Introduction

TG Therapeutics, Inc. (NASDAQ:TGTX) develops and markets treatments for B-cell malignancies and autoimmune diseases. Their FDA-approved product, Briumvi, is a monoclonal antibody therapy for various types of adult multiple sclerosis (MS).

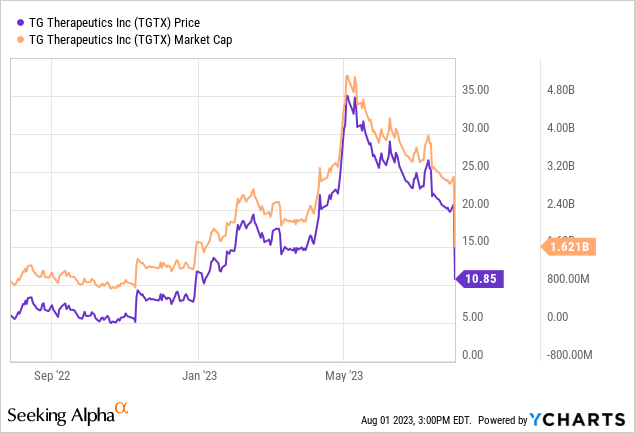

In my previous analysis, I noted the recent progress in MS treatments with Roche’s Ocrevus, a potential competitor to TG Therapeutics’ Briumvi. Both being anti-CD20 therapies, Ocrevus’ convenient administration might challenge Briumvi. The recent 15% drop in TG Therapeutics’ share price seemed overly drastic, as therapy choice in MS is multifaceted. I recommended monitoring further data from the Ocrevus trial and Briumvi’s sales. Considering the competitive dynamics in the MS market, I reaffirmed my “Sell” recommendation. Since my “Sell” recommendation, shares of TG trade ~50% lower.

Recent developments: TG Therapeutics shares fell ~45% Tuesday after missing Q2 2023 forecasts, despite strong Briumvi sales. increased R&D and SG&A expenses widened net loss to $47.6M. The company also announced a $645M deal with Neuraxpharm for Briumvi’s ex-U.S. rights.

The following article analyzes TG Therapeutics’ financial performance, recent share price drop, and a $645M deal with Neuraxpharm for Briumvi’s ex-U.S. rights, culminating in an upgrade from “Sell” to “Hold.”

Financial Performance

For the three and six months ending June 30, 2023, TG Therapeutics reported product revenue of $16.0 million and $23.8 million, largely from Briumvi sales in the U.S., compared to significantly lower revenue in 2022. R&D expenses were $28.1 million and $44.0 million, reflecting a decrease due to reduced manufacturing and trial costs. SG&A expenses rose to $30.7 million and $58.8 million, mainly from Briumvi commercialization costs. Net loss for the period was $47.6 million and $86.8 million, an improvement from 2022. Cash and equivalents stood at $144.9 million, expected to fund future operations.

Stock Evaluation

Looking at Seeking Alpha data: TG Therapeutics presents a mixed investment picture. On the positive side, the company’s EPS and sales forecasts demonstrate substantial growth, shifting to profitability in 2024 with significant subsequent growth. The strong momentum of the stock, outperforming the S&P 500 (SP500) over most time frames, and 88% upward revisions in earnings further strengthen its appeal. Additionally, there is a robust YoY revenue growth and a high gross profit margin of 89.68%.

However, the valuation of TGTX seems challenging with high P/E and EV/Sales ratios, potentially indicating overvaluation. Profitability metrics like a -170.41% return on equity and a -40.71% return on assets are concerning, reflecting underlying issues in the company’s capital efficiency. The lack of growth details in some areas, such as diluted EPS and levered free cash flow, might also be cause for caution.

At writing, the market cap stands at $1.6B, with moderate total debt of $108.43M and cash and equivalents of $144.9M.

TG Therapeutics and Neuraxpharm: European Commercialization Deal

TG Therapeutics and Neuraxpharm Group announced a commercialization agreement for Briumvi outside the U.S., Canada, and Mexico, focusing on Europe. The deal includes an upfront payment to TG Therapeutics of $140 million, $12.5 million upon the first EU country launch, and potential additional milestone payments up to $492.5 million, totaling a value of $645 million. TG will also receive tiered double-digit royalties on net product sales up to 30%. Neuraxpharm gains exclusive commercialization rights in specified territories, while TG Therapeutics retains an option to buy back the rights within two years if there’s a change in control of TG.

My Analysis & Recommendation

In my view, the recent events surrounding TG Therapeutics are indicative of a broader and more complex picture. First, let’s discuss the earnings release. The Q2 results were disappointing, and the fact that Briumvi’s revenue fell below analyst projections cannot be ignored. While the growth and positive aspects are there, the figures don’t justify previous optimism. This fact alone significantly contributed to the steep drop in TG’s stock.

Now, let’s turn to the EU deal with Neuraxpharm. The agreement, valued at $645 million, is certainly substantial, but in my eyes, it doesn’t reflect a deal for a multi-billion-dollar drug. Perhaps expectations were too high, or maybe there’s something more nuanced at play here. Either way, this deal, coupled with the earnings miss, popped the balloon of optimism that seemed to surround TG Therapeutics.

It’s essential to stress that both the earnings and the EU deal are in line with my earlier “Sell” thesis. I had previously projected no more than $500 million in peak annual revenue for Briumvi, and these recent developments only reinforce that perspective. However, I must acknowledge that the sharp drop in TG’s valuation has shifted the risk/benefit analysis somewhat. The company’s stock, which once appeared overvalued, now seems appropriately valued given the new landscape.

Therefore, while I remain cautious and recognize the challenges that TG Therapeutics must overcome, particularly with competitive dynamics in the MS market and the shadow of Roche’s Ocrevus, I am upgrading my rating from “Sell” to “Hold.” The downgrade in the valuation and the mixed investment picture mean that holding the stock might be the wise choice for now. As with any evolving situation, continued monitoring of Briumvi’s sales and the broader market will be essential. But for now, the balance of risk and reward seems to have found a more even keel.

Read the full article here