Paycom (NYSE:PAYC) found its stock crashing around 20% on Wednesday after the company reported earnings. On the surface, the results looked solid with the company sustaining resilient revenue growth and generating typically solid profit margins. There’s some likelihood that the organic growth rates are lower than they appear due to the company earning interest on customer funds, but the stock selloff appears to have more to do with a valuation pull back than any fundamental weakness. While it can always be difficult to support buy ratings amidst drastic plunges in the stock price, I must reiterate my buy rating as PAYC continues to offer a nice blend between secular growth and profitability.

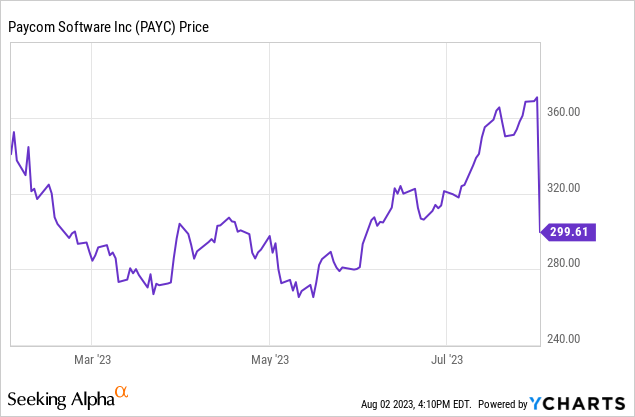

PAYC Stock Price

PAYC initially performed solidly since I covered the name in April. The stock has since given up those gains.

The broader S&P 500 market is dipping over 1% today, likely due to both news of credit rating issuer Fitch downgrading the United States credit rating to AA+, and the potentially-related profit taking in tech names which have performed strongly over the past several quarters.

Why Is Paycom Stock Falling?

The most recent quarter showed what appeared, at least on the surface, to be solid results. Revenues grew 26.6% YOY to $401.1 million, beating guidance by 3%. Unlike many tech peers, PAYC is quite profitable, generating $64.5 million in GAAP net income and $94.3 million in non-GAAP net income.

PAYC ended the quarter with $536.5 million in cash versus $29 million in debt, representing a safe net cash balance sheet. I note that this refers to corporate cash and excludes funds held on behalf of clients, which totaled $2.2 billion as of the end of the quarter.

Looking forward, management has guided for around 23% YOY revenue growth in the third quarter to $411 million. Management increased full-year guidance by $2 million to $1.715 billion in revenue. That implies around $453 million in fourth quarter revenues or 22% YOY growth.

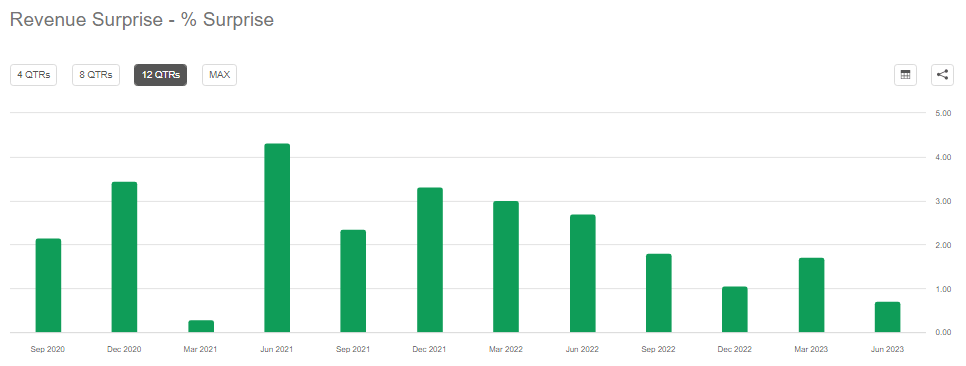

On the conference call, analysts pointed out that the magnitude of the guidance increase was smaller than in the past, totaling less than 1% versus the company historically beating on guidance in the 1.5% to 2% range.

Seeking Alpha

In my opinion, the discrepancy is probably not so significant given the small over magnitude of the historical beats anyways. Management appeared to confirm that revenue growth moving forward might be in the “low-20s” – perhaps analysts were modeling 24% to 25% growth for 2024. Again, this still represents only a slight discrepancy.

The company does not break out how much of revenues come from interest earned on client funds, and this might be a driver of the stock price decline today. The Federal Reserve has been increasing interest rates, meaning that interest earned on client funds has likely been going up. Management noted that they “typically get about $5 million annually on a 0.5 basis point increase.” Management stated that they typically aim to earn around 80 to 90 percent of the Fed funds rate. It is possible that the resilient revenue growth is being driven in no insignificant part by the higher interest rate environment, something that is not typically worth crediting to the business.

Is PAYC Stock A Buy, Sell, or Hold?

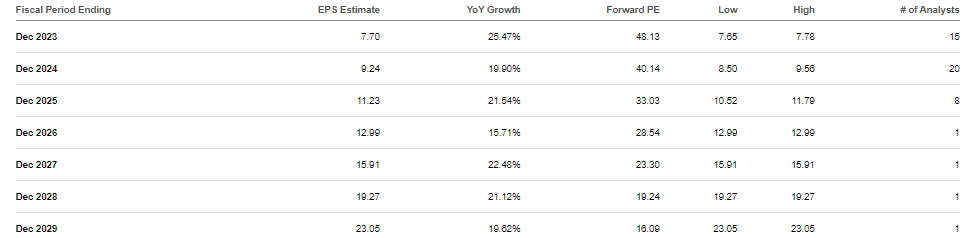

After the stock price plunge, PAYC still isn’t “dirt cheap,” trading at around 39x this year’s earnings estimates. Earnings are expected to grow rapidly over the coming years due to operating leverage.

Seeking Alpha

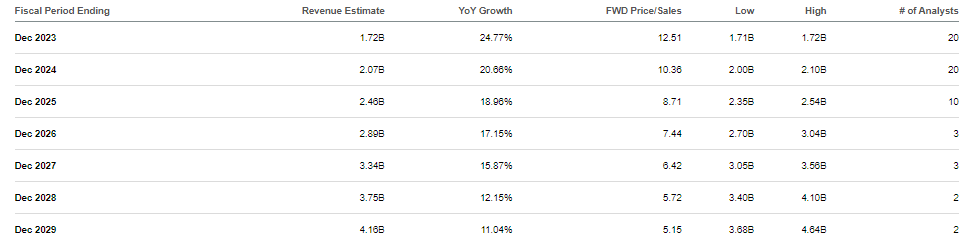

Consensus estimates have revenues growing at around 17% to 20% annually over the next five years.

Seeking Alpha

Is the stock cheap here? At around 10x sales, the stock looks at least reasonable, especially considering that Microsoft (MSFT) trades at a similar sales multiple in spite of being more mature in its growth story. Based on 20% forward growth, 30% long term net margins, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see the stock trading at around 9x sales, suggesting solid upside over the coming years on account of the double-digit projected growth.

What are the key risks? With the valuation being arguably somewhat “full” (not allowing for much multiple expansion), downside surprises to revenue growth may heavily impact the stock price. The tough macro environment may get worse, and slowdowns to organic growth might not be offset by higher interest rates in the future. I could see PAYC trading down around 30% before trading more in-line with peers of a similar growth cohort. The company’s net cash balance sheet and solid profit margins may provide some downside support, but that is no guarantee as we have seen many profitable tech names trade down to reduced valuations upon deteriorating sentiment. Perhaps the bigger question is whether the potential upside from PAYC is large enough to justify owning it versus the broader market index fund, a question that is not so easy to answer. I reiterate my buy rating as I see a high likelihood of this stock performing at least in-line with the market moving forward.

Read the full article here