After the markets closed on August 1st, 2023, Fitch Ratings surprised markets by downgrading the United State’s long-term sovereign credit rating down a notch from AAA to AA+.

Fitch’s downgrade reflects ‘the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.’

Although U.S. government officials immediately denounced Fitch’s downgrade, it does serve as a wake up call, since Fitch’s downgrade, combined with S&P’s downgrade of the United States in 2011, finally stripped the U.S. of its treasured AAA rating (In most settings, an ‘average’ of the 3 major credit rating agencies are used; prior to Fitch’s downgrade, the U.S. was still ‘rated’ AAA because Fitch and Moody’s continued to rate the U.S. AAA)

As the U.S. loses its AAA credit rating, should bond investors worry and rush to sell bond funds like the Vanguard Extended Duration Treasury ETF (NYSEARCA:EDV)?

Fund Overview

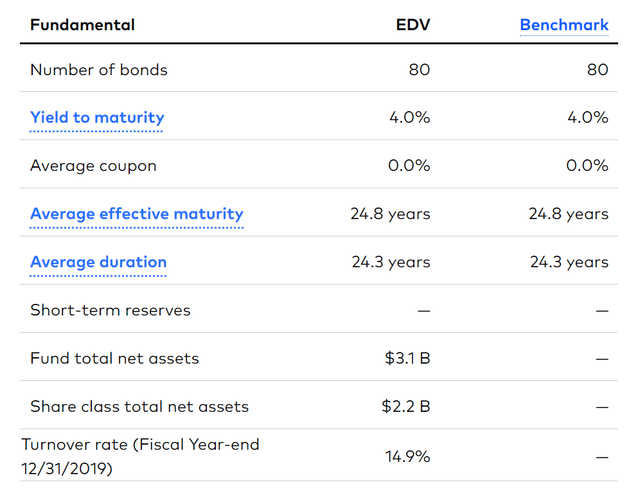

Quickly for those not familiar with the fund, the EDV ETF is a low-cost, high duration treasury bond ETF offered by Vanguard that has $3.1 billion in assets and a portfolio duration of 24.3 years (Figure 1).

Figure 1 – EDV fund overview (vanguard.com)

The EDV ETF is one of the longest-duration funds in the market and is commonly used by investors to speculate on the direction of interest rates.

Debt Ceiling Drama Finally Catching Up

To understand Fitch’s downgrade, let us go over Fitch’s concerns: fiscal deterioration in the coming years, a high and growing debt burden, and poor governance that leads to periodic debt ceiling standoffs.

First, on the erosion of governance issue, I wrote about this topic back in April when the U.S. government was pushed to the brink of a technical default over the debt ceiling fight between the Biden administration and Republican policymakers.

For those not familiar, the United States is the only country in the world where there is a political standoff every few years between the incumbent administration and politicians from the opposing party over the government’s debt limit. The political grand-standing usually ignores the potential damage to the U.S. government’s reputation, as well as potential negative ripple effects throughout the global financial system as an asset (U.S. government treasuries) long considered the global standard for ‘risk free asset’ is threatened with default.

Although crisis was ultimately averted this time when President Biden signed the ‘Fiscal Responsibility Act of 2023’ into law on June 3rd that suspends the debt ceiling until January 2025, it merely kicks the can down the road for the debt ceiling fight to resume in 2 year’s time.

Seeing the government pushed to the brink of default every few years, is it any wonder that Fitch would have concerns about the U.S. government’s governance?

Fiscal Spending Out Of Control

Another issue identified by Fitch is the U.S. government’s out of control spending. Fitch estimates the U.S. deficit to rise to 6.3% of GDP in 2023, 6.6% in 2024, and 6.9% in 2025, reflecting weaker revenues, new spending initiatives, and higher interest burden.

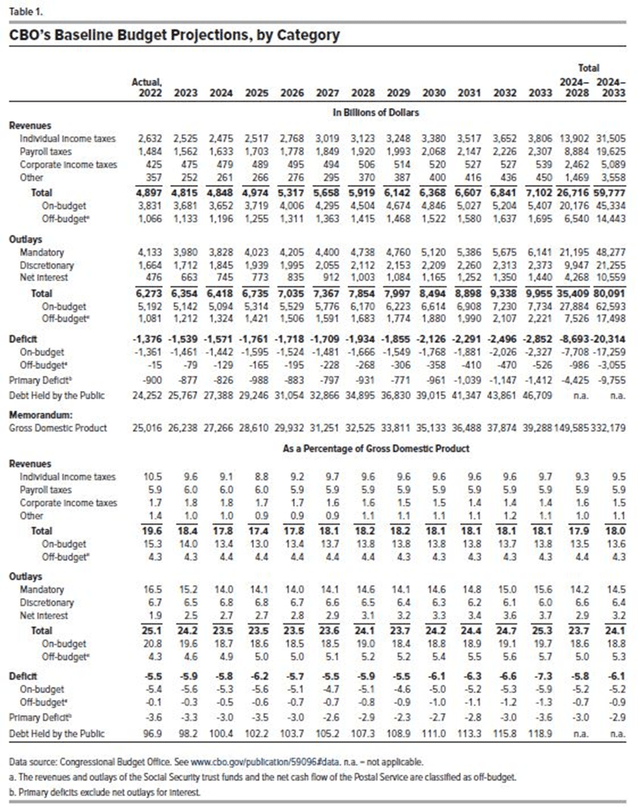

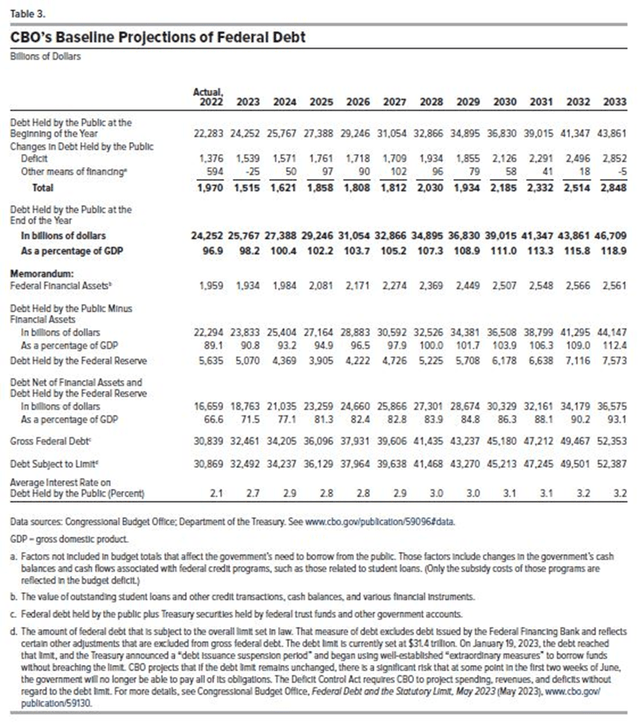

According to the Congressional Budget Office’s latest baseline projections (made before the passing of the Fiscal Responsibility Act of 2023), the U.S. government is expected to run large and expanding deficits for the foreseeable future, ranging from $1.5 trillion in 2023 to $2.1 trillion in 2030, or 5.9% of GDP in 2023 to 6.1% of GDP in 2030 (Figure 2).

Figure 2 – CBO baseline budget projection (CBO)

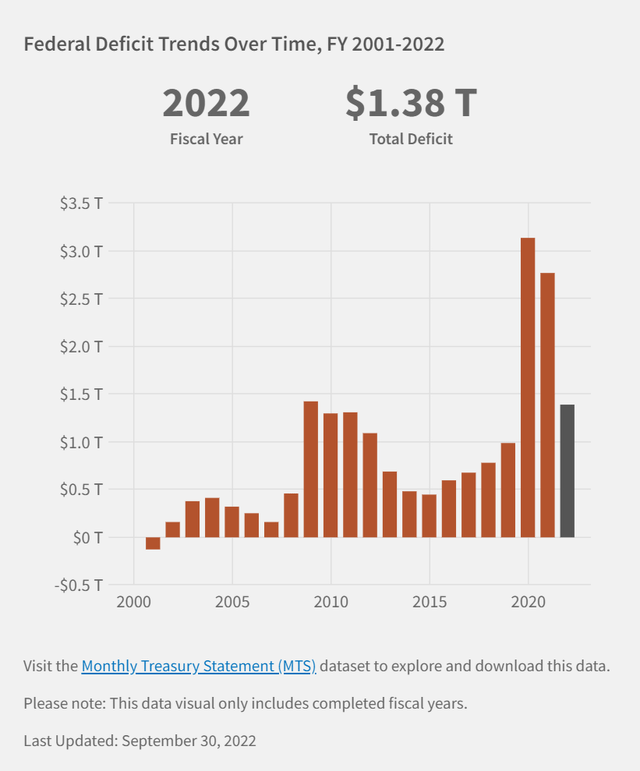

In fact, the U.S. government has not had a budget surplus since 2001 (Figure 3). While 2020 and 2021 were extraordinary years due to the COVID pandemic, the fact that all forecasted years (2023 to 2033) will continue to show a large and expanding deficit that is larger than the prior peak (2008) is extremely worrisome.

Figure 3 – U.S. government has been running deficits since 2001 (CBO)

Good governance should revolve around ‘saving for a rainy day’ by running fiscal surpluses or at least smaller deficits during economic expansions. This allows government spending to step in during crises (2008 Great Financial Crisis; 2020 COVID pandemic), to stabilize and stimulate the economy. Clearly, large and expanding deficits is not the blue print for good governance in my view.

Federal Debt On An Unsustainable Path

Out of control spending is placing the U.S. government’s debt on an unsustainable path, from $32 trillion as of 2023 (98% of GDP) to $47 trillion by 2033 (119% of GDP) (Figure 4).

Figure 4 – CBO federal debt projection (CBO)

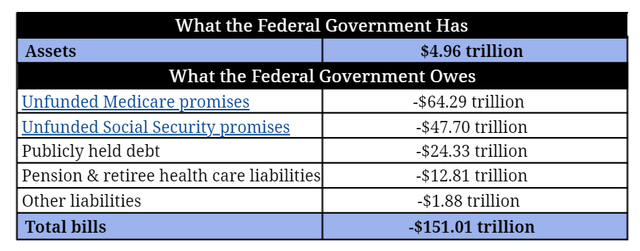

Furthermore, the published debt figures do not account for unfunded Medicare and social security benefits that some estimate run into the tens of trillions of dollars (Figure 5).

Figure 5 – Unfunded benefits could add tens of trillions to debt burden (truthinaccounting.org)

So overall, I agree with Fitch’s conclusion that the U.S. government has a governance issue and a fiscal spending problem that is worsening the U.S. government’s debt burden.

This is negative for treasury bonds in the long-run.

Time To Sell Treasury Bonds?

With all the issues highlighted above, should investors rush to sell their treasury holdings like the EDV ETF?

The short answer is not necessarily. The issues highlighted above are long-term in nature and are not really actionable on a day-to-day basis. Despite fearmongering on social media, the U.S. government is not going bankrupt anytime soon.

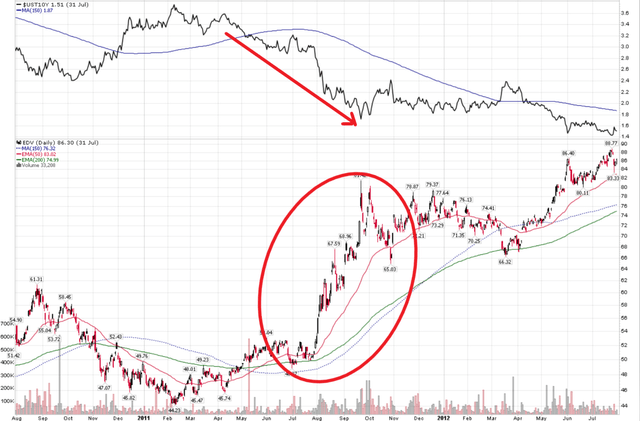

In fact, if we look at the 2011 S&P downgrade episode, treasury bonds actually staged a large rally, as the debt ceiling fight and subsequent U.S. downgrade sparked a large ‘risk off’ episode in markets, causing investors to rush to the safety of treasury bonds (Figure 6).

Figure 6 – 2011 downgrade sparked a large bond rally (Author created with price chart from stockcharts.com)

U.S. Economy Is The More Pertinent Question

The more pertinent question for investors looking at the EDV ETF right now is the path of long-term interest rates, and that may be driven more by the resilient U.S. economy than investors’ views on the U.S. fiscal situation.

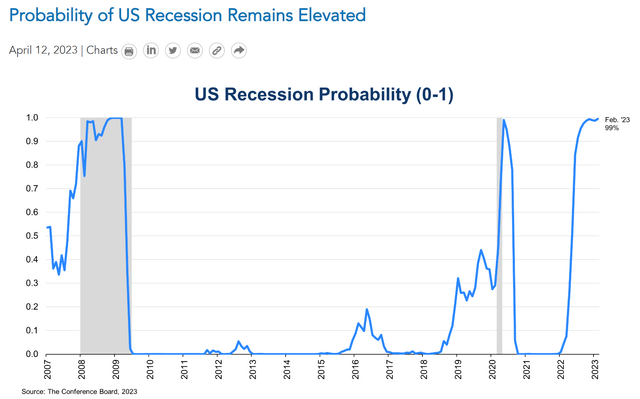

For the past few months, economists and investors (myself included), have been forecasting a pending recession in the U.S. economy driven by the Fed’s rapid interest rate increases and tightening lending conditions (Figure 7).

Figure 7 – Economists were predicting a recession (Conference Board)

Forecasted weakness in the economy have kept a lid on long-term interest rates, as investors bet that the Federal Reserve will have to cut interest rates in the near future in order to stimulate the economy out of a recession.

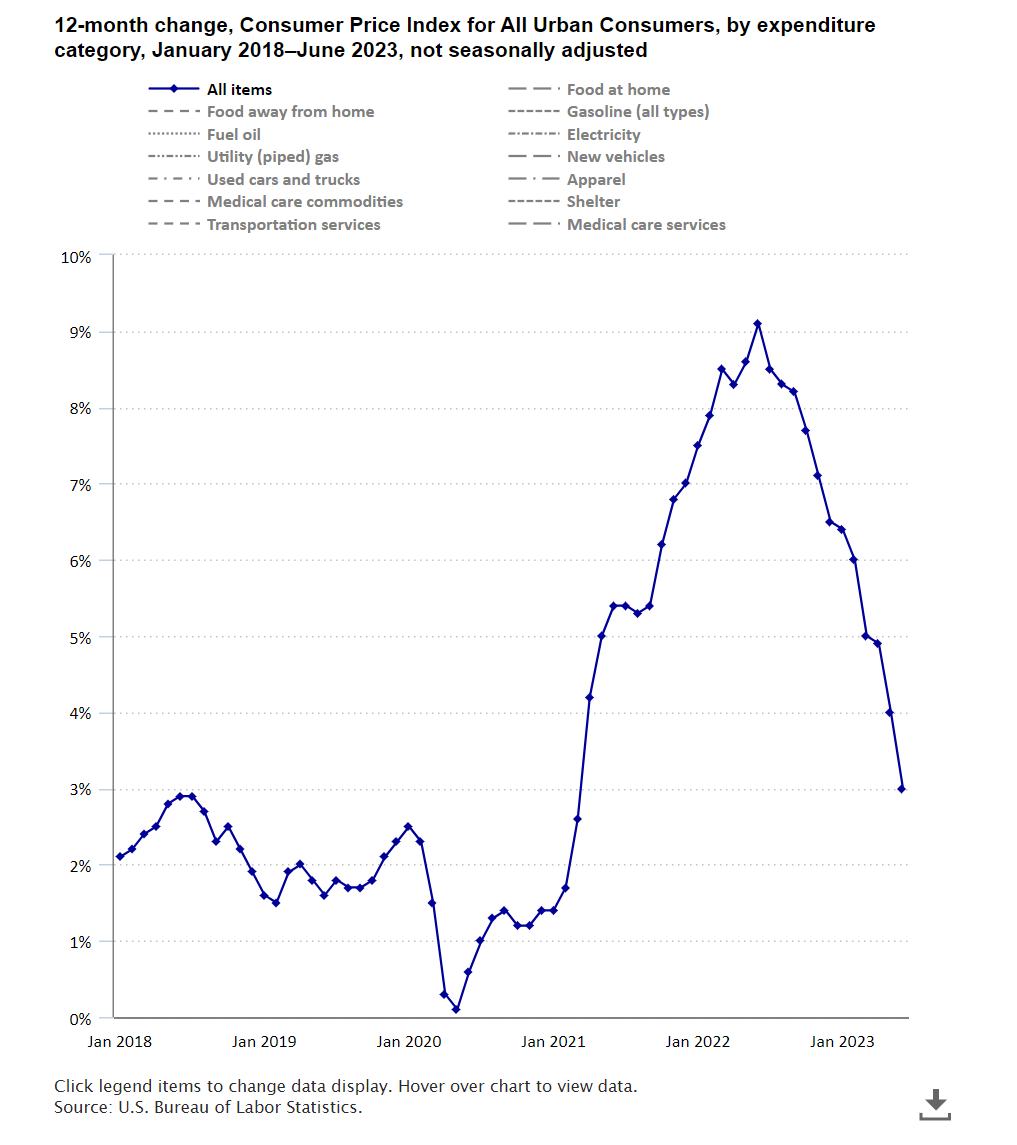

However, in recent weeks, the recession narrative has been cast to the side as inflation continues to moderate, with headline CPI inflation declining to a 3.0% YoY rate in June (Figure 8).

Figure 8 – CPI inflation declined to 3.0% YoY (BLS)

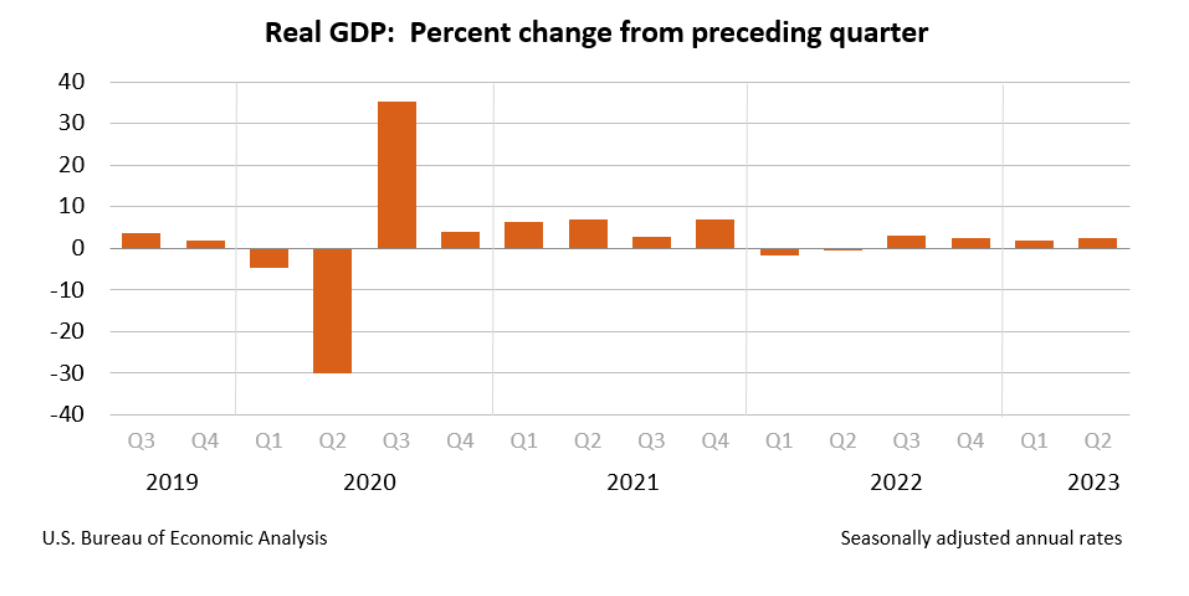

At the same time, the U.S. economy continues to grow robustly, with Q2/2023 real GDP growth of 2.4% YoY, ahead of economists who had been expecting only a 1.8% YoY increase (Figure 9).

Figure 9 – US GDP grew at 2.4% YoY pace in Q2 (BEA)

Against all odds, the Federal Reserve appears to have engineered a ‘soft landing’, where inflation moderates while economic growth continues to be strong.

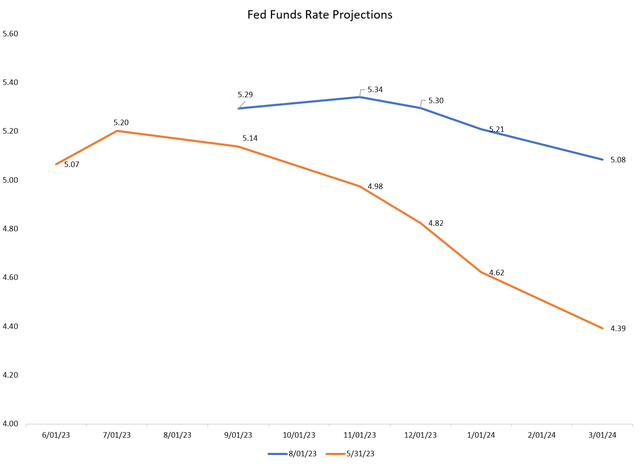

This is unfortunate for treasury bond holders, as strong economic fundamentals mean that the Fed may be able to hold their monetary policy rates ‘higher for longer‘. In fact, compared to the end of May, when investors were expecting the Fed to begin cutting interest rates by the September / November FOMC meeting, expectations for the first rate cut has now been pushed out to January 2024 (Figure 10).

Figure 10 – Rate cut expectation now pushed to 2024 (Author created with data from CME)

Furthermore, whereas investors had previously priced in 75 bps of interest rate cuts by March 2024, they are now only pricing in one rate cut by March 2024.

Long-Term Yields Breaking Out

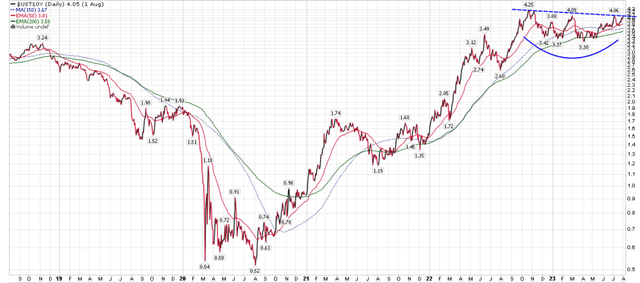

The implication of ‘higher for longer’ Fed policy is that long-term treasury yields, modeled as the 10Yr treasury yield in Figure 11, are rallying back to the highs reached in late 2022 (Figure 11).

Figure 11 – 10Yr treasury yields rallying back to 2022 highs (Author created with price chart from stockcharts.com)

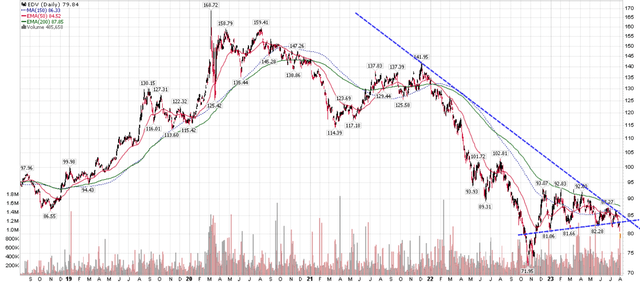

This is causing long-term treasury bond funds like the EDV ETF to break down, with a risk of re-testing 2022 lows and possibly beyond (Figure 12).

Figure 12 – EDV is breaking down due to rising long-term yields (Author created with price chart from stockcharts.com)

Long-Term Yields Still Low By Historical Standards

Taking a step back and looking at the history of bond yields, the current yield on the 10Yr treasury bond of ~4% is still very low by historical standards (Figure 13).

Figure 13 – 4% 10Yr yield is still low by historical standards (stockcharts.com)

Stick With Low Duration Treasury Bonds / Bills

Therefore, I believe as long as the U.S. economy continues to grow and the Fed maintains its tight monetary policy, long-term treasury yields will continue to have a widening bias, which will be a headwind for the EDV ETF.

In my opinion, investors are better served by holding shorter duration treasury instruments like treasury bills. For example, the U.S. Treasury 3 Month Bill ETF (TBIL) is currently yielding 5.2% compared to only 4.0% on the EDV ETF, and TBIL does not have long-duration risk like the EDV ETF. I last wrote about the TBIL ETF here.

Conclusion

While Fitch’s downgrade of the United State’s sovereign credit rating to AA+ is concerning for long-term investors, I do not believe the rating action has any near-term investment implications. Instead, investors currently holding long duration bond funds like the EDV ETF should consider the strength of the U.S. economy and the Fed’s tight monetary policy.

A resilient economy is allowing the Fed to keep interest rates ‘higher for longer’, which is pulling long-term treasury yields higher. As long as the economy continues to grow, there is a widening bias to long-term bond yields, which will act as a headwind for the EDV ETF. I continue to prefer shorter-duration treasury bills / bonds in this environment.

The time to buy long-term bond funds like the EDV ETF is when the Fed finally cuts interest rates, whether it is because they have tamed the inflation monster or because an economic recession is forcing their hand. We are not there yet.

Read the full article here