Investment thesis

Monolithic Power Systems, Inc. (NASDAQ:MPWR) has been one of the hottest stocks of the last decade, with a cumulative return above 1800%. The company has demonstrated impressive financial performance over the past decade and is well-positioned to sustain solid revenue growth and profitability metrics expansion over the next decade. The balance sheet is also strong, meaning MPWR has the resources to invest in various growth opportunities.

But the stock looks way overvalued, according to my valuation analysis. That said, I assign the stock a “Hold” rating and will look at how the nearest couple of quarters will unfold.

Company information

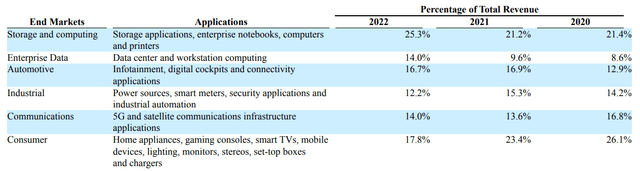

Monolithic Power Systems is a fabless company that provides high-performance, semiconductor-based power electronic solutions. The company possesses innovative proprietary semiconductor processes, system integration, and packaging technologies. The company focuses on multiple end markets, and revenue allocation between streams by end markets is presented below.

MPWR’s latest 10-K report

The company’s fiscal year ends on December 31. According to the company’s latest 10-K report, 86% of the total revenue was from customers in Asia in FY 2022.

Financials

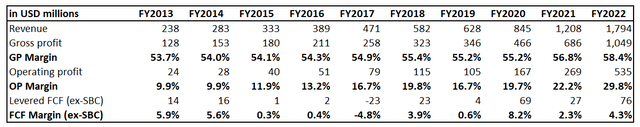

The company’s financial performance over the last decade has been solid, with revenue compounding at 25% yearly. Given the timeframe, the gross margin expanded insignificantly from 53.7% to 58.4%. But the operating margin expansion was stellar, from below 10% to almost 30%. Despite the stellar operating margin, the free cash flow [FCF] ex-stock-based compensation [ex-SBC] looks low at mid-single digits.

Author’s calculations

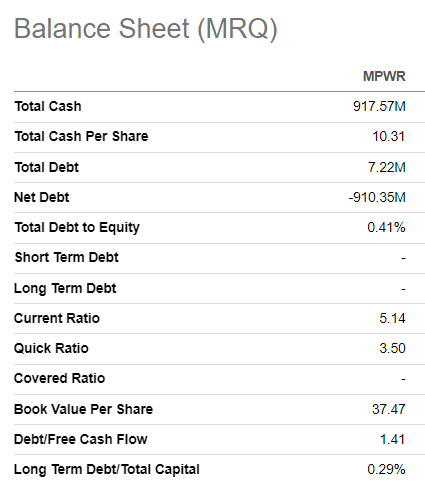

I like that the management reinvests a substantial portion of revenue in innovation. Over the past decade, the R&D to revenue ratio has been consistently above 10%, while the SG&A to revenue ratio shrank as the business scaled up. That said, the management has effectively driven the top line growth with fewer resources spent. Solid profitability metrics enabled the company to implement a shareholder-friendly capital allocation approach with consistent dividend payouts, though the current forward yield below 1% is not attractive. The company’s balance sheet looks solid, with a substantial net cash position and almost no debt. Liquidity metrics are also in excellent shape.

Seeking Alpha

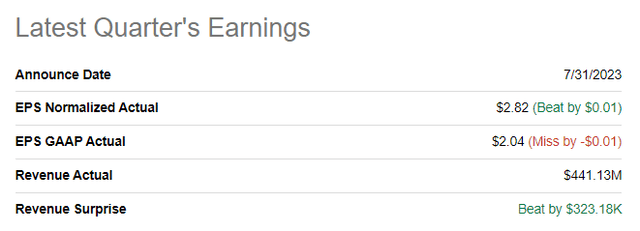

The latest quarterly earnings were released on July 31. MPWR slightly topped revenue and adjusted EPS consensus estimates. Revenue declined 4% YoY due to decreased data center and consumer sales. On the other hand, automotive sales demonstrated solid growth, as well as notebooks. The gross margin shrank YoY from 58.8% to 56.1%, mainly due to lower factory utilization amid softening end-markets demand.

Seeking Alpha

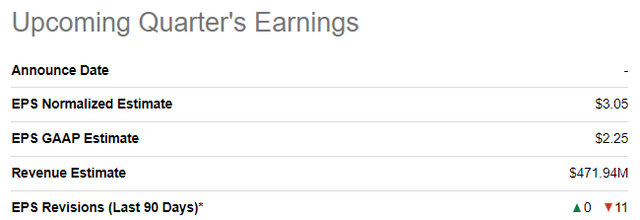

The upcoming quarter’s earnings date is not scheduled yet, but we have consensus estimates forecasting quarterly revenue at $472 million, which is about 5% lower YoY. The adjusted EPS is expected to follow the top line and shrink from $3.53 to $3.05. I expect the next few quarters to be challenging for the company due to the high-interest rates, but MPWR’s balance sheet is strong enough to weather the storm. I expect the financial performance to return to its solid revenue growth and profitability improvement path in early FY 2024 as monetary policies across the developed world are expected to pivot.

Seeking Alpha

It is essential to understand that the current headwinds are temporary and not secular. Secular trends favor the semiconductor industry and chipmakers, and MPWR is well-positioned to benefit from them. The company has a solid balance sheet and wide profitability metrics, enabling it to invest heavily in growth organically or via M&A. The company has also invested substantial funds in R&D over the past decade to build cutting-edge technologies and differentiate itself from competitors. I also like that the company’s end-market portfolio is well-diversified, and the near-term drawdown in revenue growth pace does not look deep, considering the scale of challenges businesses face amid the current uncertainty level.

It is also crucial to mention that the company is expected to benefit from the AI boom. For example, in May, Barron’s called MPWR one of the primary beneficiaries of the secular opportunities provided in AI.

Valuation

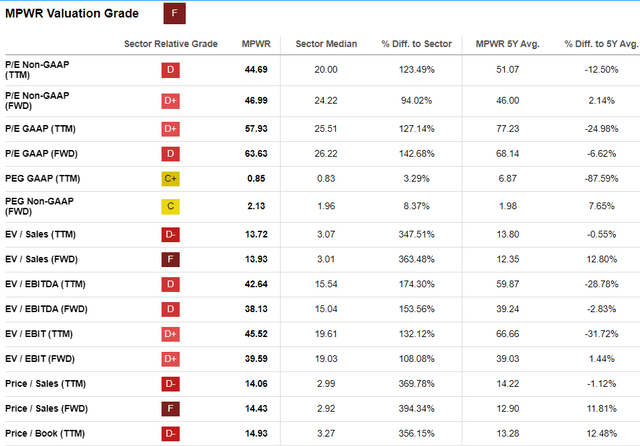

The stock rallied more than 63% year-to-date, significantly outperforming the broad U.S. stock market. Seeking Alpha Quant assigns the stock the lowest possible “F” valuation grade, which is unsurprising when you look at how valuation multiples compared to the sector median. On the other hand, looking at the past five-year averages, we can see that current multiples are mostly in line with historical levels.

Seeking Alpha

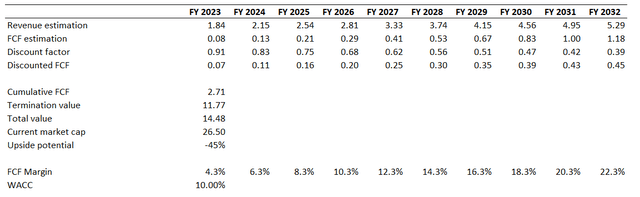

Let me proceed with the discounted cash flow [DCF] approach to get more evidence about the valuation fairness. I use a 10% WACC for all U.S.-based semiconductor growth companies; MPWR is no exception. I have earnings consensus estimates for the top line available for the next decade, projecting a 12% CAGR. I take FY 2022’s ex-SBC of 4.3% for the FCF margin and expect it to expand by two percentage points yearly as the business scales up. Please note that the FCF expansion rate is quite aggressive.

Author’s calculations

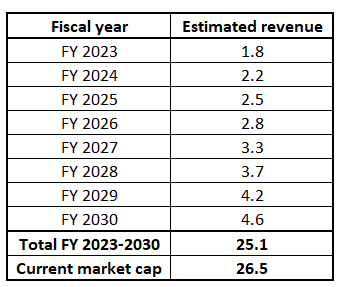

As you see, the DCF outcomes suggest that the stock is about two times overvalued, with a fair capitalization of MPWR projected below $15 billion. The company’s net cash position of above $900 million will not help much to make the current valuation look better. It is also interesting to mention that the company’s current market cap of $26.5 billion is higher than the cumulative revenue expected by consensus to be earned between FY 2023 and 2030. That said, the valuation looks ridiculously high.

Compiled by the author based on consensus estimates

Risks to consider

As a growth company, MPWR faces a significant risk to underperform high expectations priced into the current market capitalization. If MPWR fails to deliver the expected revenue growth or profitability metrics improvement, this will highly likely lead to investors’ disappointment and the stock sell-off in the near term. That said, potential investors should be tolerant to a potential massive short-term volatility and have willing to hold the stock for multiple years.

As I have mentioned above, about 86% of the total sales are generated from customers from Asia. This is a great geographic concentration risk. It is also important to remember that there are inherent risks in doing business in Asia and especially in China. The U.S. and China had difficult trade relationships in recent years, and any adverse changes to regulations and rules might disrupt MPWR’s operations.

Having the lion’s part of sales generated outside the U.S. also means the company faces significant foreign exchange risks. The fluctuations in the value of U.S. Dollar relative to other currencies not only affect the company’s earnings from foreign exchange gains and losses perspective. Fluctuations in foreign exchange rates also significantly affect the price competitiveness of MPWR’s products.

Bottom line

To sum up, Monolithic Power Systems, Inc. stock is a “Hold.” I like the company’s solid financial performance, and the balance sheet is strong enough to ensure business sustainability amid the current challenging macro environment. The company also is highly likely to benefit from the AI boom, and the management strives to build long-term value for investors by heavily investing in innovation.

But the Monolithic Power Systems, Inc. valuation looks too generous for me. I believe there will be much more attractive entry opportunities given the expected weakness in earnings in the next couple of quarters.

Read the full article here