Summary

PTC Inc. (NASDAQ:PTC) technology is primarily used by discrete manufacturers to design, operate, and maintain complex products. PTC’s technology is also used to connect products to the Internet for purposes of capturing and analyzing information.

I am recommending a hold rating as I believe the valuation has reflected the fair value of the business. However, there is potential for an upside surprise if the new CEO manages to drive shrewd execution to manage costs while growing, driving margin expansion above my expectations.

Financials / Valuation

PTC’s reported results last week. EPS met expectations, while FCF exceeded them. Constant currency ARR exceeded projections, with organic ARR increasing by 14% year over year, though growth is anticipated to slow in the coming quarters. I’d like to point out that the net timing benefit this quarter is likely responsible for the upward revision to ARR guidance for the full year; this revision does not significantly alter expectations for performance in the remaining quarters. Due to a $5 million net timing benefit, management raised the midpoint of their ARR forecast from $1.925 billion to $1.95 billion to $1.935 billion. In addition, while management is investing more into the business in 2H23, it has increased its FCF guidance from $580 million to $585 million (a $5 million increase).

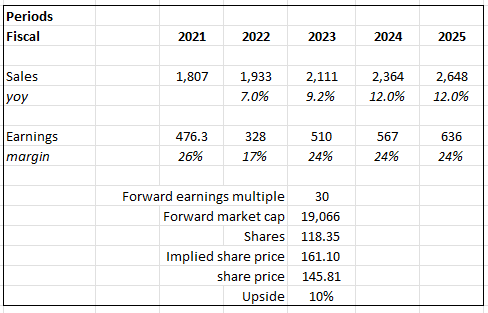

Based on my view of the business and 2Q23 results, PTC should grow in the high single digits (9% in FY23) and the low teens in FY24 and FY25. My assumed growth for the next 2 years is based on management’s confident message that FY24 is going to be similar to FY23. As for margins, I will hold my margins flat for the next 2 years as I expect PTC to reinvest in the business to drive growth.

I compared PTC to other software peers, such as:

- Synopsys (SNPS): 38x forward PE and expected to grow revenue by >30% over the next 2 years

- Autodesk (ADSK): 27x forward PE and expected to grow revenue by >30% over the next 2 years

- Ansys (ANSS): 37x forward PE and expected to grow revenue by >20% over the next 2 years

- Dassault Systemes (OTCPK:DASTY): 31x forward PE and expected to grow revenue by >20% over the next 2 years

Given that PTC is currently trading at 30x forward PE and expected to grow ~20% over the next 2 years, I think it is trading in a similar range. Valuation should be supported as it continues to grow 10+% a year.

With these assumptions, I have a price target of $161, suggesting that the stock is fairly valued. The potential upside from here would be an upside margin surprise in the coming quarters.

Based on author’s own math

Comments

If you just look at the headlines, I think the results are fine. Management increased its guidance for ARR and FCF, and EPS came in line. The stock market should continue to react favorably to the revised guidance, even though it was primarily driven by a timing benefit.

PTC has the right ingredients to thrive in this macro environment, so I anticipate this momentum will last for the foreseeable future. In particular, the recurring business model dampens the macro effect for the time being. Additionally helpful to the consensus’s model development was management’s FY24 outlook commentary. The outlook for FY24, according to management, is similar to that of FY23, a year in which they projected growth of 10-14% but ultimately achieved organic growth of 13%.

However, despite flourishing operations in Europe, aerospace/defense, and medical devices, SMB, and China in particular, remain a significant obstacle. The decision by management to remove all booking information and guides is not helpful as I believe it forces the market to take a more conservative approach, just to be on the safe side.

Finally, a change in the CEO position was announced, which was a bit of a bummer given the outgoing CEO’s crucial role in developing the successful brand that exists today. This is not to say that the incoming CEO is lacking in any way; in fact, judging by his bio, he has experience in operations, finance, and mergers and acquisitions. In my opinion, someone who has risen to the level of top management from this background should have excellent execution skills, an understanding of unit economics, and the ability to extract synergies and drive growth. Which, in the context of the P&L, is a person who thinks about margin direction and FCF creation. I am curious to see how the new CEO will promote growth in both margin and organic traffic.

I have high hopes for FY24 results because management has provided effective guidance of 12% organic growth. PTC also stated that they expect to meet or exceed their FY24 FCF target of $700-750 million, which is in line with the $700 million market estimate as of today. Overall, I see PTC’s subscription business model and low churn rates holding up well despite the difficult macro environment.

Risk & conclusion

I think the risk to the business and stock momentum is how good the new CEO is. As each transition carries a risk of cultural or operational differences, it might cause a drag on near-term performance if things do not gel well. In conclusion, I recommend a hold rating for PTC Inc. as its valuation appears to have already factored in the fair value of the business. The company’s financials and valuation indicators suggest steady growth, with potential for an upside surprise if the new CEO effectively manages costs and drives margin expansion. Comparing PTC to its software peers, it seems to be trading in a similar range, and its growth prospects should support its valuation.

Read the full article here