Where’s The Beef?

We have said it before, and we’ll say it again–the current “thing” in the market, whatever it may be, consistently drives a level of froth and hype around the affected companies and sectors that create blind spots for investors. Blind spots are, of course, a part of life. None of us is truly objective. But it is good in investing to acknowledge that they exist, and that one must be vigilant against them.

Some past “things: the market worked itself up into a frenzy over has been cryptocurrency (brought to an end by the collapse of FTX) and Web3 (laid low by the disaster of the Metaverse). While these things of course still exist, their former shine (and, more importantly, their esteem with institutional investors) is nowhere near what it once was.

Today, the current thing is artificial intelligence, or AI. Few companies have capitalized on this more successfully than Palantir Technologies Inc. (NYSE:PLTR), the data visualization company that works with companies large and small as well as regional and national governments.

The company, with 20 mentions of AI on its latest conference call, has surged this year after flailing in the single-digit stock price doldrums.

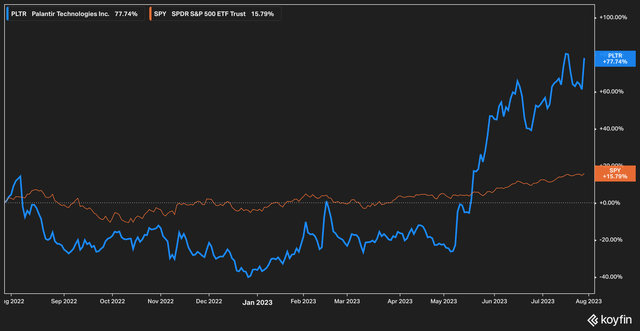

Koyfin

Over the last twelve months, Palantir has taken investors for quite a ride–falling almost 40% before rocketing upward in the last three months or so by more than 100% from its lows.

But can the stock sustain this rally? With earnings around the corner (currently set for release post-market on August 7th), we want to explore what has happened with Palantir and what we think investors and Wall Street will need to see in order to be convinced.

Sales Growth

One of the questions that has dogged Palantir recently is a deceleration of sales. This is critically important, as Palantir is generally considered a growth stock–a category whose primary attraction is the idea that future sales (and cash flows) justify the price and valuation that investors pay for today.

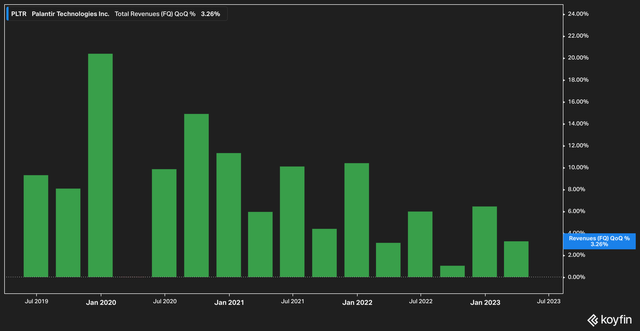

Koyfin

Since Palantir’s debut in the public markets, revenue growth (quarter over quarter growth is pictured above) has sloped downward to just 3.26% in the last reporting period. Year-over-year growth is a bit more impressive at 17%, but even this metric is trending downward. For context, we emphasize quarter over quarter versus year over year for Palantir due to its limited history as a public company.

In order to keep the growth story alive, Palantir will need to post revenue growth that gets investors excited.

The story, however, goes a little bit deeper. To pull things back, Palantir posted $1.9 billion In sales revenue in 2022. In their latest 10Q filing for the first quarter 2023 (page 10), Palantir reported $936 million in remaining performance obligations [RPO]:

“of which the Company expects to recognize approximately 57% as revenue over the next 12 months, 36% as revenue over the subsequent 13 to 36 months, and the remainder thereafter.”

From some back of the napkin math to account for the removal of the first quarter 2024 from the RPO figure, we estimate that the company has approximately $400 million left to recognize from RPOs in 2023–a nice boost.

Investors, however, should pay close attention to this by accounting for revenue included in RPOs and backing the figure out to calculate the true growth of revenues.

Further, Palantir will also need to show investors that it has replenished its RPOs. Knowing that more than 50% of outstanding obligations to customers are expected to be complete within 12 months should cause followers of the company to examine whether or not this pipeline has been sufficiently re-filled, as this would be important for long-term, sustainable growth.

AI (Of Course)

Palantir’s Artificial Intelligence Platform (known as AIP) was announced on April 7th, 2023, in a letter posted online from CEO Alex Karp. The announcement stated that AIP would be a fourth major platform for the company and stand alone or integrated as an offering alongside its other products. The letter stated that the product “will be available to an initial set of strategic partners in the coming weeks and no later than the end of May.”

Palantir executives discussed AIP and its potential to be a game-changer for the company on the first quarter conference call with Chief Revenue and Chief Legal Officer Ryan Taylor noting that “[w]e’re already seeing unprecedented demand for AIP, and we are reorganizing our efforts aggressively to capitalize on the interest.

News of AIP was received well by investors. After all, AI is (in our opinion) the current ‘thing’ that can crowds of investors to the market. However, a high demand for a product does not mean that sales of the product have been made, and there are a few key things that we will want to know regarding AIP.

- What will the capital expenditures for AIP be? The platform will presumably be expensive and require a build out or expansion of Palantir’s AI capability, which implies the need for more chips, data center space, et cetera. And,

- How quickly will Palantir turn interest in the product into actual sales?

These two questions are, to us, critical for the Palantir story. First, it may not be a given that Palantir would be able to expand to the desired capacity to accommodate new customers for AIP given the fact that existing data centers are running into issues with space, cooling capacity, and chip availability for the energy-heavy requirements of AI.

For us, concrete answers regarding how interest turns into sales, at what cost, and how quickly are of the utmost importance.

The Bottom Line

Palantir Technologies Inc. stock has rallied this year, largely in part due to interest in the company’s AI capabilities. While there are many other issues that we’re sure investors would like to see addressed (such as stock based compensation, investments in JVs, et cetera), we want to see how well Palantir refills the pipeline, and if management will deliver data versus hype regarding the company’s AI prospects for the future.

Read the full article here