Investment thesis

Our current investment thesis is:

- HBI owns several valuable brands but has struggled to maintain consumer interest, with growth reflecting this.

- Margins are also eroding, with economic pressures and high competition leaving the business a passenger in a changing industry.

- Management has initiated a multi-year strategy to reinvigorate the business but we are not sold based on past failures.

- When compared to its peers, the business is underperforming in almost every metric, illustrating what is aN unattractive situation.

Company description

Hanesbrands (NYSE:HBI) is a leading American apparel company that designs, manufactures, and markets a wide range of intimate apparel, activewear, and hosiery products. With a strong global presence, Hanesbrands owns popular brands such as Hanes, Champion, Bali, Playtex, and Maidenform, catering to a diverse customer base across various demographics.

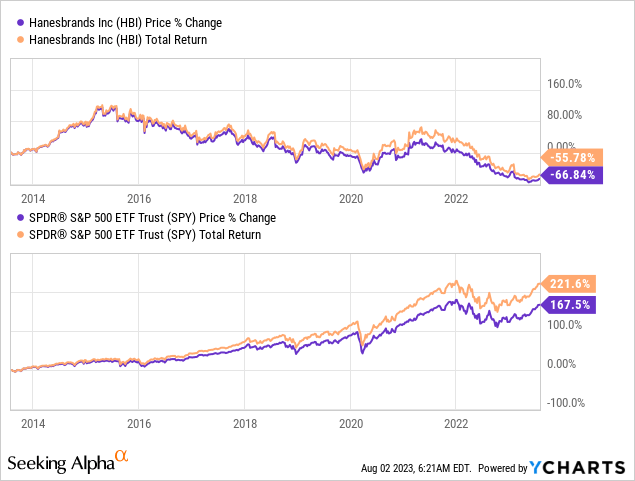

Share price

HBI has price has lost over 50% of its value in the last decade, as a declining commercial position has contributed to worsening financials.

Financial analysis

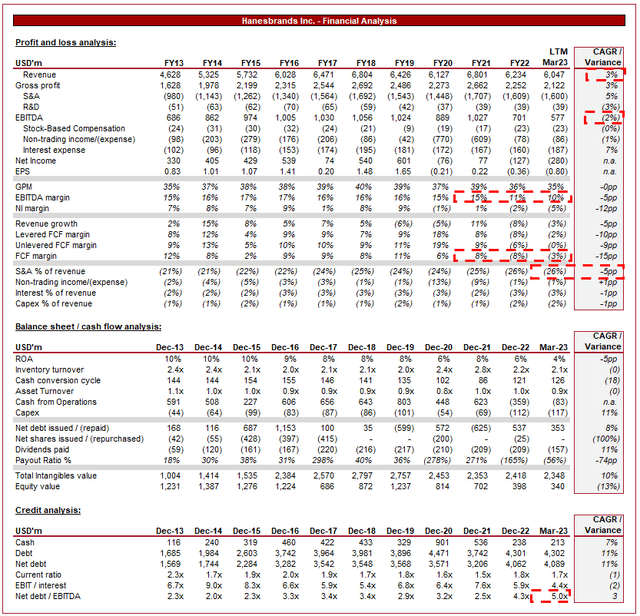

Hanesbrands international financials (Capital IQ)

Presented above is HBI’s financial performance for the last decade.

Revenue & Commercial Factors

HBI’s revenue has grown at a CAGR of 3% in the last 10 years, with a noticeable slowdown in recent years, beginning prior to the onset of the pandemic.

Business Model

HBI’s focus is on the branded segment of the innerwear and activewear segments, with a portfolio of well-known and trusted brands. The fashion industry is notoriously extremely competitive, with consumer tastes quickly changing and brands rising and falling with hype. For this reason, brand diversification is critical, with only a few showing the ability to grow consistently for several decades. HBI’s two key brands are Hanes and Champion, with Hanes providing a wide range of basics, while Champion offers athletic wear. Both brands have a strong historical presence in the industry, particularly in the US.

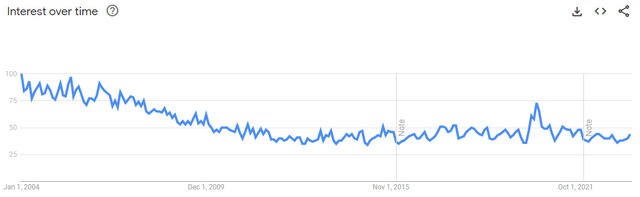

Interest has materially declined, however. In the case of the Hanes brand, the decline has been a gradual process over an extended period. The reason for this we believe is increased competition, with consumers having access to a broader range of products, in part due to the continued development of e-commerce. Even with basics, consumers now have a range of options and designs, priced similarly to Hanes, making the Hanes value proposition more blurred. We do not believe Management has adequately addressed this, with the brand a passenger to the changing market dynamics.

Hanes (Google)

The following graph is Champion, which has experienced a different trajectory. Between 2015-2020, Champion experienced an impressive resurgence, having faced a similar material decline that predated the GFC. The brand lost consumer interest and has not done a good enough job winning people back. The improvement in Champion was due to Supreme (VFC), which collaborated with the brand several times. At the time, Supreme was the hottest fashion brand in the world, and Champion was a nostalgic choice to partner with that its core fan base resonated with.

Champion (Google)

This was a second shot at mainstream success for Champion but it looks like Management were unable to capitalize on this. Interest in the brand, as the above illustrates has been declining since the end of the hyped collabs. At the time of the collabs, I remember looking to purchase a few pieces but noted the prices were unreasonable, dissuading me. Now if you go to their website, it’s difficult to find a product not on sale (many of which are over 30% off). One must question what the strategic mindset was to maintain its momentum. The business should have invested heavily in marketing to the streetwear segment and consistently collaborated with other brands in the space.

HBI utilizes a multi-channel approach, including retail, wholesale, and e-commerce, to reach consumers worldwide. This allows the business to compete against many of the e-commerce-only retailers, allowing consumers to conveniently access products across many retailers (who operate an omnichannel approach). HBI’s largest customer is currently Walmart (WMT), comprising 16% of total sales. Although Walmart has no legal obligation to purchase stock, this relationship allows HBI to reach a substantial amount of the US market.

Due to the commercial issues the business has faced, Management has initiated a multi-year growth strategy referred to as the “Full Potential plan”. This focuses on four pillars to drive growth (Source: Hanesbrands FY22 Annual accounts):

- “Grow the Champion brand globally

- Drive growth in Innerwear with brands by producing goods that appeal to younger consumers

- Build e-commerce excellence across channels

- Streamline its global portfolio.”

As with many turnaround strategies, the business is saying everything we want to hear, particularly with the 3rd point. With gradual declines such as this, the reason is usually linked to a wider demographic shift, with the uptake by the younger generation lower than the prior. This is likely the case with HBI’s brands.

Our issue with this strategy is that Management has not shown us sufficient capabilities to succeed with this. If collabs with the most hyped brand in the world cannot reinvigorate Champion, why should we believe Management can?

Fashion Industry

HBI faces competition from various players in the apparel industry, including Fruit of the Loom (BRK.B), PVH Corp (PVH), Ralph Lauren (RL), Gildan (GIL), Tapestry (TPR), adidas (OTCQX:ADDYY), Nike (NKE), and V.F. Corporation.

HBI has been losing market share to its peers for an extended period of time, as illustrated by its mediocre growth. The business must improve how it markets to customers, adapting to changing industry dynamics. This is not an easy task but begins with improving its social media presence and product innovation aligning to what consumers are interested in.

As previously mentioned, e-commerce has been a key threat to the business. HBI has scope for improvement by leaning into this, improving its direct-to-consumer sales. Not only will this reduce its exposure to the wholesale channel, but also improve sales economics by cutting out the middleman. This strategy only works if a brand can develop an intimate relationship with its customers, which will come with a successful marketing strategy.

Finally, further penetrating emerging markets and expanding internationally can help support growth. Despite the weakness the Champion brand has faced (and the wider business in general) during FY22, Champion grew in international markets. Increased economic development globally will mean more demand for Western products.

Economic & External Consideration

The company may face challenges due current economic condition, with high inflation and elevated interest rates. The key issues we see in the near term are:

- Consumer Spending. The combination of the two factors above is squeezing consumers’ financials, contributing to a reduction in non-essential spending. HBI is inevitably feeling this, driving the number of discounts it’s offering. In the most recent quarter, revenue declined 12%.

- Input Costs. Inflationary pressures increase production costs for raw materials and logistics. GPM in the LTM period is 4% below FY21, illustrating the impact it has had on the business. In the most recent quarter, GP declined 23% and Operating profit 66%.

- Debt Servicing. Management refinanced a large chunk of debt in Q1 which was due to mature in ’23/’24. Interest payments are up almost 100% in Q1 Y/Y.

Based on the company’s near-term trajectory, our expectation is for revenue to decline MSD-HSD for the full year, expecting revenue declines to soften as wholesale sales improve. More broadly, we see economic conditions improving over a 12-24 month period, which suggests a LSD growth rate at a maximum based on our commercial analysis of the business into FY25.

Margins

HBI’s margins have declined in recent years, having generally traded flat over the historical period. This is due to increased discounting alongside inflationary pressures, compounding the issues faced by the business.

With how competitive the industry is, there are no guarantees HBI will be able to win back what it has lost. Our view is that 2-3% on an EBITDA-M level is possible once the number of discounts decline and transportation costs ease, but this is not certain.

Balance sheet & Cash Flows

HBI is heavily indebted, with a ND/EBITDA ratio of 5x in the LTM23 period. Despite this, the business has raised debt in recent years, as cash flows have turned negative. During this time, dividend payments remain bizarrely, implying contradictory motivations.

The business will need to invest several years of cash flows to bring this down to a reasonable level, restricting the ability to invest in growth and shareholder distributions.

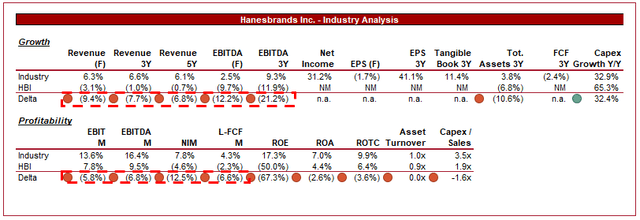

Industry analysis

Apparel, Accessories and Luxury Goods (Seeking Alpha data)

Presented above is a comparison of HBI’s growth and profitability to the average of its industry, as defined by Seeking Alpha (28 companies).

We are not going to waste too much time here because the view is fairly conclusive. HBI’s growth has been disappointing in recent years (and is forecast to continue), while its peers have grown well. This clearly illustrates a decline in market share and relevance.

Further, its margins are noticeably below its peers. Even if we assume the business can reach its FY19 EBITDA-M of 16% (which it likely will not in the next 5 years), it would only reach parity (parity with an average that could also increase during this time).

For this reason, we consider HBI unattractive within this industry and should be trading at a large discount to its peers to reflect this.

Valuation

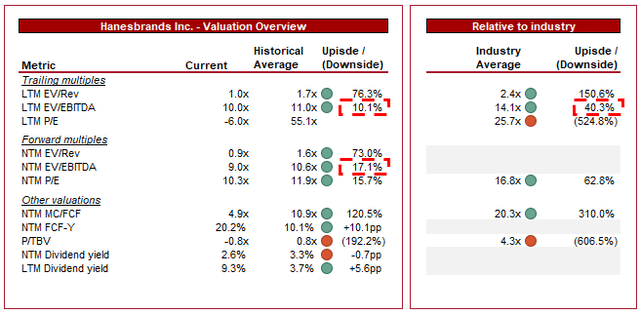

Valuation (Capital IQ)

HBI is currently trading at 10x LTM EBITDA and 9x NTM EBITDA. This is a discount to its historical average.

A discount to its historical average is undoubtedly warranted, given the decline in profitability, lack of brand attractiveness, and near-term demand concerns. As already discussed, the discount to its peer group is also justified, owing to its poor financial performance.

The current discount likely reflects the weakness HBI is facing, although there remains a heightened risk of further downside QoQ as results come in.

The degree to which HBI should be discounted is difficult to assess on a relative basis given the substantial underperformance relative to average. The business is not at all comparable, even if it is in the same industry. For this reason, assessing its fair value should be based on its historical average in our view. Given the factors discussed above, we would suggest a discount between 15-25%, although the top-end of this would only be warranted if revenue continues to decline at a substantial level (as opposed to our assessment that the business sees some recovery).

Final thoughts

HBI is a struggling business. The company owns strong brands but the interest in them is lacking. The business is currently experiencing negative growth and an erosion of margins, as near-term headwinds negatively impact the business. We see no reason why the coming quarters will be much better (beyond the impact of wholesale demand changes).

We do not see a clear route to an improvement in fortunes, as execution has been poor thus far. Financially, the business is unattractive relative to its peers and is trading at a large discount to reflect this.

Read the full article here