Dear partners and friends,

Desert Lion’s Fund returned +5.6% net for the month of June, ahead of the +4.8% return of the JSE All Share Index (J203).

In this month’s commentary we discuss recent results of one of our largest investments, Argent Industrial, which we have held in our portfolio since the Fund’s inception in 2019.

Argent Industrial Limited (OTCPK:AILTF)

Argent is an industrial conglomerate with about 24 underlying operating units across South Africa, the United Kingdom, and the United States. Its resilience is underpinned by vertical integration, self-sufficiency, and diversification across products and geographies.

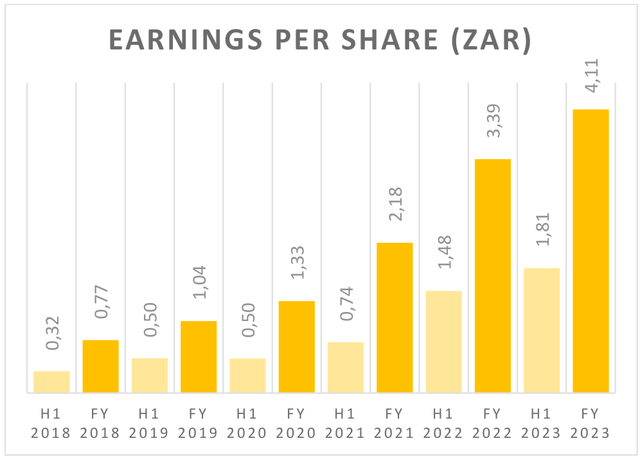

I strongly believe that the market has been wrong on this one for a while now. Argent is not a hot AI stock. Maybe that is one of the reasons it is totally ignored by the market. Yet, as a real-world- economy stock, Argent’s earnings growth would make many a tech stock blush. As illustrated by the below chart, EPS has grown at a CAGR of 40% over the past 5 years.

The company lists every subsidiary on their site here.

- The South African subsidiaries span steel trading and processing, specialty manufacturers of underground mining scrapers, industrial lifting equipment (e.g., cranes), bulk steel products such as gates and fencing, and concrete mixing and distribution. They also include additional manufacturing companies with strong brands locally and internationally.

- The UK subsidiaries comprise a number of specialist manufacturers of fuel storage solutions, (including mobile fuel storage systems for the international aviation, maritime, and vehicle industries), a range of industrial doors, shopping carts and trolleys, and iron and wooden gates for the consumer market.

- The US operation manufactures speed control “retarder” systems for classification/ marshalling rail yards that separate out freight cars among various tracks.

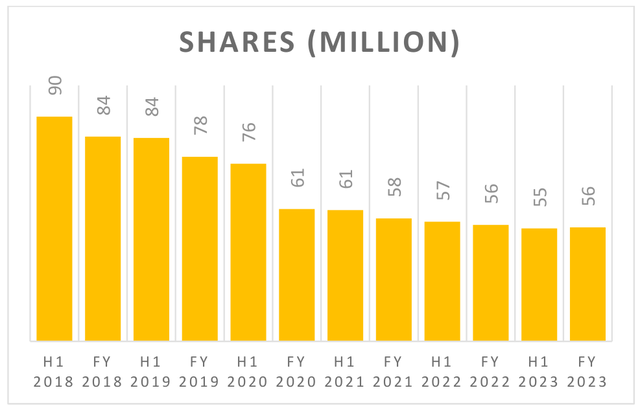

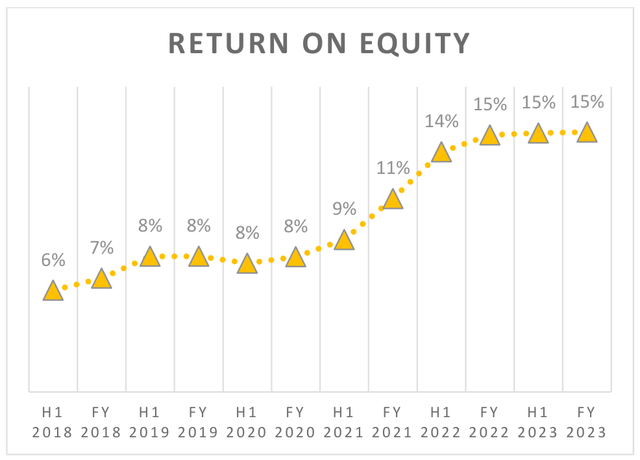

Our strategy is to turn over as many rocks as possible in inefficient corners of the market. We uncovered an informational advantage by digging deeper than everyone else. For a very long time, Argent used to be a low return on capital value trap. But about 5 years ago, a new strategic shareholder took over the capital allocation of the group. In typical Will Thorndike’s The Outsiders1 fashion, Argent disposed of low return assets, streamlined working capital, repaid debt, bought back loads of shares on the cheap, and made higher return on capital, earnings-accretive acquisitions.

I first met the new strategic shareholder in 2019 and he mapped out Argent’s capital allocation journey during our discussion. In May this year, we were both in Omaha and again talked for hours, spending a great deal of time on Argent. Argent is a cash gusher, under competent operational management, with one of the smartest capital allocators in the background directing the flows. By still framing Argent in the same box as used years ago, the market is totally oblivious to the fact that the Argent of today is a globally diversified, high growth business compounding through a combination of organic growth and smart capital allocation.

The business is virtually debt free and is firmly on a path of sustainably higher returns on equity.

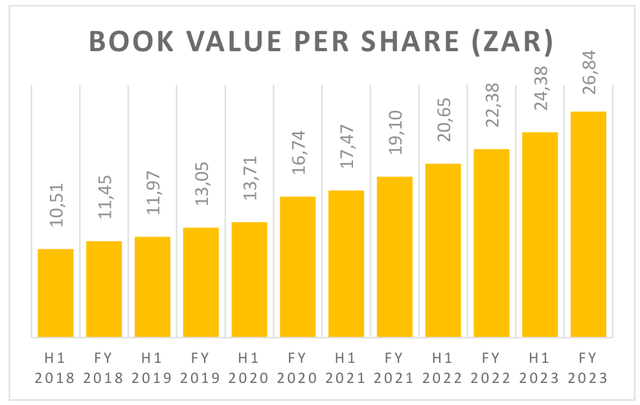

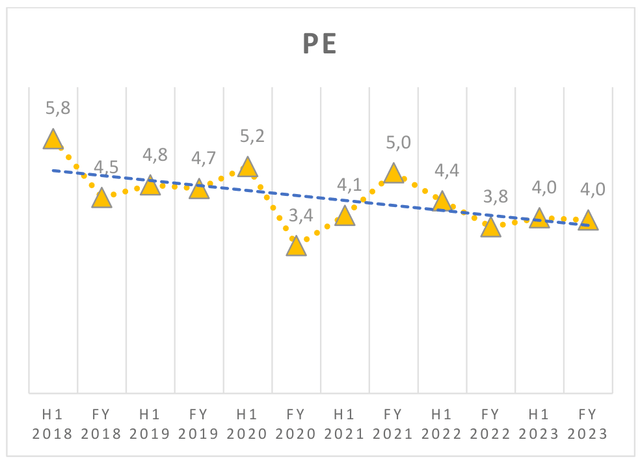

It is evident that Argent is a much better quality business today than it was 5 years ago. Yet the market is actually placing a lower valuation multiple on the business today.

This company is a great example of market inefficiency. It is small (market cap of R900m or $50m), underfollowed (only covered by one private independent analyst), under-owned (institutional ownership is less than 1% of shares outstanding), branded a “SA Inc” company (yet 60% of earnings is international non-SA), and misunderstood. At R16 per share, it is trading at a sub-4 PE and price-to-book of 0.6. We believe this is too low for a globally diversified company with exceptional capital allocation likely to continue growing earnings at 15-20% per year.

Peter Lynch wrote in his 1989 book One Up on Wall Street2 that “[t]he P/E ratio of any company that’s fairly priced will equal its growth rate” and used an inverse PEG ratio as a heuristic to determine the attractiveness of a company’s valuation. EPS growth/PE of about 1 is fairly valued. EPS growth/PE equaling about 2 is attractive and a buy. EPS growth/PE around 3 is rare and you should back up the truck. In Argent’s case, we are presented with a Lynch metric of about 4!

Argent is another example of a global company trading at South African discounts.

In closing

We continue to find compelling opportunities similar to Argent. There is a big mismatch between capital and opportunities. History instructs that the phenomenon is cyclical. We cautiously anticipate the turn.

As always, I thank you for entrusting Desert Lion with your hard-earned capital. The majority of my wealth is invested in the Fund right alongside you.

All the best,

Rudi van Niekerk

Footnotes1Highly recommended read The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success DisclaimerThis document (the “Document”) has been prepared solely for use by potential investors in Desert Lion Capital Fund I, LP (the “Fund”), which is managed by Desert Lion Capital Investment Management, LP (together with its affiliates, “Desert Lion Capital”), and shall be maintained in strict confidence. The recipient agrees that the contents of this Document are confidential, the disclosure of which is likely to cause substantial and irreparable competitive harm to Desert Lion Capital and or its investment vehicles and their respective affiliates. Any reproduction or distribution of this Document, in whole or in part, or the disclosure of its contents, without the prior written consent of Desert Lion Capital is prohibited. The information set forth herein does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Other events that were not taken into account may occur and may significantly affect the analysis. Any assumptions should not be construed to be indicative of the actual events that will occur. This Document shall not constitute an offer to sell or the solicitation of an offer to buy which may be made only at the time a qualified offeree receives a private placement memorandum describing the offering and related subscription agreement. Nothing contained herein constitutes investment, legal, tax or other advice nor is it to be relied on in making an investment or other decision. All information contained in this Document is qualified in its entirety by information contained in the Fund’s confidential private placement memorandum. An investor should consider the Fund’s investment objectives, risks, charges and expenses carefully before investing. This and other important information about the Fund can be found in the Fund’s offering memorandum. Please read the confidential private placement memorandum carefully before investing. The information in this Document is only current as of the date indicated, and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. No representation or warranty (express or implied) is made or can be given with respect to the accuracy or completeness of the information in the Document. Some of the statements presented herein may contain constitute forward-looking statements. These forward-looking statements are based on current expectations, estimates and projections. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although Desert Lion Capital believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, Desert Lion Capital can give no assurance that such expectations will be attained and therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Desert Lion Capital undertakes no duty to update any forward-looking statements appearing in this Document. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. Diversification does not assure a profit or guarantee against loss in declining markets. Investors should consider their investment objectives, risks, charges and expenses of the underlying funds before investing. The views, opinions, and assumptions expressed in this Document are as of the date of this Document, are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy or investment. The Document does not purport to contain all of the information that may be required to evaluate the matters discussed therein. It is not intended to be a risk disclosure document. Further, the Document is not intended to provide recommendations, and should not be relied upon for tax, accounting, legal or business advice. The persons to whom this document has been delivered are encouraged to ask questions of and receive answers from Desert Lion Capital and to obtain any additional information they deem necessary concerning the matters described herein. None of the information contained herein has been filed or will be filed with the Securities and Exchange Commission, any regulator under any state securities laws or any other governmental or self-regulatory authority. No governmental authority has passed or will pass on the merits of this offering or the adequacy of this document. Any representation to the contrary is unlawful. References to the MSCI Emerging Markets Index (“MXEF”) and the FTSE/JSE All Share Index (JSE alpha code “ALSH” or JSE index code “J203”) are based on published results and, although obtained from sources believed to be accurate, have not been independently verified. The MSCI Emerging Markets Index is referred to only because it represents an index typically used to gauge the general performance of the midcap and large caps in global emerging equity markets in more than two dozen emerging market countries including South Africa, China, India, Korea, Mexico, Taiwan, the United Arab Emirates and others. The returns for the MSCI Emerging Markets Index include realized and unrealized gains and losses plus reinvested dividends but do not include fees, commissions and/or markups. The FTSE/JSE All Share Index is referred to only because it represents an index typically used to gauge the general performance of the Johannesburg Stock Exchange as a whole. The returns of the FTSE/JSE All Share Index include realized and unrealized gains and losses, but do not include the reinvestment of dividends, and do not include fees, commissions and/or markups. The use of these indices is not meant to be indicative of the asset composition, volatility or strategy of the portfolio of securities held by the Fund. The Fund’s portfolio may or may not include securities which comprise the MSCI Emerging Markets Index and the FTSE/JSE All Share Index, will hold considerably fewer than the number of different securities which comprise the MSCI Emerging Markets Index and the FTSE/JSE All Share Index and engages or may engage in Fund strategies not employed by the MSCI Emerging Markets Index and the FTSE/JSE All Share Index including, without limitation, short selling and utilizing leverage. As such, an investment in the Fund should be considered riskier than an investment in the MSCI Emerging Markets Index and the FTSE/JSE All Share Index. Furthermore, indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here