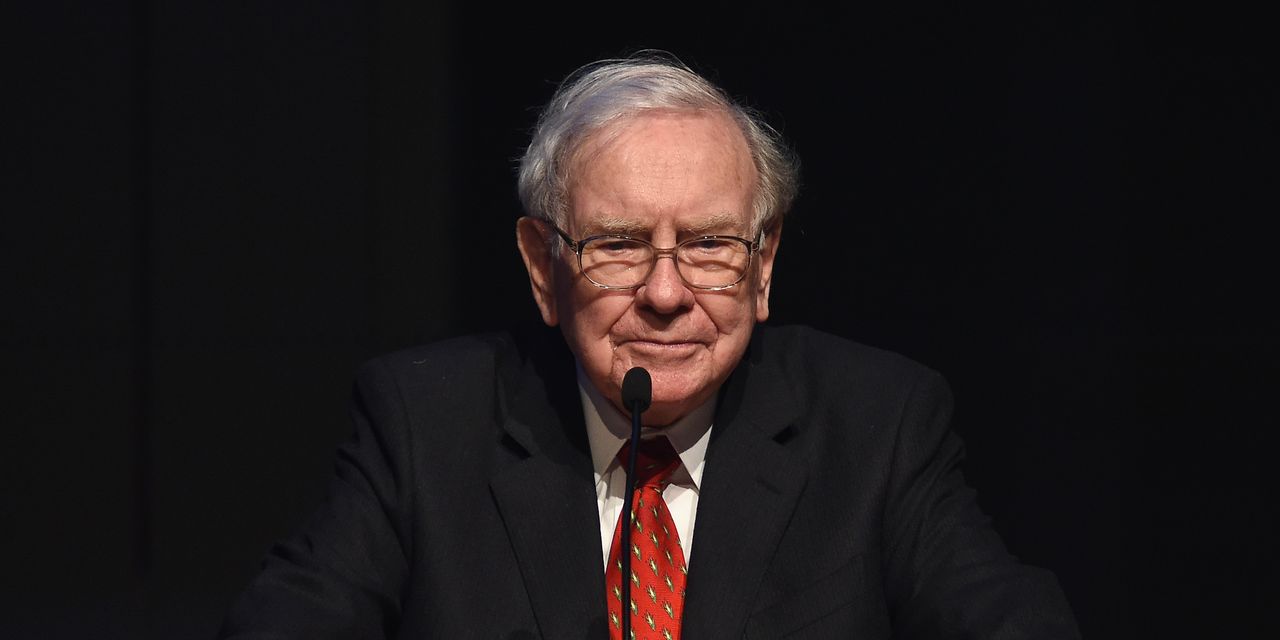

Warren Buffett is getting an early birthday present.

Berkshire Hathaway’s

class A stock finished at a record high Thursday, lifting the value of Chief Executive Officer Buffett’s 15% stake in the company to $118 billion.

Buffett, who has guided Berkshire Hathaway (Ticker BRK/A,BRK/B) since 1965, turns 93 on Aug. 30.

The class A stock rose 1.4% to $541,000 Thursday, above the closing peak of $539,180 set on March 28, 2022, Bloomberg data show.

Berkshire’s class B stock was up 0.8% to $353.81 but remains about 1.5% below its peak of $359.57 also set on March 28, 2022.

Why did the class A stock hit a record Thursday while the B shares didn’t? The class A stock now trades at a roughly 2% premium to the B shares while it traded at parity in March 2022.

Berkshire now has a market value of about $780 billion, eighth in stock market capitalization behind

Apple,

Microsoft,

Alphabet,

Amazon.com,

Nvidia,

Tesla

and

Meta Platforms.

Berkshire’s class A stock now is up about 15% so far this year and has risen more than 25,000-fold from a price of around $20 when Buffett took control of the company in 1965. The A shares have never been split while Buffett has run the company.

The stock now trades for about 1.5 times Barron’s estimate of its June 30 book value and for about 23 times projected 2023 earnings. The company reports second-quarter earnings on Saturday.

Berkshire CEO Buffett has written that his stock will be left to foundations and he started donations to them in 2006. He has designated five foundations as recipients, led by the Bill and Melinda Gates Foundation, which is the main recipient. The other four other foundations are associated with his three children.

In a press release that accompanied his annual gift to the five foundations in June which totaled about $4.5 billion, Buffett noted that he began giving away Berkshire stock to them in 2006.

“During the following 17 years, I have neither bought nor sold any A or B shares nor do I intend to do so. The five foundations have received Berkshire B shares that had a value when received of about $50 billion, substantially more than my entire net worth in 2006. I have no debts and my remaining A shares are worth about $112 billion, well over 99% of my net worth.

“Nothing extraordinary has occurred at Berkshire; a very long runway, simple and generally sound decisions, the American tailwind and compounding effects produced my current wealth. My will provides that more than 99% of my estate is destined for philanthropic usage.”

The stock that hasn’t been donated at the time of his death is expected to be distributed in the ensuing decade or so.

Write to Andrew Bary at [email protected]

Read the full article here