Dear readers/followers,

You’ll know if you follow my work that I’m a bit fan of geographical diversification. I’ll go out of my way to find country-specific outperformers, because I know that people everywhere need very basic things – heat, food, water, housing, etc. So was the case with Jerónimo Martins (OTCPK:JRONY) when I first invested in the company during COVID-19.

Why haven’t I covered the company more in detail before? A few reasons. First of all, the appeal of Portuguese investments is extremely slim. I expect that the readership for this article will be the person who asked me to post the article, myself, and a few more. Hopefully, I’ll be able to present the company in a way to elicit a more impressive readership.

Because, dear readers, the company deserves it.

Let me show you what I mean and show you what Jerónimo Martins is and does.

Jerónimo Martins – Plenty to like about groceries and trade retail.

So, first of all – I’ve made a name for myself in part by investing in companies that other investors seem to entirely ignore. This includes especially market outperformers or stalwarts in the grocery and trading field. Kesko (OTCPK:KKOYF) in Finland is one such example, where I made over 150% RoR, and am currently in the process of setting myself up for a repeat performance of such a return.

Jeronimo martins ir (Jeronimo martins ir)

I actively seek out publically-traded companies that offer exposure to a nation’s or an area’s food distribution. This company offers exactly that.

Jerónimo Martins is a Portugese-based corporate group that operates food distribution and specialized retail, similar to Kesko – except in the case of this company, its specialty includes some southern-European specific exposures such as coffee shops, chocolate boutiques, pharmacies and health/beauty stores.

Jeronimo Martins IR (Jeronimo Martins IR)

The company’s main operations lie in Discount and Convenience stores, Supermarkets, and Cash-and-Carries.

Geographically, we find Jerónimo Martins in Portugal, Poland, and Colombia.

Structurally speaking, you’ll know the company’s co-participant or JV owner very well. The group is the majority owner of Jerónimo Martins Retail, which operates among other things the Pingo Doce super- and hypermarket chain in Portugal. JMR has been run as a 51%-49% joint venture with the Dutch firm Ahold Delhaize (OTCQX:ADRNY) since 1982.

Pingo Doce and Recheio are the company’s largest brands in the home market. However, it also owns the Jeronymo Coffee Shops, the Hussel Chocolate boutiques, and in Poland it’s known for the Biedronka, the largest in no-frills supermarkets as well as the Hebe beauty and cosmetics store.

Colombia operations started 10 years ago with the first Ara stores, and the first distribution centers in the company.

History for the company includes owning Lillywhites, a sporting goods company in the UK, a stake in Eurocash, and Brazilian supermarkets, sold in 2002.

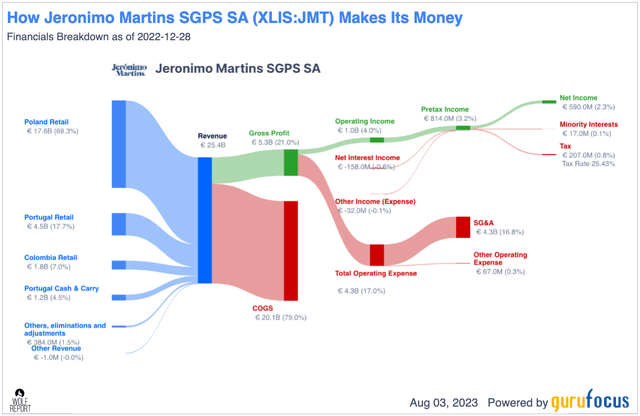

The company manages €25B+ revenues per year ad has been around for 231 years. Its headquarters are in Lisbon, Portugal.

You know how grocery companies work. Their net margins are razor-thin, and they need to find ways to make this work. Here we also find why my stake is comparatively small when compared to Scandinavian FMCG or even things like Ahold Delhaize. JRONY doesn’t manage great margins as of this time and is in all but its operating margin, a market underperformed. It’s profitable, just not the best or among the best at what it does.

Jeronimo Martins revenue/net (GuruFocus)

And you know me, I want those market outperformers – or at least market-equal performers at a cheap price.

Nothing in the company’s fundamentals speaks of worry. Like all of the FMCGs here, the company does what it does well. Revenues are climbing, the profit margins are relatively stable, and the company is consistently profitable.

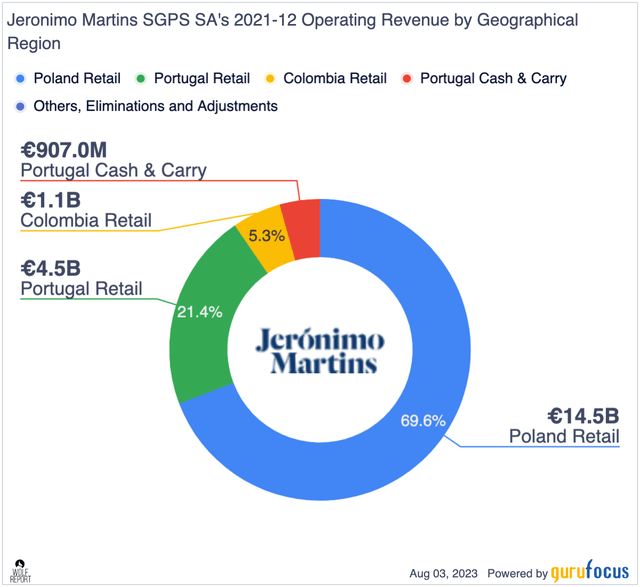

From a geographical perspective, the mix looks like this.

JRONY Mix (GuruFocus)

So, you’ll realize that JRONY is actually a very heavily-tilted Polish company, at least in terms of sales – which wasn’t something when I expected before I started researching it. The company is the leader in Poland, with a presence in over 1,000 villages and cities, 4 million daily visits, and 50% of its assets either newly built/opened or refurbished in the last five years.

The company has a very impressive private label portion of sales of over 40% ex-fruit/vegetables in Poland, lower in other countries. Recheio is the choice for many hotels and other professional customers, with over a billion in sales in core markets alone.

Ara and Colombia are part of the company’s growth strategy, and the company already has over 12,000 employees here, manning almost 1,100 stores with closing on €2B in annual sales, with a record of over 42% in private label brands.

The company also has agribusiness connections, where it secures a sustainable supply for its production. This includes businesses in Dairy, Livestock, Aquaculture, and Fruits/vegetables. For Livestock alone, for instance, the company has managed over 10,000 Angus cows sold, and over 35,000 sheep in 2022. The company holds stakes in Norwegian salmon farming, as well as significant stakes or full ownership in over 125 ha of Orange production, and 80 ha of seedless grape production.

Overall, and with its specialized retail operations included, I find this company to be an extremely interesting player. We do not, unfortunately, get granular enough information to determine exactly where the weak points in the company’s supply chain operations lie.

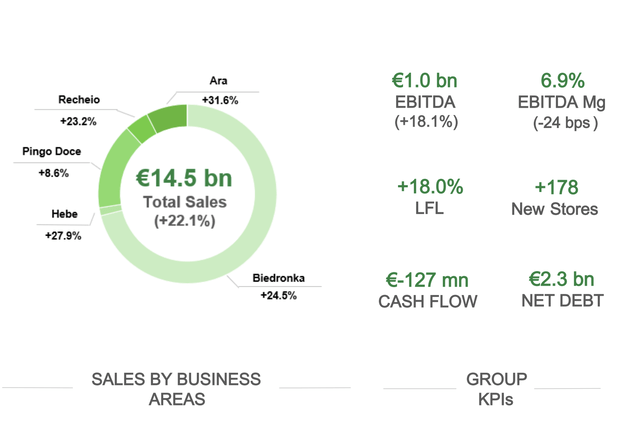

The latest results we do have are the 2H23 results, published less than a week ago. So this is a good time to introduce the company, with such fresh results around.

The company’s sales managed strong numbers for the first 6 months, with consumer demand remaining strong despite inflation. This is as you would expect – because people need to eat.

However, the company also managed significant improvements in EBITDA due to volume, while unfortunately dipping in margins and seeing negative cash flow.

JRONY IR (JRONY IR)

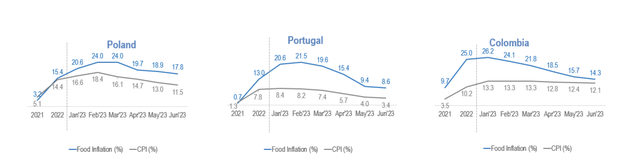

The pressure on household disposable income was particularly strong in Colombia – but pricing sensitivity and cautious behavior were the rules, not the exception, for every geography the company operates in. This makes sense because the company operates in generally weaker geographies income-wise than we would see in Sweden, Finland, Germany, or other areas. This has resulted in trading down in food retail with volume pressure. Colombia is seeing high, and long-lasting inflation (one of the problems of investing in South America), which has led to further volume pressure in food retail and more trading down. Food inflation is normalizing, but the various CPI numbers are only really normalizing in Portugal – they’re lagging in both Poland and above all, Colombia, where it’s really bad with still over 12%.

JRONY IR (JRONY IR)

The negative cash flow was not due to one specific reason, but rather several. They include increased CapEx, higher tax, interest rate payments, leases, and other trends – though much of it was attributable to a negative change in working capital. This doesn’t change the company’s balance sheet though. At a net debt of around €2.3B, the company is a debt/EBITDA of 1.8x, but it’s still very much within what I would consider standard ranges.

One of the issues is yield. I can get over 6% from Kesko, well-covered with similar operations – both food and specialty retail. JRONY manages a bare third of that at 2.25%, and that’s with a payout ratio of almost 80% – so that dividend is going anywhere fast.

This dictates to me, that I want to “BUY” the company cheap, not expensive.

Let’s look at what we have there.

Jerónimo Martins – The valuation is currently prohibitive.

JRONY trades under the native ticker JMT on the Lisbon stock market – a market I’d wager not many here invest natively in – but I have native digital access to it through my broker. That’s why I’ve been open to owning Portuguese companies. I’d be careful with the ADR due to low liquidity, but using a broker like IBKR gives you access to the native share.

However, if you follow my rating here, you don’t need to do anything – because I rate JRONY a “HOLD” here.

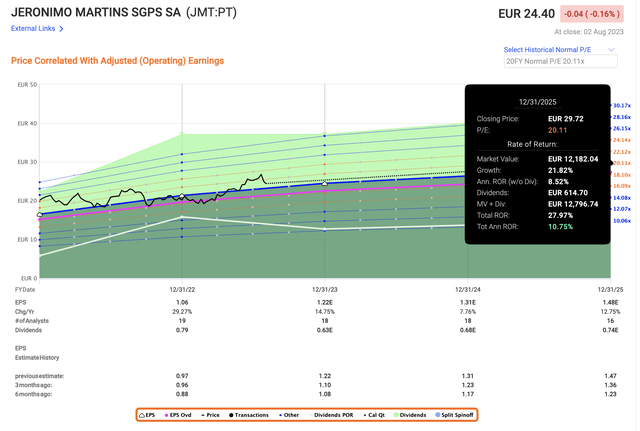

The simple fact is that while the company has a conservative upside in the double digits to a 21-22x P/E, that upside is barely 12-13%, and I want 15% if I go in with money in this investment. ‘

The company trades at an overall P/E premium on a 5-year basis of around 21.6x. However, normalizing this to a 20-year average we find ourselves working with a 20x P/E, which puts the 3-year annualized RoR at around 10.75%.

Jeronimo Martins Upside (F.A.S.T graphs)

To this, I say: not bad, but we can do better, even in this environment.

At a €22/share price we’d have a much better chance of making what I would see as a conservative positive upside of 15% annually or higher. S&P Global analysts tend to agree with this assessment. Out of 20 analysts following the company, only 5 are at a “BUY” here. The price target range is from a low of €17.5 to a high of €32.5 (would love to read that particular analysis). The average is at around €25, which is less than a 4% upside from today’s native share price of €24.4.

I put myself at €22/share or below. A real solid “BUY” with superb upside, i’d see at below €20, but we can buy it at €22/share and make a good profit.

On a DCF basis, the company’s annual growth rate of double digits implies, based on an EPS-calculated discounted cash flow model, a fair value of €21.3, which is at an 11% discount rate with a 10-12% EPS growth rate. I consider such numbers realistic, but it only confirms to me that the company is too expensive here. Using methods like Lynch values, Graham numbers, and P/S values, we also get the implication that today’s share price is too high for what’s being offered. The GF value for the company is at around €23.6 (Source: GuruFocus), which again implies an overvaluation if a slight one.

I believe this clarifies my reasoning, and why I want t a cheaper price if I’m buying this company. Here is my current thesis.

Thesis

- Jerónimo Martins is a company I do want to own, but I don’t want to own it at the price the market is currently demanding for my investment. The current valuation is around 21-22x P/E, and while this is not an uninvestable high, the company also has a lower-than-average yield, somewhat higher-than-average debt, and above-average forecast uncertainty.

- I want 15% or above out of the investments that I put my money in, on an annual basis. For that reason, JRONY giving us a potential annualized RoR of around 13.5% per year on a 21-22x P/E, I do not view this as high enough.

- For that reason, I give the company a PT of €22/share and a “HOLD” rating here. Below €20/share, this becomes a really interesting “BUY”, but for now it’s nothing.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

Because of this , I now view the company as a “HOLD”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here