Shares of

Icahn Enterprises

fell sharply Friday after the company announced a steep cut to its quarterly distribution and reported a wider second-quarter loss.

Icahn (ticker: IEP) halved its quarterly distribution to $1 from $2.

Icahn Enterprises

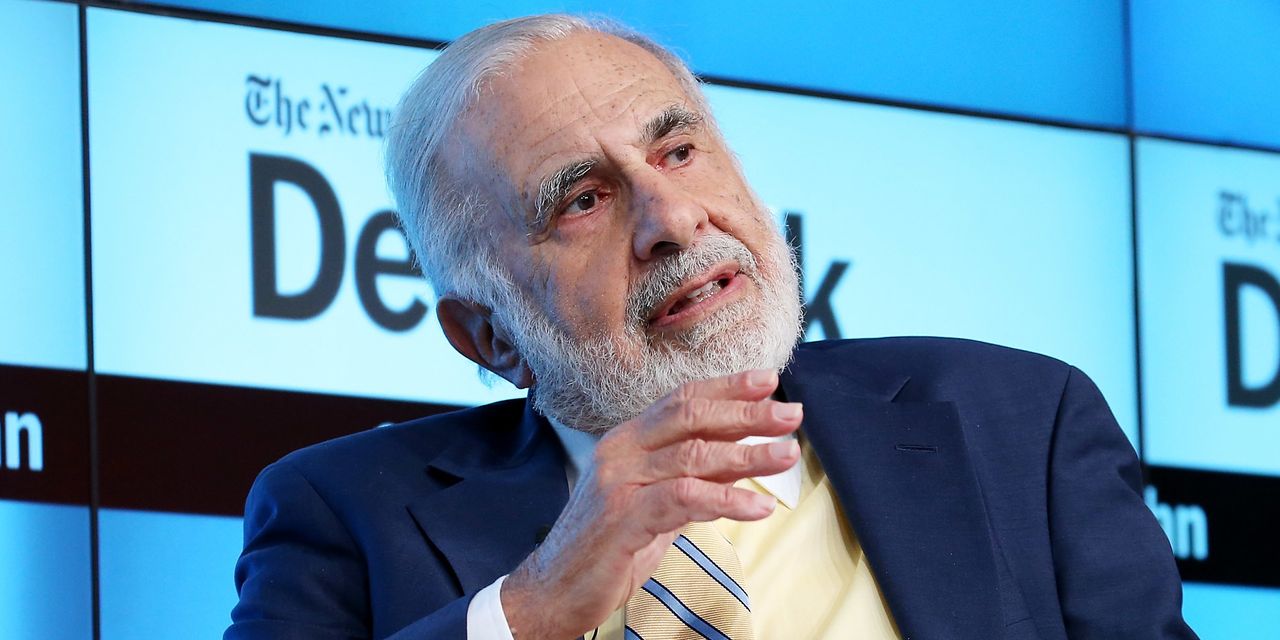

posted a loss of 72 cents a share for its second quarter, compared with the year-earlier loss of 41 cents. Revenue also fell year over year, results that Chairman Carl Icahn attributed in part to a critical report on the firm by the short-seller Hindenberg Research earlier this year.

Hindenburg alleged the company was holding assets at inflated prices and was vulnerable because Carl Icahn had borrowed against the value of the shares in the company he founded.

“I believe the second quarter partially reflected the impact of short-selling on companies we control or invest in, which I attribute to the misleading and self-serving Hindenburg report concerning our company,” the activist investor said. “It also reflected the size of the hedge book relative to our activist strategy.”

In a letter to shareholders published on Friday, Icahn noted that if investors had purchased 1,000 IEP depositary units in January 2000 for $7.63 a unit and taken their money in cash as it was paid out, they would have received about $76,000 in distributions and still retained ownership of the units.

“As compelling as the above numbers are, they would have been far more impressive had we not strayed over the past several years from our activist methodology and shorted (hedged) far more than was necessary,” Icahn wrote in the letter.

“While we made money on the long side through our activism efforts, our returns have been overwhelmed by our overly bearish view of the market and related oversized short (hedge) positions. Over the past six months, we have significantly reduced our hedges. Going forward, we intend to stick to our knitting and focus on our activist strategy while remaining appropriately hedged,” he said.

Shares of the company were down 25% to $24.42 in late morning. The stock had fallen 37% earlier, its largest intraday percent decrease on record, based on available data back to July 1987, according to Dow Jones Market Data.

Write to Emily Dattilo at [email protected]

Read the full article here