Billionaire Stanley Druckenmiller has shorted the U.S. dollar. You may not have heard about this gentleman but he remains famous for his successful bet against the British pound in 1992 as George Soros’s deputy. Also, China seems to be taking the yuan globally to counter the “weaponization” of the dollar by the U.S. government.

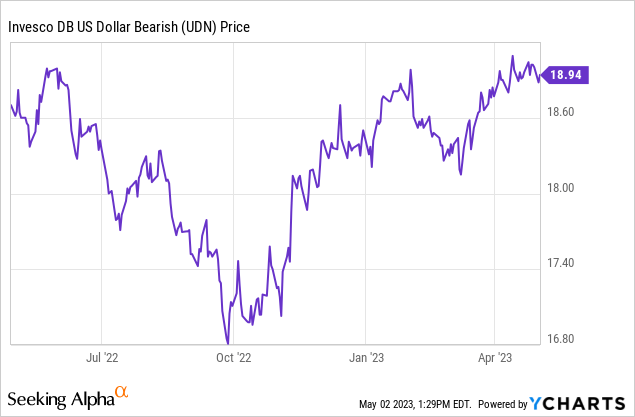

Now, as an investor, you can short the greenback through the Invesco DB US Dollar Index Bearish Fund (NYSEARCA:UDN) which, after reaching a trough back in September last year, seems to be on a sustained upside whose beginning coincided with the banking crisis in March.

Thus, my aim with this thesis is to assess whether the bearish sentiment against the dollar is justified and for this purpose, I consider factors like the Federal Reserve’s monetary policy, the differential of spreads with the euro, recession risks, as well its role as the world’s reserve currency.

First, I provide more insights into UDN.

UDN for Shorting the Dollar While Rates Plateau

Available at fees of 0.75%, UDN tracks the Deutsche Bank Short USD Currency Portfolio Index – Excess Return or DBSUSD. This is the inverse of the Deutsche Bank Long USD Currency Portfolio Index – Excess Return or DBLUSD tracked by the Invesco DB US Dollar Index Bullish Fund (UUP).

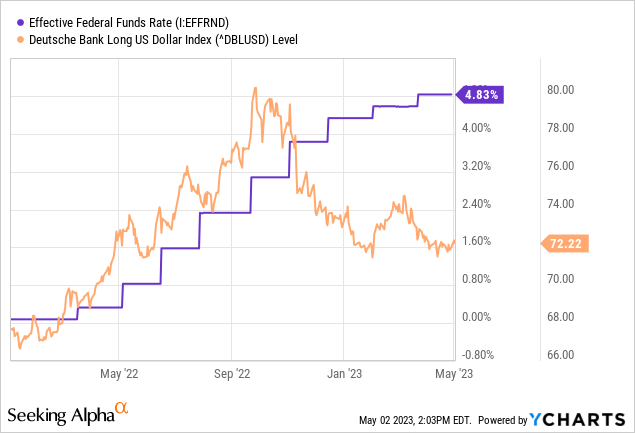

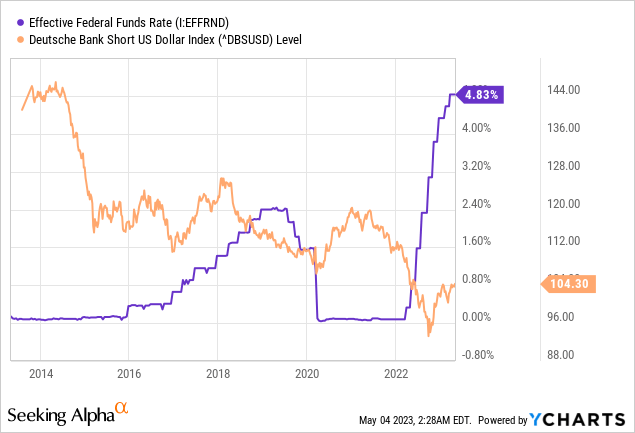

Now, DBLUSD (dollar bull index) saw a record high in 2022, rising by about 20% between March and November 2022 as shown in the orange chart below.

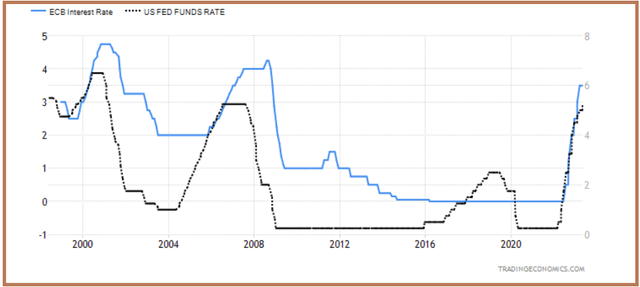

This appreciation was interest rate-led as there was a faster tightening of monetary policy by the U.S. Fed as shown by the above blue chart compared to other central banks, like the ECB (European Central Bank) or the Bank of Japan (BoJ). This more attractive rate level in the dollar zone created more demand for the currency. Dollar strength was also supported thanks to the lower risk of a recession occurring in the USA, while economic conditions were deteriorating in Europe following the cutting off of Russian gas supplies.

Now, after the Fed moderated the pace at which it raised rates as of December last year (as seen by the above blue chart’s sloping upward but less steeply), the greenback started to lose value. Furthermore, there is an increased likelihood of a Fed pause later this year because of the banking turmoil which has involved the failure of four banks plus contagion risks spreading to other regional banks like PacWest (PACW) whose shares have plunged by 76% since early March. This is despite the U.S. authorities gearing up unprecedented measures to guarantee deposits and activate tools to ensure an ample supply of liquidity for banks.

Dollar Vs Euro Demand Amid Bond Yield Spreads

Thus, in addition to taming inflation, the U.S. central bank has to ensure that it also ensures financial stability, and this not only increases the probability of a pause this year but also of a pivot in case there is severe deterioration in economic conditions as a result of tighter credit.

Now, rates are intricately linked with foreign exchange (Forex) movements, as when they fall, the yield on U.S. dollar-denominated bonds decreases. As a result, the spread (or yield differential) should become more favorable to euro-denominated bonds in 2023 in the event the European Central Bank (ECB) increases its key rates at a faster pace than the Fed, which appears likely in view of the banking system not been impacted in the same way as the U.S.

Compare euro-area and U.S. Fed interest-rate (tradingeconomics.com)

Consequently, investments in euros can become more attractive for investors, in turn leading to an increase in demand and de facto an appreciation of the European currency against the dollar.

Another factor that favors the lower dollar thesis is inflation.

For this purpose, the annual inflation rate in March 2023 stood at 8.3% in the European Union after falling from February. Despite falling from 9.9% in February, these inflation figures remain unheard of since the birth of the euro more than 20 years ago and have been driven mainly by the rise in the prices of food, alcohol, tobacco, and industrial goods and excluding energy. This compares to 5% in the U.S. Thus, the EU has further to go in the monetary policy tightening cycle, to the disadvantage of the greenback.

Risks Faced by Dollar Bears

This bearish scenario for the dollar has a risk though, due to public debt dynamics. Here, everyone’s attention is currently focused on the U.S. debt ceiling which has also contributed to recent dollar weakness. However, to be realistic total U.S. public debt as a percentage of gross GDP was 120% in the fourth quarter of 2022. Compare this to Japan’s 264% in 2022 where further increases in the budget deficit combined with a decline in the level of private savings and current account surpluses could weigh on the yen.

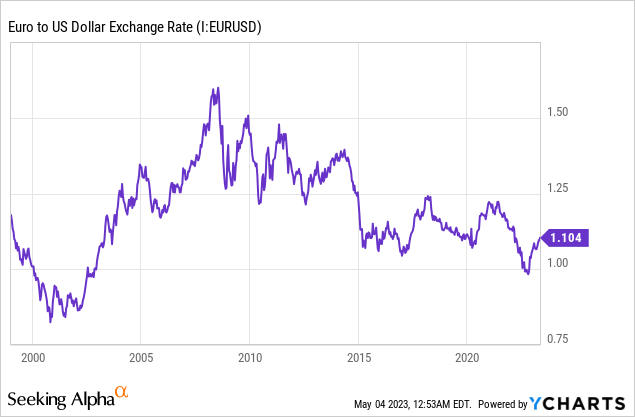

In the Eurozone, EU debt accounted for 85% of nominal GDP in Sep 2022. Well, this is less than the U.S., but it is important to look at individual countries. Thus, at the end of September last year, Greece had a staggering debt-to-GDP ratio of 178.2%, followed by Italy at 147.3%. On the other side of the spectrum, North European countries like Holland, Germany, and Luxembourg have lower ratios as a result of exercising better fiscal discipline and they put pressure to keep the EU’s overall debt ceiling down. This difference in approach to debt led to the European sovereign debt crisis from 2009 to 2010 when Greece’s sovereign debt reached 113% of GDP, almost twice the limit of 60% set by the ECB. As shown in the chart below, this crisis resulted in the Euro/Dollar exchange rate trending lower, which was also due to the ECB keeping interest rates down to zero.

Such a crisis cannot be completely ruled out, due to high debt levels in some countries combined with higher borrowing costs.

Consequently, macro-financial fundamentals seem to support a depreciation of the dollar, unless cracks start to appear on Europe’s liquidity front.

Geopolitics and Wider Adoption of the Yuan

Looking further, there are also geopolitical factors that could undermine the dollar as the world’s reserve currency as America and China strive for dominance. Thus, in March the Chinese yuan overtook the greenback as the most widely used currency for cross-border transactions. In this respect, Saudi Arabia has started accepting yuan instead of dollars for Chinese oil imports, to pay for goods and services it imports from China.

Now, it is not clear whether the oil-rich kingdom will request yuan for all of its oil shipments but one country where the Chinese currency reigns is Russia. This is not only the result of U.S led sanctions which reduce the country’s access to hard currency, but also, Beijing’s efforts to expand usage of its currency. This expansion could also be helped by the U.S. government allegedly weaponizing the dollar against countries like Iran which have started to reduce dollar exposure, but it does not mean that the rest of the world will follow.

The reason is that the Yuan is not a freely convertible currency as there is capital control by China’s Central Bank as to how much can go out of the country for items such as loans and corporate share capital contribution. Now, when a currency is not freely convertible, there can be questions as to its role as a store of value. Thus, despite being internationalized since 2010 and progress made in its adoption globally, the yuan constituted only around 3.2% of international payment settlements last year.

Therefore, China taking the yuan globally to counter the “weaponization” of the dollar is likely to get some traction but is not a reason strong enough to short the dollar, which has a proven safe-haven role in the global financial system amid geopolitical tensions and wars throughout decades.

Consequently, it is more about interest rates, debt, and economic growth as I elaborated upon earlier and further illustrated below for the 2018-2019 period. Thus, when the economy was growing even a fall in rates could not quell the dollar rise, which in turn lowered DBSUSD’s (dollar bear index) value tracked by UDN. The greenback only got support from the Covid crash due to its role as a safe haven when equities and bonds were all hammered, but this was short-lived as the economy rebounded.

Hold on to Your Cash

Extrapolating further, with a recession driven by liquidity fears forecasted for the second half of the year, and investors mostly holding on to their cash, the demand for the dollar is not likely to crater, but there should be temporary volatility as debates around the debt ceiling get hotter and small banks (not the big ones), continue to suffer. This could induce an upward momentum in UDN to the $19.10 support level, but not enough to deserve a bullish position.

Also, the US Dollar Index (DXY) has already lost around 10% since its September peak, implying that traders seem to have already priced in the yield spread (interest rate differential) between dollar and euro-denominated bonds. Therefore, it is probably too late to short at this stage, and buying now could mean that you would have to hold your shares for a long time before it appreciates enough.

In the meantime, it could suffer from decay or loss in value whereby returns significantly differ from expectations. This shows one of the disadvantages of trading leveraged ETFs like UDN for the uninitiated which on top uses futures contracts. In this case, unlike a buy-and-hold approach where you have more of a long-term investment horizon, timing is key here given the somewhat speculative nature of currency trading, which may not be suited to all investors.

Finally, this thesis has shown the ingredients for further dollar downside are present, but being data-driven, both the Fed and the ECB are likely to proceed with caution and wait for potential liquidity stress events to unfold while addressing inflation. The latest example is the ECB hiking by 25 basis points, and in these conditions, there should not be major currency moves.

Read the full article here