Thesis

Recently, C3.ai (NYSE:AI) has faced volatility in stock prices, prompting uncertainty among investors. Concerns about the company’s ability to achieve sustained profitability in the face of its competitors make predicting its future a complex task. However, C3.ai’s revenue growth, expanding customer base, and good management provide a glimmer of hope for their long-term prospects. With that in mind, investors should be incredibly attentive to all the factors that are involved when gauging the prospects of C3.ai, which this article attempts to cover.

Company Overview

C3.ai is a leading artificial intelligence software company that provides a comprehensive platform for building and deploying AI applications. They were founded in 2015 by Thomas Siebel, a long-time player in the software and AI fields. The C3.ai platform is used by companies of all sizes, and in all industries, to solve a wide range of needs, including fraud detection, customer service optimization, and predictive maintenance.

Strong Team of Industry Giants

C3.ai faces quite stiff competition from established players in the software industry, including large enterprise vendors like Microsoft, Amazon, and IBM, all of which have launched AI software solutions. Emerging competitors, like Palantir and Nvidia, pose competition as well.

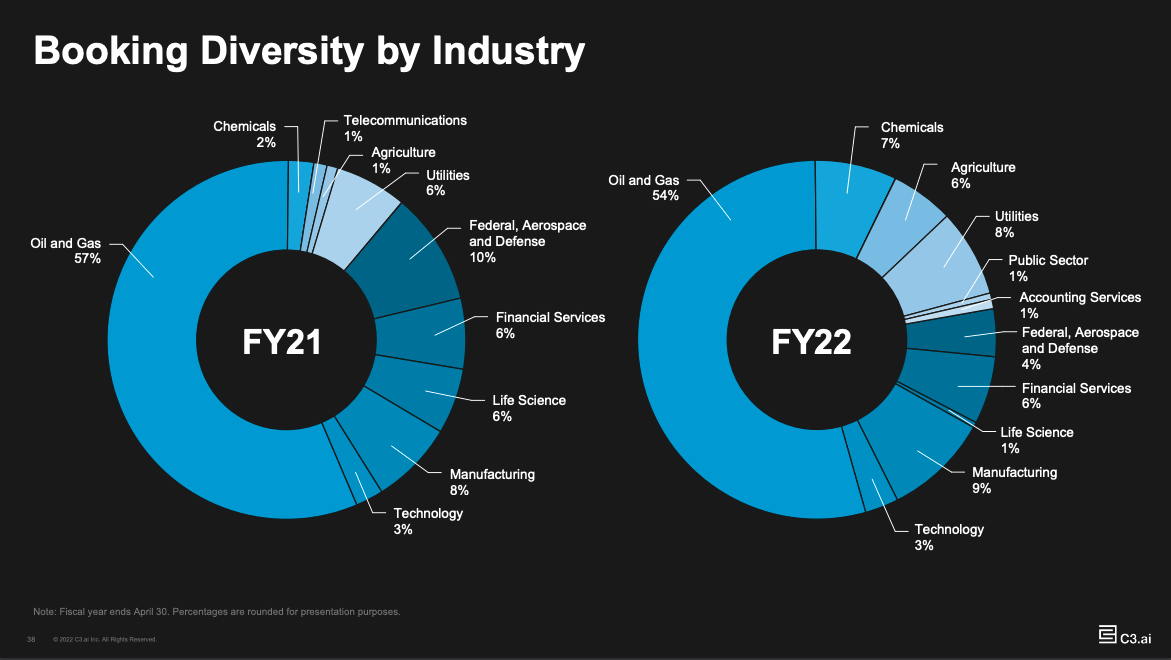

C3.ai differentiates itself from its competitors through its domain-specific AI platform, which serves a wide range of industries and was built to be easily integrated with other product offerings and cloud-based platforms. This demonstrates a large willingness to pursue industry partnerships with major players like Google, Amazon, and Microsoft. Integrating their product offerings into established cloud platforms increases their chance for longevity while they concurrently form a concrete customer base in industries like oil/gas, federal defense, and healthcare. These types of relationships already comprised >60% of their revenue in the last year. These differences can change the trajectory of their growth by increasing their cost optimization and helping them reach their target audience.

C3.ai 10-Q

Finding Profitability and Strengthening Relationships

C3.ai’s growth will revolve around its ability to maintain and grow its relationship with larger corporations to aid in its ability to serve a wider user base. Their growth will be largely contingent on their ability to maintain a lower take rate than the comparable cost of their partners internally developing similar product offerings for their clients. As a result, reinvestment into cost optimization and new technologies will be the driving factors to becoming profitable as their AI presence grows. This should translate into bigger and more secure contract renegotiations with their largest customers, like EY, PWC, Raytheon Technologies, and the U.S. Air Force.

While C3.ai’s revenue traditionally stemmed from subscription payments, they have recently transitioned to a consumption-based pricing model. This restructure is meant to expedite and drive partnership formation, which tends to take longer to negotiate in an all-encasing subscription model, while matching costs to potential revenue. Furthermore, this recent transition prevents alienation by allowing clients to control utilization for specific products that serve them and their bottom line the best, this is especially relevant when integrating with Google Cloud and Amazon Web Services’ extensive customer base. Continuing steps to strengthen their relationships and lessen costs will bring them closer to profitability, giving investors a reason for their high valuation.

C3.ai 10-Q

Financials

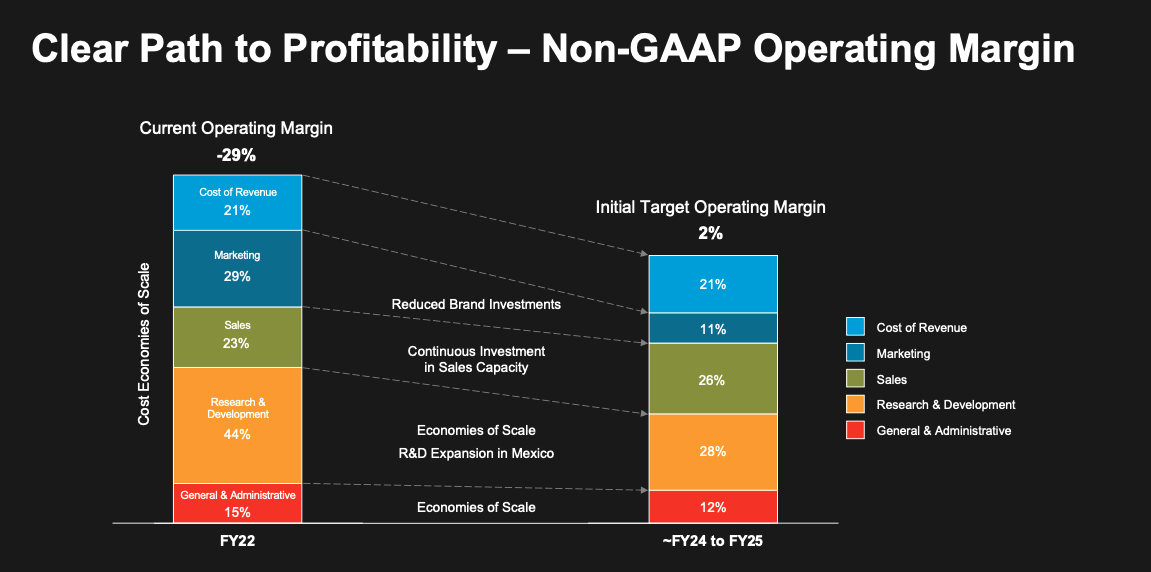

C3.ai ended their fiscal year in April 2023, reporting YoY revenue at ~$266 million, compared to 2022’s ~$252 million. This was only a mere 6% increase from the year prior with as low as a 1% increase in Q4 of last fiscal year. On top of that, their profit didn’t match said growth as their operating expenses grew by as much as ~21% in the last year. These costs were attributed to the restructuring of the platform’s internal pricing model to include a consumption monitor, but also to an increase in hiring efforts and research & design expenses. Having entered into 43 customer agreements in the last quarter, 59% more than the year prior, they have decided to concurrently reinvest in their staffing capabilities so that clients’ needs are met with satisfaction.

While their revenue is expected to see 15% growth during the current fiscal year, driving higher profits from their larger user base, I believe this number would be much higher if they were able to optimize costs and resources to lower the expenditure of rehauling their pricing model. However, these sunken costs aren’t recurring and the liabilities that they will face on their income statement likely won’t have as large of an effect on their profitability in the coming years.

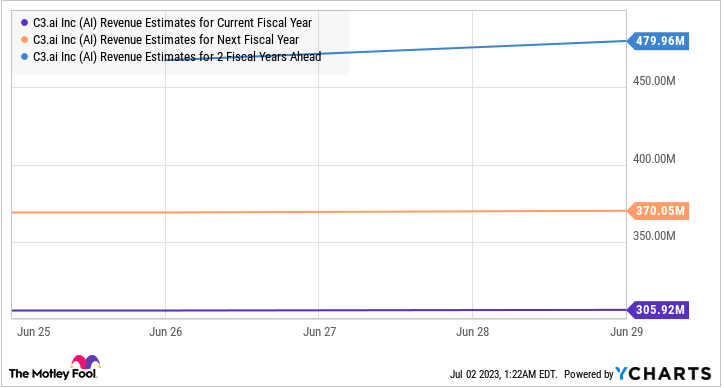

Furthermore, their industry partnerships with Amazon, Microsoft, and Google place C3.ai in a unique position of being able to operate in overlapping market share with bigger and more established companies while also pursuing individual clients. In an appreciating global industry that is expected to be worth $1.8 trillion by 2030, its ability to capitalize on this growth looks promising. As a result, I am cautiously optimistic about their ability to gain profitability, and in turn higher levels of investor confidence, in the coming quarters. I expect their growth to translate into annual revenue reporting around ~$300 million for 2023, after which they will likely mirror the compound annual growth rate (CAGR) of the AI industry at ~37% more closely.

The Motley Fool

Valuation

The AI industry as a whole has experienced a massive surge of investors over the last few years. However, this becomes problematic when companies in the industry become overvalued. This is notable in the surge in the share price for C3.ai, tripling in the first half of the year, which has failed to translate into proportional revenue gains. With a price-to-sales ratio of ~16x, investors pay a premium for their shares. This value is similar to other AI companies, such as Palantir, which has a P/S of around ~16x as well. The difference in profitability, however, is noticeable as C3.ai’s gross profit dropped YoY and their operating expenses sizeably increased. Palantir, on the other hand, has grown its profit by almost 20% YoY. Coupled with their high valuation, the lack of positive free cash flows over the last few years makes predicting share price a complex task. A discounted cash flows model (DCF) and P/E comparison are both unsuitable for a company in this financial position.

As a result, I chose to compare the enterprise value revenue ratio (TEV/revenue) of C3.ai and its competitors. With an enterprise value of $3.8 billion and annual revenue for 2022 measuring ~$267 million, this ratio comes in at 14.2x, much lower than this ratio for 2021 of 44.8x and before. This decreasing ratio can be indicative of a company that is overvalued, especially when factoring in how C3.ai’s decreased profitability likely resulted from its increase in expenditures over the last year. This fails to become relevant, however, when comparing the TEV/Revenue of their competitors. Palantir, for example, came in at 12.83x and IBM at 4.74x. This further indicates that C3.ai is likely overvalued and trading at a price that isn’t currently sustainable. Investors that are currently invested would benefit from continuing to hold to capitalize on long-term growth, while prospective investors might want to wait for further developments in their profitability.

Risks

C3.ai faces several risks which are mostly contained to their ability to maintain non-competitive relationships with their enterprise partners while being able to grow their profits and market share. Without these relationships their revenue growth prospects are fairly poor, so offering low-cost integration for new products they have developed or acquired is key. This becomes all the more difficult when the development of new products often causes operating costs to increase, which can’t be fully absorbed by their consumers or partners if they don’t want to lose the chance to renew their partnerships.

Additionally, continued failure to produce positive cash flows limits their potential to raise additional funds for reinvestment, a vital step of their business plan if they intend on meeting their valuation and maintaining market share. The industry is extremely competitive and there are several well-funded companies that offer similar, domain-specific product offerings to their clientele. Failing to innovate and integrate the most recent trends in AI technology will surely cause a decline in existing or potential market share, further damaging their revenue capabilities. If investors become disenfranchised by the brand’s ability to generate positive cash flows, there is a good chance they will invest their money elsewhere.

Conclusion

The future of C3.ai is met with a mix of optimism and caution. While they have shown revenue growth and an increase in client relationships over the last few years, concerns about their fundamentals continue to worry investors. With a unique business model centered around domain-specific product offerings, consumption billing, and industry collaboration, there is still a chance for positive growth prospects in the long term. The next few months of C3.ai’s performance will be crucial in determining whether C3.ai can beat out its competition and become one of the key players in the industry.

Read the full article here