Overview

My recommendation for TechnipFMC (NYSE:FTI) is a buy rating as I continue to be positive on Subsea performance, especially after a strong 2Q23 quarter. In addition, management’s new capital allocation policy is also a good indicator of confidence in upcoming cash flows, which I think will support the stock’s valuation. Note that I previously gave a buy rating for FTI due to the encouraging progress being made on the Subsea inbound front.

Recent results & updates

Revenue for 2Q23 came in at $1.97 billion, 14.4% growth vs 2Q22. I expect revenue to continue growing healthily given the strong performance in orders and backlog. 2Q23 orders of $4.4 billion resulted in a book-to-bill ratio of 2.25x, indicating that the backlog is still very strong. The total backlog increased by 25% to $13.3 billion in 2Q23 from $10.0 billion in 1Q23. The sheer volume of orders received caught me off guard. In particular, Subsea order intake was $4.1 billion, and management is now raising Subsea order intake guidance to $9bn in 2023, an increase of one full billion dollars from previous guidance. With the current book-to-bill ratio, $9 billion in revenue would be generated over a period of more than two years; this would represent a “lock-in” of revenue of more than $4 billion per year on average.

The strong revenue performance in 2Q23 also drove adj EBITDA to $206 million, a staggering 40% increase, indicating the strong incremental margin in the business.

The second major development is that management has pledged to return more than 60% of FCF until at least 2025, increased its buyback authorization by $400 million, and begun paying a quarterly dividend of $0.05 per share (1.1% yield). I view this as very positive news, as it should help the share price/valuation and possibly even entice cashflow investors. Using consensus estimates for FY25, the total FCF generated is implied to be $1.4 billion. Assuming management returns 75% of it, that implies $1 billion of capital returned to shareholders. The total implied yield from today to FY25 would be around 3% dividend yield (3x payment) + 12% FCF return ($1 billion / $8 billion market cap today) = 15%. Whether or not FTI can produce the projected FCF is an open question. Because of the contractual nature of the arrangement, I believe it can, It’s also clear that management is optimistic about future results:

“And looking further ahead, we remain confident that our internal initiatives coupled with the strong market backdrop provide us with a clear path in achieving subsea EBITDA of more than $1 billion by 2025.” 2Q22 earnings call

FTI balance sheet also does not show any form of stress that would impact the capital return policy either. FTI currently has a net debt-to-EBITDA ratio of around 3x. As the business grows EBITDA, this leverage should be used accordingly. As such, I don’t see any balance sheet risk.

Valuation and risk

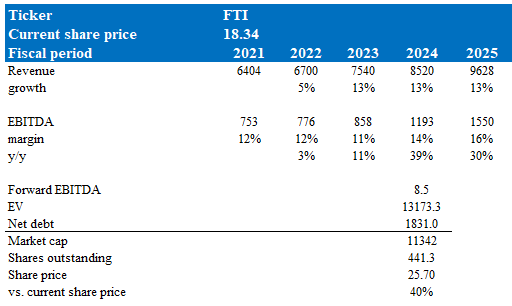

Author’s valuation model

According to my model, FTI is valued $25.7 in FY24, representing a 40% increase. This increase in target price is due to my increased growth forecast for FY23 and FY24 (from 11%/12% to 13%/13%) as I become more confident in my performance given 2Q23 Subsea performance. Margin should also expand accordingly, as incremental revenue has high incremental margin (as seen this quarter) due to the fixed cost nature of the business (large CAPEX / upfront cost associated before revenue can start rolling in).

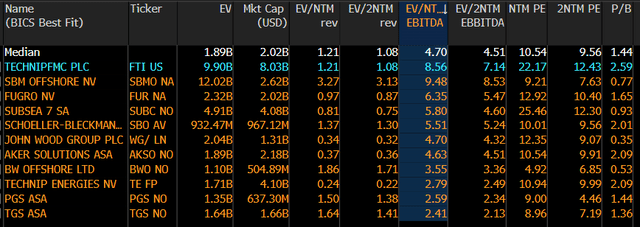

FTI is now trading at 8.5x forward EBITDA, which I believe will stay at this level over the next two years as the market continues to give credit for the improving Subsea performance and the visibility it provides to future performance. In FY24, I projected FTI would trade at 8.5x forward EBITDA. I believe the value is appropriate because it compares favorably to peers in the oilfield services and equipment industry, with FTI growing EBITDA much faster than peers.

Bloomberg

On risk, given the nature of large-scale deep-water projects, orders for subsea trees have historically been lumpy. Hence, there is a higher likelihood for FTI to “miss” expectations, as consensus typically forecasts on a linear basis. While this should not alter long-term performance, it does increase stock price volatility.

Summary

I reiterate a buy rating for FTI based on its strong 2Q23 performance and the positive outlook for its Subsea segment. The company’s capital allocation policy, which includes a commitment to return more than 60% of free cash flow to shareholders, further bolsters my confidence in the stock’s valuation. The recent increase in order intake and backlog indicates robust demand for its services, and management’s optimism about achieving substantial EBITDA by 2025 adds to the positive outlook. With a healthy balance sheet and no evident capital return risks, FTI appears well-positioned for future growth.

Read the full article here