Introduction

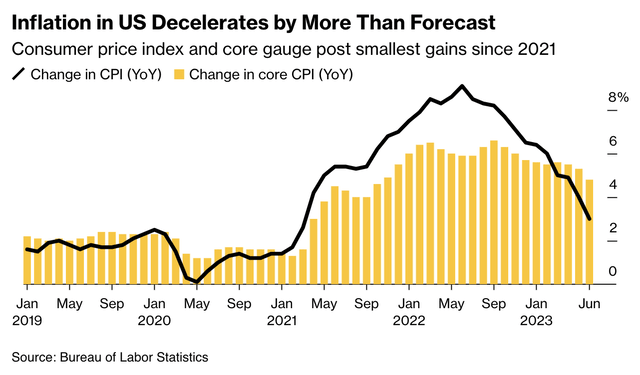

I’m in the camp of investors who believe that inflation is sticky. While we’re obviously in disinflation (do not confuse this with deflation) after inflation almost reached double digits during the summer of 2022, I do not expect inflation to settle close to the Fed’s target of 2%.

Bloomberg

A big part of my thesis is the tricky supply situation in global commodities like oil and copper.

I’ve written countless articles on the dire supply growth situation of oil and gas, which is why I have more than 17% exposure in this industry.

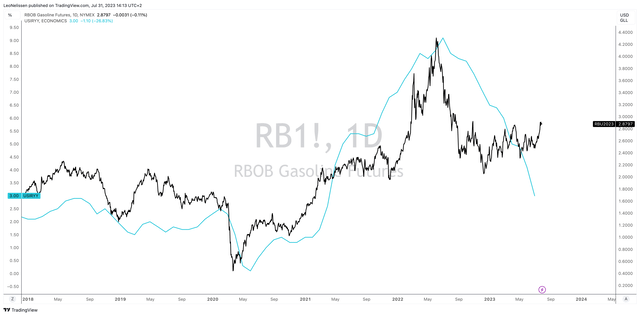

So far, it looks like oil prices are hinting at a bottom in CPI growth – at least when looking at the correlation between RBOB gasoline futures and year-on-year CPI growth in the chart below.

TradingView (RBOB Gasoline, US CPI Y/Y)

Another part of my thesis is supply growth in the mining industry.

Especially copper and related metals that are major drivers of the energy transition are in short supply, which will likely be amplified the moment global economic growth expectations bottom.

This brings me to Freeport-McMoRan (NYSE:FCX), the star of this article, with a $63 billion market cap.

In this article, we’ll dive into its fundamentals and use its comments to get a better picture of the state of its industry.

So, let’s get to it!

What Recession? Commodities Seem Fine

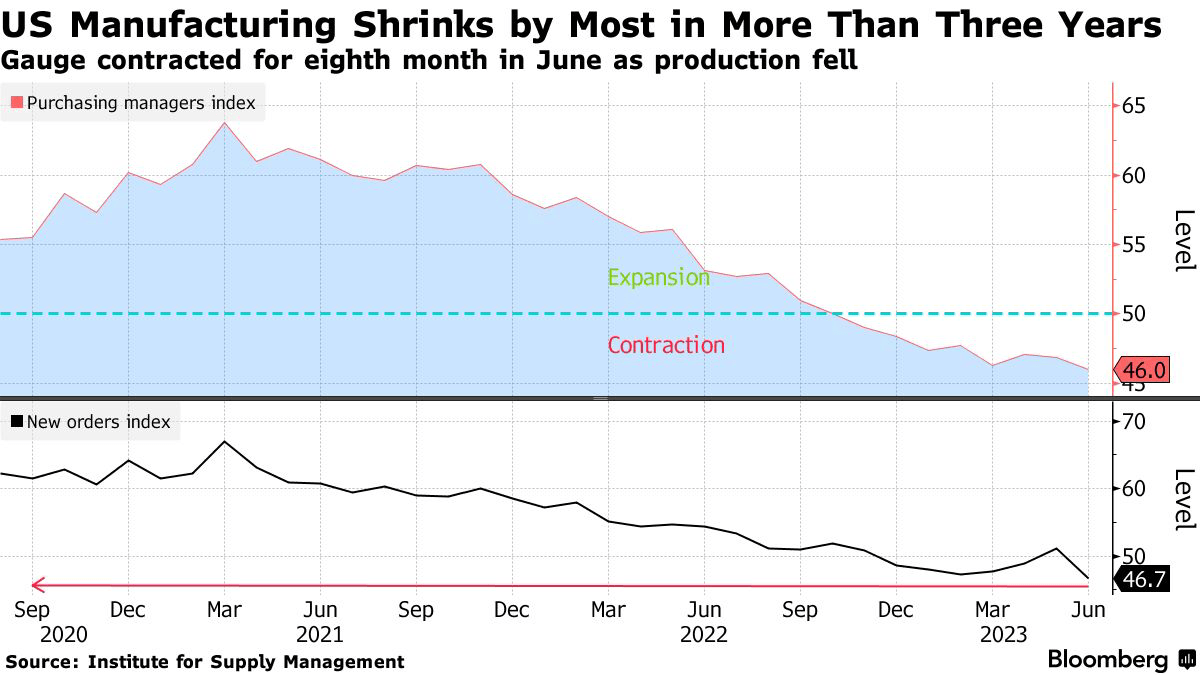

The global economy is not in great shape. China is struggling and in need of more stimulus. Europe is dealing with significant growth slowing and de-industrialization, and even the US is dealing with a manufacturing PMI below the neutral line at 50.

Bloomberg

Nonetheless, looking at the charts below, we see that both oil and copper are doing just fine. Despite trading below their 52-week highs, both commodities are way above their lows.

I often say that if the supply situation were different, oil would likely be trading in the $60s range. I’m not sure where copper would trade as it’s a different industry, but it sure wouldn’t be close to $4.

Google Finance (NYMEX Crude, COMEX Copper)

During its recent earnings call on July 20, Freeport elaborated on supply issues.

CEO Adkerson emphasized that despite concerns about a global economic slowdown and issues in China, the fundamentals of the global copper market remained positive.

The expansion of electrification due to ongoing advances in alternative energy, electric vehicles, connectivity, and supporting infrastructure contributes to the strong demand for copper.

This is an issue I have discussed in a number of articles since 2020, as I believe that the energy transition is not possible given current supply/demand developments.

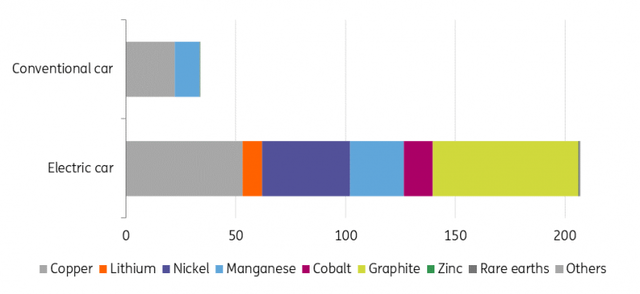

Looking at ING/IEA numbers, we see that energy transition technologies like electric cars require much more copper than conventional cars/technologies.

International Energy Agency (Via ING)

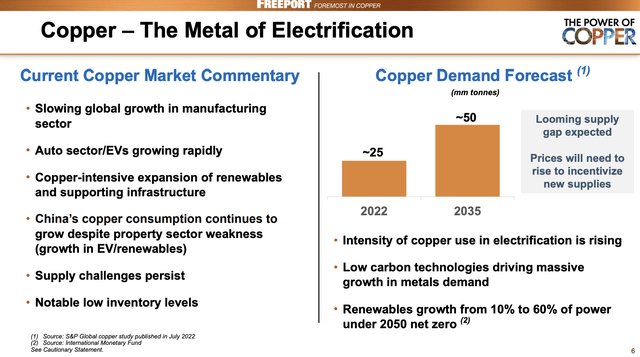

Using S&P Global numbers, Freeport sees a scenario where copper demand is set to double between 2022 and 2025, driven by strong growth in renewables and strong growth in emerging markets/China.

Freeport-McMoRan

While cyclical demand is slow, secular demand is rising and meeting another problem: subdued supply growth.

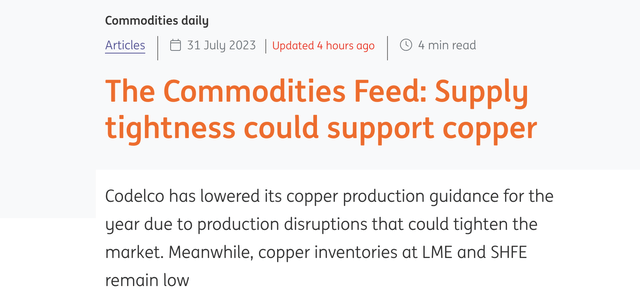

Freeport CEO Adkerson also pointed out that despite worries about the global economy and China, global copper inventories remained remarkably low.

He emphasized that the current demand for copper is much stronger than indicated by headline economic data.

According to him, market experts have differing views on the short-term outlook for the economy and copper prices, but there is a growing positive consensus on the medium and longer term.

The basis for this optimism lies in the projected demand for copper growing faster than supply development, which was also confirmed by a recent report from ING.

ING Think

Also, according to this report, buyers are returning.

Lastly, the latest CFTC data shows that speculators increased their bullish bets in COMEX copper by 2,803 lots for a second consecutive week over the last reporting week, leaving them with a net long position of 13,502 lots as of last Tuesday.

Freeport-McMoRan Is In A Terrific Position

During the aforementioned earnings call, Freeport expressed why it is well-positioned to benefit from the long-term tailwinds, in addition to being one of the biggest copper miners globally.

For starters, FCX has a strong basis of current production capabilities and room to expand production. While this may be a bit obvious, the company doesn’t have the risks that come with investing in junior miners – it also lacks some of the upside potential that some of these players have.

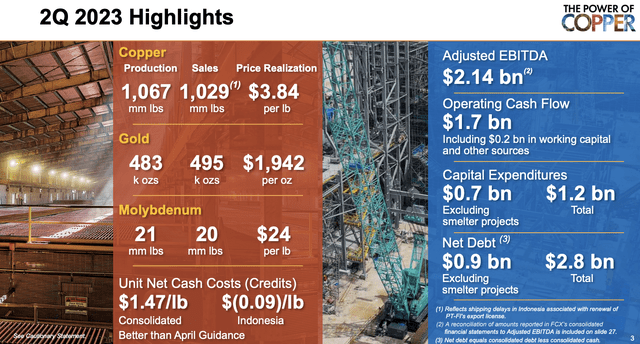

In the second quarter, FCX produced nearly 1.1 billion pounds of copper and approximately 500,000 ounces of gold.

Freeport-McMoRan

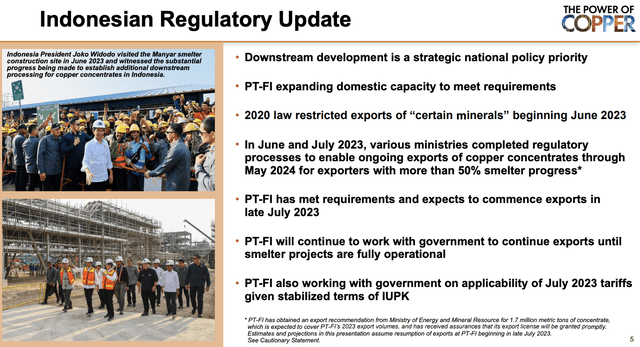

Copper sales were slightly below guidance due to administrative delays in obtaining PT-FI’s export license approval. However, PT-FI is expected to receive approval soon.

These issues in Indonesia are a bump in the road instead of an obstacle that is likely to impact future growth.

Freeport-McMoRan

Furthermore, Indonesia has passed regulations enabling ongoing exports of copper concentrates through May 2024 for exporters with over 50% smelter progress (FCX is over 70%).

However, new regulations increase export duties for certain products, including copper concentrates. FCX is engaged in discussions with the government to review the impact of these duties.

Luckily, production impacts on FCX’s operations from shipping delays have been limited, and the company is working to reduce inventories over the next few months.

Adding to that, the good news is that unit net cash costs during the quarter were better than guidance, averaging $1.47 per pound.

With average copper prices realized at $3.84 per pound, FCX generated strong margins and EBITDA of $2.14 billion. Operating cash flows were $1.7 billion, substantially exceeding mining capital expenditures.

I’m bringing this up because FCX has tremendous earnings potential – especially if copper prices rally.

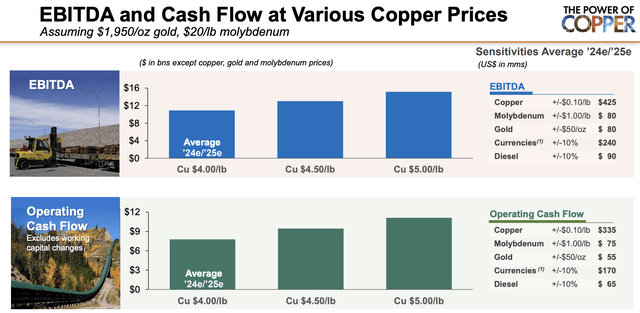

As the overview below shows, FCX modeled its EBITDA and cash flow projections at various copper prices, ranging from $4 to $5 per pound, with gold and molybdenum prices held flat.

Freeport-McMoRan

The result is that EBITDA would range from about $11 to $15 billion per year, with operating cash flows ranging from nearly $8 to $11 billion per year.

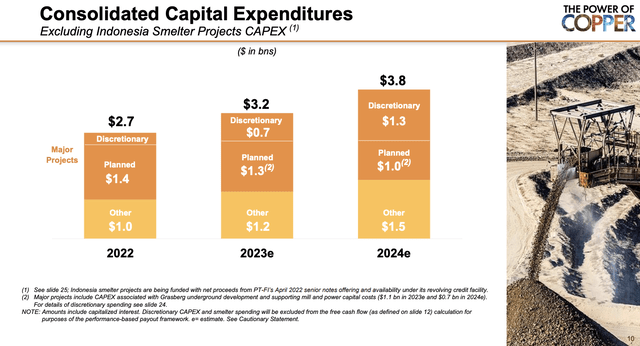

Having said that, the company is in a good spot to grow without having to meaningfully accelerate investments in its business – at least compared to prior guidance.

Freeport-McMoRan

In its 2Q23 earning call, FCX made clear that its forecast for capital expenditures in 2023 and 2024 remains similar, with a 3% increase primarily due to updated estimates for projects at Grasberg, where it reached the highest mill rates in over a decade in the second quarter.

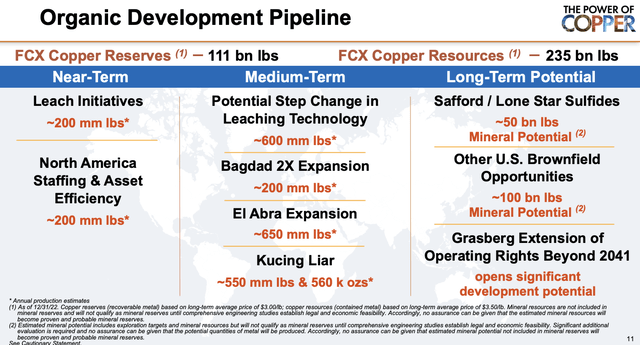

Essentially, the company is pursuing a brownfield strategy to grow its copper resources within its portfolio.

Freeport-McMoRan

Near-term growth options include achieving initial leach targets in the US, expanding leach opportunities beyond 200 million pounds per year, and advancing projects at Bagdad, El Abra, and Kucing Liar.

FCX sees the potential to expand the initial 200 million pounds to 800 million pounds per year over the next three to five years.

What About Shareholders?

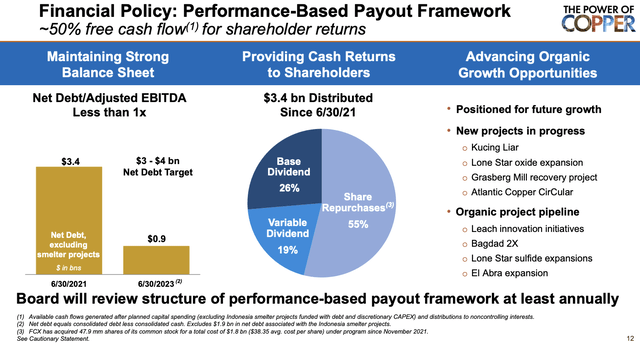

Shareholders are in a great place, as FCX maintains a strong balance sheet with solid credit metrics and flexibility to execute the aforementioned projects.

Since 2021, FCX has reduced net debt from $3.4 billion to less than $1.0 billion, which is well below its target and less than 1x EBITDA.

Hence, the company is able to distribute cash without having to prioritize debtholders over shareholders, which is what it has done.

Since June 30, 2021, the company has distributed over $3 billion to shareholders through dividends and share purchases.

Freeport-McMoRan

- 55% of this consisted of buybacks.

- The base dividend accounted for 26% of total distributions.

- Variable dividends were used to sweeten the deal.

The base yield is currently 1.3%, which isn’t something to write home about.

However, the company is in a good spot to boost free cash flow to $5.4 billion in 2024, which would imply an 8.6% free cash flow yield.

Given the company’s healthy balance sheet and the fact that capital expenditure expectations are already included in free cash flow (free cash flow is operating cash flow minus CapEx), we can assume that FCX will boost the dividend and continue aggressive buybacks potentially accompanied by variable dividends if the copper bull case unfolds as expected.

It also helps the valuation, as the company is trading at just 11.6x next year’s expected free cash flow. That’s without incorporating the high probability of further rising copper prices.

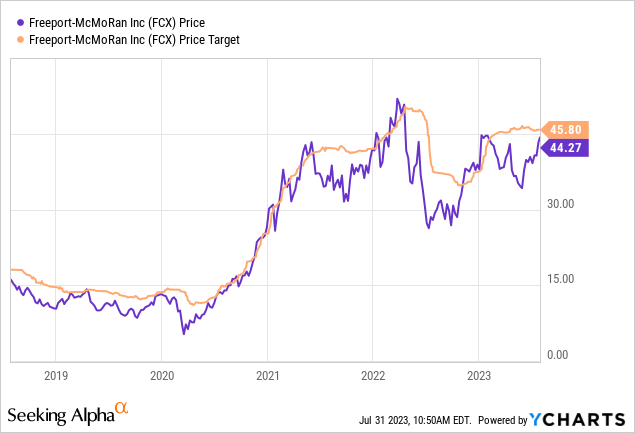

Having said that, FCX is currently trading a dollar below its $45 consensus price target, which shows that analysts aren’t yet willing to bet on a copper recovery, which is often the case.

Looking at the chart below, we see that analysts are always late to the party. They tend to hike their targets after rallies and cut after stock price corrections.

Having said that, I’m giving FCX a bullish target to reflect that I expect commodities to run hot if economic growth bottoms, further amplified by supply issues.

However, buyers need to be aware that FCX is 71% above its 52-week low and up 17% over the past four weeks.

This isn’t a deep-value buying opportunity.

If I were in the market for more cyclical exposure, I would start buying small and add to my position on potential corrections.

Takeaway

My bullish stance on Freeport-McMoRan is rooted in the robust demand for copper driven by the energy transition and strong growth in emerging markets.

While the global economy faces challenges, commodities like copper and oil remain resilient, indicating the potential for further price increases if economic growth indicators bottom.

FCX is well-positioned to capitalize on these tailwinds with its solid production capabilities and expansion plans.

Shareholders stand to benefit as FCX maintains a strong balance sheet and has the potential to boost free cash flow, leading to increased dividends and aggressive buybacks.

However, potential investors should be cautious, considering FCX’s recent price gains.

To capitalize on cyclical exposure, starting with small investments and adding to positions during corrections may be a prudent strategy.

Overall, I expect commodities to heat up as economic growth bottoms and supply constraints persist, potentially driving further gains for FCX shareholders.

Read the full article here