Arista Networks (NYSE:ANET) reported a very strong second quarter and announced guidance for the 3rd quarter, both of which were ahead of FactSet consensus. This reinforces a key tenet of my investment thesis: that the market will continue to underestimate the growth potential of this company and earnings upgrades will continue and drive value for shareholders.

I am upgrading my own forecasts for 2023, which increases my valuation to $192. While only a small premium to the current share price, investors should view this as an attractive time to buy a high quality company that is profitable and growing strongly with a view to hold it for the long term.

Company Profile

Arista Networks is a supplier of ethernet switches and routing equipment that are key components of data centers. This equipment is used by both large internet companies offering cloud services, such as Microsoft (MSFT) and Meta Platforms (META), as well as smaller businesses that offer their own cloud-hosted enterprise products.

Importantly, ANET is more than simply a “picks and shovels” enabler of the cloud revolution, as it overlays this hardware with its proprietary software via their Extensible Operating System (EOS). EOS is a data-driven, standards-based operating system that operates on the Arista hardware. It is programmable, allowing for a high level of customizability and integration with 3rd party APIs. While the hardware is world-leading, it is the EOS software that truly sets the company apart.

2Q23 Result Was Outstanding

For the June 2023 quarter, Arista reported 38.7% revenue growth over the June 2022 quarter to $1,459 million. This was 4% above the top end of the guidance range issued in May of $1,350 million to $1,400 million. It was also 6% ahead of the 1Q23 number. This was a result of strong demand in enterprise, despite moderating cloud titan spend.

Importantly, the gross margin shows signs of improvement after a year of weakness. On a GAAP basis, gross margin was 60.6%, up from 59.5% in the March quarter, but this is still behind the 63%-64% that has been reported consistently in the periods prior to the June 2022 quarter. With the supply chain bottlenecks largely in the rearview mirror and purchasing times returning to normal, this should see a gradual improvement back to these levels.

I’ll make a brief non-GAAP comment only to say that the non-GAAP gross margin of 61.3% was also slightly ahead of guidance of 61%. Given that the difference in non-GAAP to GAAP is primarily stock-based compensation, and is only a small amount relative to sales, my preference is to stick with the GAAP results.

On the back of these strong margins, net income and EPS increased substantially. On a GAAP basis, net income increased 64% to $491.2 million compared to the prior June quarter, and EPS increased 65% to $1.55. The net margin expansion was a result of operating expenses only growing by 26%, but was also thanks to $56m in Other Income, $32.2m of which was interest income, and $24.7 million of which was for the change in value of listed securities.

This slight difference between net income and EPS growth was a result of the company buying back around 219,000 shares at an average price of $137 through the quarter for a total of $30 million, which was significantly lower than the $82 million in shares bought back in the March period. Further, Arista repurchased $620 million shares in the 1H22 period, suggesting that Arista is not seeing the stock as attractively priced as it did last year when the stock was in the low $100s. This demonstrates to me excellent capital allocation ability, as the company was able to take advantage of their strong cash position to return cash to shareholders at an attractive price, while not feeling obligated to do so after the price has risen.

3Q23 Guidance Was Even Better

Arista provided guidance for the coming 3rd quarter for $1.45 billion to $1.5 billion. This is 6% ahead of the FactSet consensus estimate prior to the announcement of $1.39 billion and if achieved, this would be 25% growth on the 3Q22 sales figure. This dynamic is exactly what my investment thesis is predicated on. Consensus growth estimates tend to fade into the latter years as sell side analysts (which in aggregate determine the consensus figure) assume this growth can’t last forever. While that statement is true, a company like Arista Networks that is riding a secular tailwind such as the growth in data usage and an increasing number of use cases for artificial intelligence has a good chance to grow at high rates for longer than consensus is baking into their numbers. This leads to earnings upgrades, which drives the share price higher, which is exactly what we have seen with the 2Q23 result announcement.

Arista also provided gross and operating margin guidance for 3Q23. Non-GAAP gross margin is anticipated to rise from the 61.3% reported this quarter to 62%, which would also be an improvement from 60.3% in the 3Q22.

Further, Arista expects Non-GAAP operating margin to come in at 41%, a hair below the 41.6% reported this quarter and also behind the 41.8% reported in the 3Q22 period.

Analysis and Outlook

Including the guidance provided for 3Q23 (if achieved), in the 2023 year Arista will have produced sales growth of 54%, 39%, and 25% on the prior corresponding period. If we assume that December produces a growth rate of 25%, this will produce sales of $5,880 million, which is growth of 34.2% on 2022. To confirm this estimate, CEO Jayshree Ullal also mentioned on the conference call “we will grow in excess of 30% annually versus our prior Analyst Day forecast of 25%”. Further, per the Analyst Day presentation in November 2022, the company is targeting 20%+ annual revenue growth to 2025.

Following this to its logical extension, if net margins of 33.7% can be maintained for the next two quarters, this would produce net income of $1,963 million. This is a substantial increase on my prior forecast, which is driven by a higher revenue growth forecast and better margins, as discussed. If the net margin increases, which could be implied by the increased operating margin guidance of 41% compared to the 1H23 margin of 36.1%, this would provide further upside.

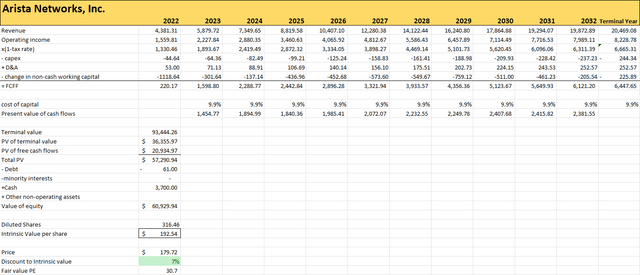

My model forecasts a 10 year revenue CAGR of 16% and assumes net margins stay at around the similar level as 2023 to date (about 34%), with a slight moderation due to a tax rate that edges towards the US corporate tax rate of 21%.

I have increased my WACC to 9.9%, as I believe the beta I was using was too low. Even though I stand by the methodology of using a peer-based beta, adjusting for differences in leverage, on reflection, a beta of 0.91 seems a little aggressive. This has been partially offset by a reduction in the equity risk premium from 5.3% to 5.0%, as per Aswath Damodaran’s calculation. My 4.0% risk free rate and 3.0% terminal growth rate remain unchanged.

Author Analysis using FactSet data

This produces an estimated fair value of $192, approximately 7% ahead of the post-result share price. This suggests a fair value P/E of 30.6x, a price investors should be willing to pay for a company that is expected to continue growing earnings quickly by reinvesting profits at high rates of return on capital. For investors that feel like they may have missed the opportunity after my last Arista article, although the share price has increased since then, the opportunity remains.

Risks to the thesis

The main risk to the thesis that I see is the growth rate. Arista is a high growth company riding secular tailwinds. The upgrades to growth this quarter have largely come from enterprise, with cloud (including AI) being good, but moderating. In the words of CEO Jayshree Ullal, the last 2 years for cloud have been “out of this world and phenomenal”, which means the company will be cycling some very tough comps. Even though at an absolute level future earnings may be robust, if they fail to beat these strong prior periods by a sufficient margin, the market is likely to get spooked and sell down the shares.

This discussion speaks to the seasonality of purchasing from the cloud titans. One can see year to year that the contribution to revenue by META and MSFT as a percentage moves around quite a lot. This is because data centers are typically a large up front build, after which the titan will take some time to grow into it. The growth is there over a multi-year period, but it may not be smooth growth from year to year.

On the 2Q23 conference call, CEO Jayshree Ullal urged investors to take a three year view of earnings rather than a single quarter or single year for this very reason. I would echo this sentiment for any investment, but it seems especially prudent for owning Arista, as the growth could potentially be lumpy, depending on cloud titan capex upgrade cycles.

Conclusion

There will undoubtedly be earnings and share price fluctuations in the future, but Arista Networks is very well placed to continue taking market share in a growing industry. Although the valuation does not imply much of a margin of safety, investors wishing to buy a quality, growing company should be willing to pay what seems like a fair price. On this basis, Arista remains an attractive buy for the long term holder.

Read the full article here