One of the things that I love about value investing is that when you purchase shares of a company at a low price, it’s difficult for the stock to fall further. Having said that, there is no guarantee that it won’t. One firm that most certainly fits the value description that has experienced some weakness as of late is specialty accommodations business Civeo Corp (NYSE:CVEO). Despite robust oil drilling activities in Canada where the company gets the largest portion of its revenue, the enterprise, which focuses on providing accommodations and various other services to companies that perform a natural resource extraction far away from civilization, has seen revenue, profits, and cash flows decline. Even though shares of the enterprise are incredibly cheap, this has resulted in the stock taking a beating in recent months. In the near term, this might be frustrating for investors. But for those truly focused on the long haul, I do believe that the outcome down the road will be positive.

Recent performance has been challenged

Purely from a share price perspective, things have not been going well for Civeo Corp and its investors. In an article that I published in early March of this year, I acknowledged that the stock was being pressured because of a weak forecast for the 2023 fiscal year. Even so, I recognized just how cheap shares were and, as a result, assigned it a ‘buy’ rating to reflect my view at the time that shares should outperform the broader market for the foreseeable future. Unfortunately, the opposite has occurred so far. Since the publication of that article, the stock is down 17.1% at a time when the S&P 500 has popped 14.8%.

Author – SEC EDGAR Data

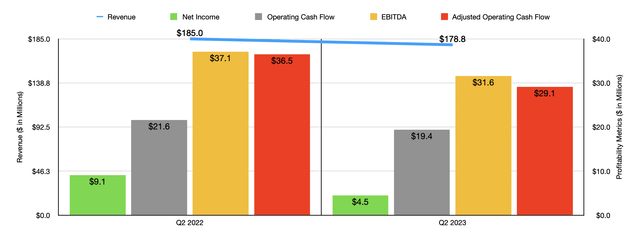

When you ignore the valuation of the company and focus solely on its financial performance, it’s not difficult to understand why the stock has experienced downward pressure. Consider financial results covering the second quarter of the company’s 2023 fiscal year. These were just announced on July 28th. Even though revenue exceeded analysts’ expectations to the tune of $5.3 million, overall sales of $178.8 million came in lower than the $185 million the company reported one year earlier.

The largest area of weakness for the company involved its operations throughout Canada. Revenue associated with our northern neighbor plunged 12.4% from $109 million to $95.5 million. $5.1 million, or 37.8% of this decline, can be attributed to the weakening of the exchange rate for the Canadian dollar compared to the U.S. dollar. The rest of the drop was driven largely by weak demand for the company’s accommodations services and its mobile facility rental services. Total billed rooms for lodges, for instance, dropped 6.1% year over year from 771,267 to 724,299.

The picture would have been worse had it not been for robust performance in Australia, which is the company’s second largest market. Revenue there jumped 21.7% from $67.8 million to $82.5 million. Most of that increase was attributable not to the accommodation side of the picture, but instead to food services and other services. Interestingly, the picture would have been better had it not been for foreign currency fluctuations that impacted sales negatively to the tune of $5.7 million. Total billed rooms for villages that the company owns shot up 16.3% from 505,310 to 587,855.

On the bottom line, the picture also worsened. Net income, for instance, was cut by more than half from $9.1 million to $4.5 million. A big part of the pain can be chalked up not only to the decrease in sales, but also to a decline in the gross margin for its operations in Canada from 31.2% to 24.7%. This decrease, according to management, was driven largely by inflationary pressures. Even with its Australian operations, Civeo Corp experienced a decline in margins, with the gross profit margin falling from 29.7% to 29.1% thanks to the fact that the company’s integrated services business, which has a service only business model, generates lower gross margins than its accommodation operations. On a per share basis, the company generated profits of $0.30. On top of being down substantially from the $0.54 per share reported the same time last year, the figure also missed analysts’ expectations by $0.01. Other profitability metrics followed the same trajectory. Operating cash flow dipped slightly from $21.6 million to $19.4 million. If we adjust for changes in working capital, we would see a decline from $36.5 million to $29.1 million. And finally, EBITDA for the company dropped from $37.1 million to $31.6 million.

Author – SEC EDGAR Data

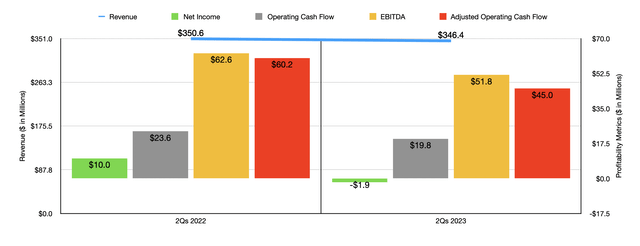

As you can see in the chart above, the first half of 2023 as a whole looks rather painful. A good portion of this pain came from the second quarter. But this doesn’t change the fact that the first quarter was also problematic for the company. Despite these issues, management has actually increased guidance for the entirety of the year. Previously, they were forecasting revenue of between $630 million and $650 million. This has now been increased to between $640 million and $650 million. Meanwhile, EBITDA is now expected to come in at between $90 million and $95 million compared to the $85 million to $95 million previously anticipated.

Author – SEC EDGAR Data

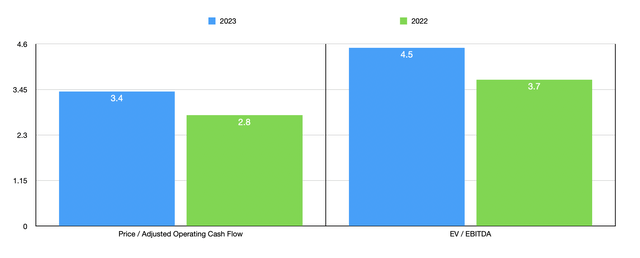

If the midpoint of guidance comes to fruition for EBITDA, that would imply adjusted operating cash flow for this year of around $86.7 million. On a forward basis, this would translate to a price to adjusted operating cash flow multiple of only 3.4. Even though that is incredibly low, it is higher than the 2.8 reading that we get using data from 2022. Meanwhile, the EV to EBITDA multiple would be 4.5 compared to the 3.7 reading that we get using data from last year. No matter how you stack it, these numbers are very attractive and classify the company, at least in my book, as a deep value prospect.

Civeo Corp

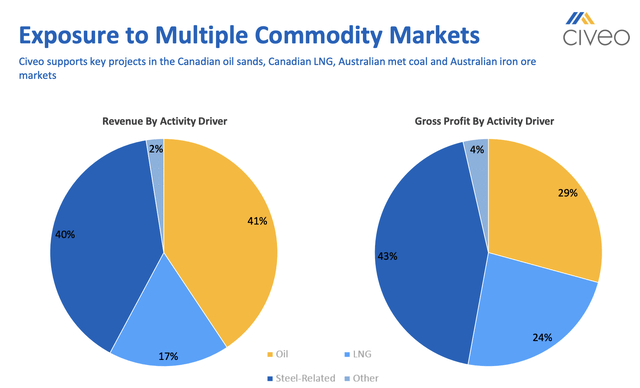

This is not to say that the picture for the business can’t continue to worsen. The fact of the matter is that any enterprise that generates the bulk of its wealth from commodities can experience significant fluctuations in revenue, profits, and cash flows. On this front, the picture for the firm is admittedly a bit uncertain. The good news is that we know the primary drivers of the company’s revenue. About 41% of the firm’s revenue can be chalked up to oil production. Another 17% involves LNG production. And 40% involves steel in some capacity. The oil and LNG activities are largely centered in Canada, while the steel related activities in the form of metallurgical coal, iron ore, and other commodities, take place in Australia.

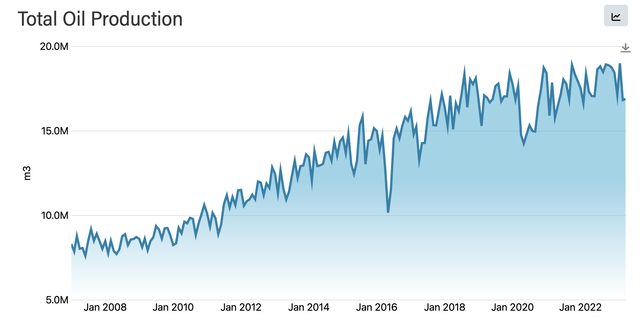

Alberta Energy Regulator

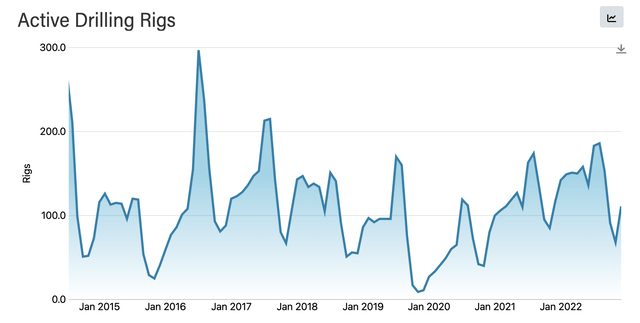

As you can see in the chart above, total oil production in Alberta, Canada, where the vast majority of the company’s 16 Canadian lodges are located, has been on the rise for several years now. This is in spite of the fact that Canadian crude is some of the most costly to get to market in the world. The heavy nature of it, combined with logistics issues, make it difficult to deal with. But even so, output continues to rise. Of course, this does not necessarily mean that Civeo Corp stands to benefit from this. There is a difference between oil output and the kinds of activities needed to achieve that output. Year after year, drilling rigs become more efficient thanks to technological improvements. When you look at the total number of active drilling rigs in Alberta, that picture over the past several years has remained in a fairly narrow range. For the most recent month available, which would involve data from June 1st of this year, the total number of active drilling rigs came out to 111. This is down slightly from the 117 reported the same time last year. But this doesn’t mean that the entire year is bad. If we take the data from the peak drilling season, which would be as of January 1st, we would get 183 active rigs in Alberta for this year. That’s actually up from the 163 reported the same time last year.

Alberta Energy Regulator

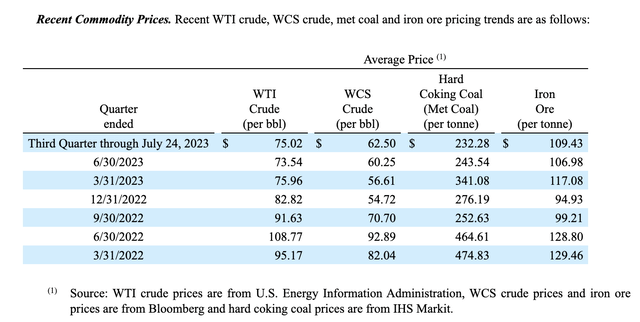

Investors who are skeptical about the company would be correct to point out that the decline in oil prices in recent months does not bode well for demand. This is absolutely true. In the second quarter of this year, for instance, WTI crude was $73.54 per barrel. By comparison, WCS crude was $60.25 per barrel. These numbers are down 32.4% and 35.1%, respectively, compared to where they were the same time last year. The good news is that, even with pricing down like this, the average number of active drilling rigs per month experienced in the first six months of this year was the highest it had been in at least five years. The closest was last year when we saw an average of 154 rigs per month in the first half of the year. This year, that number is 158. To put this in perspective, the range for the three years prior to last year was between 89 and 109.

Civeo Corp

The picture regarding Australia is a bit more complicated. Based on the most recent data I could find, Australia accounts for roughly 37% of all global iron ore production and for roughly 6% of metallurgical coal production. Just like with oil, prices for both iron ore and metallurgical coal has fallen compared to what it was last year. The good news is that, in the long run, demand for both of these products should only increase. According to one source, strong growth not only from China, but also from India, should cause coking coal demand to jump by 43% by 2050. This works out really well for Civeo Corp since coal accounts for 74% of Australia’s total exports to India. And most of that is coking coal. As another source indicated, iron ore pricing is expected to continue to weaken over the next few years. But overall volumes are forecasted to rise as well. The ramping up of Greenfield projects from major companies such as Rio Tinto Group (RIO), BHP Group (BHP), and Fortescue Metals Group (OTCQX:FSUMF) (OTCQX:FSUGY) are expected to boost Australian exports moving forward.

Takeaway

Even though the market it’s not very happy with Civeo Corp as of this moment, I cannot help but to remain optimistic about the company and its future. Trading multiples are incredibly low and, even though financial performance has worsened recently, I believe that the long-term outlook for the company is positive. Given these factors and in spite of the direction that the market has pushed shares, I cannot help but to keep the company rated a ‘buy’ for now.

Read the full article here