It’s been a mixed start to the Q2 Earnings Season for the Gold Miners Index (GDX) despite a record average realized gold price sector-wide, with the average realized gold price of producers reporting to date coming in above $1,960/oz, well above the ~$1,920/oz in Q3 2020. Unfortunately, several producers saw lower than planned production because of one-time headwinds (wildfires, severe rainfall, weather-related power outages, strikes) and while inflationary pressures have eased on key consumables from their Q3/Q4 peaks, labor/contractor inflation has remained sticky and costs remain elevated relative to H1 2022 levels. One of the most recent companies to report, Equinox Gold (NYSE:EQX) had satisfactory results overall. That said, margins benefited from deferred sustaining capital and the higher gold price, yet were still well below the industry average. Let’s dig into its results below:

Los Filos Operations (Company Website)

All figures are in United States Dollars unless otherwise noted.

Q2 Production & Sales

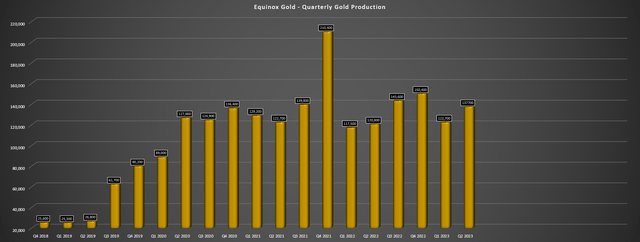

Equinox Gold announced its Q2 production results this week, reporting quarterly gold production of ~137,700 ounces, a 14% increase from the year-ago period. The increase in production was partially due to of being up against easy year-over-year comps with production down year-over-year from Q2 2022 vs. Q2 2021, and also because of the benefit of nearly a full quarter (ex-fatality related shutdown in June 2023) of contribution from its new Santa Luz Mine in Brazil. As for Equinox’s progress on delivering into guidance after a disappointing 2022, the company is sitting at ~44% of its annual guidance midpoint with a record ~260,400 ounces produced in H1, with production expected to be back-end weighted with a 45/55 split. So, the guidance looks achievable if we don’t see any hiccups, with a meaningful step up in production expected next year with commercial production on track for H2 2024 at Greenstone.

Equinox Gold – Quarterly Gold Production (Company Filings, Author’s Chart)

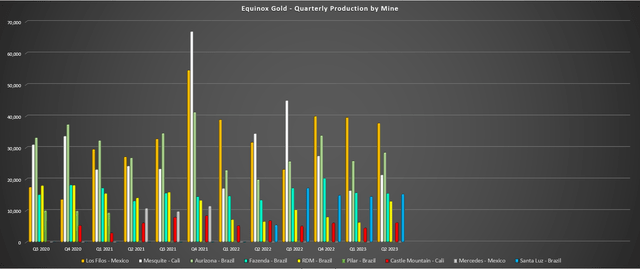

As for Equinox’s other Brazilian operations, RDM had a better quarter and was up against easy comps because of limited access to high-grade ore in the year-ago period with it pumping water from the TSF to comply with regulatory requirements and the temporary suspension due to the delayed receipt for a permit on its scheduled TSF raise. Fortunately, with a more normal quarter, production increased over 95% to ~13,000 ounces at lower costs of $1,553/oz (Q2 2022: $1,849/oz). Elsewhere, Fazenda also had a better quarter with ~15,500 ounces of gold produced at $1,487/oz (Q2 2022: $1,572/oz), benefiting from higher throughput and grades, partially offset by a 70 basis point decline in recoveries. Finally, at Aurizona, production improved materially to ~28,500 ounces at $1,390/oz vs. ~19,900 ounces at $1,627/oz, and generated mine site free cash flow of $14.9 million.

Equinox Gold – Quarterly Production by Mine (Company Filings, Author’s Chart)

As for Equinox’s Los Filos operation, it was a much better quarter here as well, with higher throughput and underground grades helping the mine to produce ~37,800 ounces vs. ~31,700 ounces in the year-ago period. However, according to Equinox, recoveries were affected by solution management issues and ore with a higher copper content, and there were recovery delays in a section of the leach pad because of piping problems. And while all-in sustaining costs [AISC] at this asset remained elevated at $1,701/oz, even if down from $2,141/oz in the year-ago period. That said, a marginally profitable half-year period without a temporary blockade at this asset is a win at this point after the rough past two years that this asset has had since 2021. During the quarter, Los Filos generated $9.8 million in mine site free cash flow, an improvement from a $24.8 million cash outflow in Q2 2022, benefiting from non-sustaining capital spend in the year-ago period.

Finally, the most important development for Equinox is its 60% owned Greenstone Project shared with Orion Mine Finance, situated 4 kilometers from Geraldton, Ontario. As of the most recent update, Equinox noted that 4 million hours were worked LTI-free, the project was 85% complete, and a third independent quantitative risk assessment completed last quarter determined that it remains on schedule to pour first gold in H1 2024. And against all odds, the project remains on budget despite massive capex blowouts at other projects in Ontario, which include Magino and Cote. As of quarter-end, Equinox and Orion Mine Finance had spent ~$940 million (76% of budget on a 100% basis), with Equinox’s share sitting at just ~$170 million, easily covered by over $300 million in liquidity, helped by the better than expected gold price year-to-date which has reduced cash outflows.

Greenstone Project (Company Website)

Notably, all major equipment is on site, so there are no worries about supply chain delays, and the TransCanada Highway 11 relocation was completed earlier than expected. Elsewhere, two Epiroc Pit Viper 235 drill rigs and an eight CAT 793F haul truck (250 ton payload) were commissioned in Q2, with nearly 11 million tonnes of material moved to date. Meanwhile, the natural gas pipeline to site has been commissioned and is operational, and mechanical installations are 75% complete while electrical installations are 67% complete. Lastly, plant site earthworks are 97% complete and the TSF is 80% complete with overall commissioning expected in Q1-Q2 2024. Overall, this is very encouraging and a feather in the company’s cap given that few projects have been completed on time and budget sector-wide, and certainly not in prolific regions with labor tightness like Ontario, Canada.

Costs & Margins

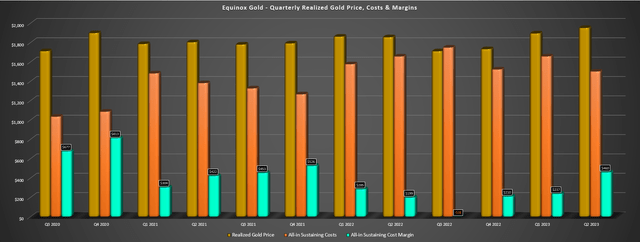

Moving over to costs and margins, it was a better quarter for Equinox, with cash costs of $1,361/oz and all-in sustaining costs of $1,502/oz comparing favorably to $1,482/oz and $1,657/oz in the year-ago period. That said, Equinox was lapping an extremely high cost quarter in Q2 2022, which gave it easy year-over-year comparisons, and it saw a significant benefit from sustaining capital that was deferred into H2 2023, with quarterly sustaining capital expected to average ~$32 million this year and coming in at just ~$12.7 million in Q2. And if we adjust for where sustaining capital should have landed (~$30+ million), all-in sustaining costs would have come in closer to $1,630/oz. So, with the benefit of lower than planned spending and a higher average realized gold price, Equinox’s AISC margins improved to $460/oz.

As for a full-year basis, Equinox has sold ~261,400 ounces at all-in sustaining costs of $1,576/oz, which might lead some to believe that it will beat its FY2023 cost guidance range of $1,575/oz to $1,695/oz with production guidance implying a strong H2 ahead. However, Equinox may benefit from a stronger H2 operationally, but it’s tracking at just ~35.5% of planned sustaining capital spend, more than offsetting the benefit of higher production to finish the year. Hence, despite year-to-date AISC hugging the low end of guidance, I would be surprised to see the company beat its FY2023 AISC guidance midpoint of $1,635/oz.

Equinox Gold – Quarterly Gold Price, Costs & AISC Margins (Company Filings, Author’s Chart)

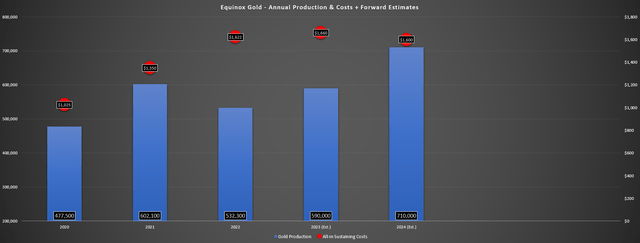

Some investors will note that getting hung up on the current cost profile is looking in the rear-view mirror given that the company will transform its cost profile with Greenstone (60%), which is expected to produce ~250,000 ounces of gold per year in its first five years (Equinox attributable) at sub $900/oz all-in sustaining costs. However, 2024 will be a partial year of commercial production for Greenstone, so we won’t see the benefits of this improved cost profile immediately. Hence, I would expect Equinox to remain a high-cost producer in 2024 for a fourth consecutive year, with annual production of 710,000+ ounces at all-in sustaining costs of ~$1,600/oz. Therefore, with 2025 being the real year where Equinox reports more respectable margins relative to peers, we could see a slower re-rating vs. the overnight re-rating that some investors might be anticipating.

Equinox Gold – Annual Production & Costs, Forward Estimates (Company Filings, Author’s Chart & Estimates)

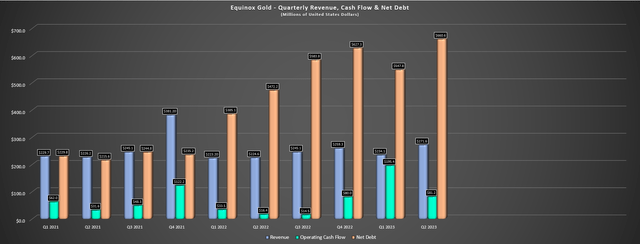

Finally, looking at Equinox’s financial results, Q2 2023 was a much better quarter, though this was largely attributed to the gold price, some easing inflationary pressures and a net cash payment of $9.9 million for its gold prepay arrangement. As shown in the chart below, revenue increased 21% year-over-year to $271.6 million (higher gold sales at higher gold price of $1,952/oz), and operating cash flow increased to $81.2 million vs. $16.4 million in the year-ago period. Meanwhile, the company reported mine site free cash flow of $52.4 million (Q2 2022: [-] $13.1 million), benefiting from significantly lower capex and the higher gold price. The key contributors to Q2 mine site free cash flow were Mesquite and Aurizona.

Equinox Gold – Quarterly Revenue, Cash Flow & Net Debt (Company Filings, Author’s Chart)

From a balance sheet standpoint, Equinox remains more leveraged than its peers with ~$660 million in net debt, but with ~$175 million in cash and $127 million available (recently drawn) on its RCF and $170 million in attributable cost to completion for Greenstone. This certainly eases investors’ concerns about future share sales (there were no additional shares sold under Equinox’s ATM in Q2), and the worries about a capex blowout are now behind us, with an all-star team in G Mining doing an incredible job at the site to keep it on time and budget during a period of near unprecedented challenges (inflationary, absenteeism, labor tightness), and the benefit of 85% of detailed engineering being complete at the onset of construction vs. examples of other cost blowouts like Cote at closer to 60%.

Valuation

Based on ~366 million fully diluted shares and a share price of US$4.80, Equinox trades at a market cap of ~$1.76 billion and an enterprise value of ~$2.42 billion. This has left the company trading at a discount to its estimated net asset value of ~$2.03 billion, with Equinox trading at just ~0.87x P/NAV. Meanwhile, from a cash flow per share standpoint, Equinox continues to be one of the more reasonably priced names sector-wide, trading at just ~5.5x FY2023 cash flow per share estimates ($0.88). And if we use a 65/35 weighting to P/NAV and P/CF with multiples of 1.0x P/NAV and 7.0x cash flow to reflect Equinox’s higher-cost profile vs. peers and less than 50% of production from Tier-1 jurisdictions post-Greenstone, this points to a fair value for Equinox of US$5.76 – 20% upside from current levels.

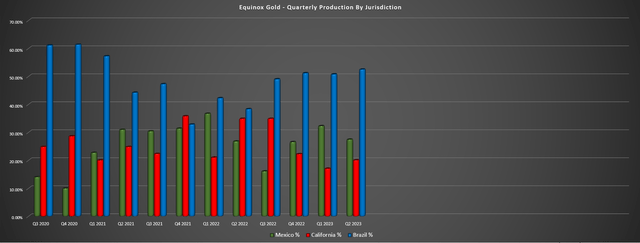

Equinox Gold – Quarterly Production by Jurisdiction (Company Filings, Author’s Chart)

While this is an attractive upside proposition, I only believe in investing in precious metals stocks when they are trading at a deep discount to fair value, and this means a 40% discount to estimated fair value for small-cap producers. So, while Equinox may have a decent upside to its fair value estimate (20%), the ideal buy zone for the stock is at US$3.46 or lower, well below current levels. Obviously, there’s no guarantee that the stock trades down to these levels, and by being unwilling to pay up for the stock, this could translate to an opportunity cost. That said, when there are higher-margin producers with world-class assets trading at less than 0.60x P/NAV and less than 5x FY2025 free cash flow estimates, and when larger diversified producers like Barrick (GOLD) are only slightly more expensive than Equinox because of year-to-date underperformance, I continue to see more attractive reward/risk opportunities elsewhere in the sector.

Summary

Equinox Gold had a better Q2 year-over-year with an increase in mine site free cash flow and improved cost performance (albeit still relatively high costs) at key assets like Los Filos and Aurizona. And with the benefit of a higher average realized gold price, lapping easy year-over-year comps and the easing of inflationary pressures, we saw a meaningful improvement in AISC margins on a year-over-year basis. That said, while production will be back end weighted (~55% of production in H2), sustaining capital is tracking well behind guidance, sitting at just 35% of annual guidance, translating to a high-cost H2 as well. And while EQX remains reasonably valued, the company arguably only one exceptional asset (of which it owns 60%), so while it ranks high on diversification, it is average on a quality score basis. So, without an adequate margin of safety at current levels and EQX being an average producer, I continue to see more attractive bets elsewhere in the sector.

Read the full article here