Three Part Article

This article is organized in three parts:

- Data/Charts

- Thoughts on Bank Stocks

- Fed/FDIC Concerns

I. Data/Charts

Methodology

Using Ycharts data, I have compiled quarterly valuation history for 57 US banks covering 1990 – May 2, 2023.

Not all the banks have valuation history going back to 1990, although all have such data since 1995. (1990 valuations include 21 of the 57 banks, 1991 = 41 banks, 1992 = 45 banks, 1993 and 1994 = 56 banks.)

The 56 banks are headquartered in 25 different states and include community banks as well as the nation’s largest banks.

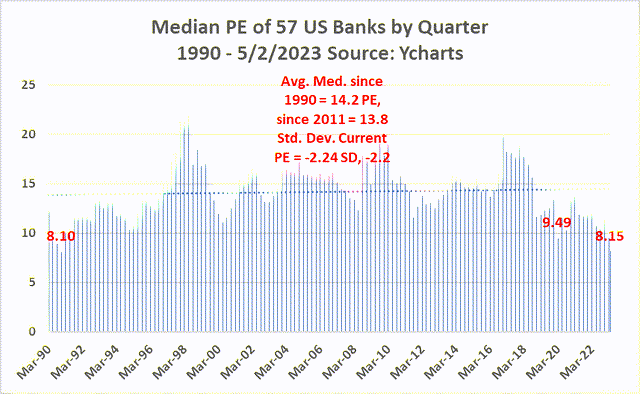

Price/Earnings

This first chart gives bank investors a clear picture as to the current state of bank valuations.

As of May 2, the median P/E of the 57 banks is 8.15x, a number -2.24 standard deviations from the average since 1990 and -2.20 since 2011.

A standard deviation +/- 2.0 shows significant statistical change from history.

Viewed another way, today’s median bank P/E is -43% lower than the average P/E since 1990 and -41% lower than the average since 2011.

PE 57 Banks (Ycharts)

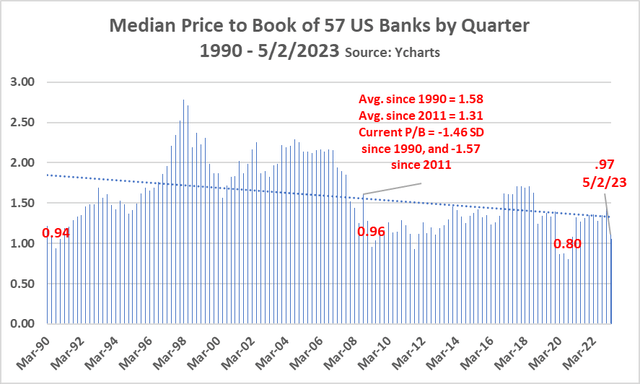

Price to Book

As of May 2, the median P/B of the 57 banks is less than book value at .97x.

The current median P/B is as low as any time in history except for the summer of 2020 when Covid fears peaked.

The current median bank P/B is -1.46 standard deviations below the 1990 average P/B and -1.57 below the average since 2011.

If you are wondering why the decline is greater since 2011 than since 1990 despite the median P/B ratio being higher since 2011, the answer is because the variation (i.e., volatility) in P/B was much greater going back 34 years to 1990 compared to 2011-2023.

Price to Book (Ycharts)

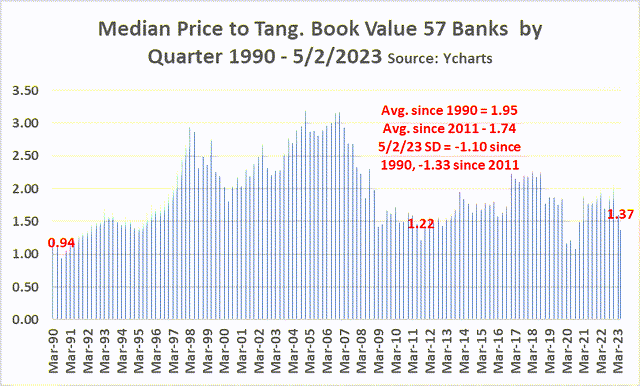

Price to Tangible Book Value

As of May 2, the median P/TBV of the 57 banks is 1.37x compared to 1.95 since 1990 and 1.74 since 2011.

The current median P/TBV is not as low as the industry got in 1990 or during 2020.

The current median bank P/TBV is “only” -1.10 standard deviations below the 1990 and -1.33 below the average since 2011.

Price to TBV (Ycharts)

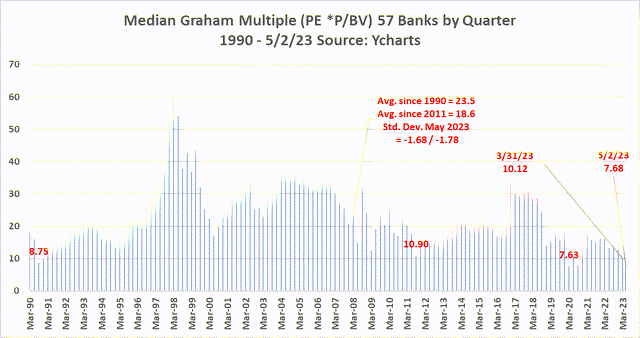

Graham Multiple

Warren Buffett’s mentor is Benjamin Graham whose book, “The Intelligent Investor,” includes a chapter on valuing a stock.

Graham multiplied a company’s P/E by its P/B. I call this metric the “Graham Multiple.”

Using this method, the median bank stock’s Graham Multiple is 7.58x, a number as low as any time in banking’s most recent 34-year history.

Graham Mult. (Ycharts)

Returns

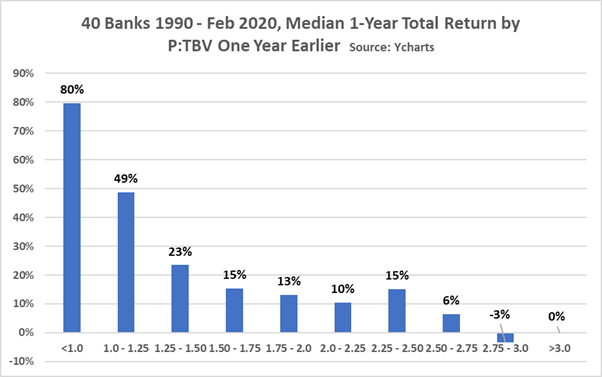

This next chart is from my March 2020 article, “12 Charts: The Case for Buffett Buying Bank Stocks at Today’s Valuations.”

The 12 charts from that post show that low valuations are associated with superior long-term returns.

The May 2 median bank P/TBV of 1.37 is bullish for bank stocks (at least the survivors).

This chart shows the history of median total returns based on various median industry P/TBV ratios.

Stock Price Change (Ycharts)

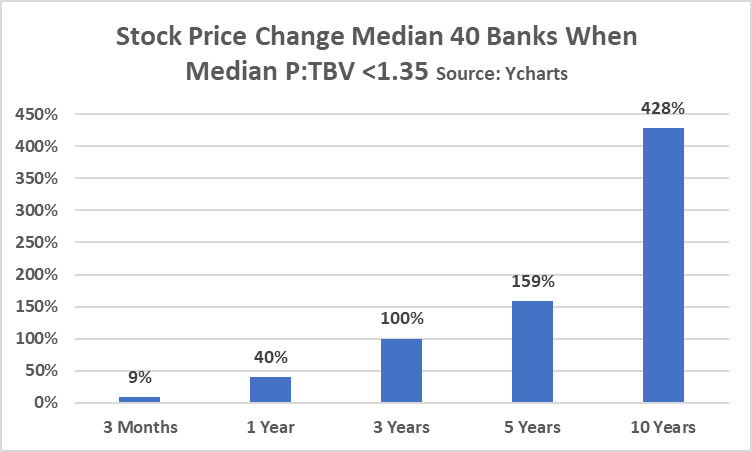

This next chart shows price change over five timeframes when P/TBV is less than 1.35, a valuation historically that is especially bullish.

Stock Price Change (Ycharts)

My View of Bank Stocks

Bill Gross Buys Regionals

Bill Gross, the “Bond King,” reported on April 21 that he is a big buyer of regional bank stocks.

“Well, I’ve always told myself and close friends that I wish I could start a bank… It’s a license to make money even when run conservatively…. “my long-time wish to own a bank is now possible via public markets… Recent ROEs of 9%-10% at 60% of book provide an enticing long-term investment.”

History Suggests Gross is Right

History shows that the best time to buy bank stocks is when they are most shunned.

Bearish on Banks

Despite Gross’s enthusiasm, I am bearish on the banking sector, although I am cautiously optimistic about a small sliver of bank stocks at this time of depressed valuations.

My September 2022 article about “Have and Have Not Banks” expressed my concern that there are too many “Have Not” banks in the US.

Tough Two Quarters Ahead

The Fed’s action yesterday bolstered my view that bank stocks will struggle between now and September 2023. Therefore, even better price entry points are likely in late 3Q or early 4Q. But who knows?

Accumulating 3 High-Quality Banks on Weakness

I prefer to own high-quality “Have” banks at times like these.

“Have” banks that I am currently accumulating are HBT Financial, Inc. (HBT), Pathward Financial, Inc. (CASH), and Cullen/Frost Bankers, Inc. (CFR). Each delivered strong earnings reports that beat expectations for the quarter ending March 31.

CASH repurchased more than 1.17 million shares during the quarter at an average price of $46.60. The buybacks represented 4% of the bank’s 12/31/22 share count. Here is a link to my November Pathward article.

I have been a modest buyer in recent weeks of Pathward shares at prices between $40-42.

HBT Financial is a small Illinois community bank that I first identified in September when I was looking for “Have” banks. I wrote about the bank in December as well as April.

HBT’s 10-Q was released this morning and I was pleased to see that it appears the bank bought back 55,000 shares (estimate $10 million at ~$18/share) between April 25 when Q1 earnings were reported and yesterday.

55,000 is my estimate, not a number reported by the bank. This repurchase is on top of the nearly 80,000 shares repurchased in Q1 with an average cost of $19.92. I have been a buyer in the past week at prices ranging between $17.40 and $18.80. The bank’s current dividend (3.89%) appears safe to me, however, Seeking Alpha gives it an “F” for safety.

The third high-quality “Have” bank that I am accumulating is Cullen/Frost. Its Q1 earnings report was strong as I expected it would be. I most recently wrote about Cullen/Frost on April 2. It is a Dividend Champion that currently yields 3.5% and has a “B” safety rating from Seeking Alpha.

As much as I like Cullen/Frost, I must admit I was a bit uneasy with the tone of the bank’s recent earnings call. Maybe I am misreading something, but I sensed that Cullen/Frost management was a bit too positive and upbeat in its assessment of their performance and outlook. I worry when bankers are too gung-ho, no matter how well they run their banks. I have not bought shares since early April when I was a buyer of the common at $104 and the preferred in the low $18s.

Caution

Warning: I am the guy who thought for ten years that First Republic Bank was a high-quality bank. Banking is a tough business as evidenced by not just 3 failures this year, but 500 in 2009-2011, 3,000 from 1987-1991, and 9,000 during the 1930s.

Big Worry: Fed, FDIC Systemic Risk

Fed Up

The Fed is proving to be even more reckless than I described ad nauseam in my SVB post-mortem article.

Powell’s Q&A yesterday was disconcerting. He appears to be, on the surface, cavalier in his view of bank problems.

Powell’s (and Yellin’s) history (“transitory” inflation) does not lend confidence to their public policy decisions. They clearly did not foresee the unintended consequences of record rate hikes on bank safety and soundness.

I see Fed Open Market Committee Actions as systemic risk. Powell is playing with fire. Yellin does not engender confidence when I see her testify before Congress.

FDIC Supervision

Both the Fed and FDIC self-reported this past Friday on errors they made in the supervision of failed banks. To the credit of each regulator, the analyses seem credible and actionable.

There is no kind way to put it: The FDIC’s April 28 analysis of Signature Bank’s supervision is an atrocious self-indictment.

The simple fact that the FDIC’s overall CAMELS rating of Signature was a “2” (on a 1-5 scale with 1 being best) is prima facia evidence of poor supervision.

The bank’s liquidity rating was “3” at the time of failure. Serious bank investors should read the 53-page report. Then again, if you are prone to nightmares, you may want to avoid reading it.

The most troublesome self-identified issue facing the FDIC is chronic staffing shortages.

“Beyond SBNY, the NYRO has experienced persistent staffing shortages within its large financial institution (LFI) examiner ranks. Since 2020, an average of 40 percent of the LFI positions in the NYRO have been vacant or filled by temporary staff, and a number of large bank dedicated teams have significant vacancies. Several other FDIC regions also have an elevated number of LFI examiner vacancies.”

When the FDIC has a 40% staffing shortage, can investors be confident that the banks are being supervised adequately? Of course not.

Federal Reserve Supervision

Appalling as the FDIC was in its supervision of Signature, the record is even worse for the Fed’s supervision of SVB. Here is a link to the Fed’s review of its SVB mistakes.

The worst paragraph in the 49-page report is this one:

“With regard to interest rate risk-management, supervisors identified interest rate risk deficiencies in the 2020, 2021, and 2022 CAMELS exams but did not issue supervisory findings (MRA/ MRIA). The deficiencies were only communicated as written advisories or verbal observations… The supervisory team issued an MRA in November 2022 and planned to downgrade the Sensitivity to Market Risk rating in the CAMELS framework from “Satisfactory-2” to “Less-than-Satisfactory-3″ as part of the 2022 CAMELS exam. The firm failed before that downgrade was finalized.”

Buried on page 42 of the Federal Reserve review is commentary indicating that the regulator planned to issue an MOU (Memorandum of Understanding) in August 2022. Here is text from pages 42-43 describing the bureaucratic leviathan strangling the Federal Reserve:

“The MOU was still in draft form and was in process of being submitted to the CDFPI for another round of review when SVB failed. The MOU drafting process involves stakeholders across all agencies, including FRBSF, Board S&R, Board Legal, and CDFPI, and can be time consuming to complete. The SVBFG MOU was also delayed as stakeholders considered whether upcoming examinations would contribute to the content of the draft MOU.”

In other words, checkers checking checkers checking checkers, and poof, seven months later the bank disappears sans an MOU.

Also bear this in mind: The 2022 CAMELS exam had not even been completed at the time the bank failed in March. Unbelievable.

And note that the intended, but not communicated, downgrade was just a one notch downgrade, from 2 to 3.

Talk about getting caught with your pants down. The lack of a sense of urgency is beyond comprehension. Unbelievable.

Consider the irony: The FDIC is 40% short of examiners, and the Federal Reserve is so overstaffed that its bureaucracy simply grinds its actions to a snail’s pace. Here’s an idea: Send half the over-staffed Fed to the FDIC.

Fed and First Horizon & TD

This morning The Toronto-Dominion Bank (TD) and First Horizon Corporation (FHN) announced that they will not merge after reaching an agreement to do so more than a year ago.

Who do you think supervises both banks?

Yep, the Federal Reserve.

Ever since the Biden Administration took charge, bank merger approvals have slowed to a crawl. Politics maybe? Elizabeth Warren maybe?

I wrote about my concerns when Michael Barr was appointed to be Vice Chair of Supervision for the Federal Reserve of Governors.

First Horizon is a solid bank that has been weakened by regulatory foot-dragging.

How many key people did the bank lose over the past year as employees moved to new opportunities fearful of losing their jobs when the merger closed?

The Fed needs to disclose its role in the failure of TD and FHN to close their merger. Investors deserve to understand reservations. Could it be that the same bureaucracy that failed to issue timely MOUs and CAMELS reports to SVB also stopped the FHN-TD dead in its tracks?

Consolidation Inevitable

The industry needs and will sooner than later get consolidation for two reasons.

First, as noted, the FDIC acknowledged publicly that they lack a deep bench of talent; the same is true of the banking industry. Mergers are necessary so that all banks have skilled bankers and directors (and there are very few of them) to run and govern banks. And by the way, fewer banks will help the FDIC spread its limited talent more effectively.

Second, bank lending is a commodity business. Scale and productivity are absolutely necessary to compete and earn returns greater than the cost of capital. Efficiency ratios vary tremendously across the industry. Costs need to come out. For that matter, banks need to raise interest rates charged on loans.

Recession Imminent?

As I talk to bankers around the country, it is clear that liquidity worries are front and center for just about everyone.

The implications are just as clear today as they were in 2009 when Washington identified capital inadequacy as a major problem for US banks.

The banker’s response to capital concerns in 2009-2013 was to freeze lending. And the same thing is happening today as banks respond to the liquidity crisis induced by Fed action’s interest rate policies.

The problem with credit freezes/slowdowns is that asset values, especially commercial real estate, depend to some degree on steadily available capital and credit. The problem can be particularly acute in smaller MSAs and rural communities where just a few lenders provide the bulk of lending to local real estate developers. When these lenders all slow lending, problems occur.

In such markets, a credit slowdown can result in a self-perpetuating decline in local commercial real estate values.

The best CRE lending community banks in the country mitigate against this risk by having at least three sources of repayment: 1) Going Concern, 2) Low loan-to-value which protects lender in event of default and subsequent fire sale of property, 3) Personal Guarantees.

Diminishing Confidence Bordering on No Confidence

As much as it dismays me to admit this, I have diminishing confidence in the supervisory skills of the Fed or FDIC.

I do not put the OCC in the same bucket as the Fed and FDIC. My review of their work suggests the OCC is now the premier bank regulator in the US. To that point, since the US has the odd wrinkle that allows banks to choose their regulator, I would prefer that the banks I invest in be supervised by the OCC.

I think the Fed and FDIC are today a systemic risk to the US banking system.

Closing Thoughts

We will get through this challenging time. Bank stocks will bounce back… eventually. The Fed and FDIC will get their acts together eventually.

That said, it is possible that bank stock valuations could decline further. Anecdotal evidence that I have indicates that bank P/Es fell to ~5x to 6x in the mid-1970s when stagflation gripped the nation.

I think there is a 20% chance that the median bank P/E falls to 6x. The actual decline in bank stock prices could be even more significant if there is a decline in earnings.

Bear in mind that credit quality is nearly as good today as it has been at any time in the past four decades. Some reversion to the 40-year average Provision expense ratio will not come as a surprise.

Final thoughts:

- There is too much macro-economic and public policy uncertainty for this risk-averse investor to invest in the high-profile banks that find themselves today on the ropes.

- Bullish as I am in CFR, CASH, and HBT, I will keep my exposure to bank equities to no more than 6% of total investable assets for now.

- CD’s and Treasuries remain attractive alternatives.

Caveat

The foregoing is my opinion. I share my investment thoughts for the purpose of getting feedback and questions that challenge my ideas and assumptions.

Every investor needs to do his/her own due diligence before investing as well as determine their risk profile. I am risk-averse, preferring to invest in the nation’s best banks which historically earn returns exceeding cost of capital.

Read the full article here