Here at the Lab, we have always been supported by Linde PLC (NYSE:LIN) development. In our initiation of coverage titled “Defensiveness At A Discount,” we highlighted MACRO and MICRO’s potential upside backed by Linde’s downside protection competitive on end-customer contracts. Indeed, the company’s clients have a decade-long contract with margin and volume guarantees (with a full pass-through on energy price development). In addition, as emphasized in Q4 and Q1 results, we were ahead of Wall Street estimates and continued increasing our target price (i.e., Another Beat, Another Raise).

Mare Past Analysis

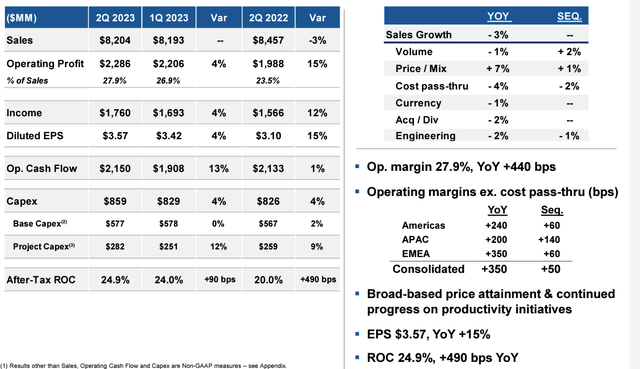

Q2 results

Linde reported a turnover of $8.20 billion in Q2. The top-line sales decreased by 3% on a yearly basis and by 4% versus Wall Street analyst expectations. Having analyzed Air Liquide Q2 financial figures, we are not surprised by a negative sales growth trajectory. As a reminder, Air Liquide sales were down by 7%. Therefore, Linde is gaining market share. (Today, we will also check Air Products and Chemicals Q2 results). Linde Q2’s core operating profit reached $2.28 billion and was up by 15% on a yearly comparison and again was a beat vs consensus. Even if sales decreased, organic turnover increased by 6%. This is because energy costs are going down, but prices were up by 7%, with volume only down by 1%. In detail, the energy cost pass-through recorded a negative performance of -4% and a minus 1% on currency effect. Looking at the GEO level, the Q2 core operating profit margin increased by 440 basis points to 27.9% (up by 350 basis points excluding energy). The Americas was up 5% in the regions with lower volume due to customer industrial slowdown; however, EBIT margin increased. The EMEA area, the negative outlier, was back to growth and reported a 350 basis point increase in EBIT margin, thanks to prices up by 11%. Volumes are still down by 4%, with weakness in clientele business onsite, particularly in the chemicals. At the same time, the APAC region volume increased by 5% and 7% yearly and quarterly, respectively. For this reason, Linde’s adj. EPS reached $3.57 (up 15%) and 3% ahead of consensus.

Linde Q2 Financials in a Snap

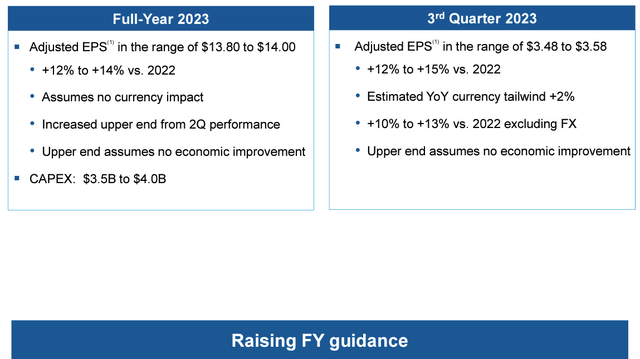

It is vital to report that Linde raised its Fiscal Year 2023 guidance. The company’s management increased the EPS outlook from $13.45 – $13.85 to $13.80 – $14.00, assuming no impact from currency. In addition, Linde’s upper-end guidance assumes no economic improvement. The guidance mid-point is now at $13.90 and represents a 13% growth on a yearly basis and is up by 1% compared to Wall Street estimates.

Linde Full Year 2023 Outlook

Mare Upside

- Following the quarterly results, we are now guiding a Q3 EPS at the Linde upper end at $3.58 and above Visible Alpha consensus;

- Linde net debt reached $14.1 billion and was $13.8 billion at Q1 end. This was due to ongoing buybacks of $1.7 billion and dividend payments of $1.2 billion. The company’s free cash flow was $1.3 billion with an operating profit of $2.2 billion and CAPEX of $0.9 billion;

- On the CAPEX outlook, we continue the guidance high-end of $4 billion for the fiscal year 2023;

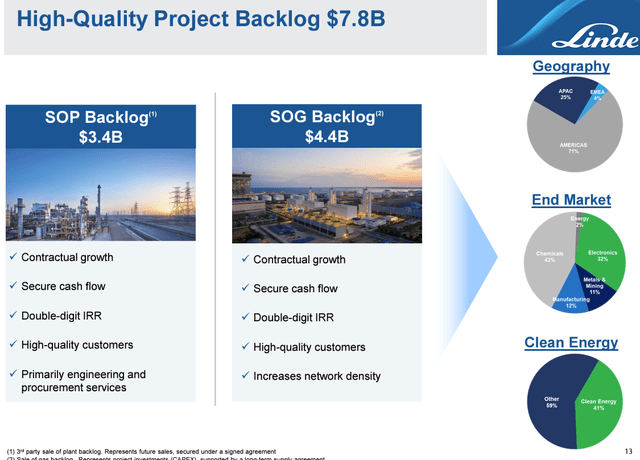

- Order backlog continues to be supportive (Fig 1);

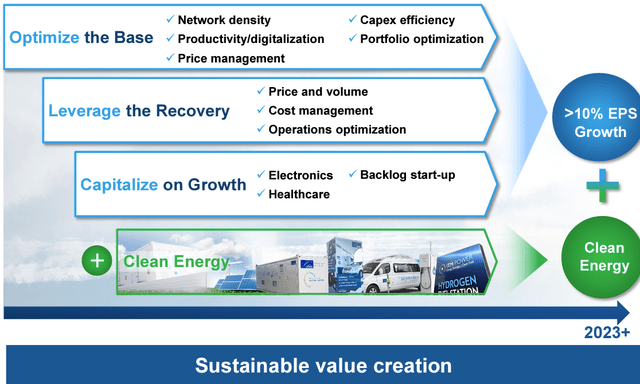

- Linde Is Set To Growth with sustainable value creation (Fig 2) and a double-digit EPS growth rate. This is backed by the ongoing energy revolution US IRA framework’s potential and the EU response.

Linde order backlog

Fig 1

Linde value creation

Fig 2

Conclusion and Valuation

Linde’s stock price reacted positively as the company continued to deliver double-digit EPS growth supported by solid cash generation. Last time, we increased our price target to $370 per share. Today, Linde is trading at $388 per share. Rolling forward our estimates, we arrived at a year-end net debt of $13.3 billion, and our twelve-month EBITDA reached $13.75 billion. Applying an unchanged EBITDA multiple of 15x (in line with our historical valuation), we increased our target price to $400 per share. Downside risks are included in our initiation of coverage.

Read the full article here