Investment action

I recommended a buy rating for Nestle (OTCPK:NSRGY) when I wrote about it the last time, as I was cautiously optimistic about the improved visibility into FY23 and the cheap valuation relative to peers.

Based on my current outlook and analysis of NSRGY, I reiterate a buy rating. I note that the upside is not fantastic, but this is a stable company that has strong brand equity across the globe. There are also visible catalysts, such as volume and gross margin improvements, that could drive near-term positive momentum (both positive for stock sentiment and earnings).

Basic Recap

NSRGY is a well-known, trusted company. Milk, chocolate, candy, coffee, etc. are just some of the many items it produces and sells.

Review

At the group level, 2Q23 organic growth [OSG] was 9.2% for price and -1.1% for volume, equating to an actual OSG of 8.1%. 1H23 underlying trading margin increased 20bps from 2Q22 to 17.1%, which resulted in an EPS of CHF2.43, which was CHF0.10 higher than the consensus estimate. The OSG in developed markets is 7.4%, while in emerging markets it is 8.9%. Sales increased by 7.3% at retailers while 9.2% were up for out-of-home. While RIG is still struggling, management has said that things should start looking up in 2H23.

Volume growth ahead

In my opinion, volume growth will accelerate in the 2H23. Management has stated their desire and intention to drive positive growth, although they have not committed to a positive RIG for the full year. Increased marketing and portfolio optimization (including the exit of the Canada Frozen Food business) are two key factors that management believes will yield positive results. I have faith in NSRGY’s marketing prowess because of their extensive background in the industry (note that NSRGY is a business with near CHF100 billion in revenue and over 100 years of operating history). Moderating prices, I believe, will unquestionably aid in capturing wallet share from consumers who have tighter consumer budgets. I understand there are concerns that recession fears and inflation will hurt NSRGY demand. However, I believ belief that current volume level is sustainable as management has not observed any signs of increased elasticity and consumer trading down in response to its pricing actions. They also stated that they saw no quarterly decline in global consumer spending, which was reassuring. In fact, NSRGY experienced gradual improvement from April’s dismal start through the months of May and June. Furthermore, volume growth of some percentage is likely, given the low bar set by last year.

“In case you are concerned about a slide in global consumer sentiment, I would like to assure you, that we did not see a downward trend inside the second quarter. April was rather weak in line with what some of our peers reported. Sales in May and June were quite a few” 1H23 earnings call

Gross margin

One area I would be monitoring is gross margin, and management guided 2H23 gross margins to be up significantly. I am positive that gross margin will improve over time due to 3 reasons. Firstly, the sequential improvement of 115bps is clearly supportive of management confidence. Secondly, as I look at NSRGY’s historical performance, gross margin tends to revolve around the ~50% range, with minor ups and downs. As such, I see room for further expansion here (NSRGY had gross margin of 49.79%, 49.77%, and 49.26% in the 3 years before covid, from FY18 to FY20). Lastly, commodity prices should continue to ease as supply chain issues ease. The combination of sustained price hikes and lower input costs should drive margin expansion.

Valuation

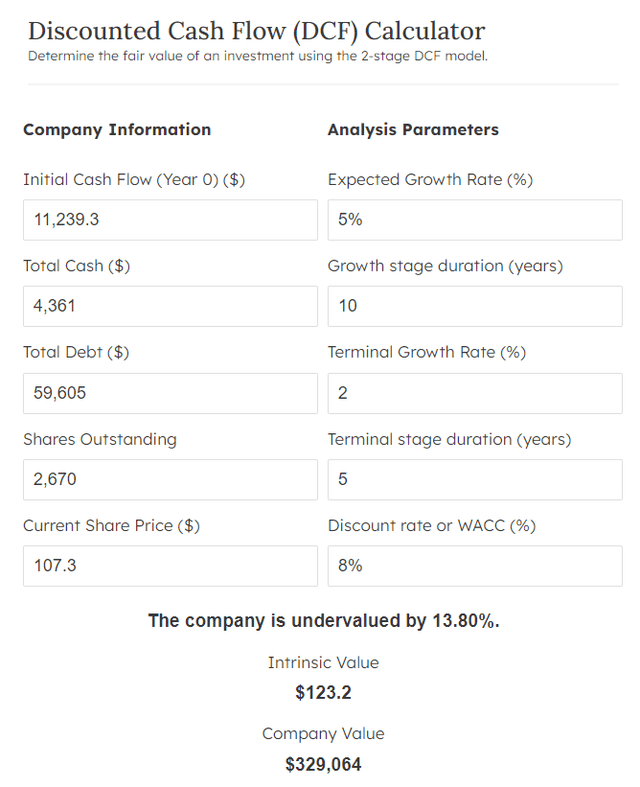

Finmasters

I believe NSRGY can grow FCF in the mid-single digits for the long-term, driven by stable low to mid-single digit growth (just as it has performed in the past) and margin expansion (largely from gross margin normalization). Given the size and nature of NSRGY, this is a mature company that is unlikely to see surging growth rates. I would also categorize NSRGY as a pretty stable company that has generated stable growth (except for FY15 and FY20), positive EBITDA margins, and positive FCF over the past decade. As such, I had a lower discount rate for it. Based on my DCF model, my price target is CHF123.20.

(Please note there wasn’t an option to switch the $ to CHF in the DCF model, hence I used $ as a proxy for CHF)

Risk and final thoughts

While the business has not seen a trade down yet, I think the risk is a further deterioration in consumer disposable income (due to macro factors), which will eventually trigger a trade-down effect, impacting volume performance. Specifically, volume performance may be negatively impacted due to consumers’ preference for white label or cheaper brands than what Nestle currently offers during economic downturns.

I reiterate a buy rating for NSRGY as the outlook remains positive with visible catalysts such as volume and gross margin improvements. The 2Q23 results showed encouraging organic growth and increased trading margins. Looking ahead, management’s commitment to driving positive growth through marketing efforts and portfolio optimization bodes well for volume expansion in 2H23. As with any investment, there are inherent risks, but the company’s track record and strategies inspire confidence in its ability to navigate challenges and deliver solid results.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here