Editor’s note: Seeking Alpha is proud to welcome Sapphire Wealth Insights as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Introduction

Founded in 2008, BioNTech (NASDAQ:BNTX) has emerged as a global leader in immunotherapy, driving innovations in cancer treatments, infectious diseases, and other serious conditions. Under the guidance of CEO and co-founder Uğur Şahin, a distinguished German oncologist and immunologist, the company focuses primarily on cancer research and immunology therapies, expected to become its main revenue drivers after the groundbreaking success of COVID-19 vaccines in recent years. Leveraging a comprehensive model and diverse technological suite, BioNTech has made significant strides in mRNA vaccines, gene therapies, and targeted antibodies. Their remarkable portfolio includes Comirnaty, a COVID-19 vaccine, along with over 25 products in clinical trials and 30 ongoing research initiatives.

BioNTech’s patient-centric approach harnesses the immune system’s potential to address critical health challenges, cementing its position as a trailblazer in cutting-edge therapeutic solutions. The success of their COVID-19 vaccine demonstrates the company’s capabilities and bright future in the fields of immune therapy and cancer treatments. Additionally, the COVID-19 crisis has bolstered BioNTech’s financial position with a substantial cash reserve.

In the following sections, we will delve into BioNTech’s business prospects and explore why the company represents an enticing investment opportunity. With a history of groundbreaking innovations, a strong pipeline ahead, and a successful partnership that led to a globally acclaimed COVID-19 vaccine, BioNTech has demonstrated its leadership in the biotechnology sector. Furthermore, its unwavering commitment to research, development, and strategic collaborations positions the company for significant growth and further advancements in the medical field. Additionally, the company has accumulated a significant cash position. I will implement a Net Present Value approach to assess a fair value for BioNTech shares, providing you with perspective on what is possible and potential indications for the future development of BioNTech’s share price.

Disclaimer: All amounts within this article are provided in euros based on the current USD/EUR exchange rate, which may result in a nominal difference of approximately 10% per dollar (1 USD = 0.91 euros as of 7/29/2023). Additionally, some of the figures and financial data presented in this article are based on estimates and may have been rounded for simplicity.

Recent Results (Three Months Ended March 31, 2023)

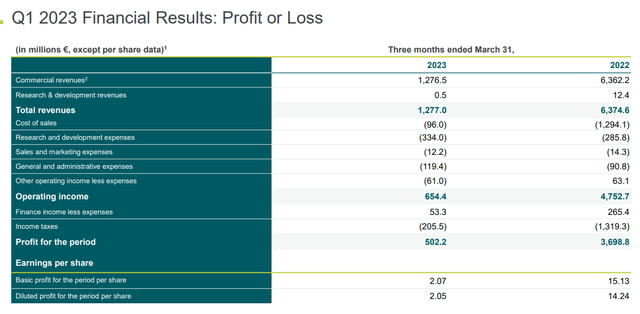

In the first quarter of 2023, BioNTech reported, in its first quarterly report for fiscal year 2023, total revenue of 1,277.0 million euros. It’s important to note that this figure reflects a sharp decline compared to Q1 2022. This is primarily due to the extraordinary impact of COVID-19 vaccine sales during that period. As a result, a direct comparison between the two quarters may not be suitable since the COVID pandemic, in many respects, can be deemed an extraordinary environment. Breaking down the major cost positions, research and development expenses amounted to 334.0 million euros, while the cost of sales stood at 96.0 million euros. Sales and marketing expenses were reported at 12.2 million euros, with general and administrative expenses recorded at 119.4 million euros. Additionally, other operating expenses totaled 118.1 million euros, while other operating income amounted to 57.1 million euros. With an operating income of 654.4 million euros, BioNTech demonstrated its operational efficiency. Considering other financial income, the company reported profits before tax of 707.7 million euros. After taxes, the net income reached 502.2 million euros, translating to a profit of about 2.07 euros per share.

BioNTech’s Q1 financial figures (BioNTech – Investor Presentation)

Guidance Outlook & Upcoming earnings on August 7, 2023

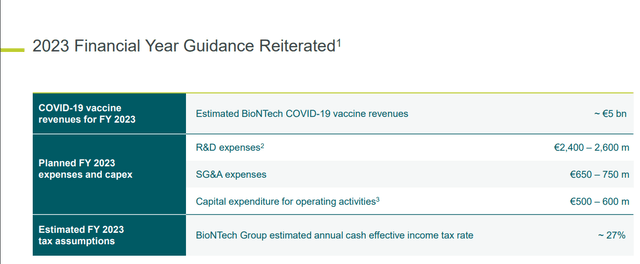

Seeking Alpha analysts project revenue to be around 5.4 billion euros for fiscal year 2023, with a consensus EPS of 5,1 euros, implying a net income of approximately 1.2 billion euros based on the outstanding shares of 240,990,499 (excluding 7,561,701 shares held in treasury, as per the latest quarterly filing).

BioNTech’s Financial Guidance 2023 (BioNTech – Investor Presentation)

Looking ahead, estimates extend until fiscal year 2025, with projected revenue decreasing to 4.3 billion euros and net profits reaching 624 million euros. The main takeaway for me is that the company is expected to achieve profitability, which is among other things, an important quality indicator if you consider a company to be a promising investment.

As the release of Q2 numbers approaches, consensus estimates point to a slightly negative EPS of -0.70 euros per share and revenue of about 730 million euros. This trend could be attributed to the cyclical nature of biotech businesses, particularly the gradual decline in COVID-19 vaccine sales over the past few months. Despite downward revisions in quarterly estimates, it’s worth noting that BioNTech has consistently outperformed expectations in its last three earnings reports, providing a boost to the stock on the day of its earnings releases.

Currently trading near a one-year low, the stock presents an opportunity for investors, especially if the earnings report surpasses the conservative estimates. However, I believe the stock is a compelling buy even before the earnings release, considering the company’s strong business prospects, promising pipeline, and projected growth in the coming years.

In the following section, I will delve into the reasons why BioNTech remains an attractive investment opportunity, regardless of the upcoming earnings results.

Financials

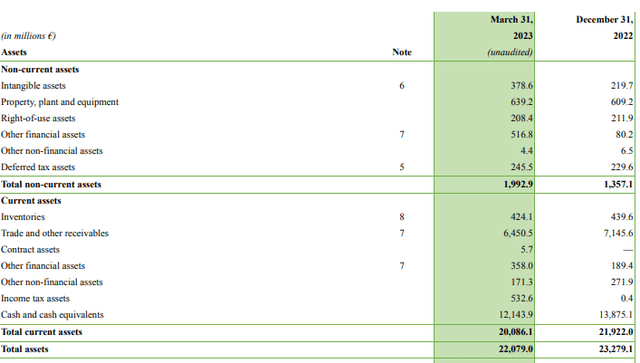

As of the three months ended March 31, 2023, BioNTech showcased a robust financial position. The company’s cash position was reported at 12,143.9 million euros, reflecting a very healthy liquidity situation. Furthermore, the total liabilities were relatively low, standing at 1,813.7 million euros, indicating favorable financial health and manageable debt levels.

BioNTech – Assets (BioNTech – 6-K filing)

With such a strong cash position and manageable liabilities, BioNTech appears to be in a prime position to unlock its growth potential. Considering the current share price and the company’s solid financial foundation, there is a compelling case to view BioNTech as an investment opportunity with significant upside potential. In the following section, we will delve into the valuation and explore why the current market price might undervalue the company’s true worth, making it a potential bargain for investors.

Valuation

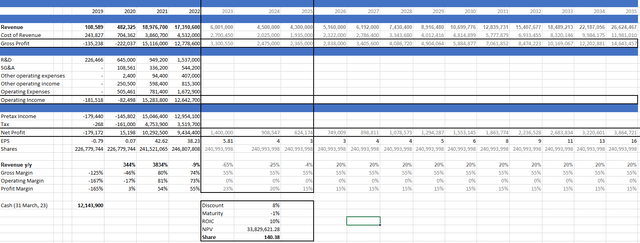

Taking a deeper look into BioNTech’s potential, we can analyze the company’s forward Price-Earnings (P/E) ratio, currently at approximately 18 based on consensus net profit estimates for the fiscal period 2023. While this already sounds promising, I’ve conducted a simple Excel model using the Net Present Value (NPV) approach to estimate a fair value for BioNTech’s shares based on future net profits. In the model, I considered various scenarios with reasonable estimates, though with a degree of uncertainty in the future.

NPV-Excel-Model-BNTX (Author)

From 2025 to 2035, I conservatively estimated a 20% annual increase in revenue, reflecting the company’s promising pipeline and potential to capitalize on opportunities. Additionally, I projected a gross margin of at least 50%, aligned with similar biotech companies like BioNTech. Net profits are expected to grow at a rate of 15% annually from 2025 to 2035. Beyond 2035, I assumed no further revenue or net profit growth and implied a slight decline in net profit at an annual rate of 1%, reflecting a maturity rate. With these conservative assumptions, the NPV calculation yields a fair value per share of approximately 140 euros, suggesting an upside potential of about 40% from the current share price. Notably, this calculation does not consider BioNTech’s substantial cash reserves, accounting for 50% of the current market cap. Taking this cash position into account, the fair value per share increases by another 50%. It is essential to recognize that this model is simplified, and some estimates are qualified guesses. However, I believe they are reasonable and conservative. The purpose of this model is to demonstrate a tendency and direction, indicating significant potential for BioNTech’s future growth, which might be very likely to exceed the conservative estimates I presented in the context of my model.

Outlook, and Risks

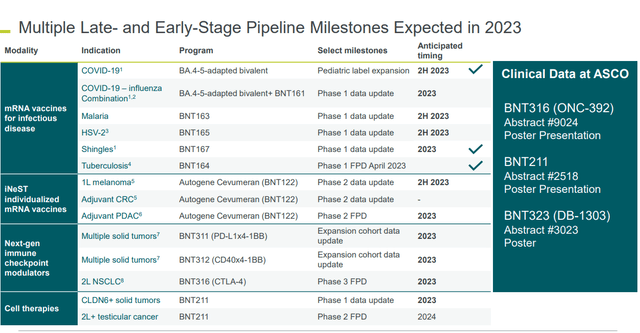

BioNTech’s strong focus on oncology is evident in their pipeline, which includes promising developments in targeted therapies and mRNA cancer vaccines.

BioNTech – Pipeline & Milestones expected in 2023 (BioNTech – Investor Presentation)

Collaborations with OncoC4 and DualityBio have yielded notable advancements, such as BNT316 (ONC-392), an anti-CTLA-4 monoclonal antibody for NSCLC treatments, and BNT323 (DB-1303), an FDA Fast Track-designated ADC for advanced endometrial carcinoma. Their mRNA technology is also applied in cancer immunotherapy, with BNT122, an mRNA cancer vaccine for pancreatic ductal adenocarcinoma, set to enter Phase 2 trials, and BNT211, a CAR-T cell therapy targeting CLDN6, showcasing cutting-edge treatments. In infectious diseases, BioNTech’s success with mRNA vaccines extends beyond COVID-19, with developments in TB and shingles vaccines, demonstrating their expansion into this area. The company’s pipeline balances addressing immediate needs like COVID-19 with long-term challenges in oncology and infectious diseases, positioning them to make substantial impacts in healthcare through strategic collaborations and personalized medicine exploration. While BioNTech’s innovative prowess is commendable, certain risks warrant consideration for investors. Uncertainty in clinical trials, dependence on COVID-19 vaccines for revenue, market competition, and legal challenges pose potential threats to the company’s future performance and stock valuation. As with any biotech company, the outcomes of clinical trials are uncertain, and regulatory setbacks or failures can impact financials. The future of COVID-19 vaccine revenues remains uncertain due to global vaccine rollout and potential vaccine modifications for new variants. Fierce competition in the industry and legal challenges regarding patents also add to the risk profile. In light of these factors, my “Buy” recommendation considers BioNTech’s strong potential.

Conclusion/Opinion

In conclusion, BioNTech SE stands as an exceptional company with a capable management team, as exemplified by its remarkable performance during the COVID-19 pandemic. The company’s focus on immunotherapy and cutting-edge technologies has positioned it as a front-runner in the industry, with a promising pipeline that extends beyond its COVID-19 vaccine.

Based on the valuation model and financial analysis, it becomes evident that BioNTech is undervalued, presenting significant upside potential. The company’s impressive cash position, amounting to approximately 50% of its current market cap, further adds to its allure as an investment opportunity.

Considering the upcoming earnings release, historical performance, and current market sentiment, it is reasonable to anticipate a potential surge in the share price, whether due to a positive earnings surprise or a market correction. Even if the earnings disappoint, it wouldn’t change my investment view on BioNTech, as its long-term prospects remain promising.

However, it is essential to bear in mind the inherent risks that accompany any investment, particularly in the biotech sector. The company’s future success heavily relies on the performance of its pipeline products, and any unforeseen significant setbacks or disappointing results in the long run could impact its prospects and alter my investment case.

Moreover, ongoing lawsuits represent potential risks that warrant close monitoring. Investors should stay vigilant and keep a close eye on the company’s operational updates, both in quarterly and annual publications. Careful observation will be key to gauging BioNTech’s continued success in the evolving biotech landscape.

Read the full article here