Article Thesis

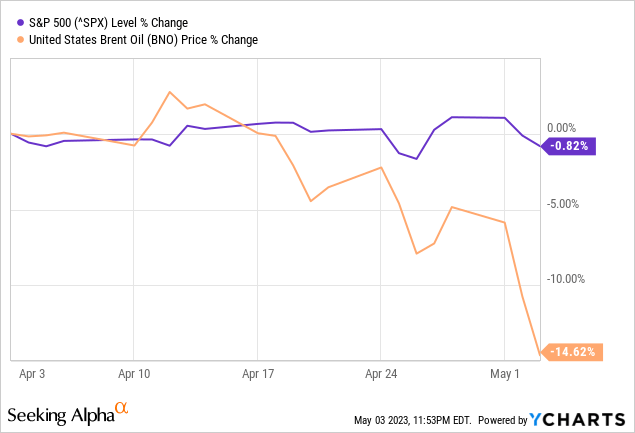

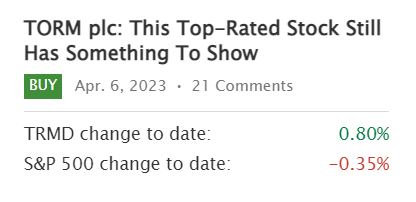

I wrote about TORM plc (NASDAQ:TRMD) early last month. Since then, TRMD stock has risen, rapidly at first, only to cool off again at some point – most likely against the backdrop of a general market correction and falling crude oil prices.

So far, however, my bullish recommendation has paid off compared to S&P 500 Index (SPX):

Seeking Alpha, my coverage of TORM

I expect TORM stock to continue to grow in the next few years, thanks to favorable market conditions and the still underestimated outlook of Wall Street analysts, who are still quite pessimistic about the company’s sales and EPS prospects.

At the same time, I believe that International Seaways, Inc. (NYSE:INSW) appears cheaper based on some industry-specific valuation metrics. Ceteris paribus, INSW stock may have a relatively higher total return in comparable years.

But first, what “favorable market conditions” am I talking about?

Tanker Market Outlook – Higher For Longer

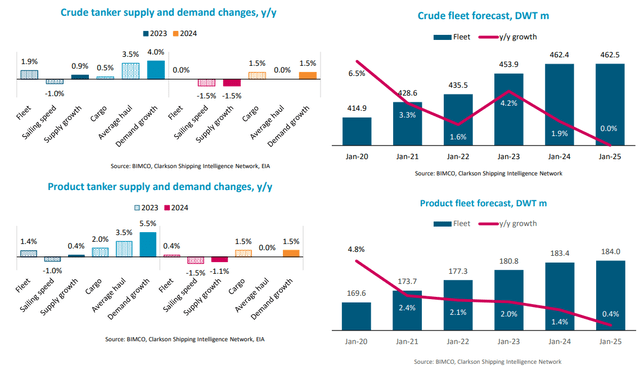

Like any other structural component in a market economy, the tanker market depends entirely on the states of supply and demand. All economic faculty freshmen know – the D [demand] curve must cross the S [supply] curve and form an equilibrium at a certain point, which should change due to some price and non-price factors. I suggest using a recent study by BIMCO – the world’s largest direct membership organization of shipowners, charterers, shipbrokers, and agents – to try to estimate the “D” and “S” of the tanker market:

BIMCO: Tanker Shipping Market Overview & Outlook – Q1 2023

So BIMCO’s forecast for FY2023 and FY2024 suggests that demand will outpace supply in both years. Specifically, crude tanker demand is predicted to increase by 4.5-6.5% in FY2024, with a 0.6% decrease in supply, while product tanker demand is expected to grow by 6-8%, with a 0.7% fall in supply. This brings us back to the equilibrium equation mentioned above: the demand curve should move to the right while the supply curve moves to the left. Moreover, if the “D” continues to move systematically to the right at least until the end of 2024, then the “S” will be pointing to the left all the time because old ships are out of service (even if only temporarily) and new ships are simply not being built (low order backlog). That’s why the anticipated increase in demand and decrease in supply are expected to drive gains in freight rates, time charter rates, and second-ship values in both 2023 and 2024.

The growth in demand is attributed to renewed growth in China and increased demand for jet fuel following the reopening of travel to and from China. Additionally, the expected increase in average sailing distances of 3-4% following the EU’s ban on Russian oil and oil products is expected to contribute to the rise in tonne miles demand.

The fleet growth is limited due to small order books, and a predicted reduction in sailing speeds of 2-3% due to decarbonization regulations will ultimately lead to a decrease in overall supply.

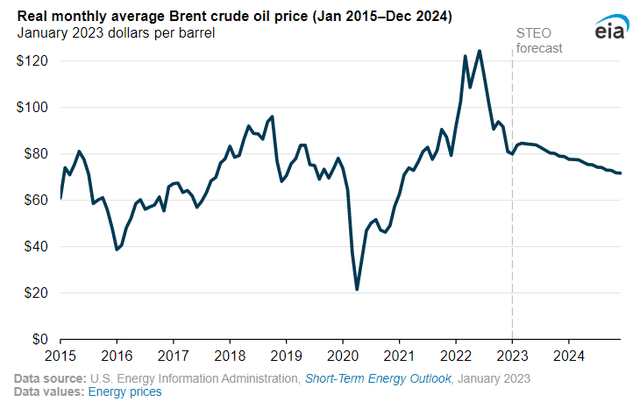

Despite the positive outlook, there are some downside risks to the positive outlook BIMCO says we should pay attention to. The IMF predicts global GDP growth of 2.9% in 2023 and 3.1% in 2024 but highlights that risks remain weighted on the downside. Furthermore, the EIA predicts that oil prices will fall throughout 2023 and 2024, with Brent falling below USD 80/barrel in FY2024.

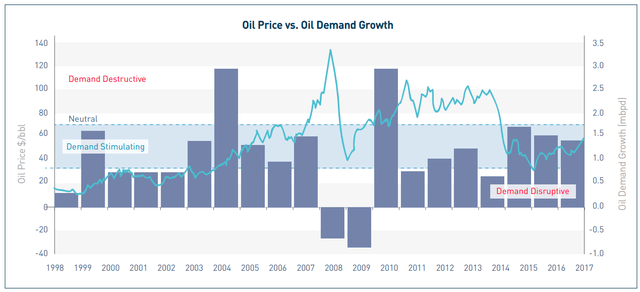

EIA

But I believe that the recent drop in oil prices is not necessarily a risk factor for tanker companies. While there is typically a positive correlation between lower oil prices and increased demand, the relationship is not strictly linear. In 2018 Euronav (EURN) published a great IR material explaining the tanker market basics. They believe that there is a price band between USD 35 and USD 70 where the oil demand will be stimulated. Within a range of approximately USD 70 to USD 80, the price becomes neutral, and above this level, it becomes demand-destructive. However, it is important to note that a very low oil price, as seen in the first quarter of 2016, can also be disruptive, particularly for oil-producing and exporting nations.

Euronav’s IR material

That’s why freight rates have only gone up, even though the Brent crude oil price has fallen ~35% since early May [to date]:

Fearnleys Weekly Report [Week 18 – May 04, 2023]![Fearnleys Weekly Report [Week 18 - May 04, 2023]](https://ifintechworld.com/wp-content/uploads/2023/05/49513514-16831732735464382.png)

A potential recession will, of course, put pressure on demand for tankers – but that is true for absolutely any industry. The conclusion from such a ruling would be to keep all the money in the till – and that is clearly not an option. In my opinion, despite the risks of an approaching recession, demand is still quite stable – emerging markets (especially China and India) and also Russia will need a lot of tankers in 2023 and a few years beyond. And amid the difficulties on the supply side [the lack of new vessels], the demand side should drive up freight rates and the valuation of tanker companies’ assets, which are currently quite pessimistically valued.

Speaking of Mr. Market’s pessimism about tanker stocks valuations, let us first refresh our memory on TORM.

TORM Stock – Still Great, But With A Sword Of Damocles Hanging Over Its Head

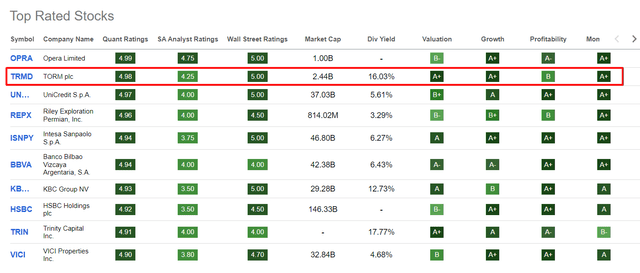

TORM stock remains among the 3 strongest stocks in the entire universe of U.S.-listed companies, according to Seeking Alpha’s Quant System:

Seeking Alpha’s Top Rated Stocks, author’s notes

And that’s not surprising: over the past year, TORM has grown 175%, and 6.4% year-to-date, which is also very good. The company will report for calendar quarter Q1 2023 on May 11, according to Seeking Alpha – so not much has changed since I wrote about TORM in early April. Let me briefly review the information from my old article.

The company makes money by transporting refined oil products and sometimes crude oil for customers, including major oil companies and international trading houses. Its fleet includes LR1, LR2, MR, and Handy tankers, being a pure-play product tanker market player.

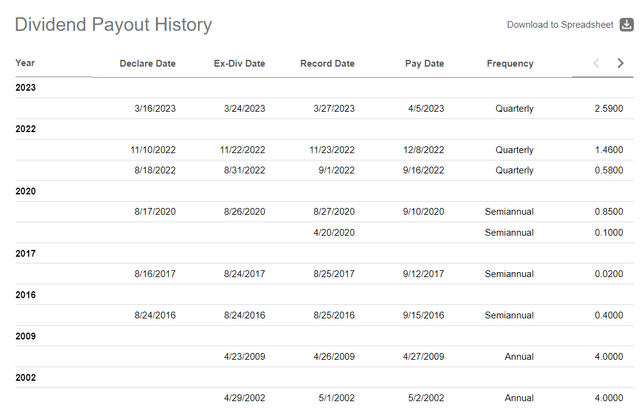

TORM reported record-high TCE rates in Q3 and Q4 2022, leading to its highest EBITDA and fleet value increase. In Q1 2023, TORM fixed 90% of tanker days at an average rate of $43,002 per day, so the company is likely to report another strong quarter with high TCE rates on May 11th. Management expected to distribute a total dividend of $378 million for FY2022 so it did after paying $2.59 per share on April 5th, based on Q4 cash balances:

Seeking Alpha, TRMD, Dividend History

Given that the company has attracted a lot of attention in recent months – it has long been in the top 3 of SA’s key rating – this has become a double-edged sword. On the one hand, the stock became much more confident and, from my observations, did not fall as much as its peers; but this created a comparative overvaluation because the qualitative difference between TRMD, while obvious, was not that outstanding to justify the discrepancy.

Oaktree Capital Management, which owns 66% of TORM’s stock, disclosed its plans to reduce its holding of TORM shares through a secondary public offering on March 29th, according to TradeWinds. The announcement caused investor concern, resulting in a 13% decline in stock price the following day as Citigroup, Evercore, and Jefferies attempted to build the deal book. However, the stock was eventually saved by the news that Oaktree Capital Management had backed out of the sale due to current market conditions not being favorable. It’s kind of a sword of Damocles hanging over TORM stock – as long as Oaktree thinks the company is undervalued, I assume the PE firm will not sell its stake. However, once TORM enters the fair value zone, OCM may start selling, putting undue pressure on the company’s retail shareholders.

That is why I would beware of too much exposure scaling on the dips. TRMD does look like an interesting company with relatively the best leverage profile and strong fundamentals among pure-play peers. But due to its idiosyncratic features and being slightly overcrowded, TORM stock is now a Hold, not a Buy.

International Seaways Stock Looks Cheaper And May Deliver More

I have never covered INSW stock before, so I’ll go into a little more detail here.

Based on the company’s 10-K, International Seaways, Inc. owns and operates a fleet of oceangoing vessels engaged primarily in the transportation of crude oil and petroleum products. They have 2 segments: Crude Tankers and Product Carriers, and their fleet consists of 74 vessels, including VLCC, Suezmax, and Aframax crude tankers, as well as LR2, LR1, and MR product carriers. The company is also set to receive 3 dual-fuel LNG VLCC newbuilds in 1H 2023, bringing the total fleet to 77 vessels.

Based on the description, INSW is quite different from TORM – at least it is not a pure-play peer. Since it was not my task to find the most suitable peer to replace TRMD – the main condition for me was not to go beyond the tanker market – I accept this discrepancy in the business structure of the companies.

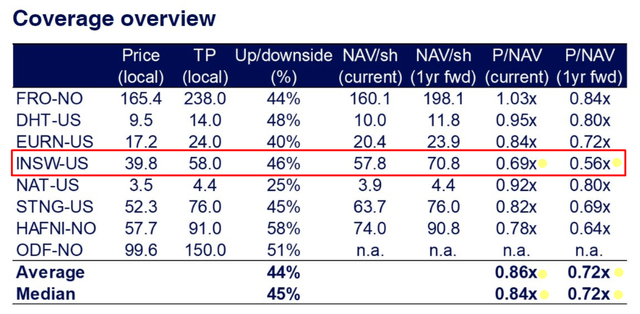

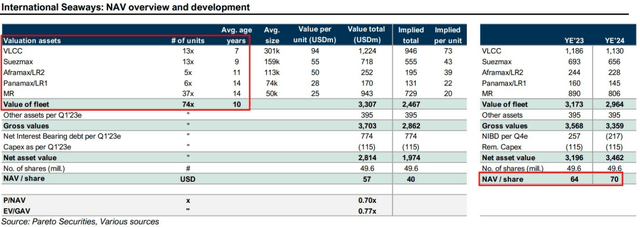

I deliberately turned to INSW stock – just look at what a large discount to its net asset value [NAV] the company is trading at:

A sector report on tankers by Arctic Securities, published on Twitter by @ed_fin

With a current average age of the fleet of ~10 years, which is a lot but not critical, INSW should increase its NAV per share to $70 by the end of FY2024 while lowering its average fleet age with new vessels, according to analysts at Pareto Securities:

Pareto Securities, published on Twitter by @ed_fin

Note: INSW’s share price at the time of this writing is $37.04!

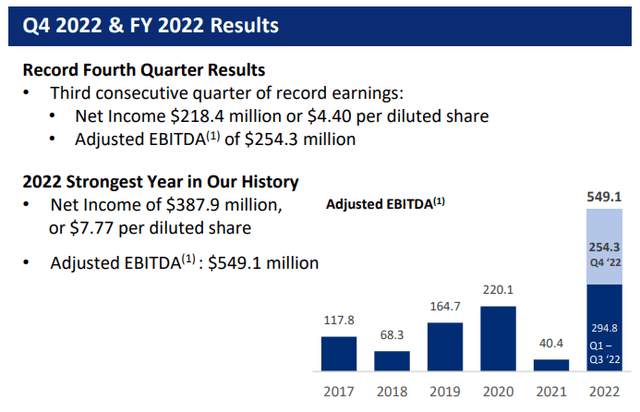

As the vast majority of companies in the sector discussed here, INSW has delivered an exceptional FY2022 with adjusted EBITDA hitting all past 5 years combined:

INSW’s Q4 FY2022 IR presentation

In 2022, International Seaways achieved shipping revenues and TCE revenues of $864.7 million and $853.7 million, respectively. Income from vessel operations increased to $442.7 million from a loss of $112.1 million in 2021, driven by higher average daily rates across all fleet sectors and the absence of one-time merger and integration costs incurred in 2021.

INSW’s goals for 2022 were to maximize fleet earnings, allocate capital responsibly, and execute transactions to unlock shareholder value. They paid $69.8 million in dividends and repurchased 687,740 shares of common stock at an average price of $29.08 per share. They continued to construct three dual-fuel LNG VLCCs, completed scrubber installation on one vessel and sold underperforming vessels for $68 million. They also executed several liquidity enhancing and financing diversification initiatives, including selling their 50% equity interest in the FSO Joint Venture for $140 million and refinancing three MRs through sale and leaseback arrangements.

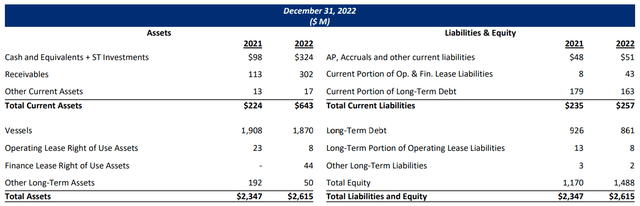

The company generated so much cash last year that its current assets on the balance sheet increased 187% YoY, while long-term debt and the current portion of it decreased ~7% and ~9%, respectively [also YoY].

INSW’s Q4 FY2022 IR presentation

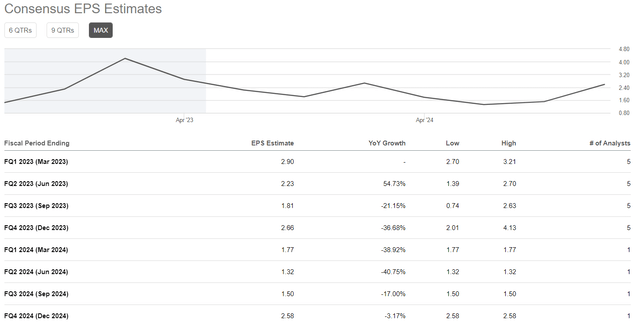

As the company gets rid of a significant portion of its debt – the interest expenses are going to be lower going forward – analysts foresee a relatively bleak future for the company’s EPS growth:

Seeking Alpha, INSW’s Earnings Estimates

For reasons unknown to me, Wall Street analysts see the FY2024 revenue consensus down -6.03% year-over-year – even though next year’s backlog will be smaller and demand is expected to grow more than in FY2023, as far as we remember from the first parts of this article.

The company is already reporting on May 5 [pre-market] – we will most likely see confirmation of solid TCE rates and great EBITDA numbers. Sell-side analysts will likely update their models and raise their old price forecasts – that should give INSW stock a tailwind, in my opinion.

Risks In Tanker Stocks

The tanker industry, particularly in oil and gas, is known for its volatility and cyclical nature, despite offering some of the highest dividends during good times. TORM’s and INSW’s financials demonstrate the benefits of peak profitability and growth for portfolios, but any trend reversal, such as a recession or decrease in demand, can spell trouble.

The conflict in Ukraine and other geopolitical events can greatly affect energy production, trade patterns, and shipping in the Black Sea and other areas. While the current impact on tanker rates has been positive, the long-term effects remain uncertain, and any changes in industry conditions are unpredictable. TORM’s profitability is subject to factors beyond its control, such as changes in supply and demand, oil price fluctuations, and global economic conditions.

Bottom Line

Although tanker stocks are subject to many idiosyncratic risks and are also very sensitive to cyclical changes, we currently see a very interesting risk-reward picture that still favors new-coming investors even though many stocks in the sector have risen exponentially in recent months. Tanker charter rates are likely to remain high for a couple more years, giving both INSW and TORM great upside potential now that Wall Street is somewhat skeptical (apparently due to cyclicality and an already high base). At the moment, I like INSW better than TRMD. That’s mostly because the company looks cheaper, is more diversified, and will likely raise its dividend after the Q1 report [May 5th], which should attract new income-seeking investors and may offset the discount on the company’s valuation. I am definitely counting on it.

As always, please share your opinion in the comments! Thank you for reading!

Read the full article here