Apple has said that its users have deposited more than $10 billion in savings accounts it offers in partnership with Goldman Sachs Group. The iPhone maker is emphasizing financial services as a growth opportunity ahead of earnings which are likely to show a slowdown in smartphone sales.

Apple

(ticker: AAPL) said late Wednesday that users had poured money into the savings account –which is offered by

Goldman Sachs

(GS) and has a 4.15% annual percentage yield– since its launch in April. The account is available to holders of the co-branded Apple credit card.

The statement about the program’s success comes just months after The Wall Street Journal reported that Goldman Sachs was trying to end its partnership with Apple as it scales back its consumer business.

“We are very pleased with the success of the Savings account as we continue to deliver seamless, valuable products to Apple Card customers,” said Liz Martin, Goldman Sachs’s head of Enterprise Partnerships, in the companies’ joint statement.

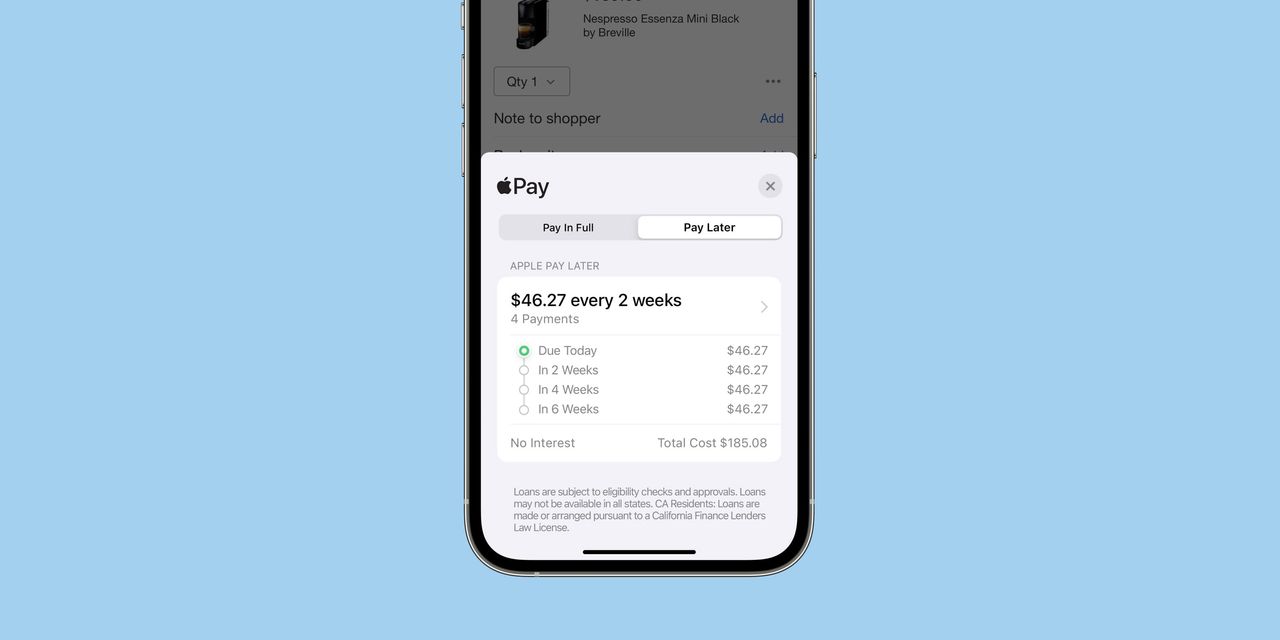

Apple has rolled out a suite of financial services including bill pay features, credit card issuance, and buy-now-pay-later services in recent years. They could provide a source of growth in its earnings report, when it is expected to report a drop in iPhone and other electronics sales.

Write to Adam Clark at [email protected]

Read the full article here