rapid moves up, it is extremely likely that the stock has many unfilled gaps lower. That means, should earnings disappoint, the stock may struggle to find a firm bottom with even the 100-Day moving average about 33% from the current price.

PLTR Moving Avgs (barchart.com)

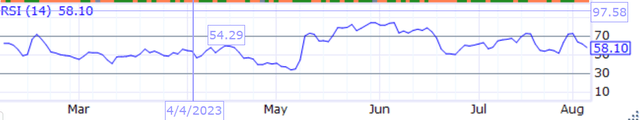

The stock’s Relative Strength Index (“RSI”) of 58.1 is not surprising given the near 10% pullback in the stock price since breaching $20 on August 1st. I’d argue this actually makes thing more favorable for the bulls than if the stock had gone into earnings with further momentum and extremely overbought conditions.

PLTR RSI (profitspi.com)

Conclusion

While I may be sounding cautious throughout the article, there are many aspects of Palantir that I like. I like the fact that the company has turned (GAAP) profitable already. I like that it has no debt and nearly $3 billion in cash. And there is something earnest about CEO Alex Karp that I am not able to explain well. Something about him reeks of honesty and vision. But stock tends to get far ahead of even the most grandiose vision. I believe that is the case with Palantir right now after a 200% run YTD. I expect the company to be profitable in Q2 as well but that may not cut it at the current lofty valuation. I highly suggest trimming your position and booking profits (directly or at least sell covered calls to collect premiums). The ideal position would be to let the house money (your gains) in and take out your original investment if possible. That said, I don’t suggest entirely selling out your position due to the long-term potential and short-term momentum the company has.

What do you think of Palantir’s upcoming Q2 and its future in general? Please leave your comments below.

Disclaimer: I do not currently hold a position in Palantir but may trade it on either long or short side for leading up to and after earnings.

Read the full article here