Artificial Intelligence, or AI, has come onto Wall Street with a loud bang. It has investors hot and bothered, and the symptoms of a manic fever are occurring. The only question in investors’ minds seems to be whether AI will be more significant than fire or the Gutenberg Printing Press.

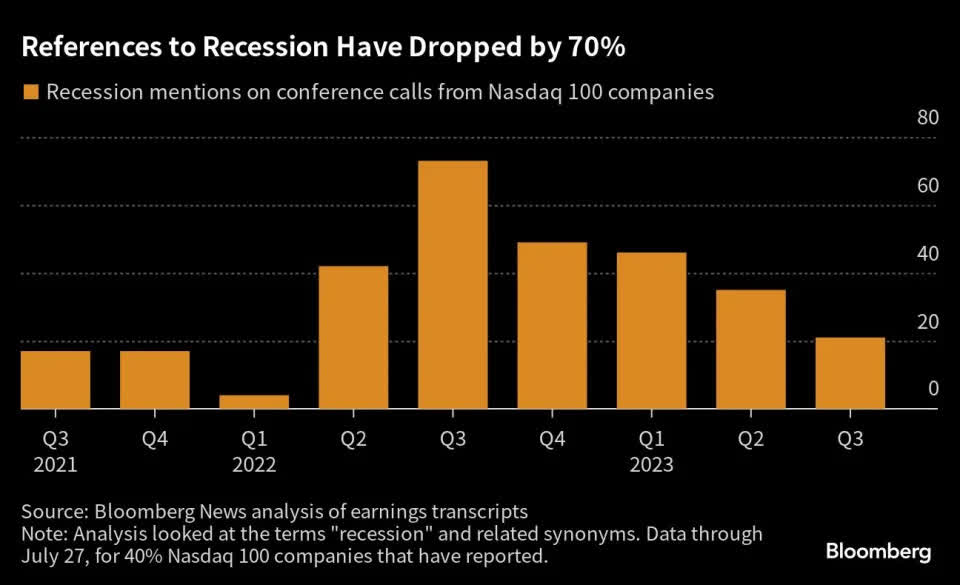

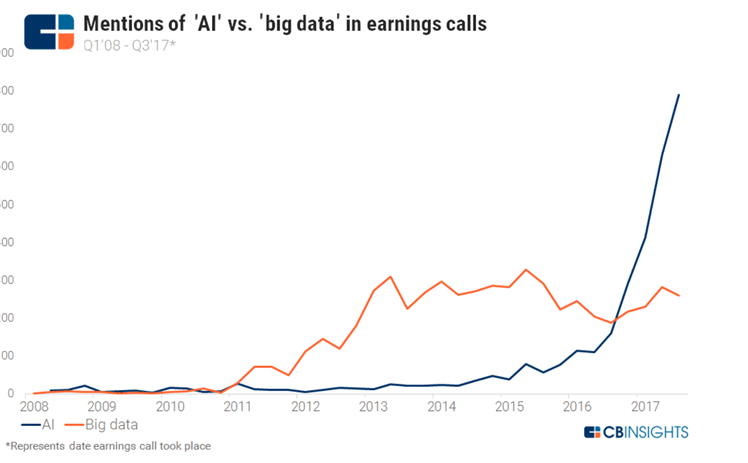

Of course, we all know the hype will eventually result in some spilled milk, but I think we are in the early stages of AI hype rather than anywhere near its culmination. In other words, for discerning investors, there is likely still a lot of money to still be made. There was a focus on recent Nasdaq earnings. Less recession talk and more AI mentions.

Bloomberg

For years, companies have been talking about the potential of AI. Many companies, like some I highlight in this article, have been making money from AI for years before Chat GPT forever rendered the Turing Test to the dustbin of history and, in doing so, created an avalanche of accelerating investor interest.

Much of this interest has been, well, indiscriminate. There’s a lot to parse through, and determining how shareholder value can be unlocked with AI requires careful analysis, not indiscriminate enthusiasm.

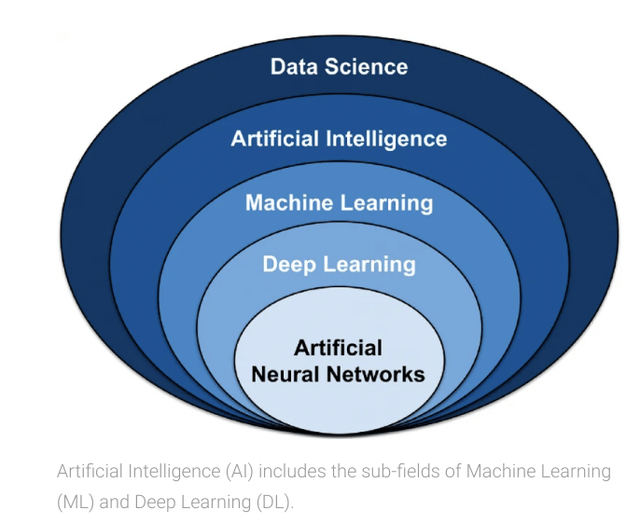

viso.ai

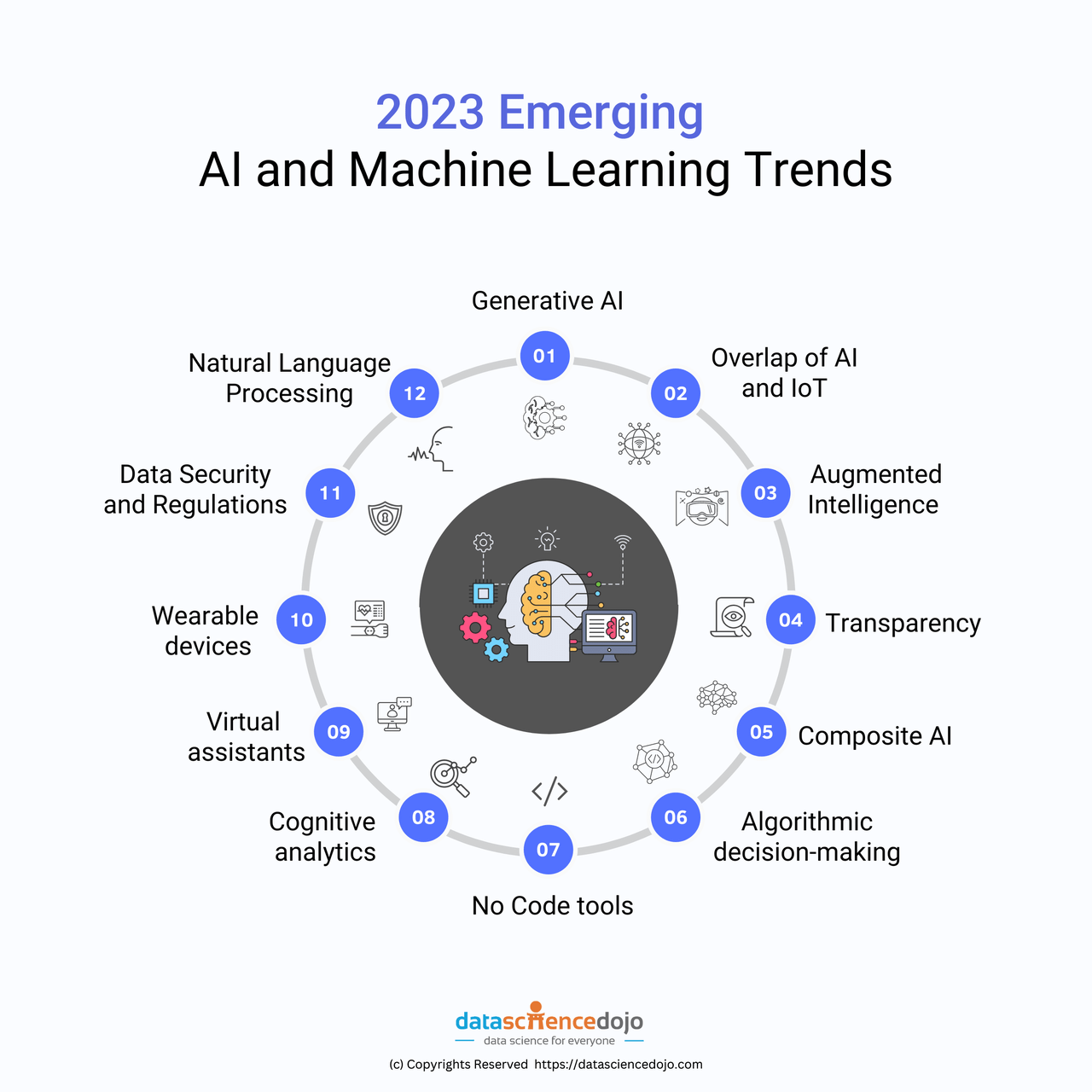

There’s also quite a large sandbox of toys for companies to play with as they determine how to deploy AI toward their goals, of which Large Language Models are only one. But there’s one thing you need to make AI commercially viable or even relevant.

That one thing is data, and generally, the more of it and the longer back it goes, the better. The companies that have that in spades aren’t always the ones you would think of, nor are the companies that would benefit most from its reinterpretation with new tools.

Still, despite what you may think of AI from movies, the reality is that it is next-generation data science. It’s much more spreadsheets of the future than Skynet, friends. Thus, data and different ways to gain insights from it will be at the core of strategies that derive commercial success from current AI capabilities.

Clever Hans Has China Syndrome

I think we’re at the end of the era where it’s going to be these, like, giant, giant models. We’ll make them better in different ways.

-Sam Altman, CEO & Founder of OpenAI

Thematic investing is a top-down approach to capitalizing on prodigious technological trends that can deliver incredible returns. An important thing to remember is that thematic investing is not about being right; it’s about getting exposure to the trend. My first Thematic AI pick was Microsoft, but I think it’s important when investing thematically to diversify across industries and different sub-genres of the underlying technology.

Sam Altman’s quote above should give you an idea of what will happen to folks who are exclusively chasing the hot new LLMs and their incredible abilities but leave behind other promising components of the exciting technological revolution that is now transpiring. When the rubber really meets the road, the path to achieving accretive gains is currently somewhat limited. People are now chasing a technology whose founding pioneers say it has diminishing returns.

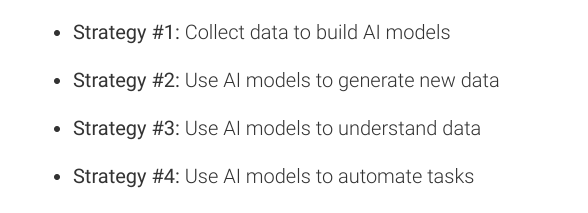

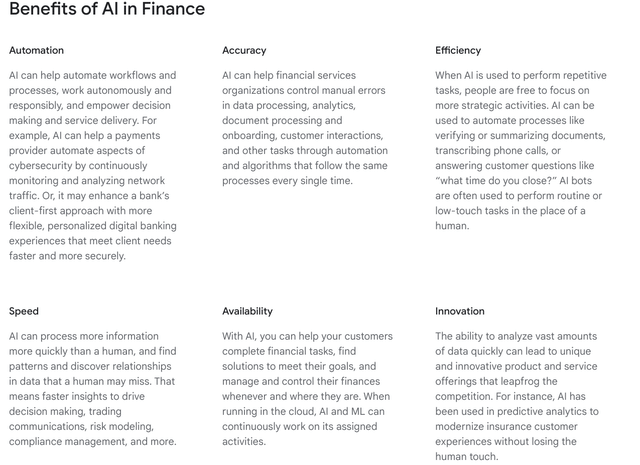

But when you’re thinking about how companies can benefit from AI, the below strategies are a good summary of how it can be done with current tech.

viso.ai

Of course, as with all hot technological trends, company management teams will pile into the space and try to see if they can use new technology in a way that is accretive to shareholders. Though best efforts may be genuine, most management teams currently trying to utilize AI to boost earnings will fail if history is any guide.

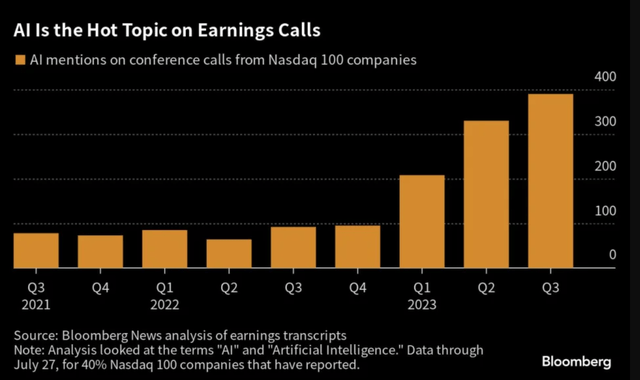

Bloomberg

Despite this fact, investors are seeking AI like sharks seek blood in the water, and as you can see above, mentions of AI in Nasdaq 100 (QQQ) earnings calls have gone parabolic over the last few quarters. The Keynesian Beauty Contest is one of my favorite concepts to pay attention to in markets when selecting and analyzing investments.

Of course, Mr. Keynes summarizes it himself better than I could below. Still, the general idea is that if you’re trying to select the contestant in a beauty contest that the crowd thinks is most beautiful instead of the one you find most beautiful, then it is a much more complicated endeavor.

It is not a case of choosing those [faces] that, to the best of one’s judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be.

We know the crowd loves AI, and we know they will likely pile into names that are improving earnings potential with the exciting technology. Because of the data-driven nature of AI commercial success, sometimes more mature companies have the most to gain, which may be counterintuitive to most of the crowd. But they’ll come around, and you’ll sit on gains when they do.

Age before beauty should guide a thematic strategy. Anchor your portfolio in safer companies that will make money sooner, and complement it with a satellite of moon shots. Your portfolio should comprise many names currently making money from AI and who have the data, expertise, and networks to make those gains meaningful for shareholders in the near future, not in decades.

When you think of the burgeoning bull market around AI, you might think of established Tech Titans who have established an impressive lead, like Microsoft (MSFT). Alternatively, you might consider hot new startups with young kids as CEOs and bold promises of what they can do in the future.

One of the last areas you might think to invest is in boring old dividend aristocrats. But pairing AI price appreciation with market-leading capital return policies will likely be a particularly lucrative sweet spot for long-term investors.

Let’s remember that interest in AI was already increasing well before Microsoft’s captivating breakthrough, and a lot of the work done before then is where the rubber will meet the road regarding the commercial transformation that AI can unleash.

CB Insights

However, this would be misguided, in my estimation. I agree with many analysts that mega-cap Technology has the best near-term prospects for significantly augmenting their intrinsic value with AI applied to existing product ecosystems. Still, these prodigious firms have primary profit drivers outside AI that are still more important to price movement than the hot new technology. AI is the cherry on top, but it’s far from the main show.

So, we must remember that one of the main things that changed when Microsoft unveiled its incredible technology was the crowd’s perception, not the AI technology itself. The LLMs that have dazzled crowds today won’t necessarily be what deliver outsized returns in five years.

When I think about investing in a transformational and profound theme such as AI, not to mention one that so captures the human imagination, I know eventually, the crowd will pile into the stocks using the technology most effectively. Like the internet, I suspect many companies utilizing AI will do so to great success, and many will fail.

Slide Geek

Therefore, I think several more mature companies have data-centric business models rife for AI-driven improvement or already had AI as an integral part of their profit engine before the exponential growth in the crowd’s interest. So with that, I will give you two dividend aristocrats that could see major upside from the market’s hottest trend.

Abbot Laboratories (ABT)

This firm is a well-established healthcare conglomerate with a lot of power in pharmaceuticals. The firm’s product mix and diverse segments appear poised to benefit from major secular and demographic tailwinds. Like all firms selected as BUY recommendations in this article, the firm’s management has been talking about and extracting value with artificial intelligence long before Chat GPT catapulted it into the public consciousness.

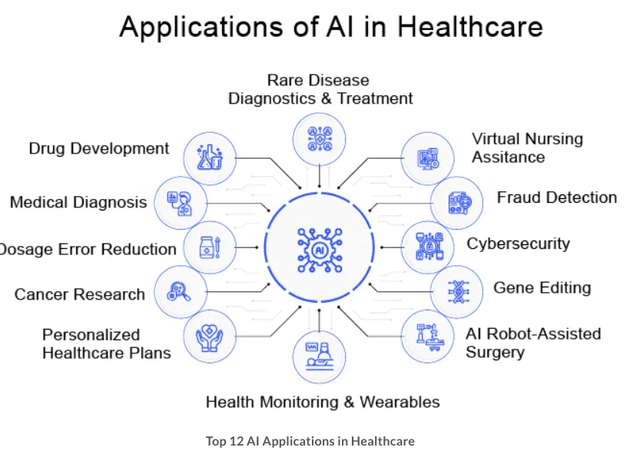

Delve Insight

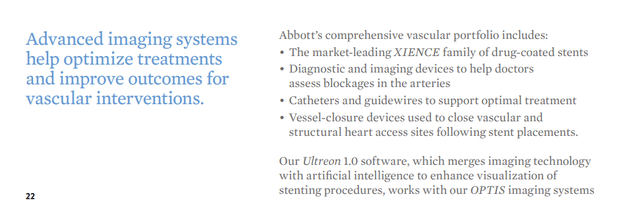

Having a Chatbot that answers most questions in a way that resonates with humans and has decent accuracy is an impressive feat. But so is predicting heart attacks and dramatically improving the accuracy and timeliness of medical imaging. This is what Abbott Laboratories uses AI for, among other exciting things. Impressively, AI has potential to improve profitability and efficiency across ALL the firm’s four segments.

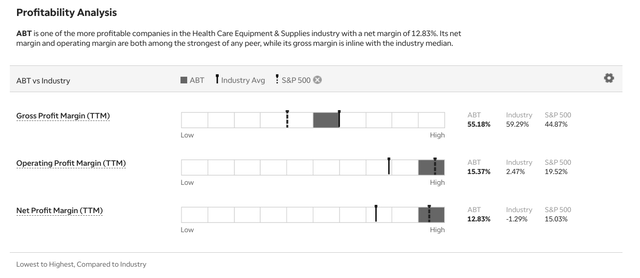

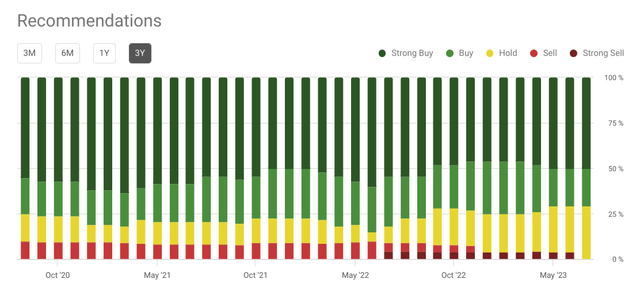

TD Ameritrade

The firm recently received an upgrade after it had a positive Q2 earnings report. Momentum has been positive amongst analyst ratings, and the firm is priced well below the average price target.

Seeking Alpha

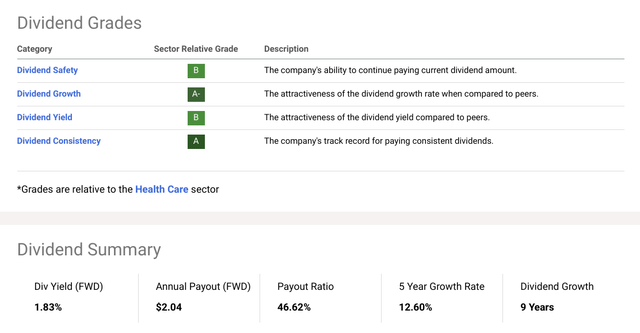

Of course, the company is a distinguished dividend aristocrat with a capital return policy with a reputation that precedes it. Of course, this is the key to these three recommendations. These are great stocks to own because they have advantageous price upside from a thematic technological trend. They also have mature management, solid competitive moats, and a margin of safety created by generous capital return policies that will be otherwise hard to find in AI investments.

Seeking Alpha

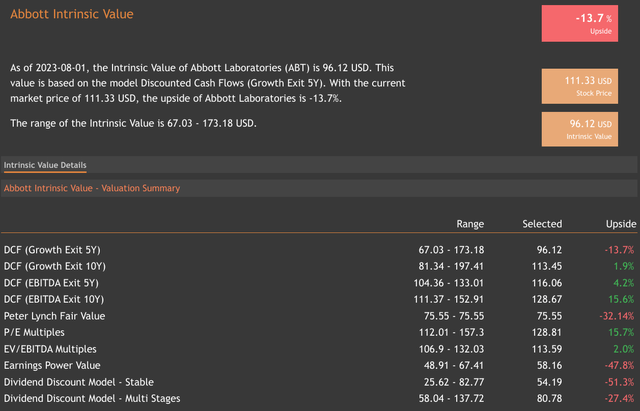

The most considerable risk for the firm is valuation; because it is such a loved stalwart, folks tend to pay a premium for safety and reliability. I know a lot of yield-hound dividend investors, and they may scoff at ABT’s yield. I always like to remind folks that one of the primary reasons for a high dividend in a stock is that its price has collapsed. Thus, high yields can often be a good proxy for value traps.

valueinvesting.io

So, in this light, you can look at Abbott being overvalued on an intrinsic basis as at least confirmation that the firm is not a value trap. The lower yield indicates a strong stock in the case of Abbott, not a management team with a poor capital return policy.

Remember, successful compounding is about the dividend and the price appreciation potential, which in the case of this firm, is significantly augmented by its rubber-meets-the-road approach to using AI to improve healthcare products, pharmaceuticals, and patient outcomes.

Abbott Labs 2022 Annual Report

One of the main reasons I selected Abbott Laboratories for an AI thematic investment is that it is currently well suited to make money in all four strategies for monetizing AI shown above. I also suspect that Abbott’s efforts using AI across its business will synergistically dovetail with necessary future efforts to reduce healthcare costs in the United States.

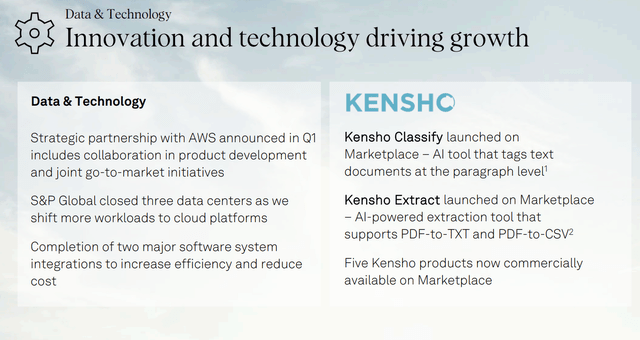

S&P Global (SPGI)

S&P Global is a veritable data titan, making it particularly well-suited to compete in the age of artificial intelligence. Like Abbott, the firm has been monetizing and putting serious investment into artificial intelligence long before the crowd was fixated on it. Also, like Abbott, this firm is a dividend aristocrat with high walls preventing serious competition. It is the leader of an oligopoly and thus is strongly insulated from competition.

Google Cloud

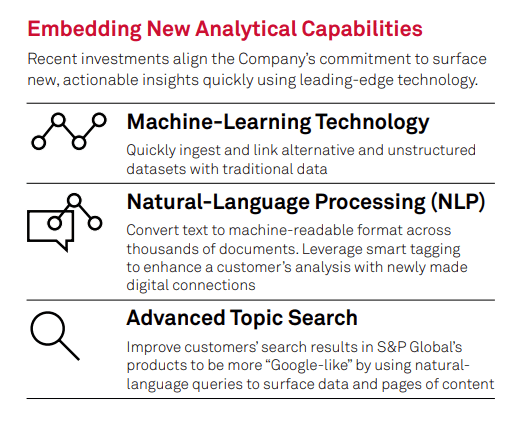

The firm’s business is cyclical, but it increasingly uses data to achieve higher profitability and greater product desirability from the consumer’s point of view. Increasingly the firm is receiving accolades as a premier provider of artificial intelligence technology and the vital insights it can unlock from previously hard-to-manage datasets.

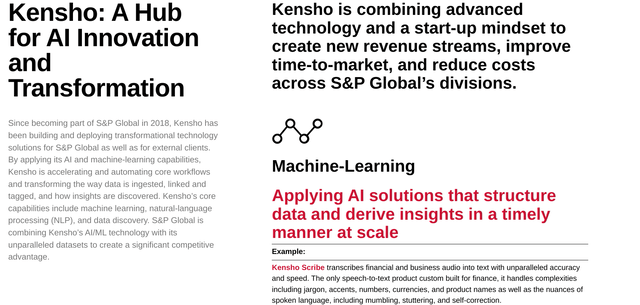

S&P Global 2021 Investor Factbook

S&P Global has been at the vanguard of making AI accessible to large commercial, financial entities. Increasingly, AI and the capabilities it unlocks in finance are not a “nice-to-have” but a “have-or-perish” type incentive structure.

I believe this proven company, which has navigated multiple existential crises in the last decade and a half, will be a primary beneficiary company’s scrambling to have effective AI strategies and to use AI to extract valuable insights from ever-increasing volumes and sources of financial data. If data is the new oil in a world experiencing the AI revolution, then S&P Global is like an oilfield services company, helping folks extract value more efficiently and cleverly.

S&P Global 2021 Annual Report

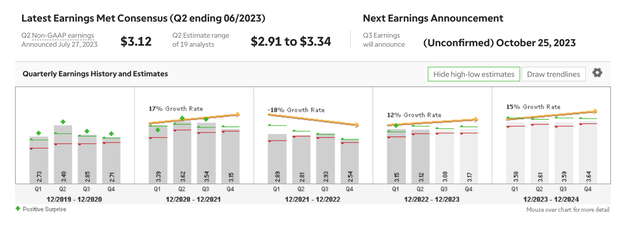

Rating agencies are probably one of the most data-intensive businesses around. Thus their core function will be easily complemented (and indeed already has been) by the rising tides of the AI revolution. Importantly, this firm is considered a central commercial gatekeeper of AI. For me, this helps compensate for the firm being overvalued compared to some peers. The company also has good earnings growth slated for the near future.

TD Ameritrade

Many other S&P components with less-formed AI strategies will likely be coming to S&P Global to assist them in crafting their idiosyncratic strategies and solutions. The company has a proactive strategy already well in motion compared to many competitors and has key partnerships to support monetization.

S&P Global Q2 Earnings Presentation

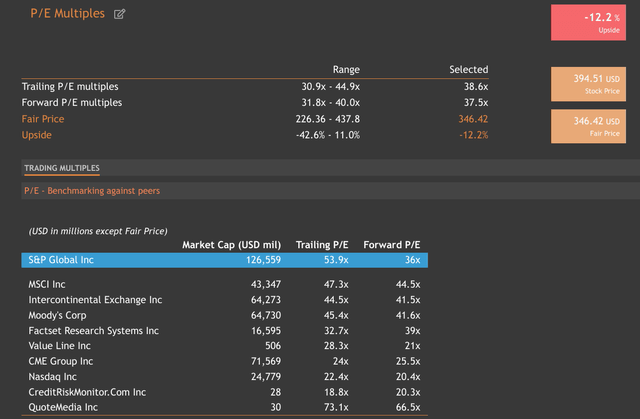

Of course, this firm also enjoys a premium valuation because of its strong competitive position and the intangible value of being an entrenched leader of an oligopoly with probably one of the world’s most valuable networks of institutional investors. So, like the other pick in this article, the firm’s main weakness is that it is richly valued.

valueinvesting.io

Still, comparing this firm to peers, I think the valuation picture becomes more advantageous. Of course, one of the best ways to overcome a high valuation in our times is to have a viable and profitable AI-driven strategy, and this firm certainly has that.

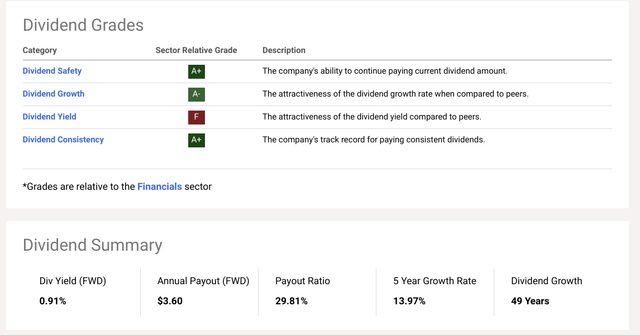

Seeking Alpha

This is a quality company that you can feel comfortable owning. The firm outshines its industry in terms of profitability and its continued prowess in acquiring beneficial pieces to assemble the premier AI financial conglomerate in the world. While you may scoff at the yield, the quality, strong competitive position, and price appreciation potential from AI all compensate for this chink in the armor.

Risks and Where I Could Be Wrong

If you had bought some IBM stock when its AI platform beat Gary Kasparov in chess, you would have missed many other great investments and technological trends. Remember, excellent technology and functionality is not what we’re after as investors. First adopters and techno enthusiasts are after that; we are after sustainable ways that the new technology can create value for shareholders.

I’ve elaborated on valuation risk earlier in my writing on each company, but these firms are also vulnerable if a market-wide correction or sharper-than-expected recession occurs. Any of the following catalysts could cause this to happen:

- Monetary policy lag and QT cause a rapid reversal of economic conditions.

- Debt-strapped companies start to buckle under the weight of higher rates, causing higher unemployment than predicted by the SEP.

- Inflation returns.

- Fed policy error.

- Escalation of geopolitical tensions.

One of the best ways to mitigate risk is to buy a dividend aristocrat for firms achieving that hallowed status; they have proven that their management can consistently reward shareholders through all the undulations the economic cycle and market panics can throw at them. Of course, no stock, even safe ones with imposing competitive moats, is immune from risks.

Conclusion

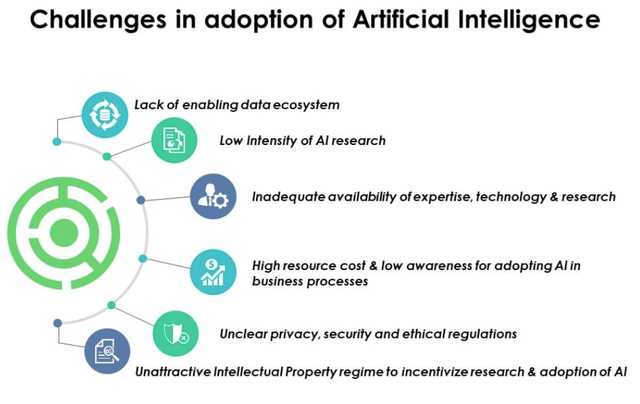

There are a lot of barriers to making AI work commercially. These companies have already demonstrated they can create value with AI and have the in-house expertise, networks, and product ecosystems to capitalize on it. Just because a trend is promising doesn’t mean what we think today will lead to commercial supremacy will be in any way relevant in a couple of years.

Data Science Dojo

Think of some earlier winners of the internet bubble that fell by the wayside as valuations stretched and many early leaders failed to deliver on bold promises to investors. One of the reasons I think Abbott Laboratories and S&P Global can make money from AI in the future is because they’ve been making money with it for years already.

The Large Language Model mania may have already reached its technological pinnacle. We may picture the Terminator when we think of AI. Still, the truth is that from a commercial point of view, the value of AI is primarily tied to the value and utility of companies’ proprietary data. This gives a surprising advantage to many more mature companies.

Buying dividend aristocrats is generally a profitable long-term strategy on its own. And when you pair it with the price appreciation from successful AI strategies, which the crowd will increasingly reward, it creates a significant opportunity for long-term investors trying to access the benefits of compounding.

Read the full article here