Stock futures were falling sharply Wednesday after Fitch Ratings downgraded its rating on U.S. long-term debt one notch to AA+ from AAA. The downgrade, Fitch said, reflects “the expected fiscal deterioration over the next three years, a high and growing general government debt burden and the erosion of governance” following repeated debt limit standoffs and last-minute resolutions.

These stocks were poised to make moves Wednesday:

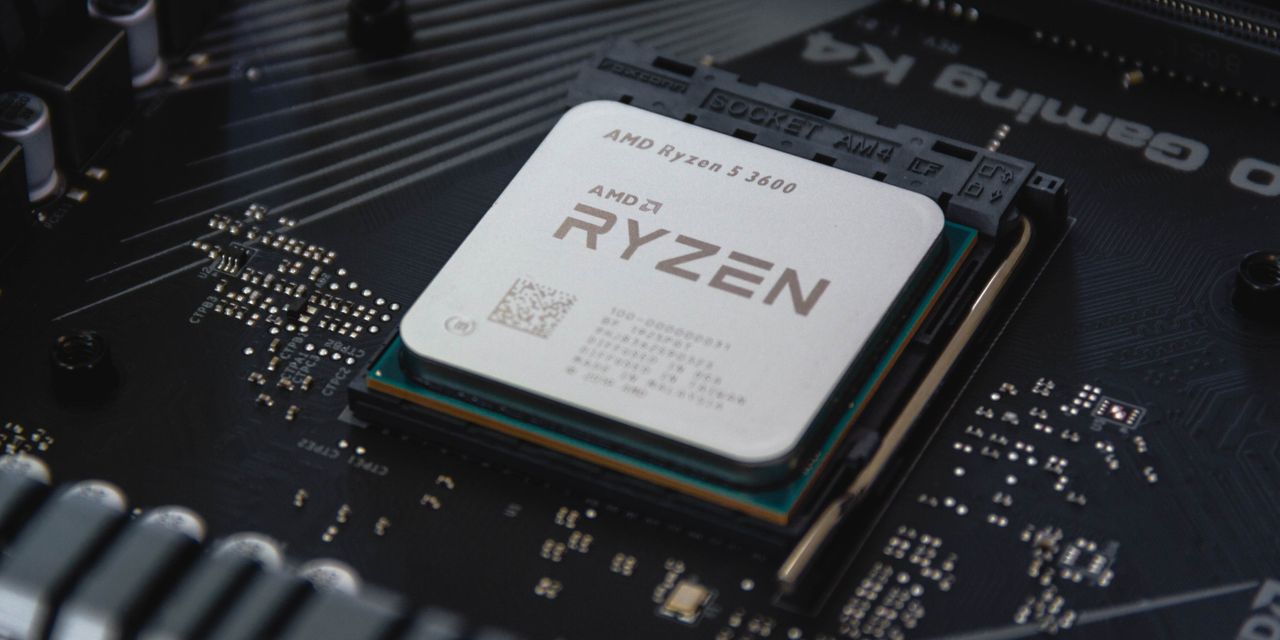

Advanced Micro Devices

(AMD) reported second-quarter earnings that beat analysts’ expectations and issued revenue guidance for the third quarter of $5.7 billion at the midpoint of a range, slightly below consensus of $5.8 billion. The stock was up 2.2% in premarket trading, getting a lift from the chip maker’s latest update on its artificial intelligence portfolio and predictions about the AI market.

Fiscal third-quarter earnings from

Starbucks

(SBUX) topped Wall Street estimates, but sales came up short and shares of the coffee chain were falling 1.3% in premarket trading. Same-store sales rose by 10%, below analysts’ forecasts of 11%.

Generac

(GNRC) dropped 12% after the company, which sells generators and other backup power systems, reported second-quarter earnings that missed estimates and Chief Executive Aaron Jagdfeld said that “expectations for the consumer environment are now softer than previously projected.”

Humana

(HUM) was rising 4.5% after the health insurer reported second-quarter earnings above forecasts and noted the Medicare Advantage utilization environment was “stabilizing” based on recent claims activity.

Electronic Arts

(EA) slumped 4.5% after the videogame publisher forecast fiscal second-quarter earnings of 72 cents a share to 89 cents a share on net revenue of $1.83 billion to $1.93 billion, missing analysts’ expectations. EA also said it expects bookings of $1.7 billion to $1.8 billion in the period vs. consensus of $1.82 billion.

Pinterest

(PINS) posted adjusted earnings and revenue in the second quarter that topped analysts’ estimates. Shares of the image-sharing platform, however, fell 2.7% in premarket trading.

SolarEdge Technologies

(SEDG) fell 13% after missing second-quarter revenue expectations and issuing a third-quarter revenue forecast that also was below estimates. In a statement, the company said the U.S. residential solar market was “currently seeing some headwinds primarily related to higher interest rates.”

Shares of

e.l.f. Beauty

(ELF) surged 18% after the maker of beauty products reported fiscal first-quarter earnings and sales that smashed Wall Street expectations and boosted guidance for the fiscal year.

Match Group

(MTCH) was up 10% after the online dating company swung to a profit in the second quarter and revenue rose 4% to $830 million, beating forecasts of $812 million.

Virgin Galactic

(SPCE) fell 6.3% after reporting second-quarter revenue that missed analysts’ estimates. The space tourism company also reported a quarterly loss of 46 cents a share, narrower than estimates that called for a loss of 51 cents.

CVS Health

(CVS) was rising 2% in premarket trading after the health insurance provider, which also owns a retail pharmacy chain and a pharmacy benefit manager, reported second-quarter adjusted earnings that beat analysts’ estimates.

Write to Joe Woelfel at [email protected]

Read the full article here