A Quick Take On LiveRamp

LiveRamp Holdings, Inc. (NYSE:RAMP) provides identity resolution software and related capabilities for online marketing activities.

I previously wrote about the company with a Hold outlook.

Given management’s slowing revenue growth outlook for fiscal 2024, continued operating losses and difficult customer environment, I remain Neutral [Hold] on LiveRamp Holdings, Inc. stock in the near term.

LiveRamp Overview And Market

San Francisco-based LiveRamp was founded to offer a suite of audience identification and data tools for online marketing purposes.

The firm is headed by Chief Executive Office Scott Howe, who was previously president and CEO of marketing services company Acxiom.

The company’s primary offerings include:

-

Identity resolution

-

Data activation

-

Measurement

-

Data collaboration

-

Marketplace.

The firm acquires customers via its direct sales teams as well as through partners and cloud provider channels.

According to a 2021 market research report by MarTech referencing a report by Winterberry Group, the global market for identity resolution services is forecast to reach $2.6 billion by the end 2022.

As marketers lose access to some forms of data such as via “cookies” from major mobile platforms from Apple and Google, data from alternative sources is becoming more valuable.

Different industries are more or less reliant on third-party cookies for their online marketing efforts, with the financial services and travel industries reporting the greatest reliance on cookies.

Major competitive vendors or other industry participants include:

-

Intent IQ

-

Saint-Gobain S.A Tapad

-

Amperity

-

Merkle

-

Zeta Global

-

Throtle

-

Xoriant Katch

-

Signal

-

Neustar

-

BounceX

-

NetOwl

-

Informatica

-

Infutor

-

Criteo.

LiveRamp’s Recent Financial Trends

-

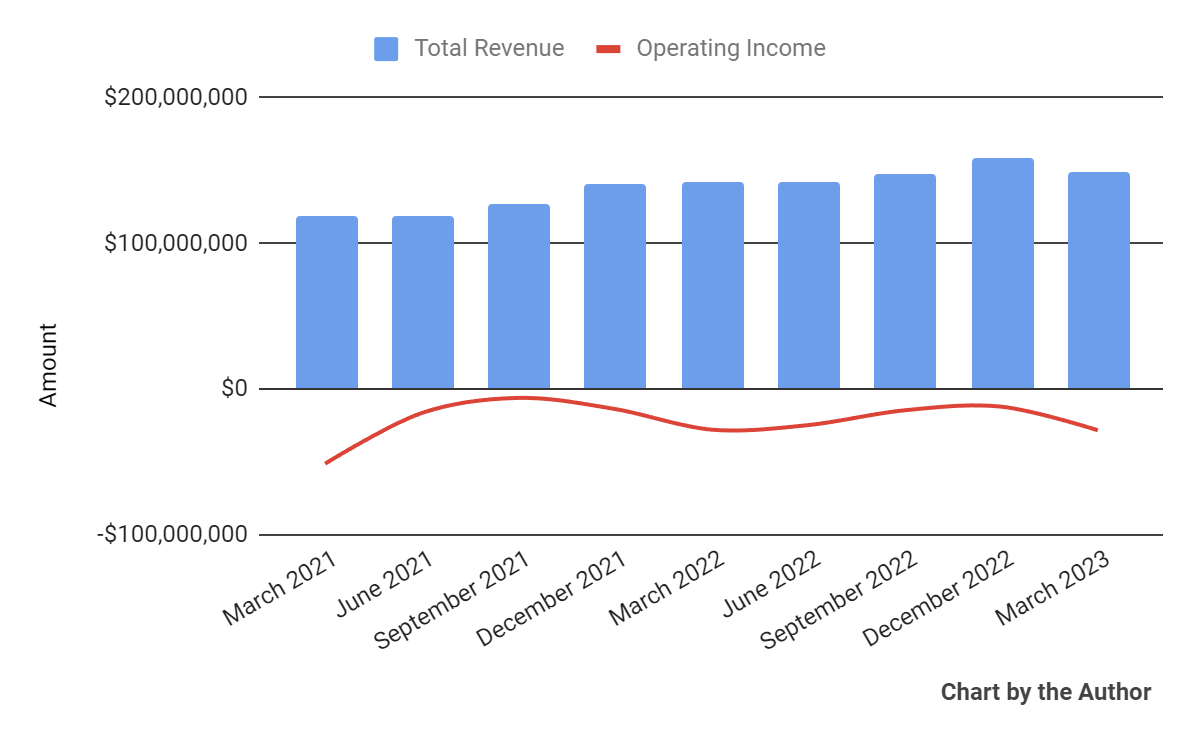

Total revenue by quarter has plateaued recently; Operating losses continue and have worsened in the most recent quarter.

Total Revenue and Operating Income (Seeking Alpha)

-

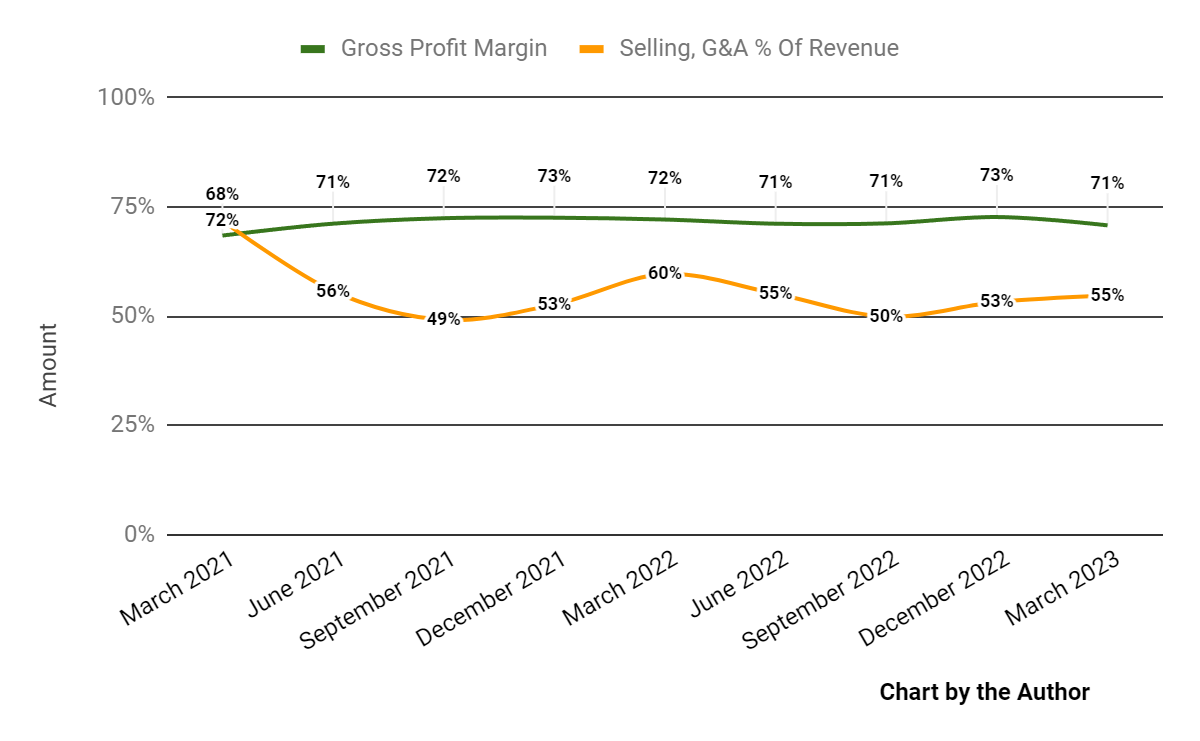

Gross profit margin by quarter has trended slightly lower; Selling, G&A expenses as a percentage of total revenue by quarter have also moved lower recently.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

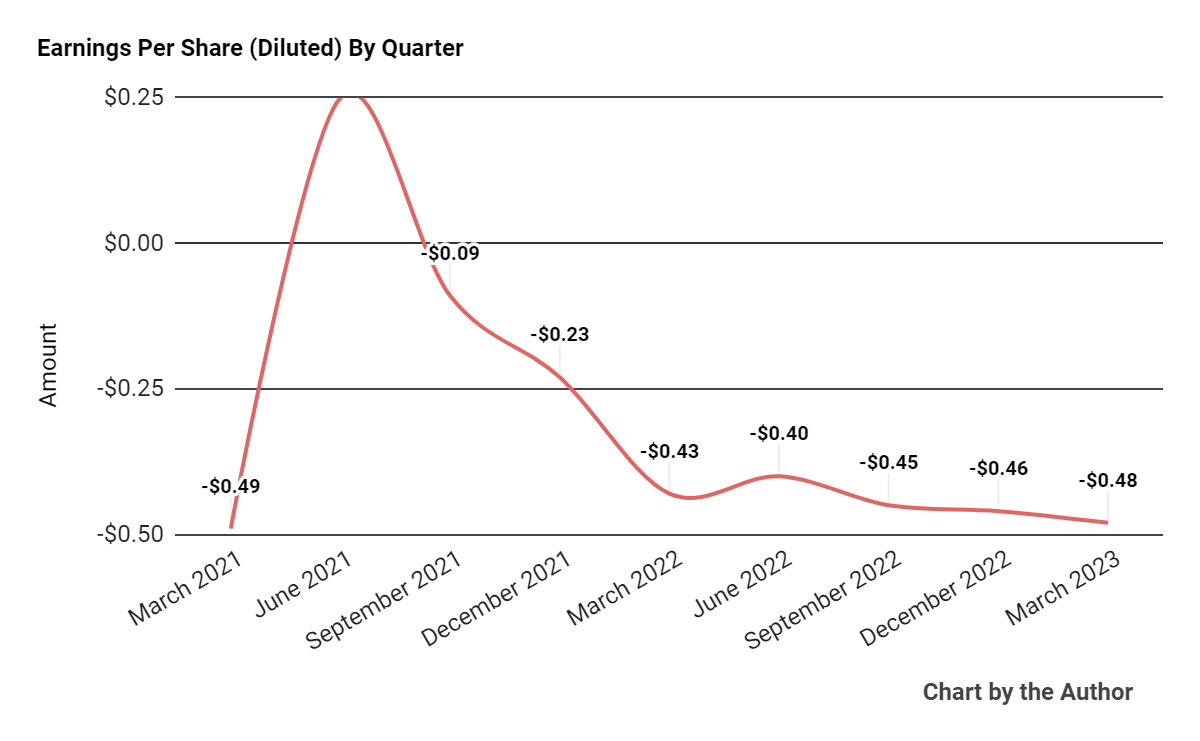

Earnings per share (Diluted) have deteriorated further in the past few years.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

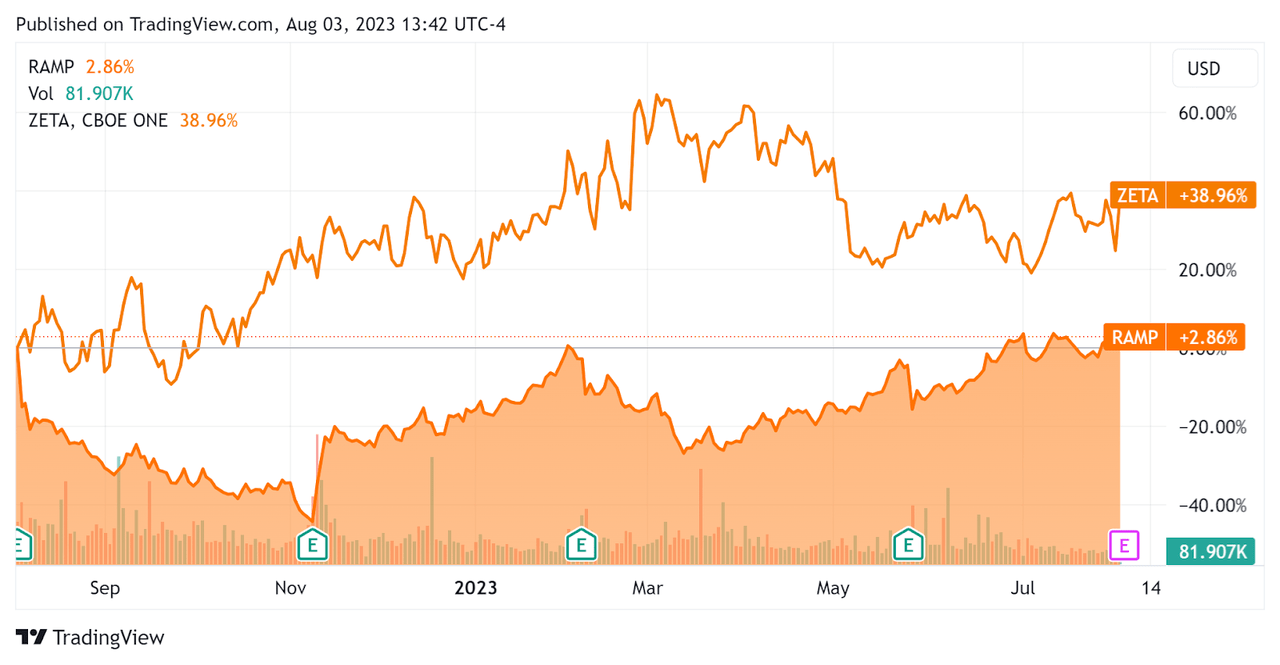

In the past 12 months, RAMP’s stock price has risen only 2.86% vs. that of Zeta Global Holdings Corp.’s (ZETA) rise of 38.96%, as the chart indicates below.

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $497.3 million in cash, equivalents and short-term investments and no debt.

Over the trailing twelve months, free cash flow was $35.1 million, during which capital expenditures were $4.7 million. The company paid a hefty $125.8 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters.

Valuation And Other Metrics For LiveRamp

Below is a table of relevant capitalization and valuation figures for the company.

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.4 |

|

Enterprise Value / EBITDA |

NM |

|

Price / Sales |

3.2 |

|

Revenue Growth Rate |

12.9% |

|

Net Income Margin |

-19.9% |

|

EBITDA % |

-10.2% |

|

Net Debt To Annual EBITDA |

8.2 |

|

Market Capitalization |

$1,910,000,000 |

|

Enterprise Value |

$1,460,000,000 |

|

Operating Cash Flow |

$34,440,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.79 |

(Source – Seeking Alpha.)

As a reference, a relevant partial public comparable would be Zeta Global; shown below is a comparison of their primary valuation metrics.

|

Metric [TTM] |

Zeta Global |

LiveRamp |

Variance |

|

Enterprise Value / Sales |

3.3 |

2.4 |

-25.4% |

|

Enterprise Value / EBITDA |

NM |

NM |

–% |

|

Revenue Growth Rate |

28.8% |

12.9% |

-55.4% |

|

Net Income Margin |

-42.5% |

-19.9% |

–% |

|

Operating Cash Flow |

$77,410,000 |

$34,440,000 |

-55.5% |

(Source – Seeking Alpha.)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

RAMP’s most recent unadjusted Rule of 40 calculation was only 2.7% as of FQ4 2023’s results, so the firm is in need of substantial improvement in this regard, per the table below.

|

Rule of 40 Performance (Unadjusted) |

FQ1 2023 |

FQ4 2023 |

|

Revenue Growth % |

19.0% |

12.9% |

|

EBITDA % |

-9.0% |

-10.2% |

|

Total |

10.0% |

2.7% |

(Source – Seeking Alpha.)

Commentary On LiveRamp

In its last earnings call (Source – Seeking Alpha), covering FQ4 2023’s results, management highlighted “more promising leading indicators we are seeing now,” which they believe will translate into better growth in the near future.

The firm finished the quarter with 920 customers, an increase of 10 from the previous quarter.

Leadership says it believes it can get to double-digit growth in revenue.

The company’s platform net retention rate was 99%, and management seeks to improve on that rather moderate performance by things such as implementing a new dashboard highlighting potential customers at risk of loss.

Total revenue for FQ4 2023 rose 4.9% year-over-year, while gross profit margin dropped 1.3%.

Selling, G&A expenses as a percentage of revenue fell 4.9% YoY, a positive signal indicating improving efficiency, but operating losses widened 1.4% to $28.4 million.

The company’s financial position is strong, with plenty of liquidity, no debt and positive free cash flow generation.

RAMP’s Rule of 40 performance has been disappointing and worsening in the most recent quarter.

Looking ahead, management guided full year fiscal 2024 revenue to $315 million, or 3.1% year-over-year growth.

If achieved, this would represent a sharp drop in revenue growth versus fiscal 2023’s growth rate of 12.85% over fiscal 2022, indicating a slowing growth trajectory.

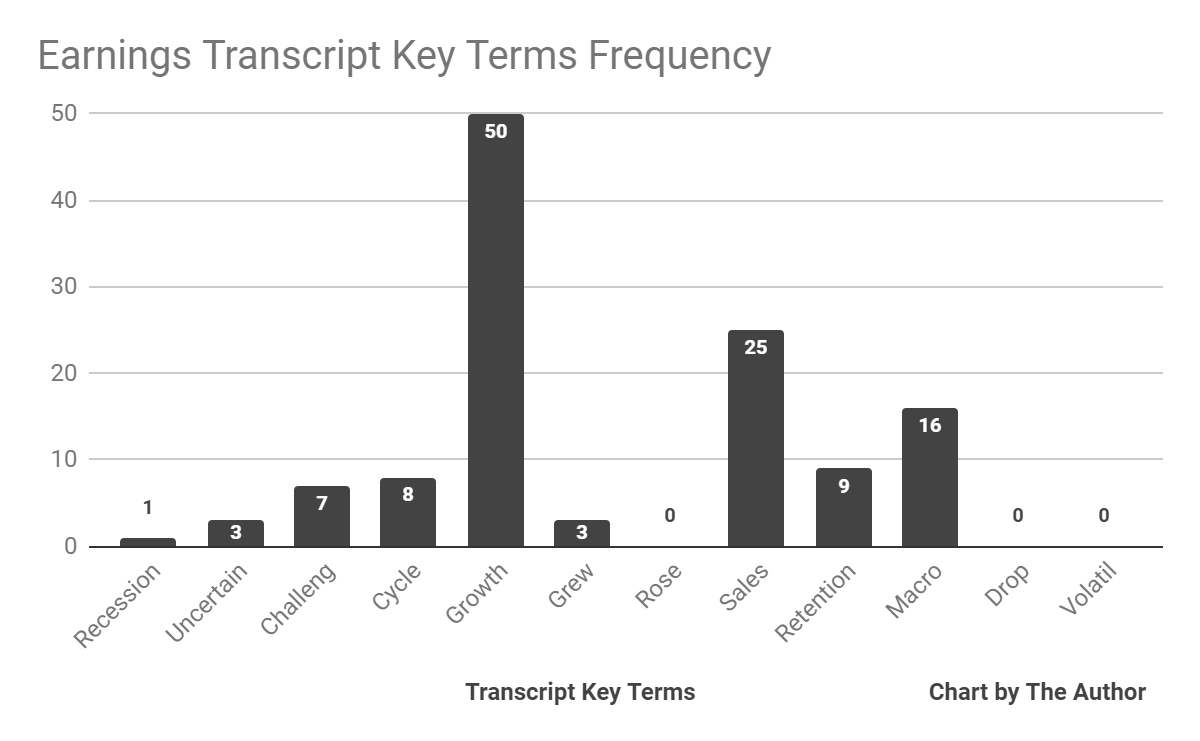

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below.

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited “Recession” once, “Uncertain” three times, “Challeng[es][ing]” seven times, and “Macro” 16 times.

The frequency of these negative terms suggests a business that is struggling with a variety of headwinds.

Analysts questioned company leadership about sales cycle lengths and management responded that it is seeing longer sales cycles but also more aggressive procurement practices at its customers who want lower pricing.

Regarding valuation, the market is valuing RAMP at an EV/Sales multiple of around 2.4x on TTM revenue growth rate of 12.9% against Zeta Global’s 3.3x EV/Sales multiple on 28.8% revenue growth rate.

Risks to the company’s outlook include an economic slowdown that may be underway, reduced credit availability which may affect customer/prospect spending plans and lengthening sales cycles which may reduce its revenue growth potential in the near term.

Given the firm’s slowing growth rate, continued operating losses and tougher operating environment, I remain Neutral [Hold] on LiveRamp Holdings, Inc. for the near term.

Read the full article here