Investment Thesis

In the previous article on B. Riley Financial (NASDAQ:RILY), I arrived at a cautious ‘Hold’ rating for the controversial California-based investment bank, balancing several dynamics at play: the cyclicality of the company’s core operations, speculative-grade investment portfolio, and reputational risks associated with its focus on financially-distressed businesses. These concerns were counterbalanced by RILY’s historical outperformance, management’s unwavering commitment to shareholder returns, and its notably low valuation.

However, recent developments, including RILY’s stock rally in the past few weeks, have prompted me to revisit this middle-of-the-road stance. The valuation hypothesis that backed the ‘Hold’ rating in the previous piece no longer appears valid. Furthermore, a deeper dive into the performance of the non-core operations suggests they might not be living up to expectations, prompting a fresh evaluation of the company’s overall outlook.

Last week’s decision to raise capital through a new equity offering while simultaneously paying dividends highlights an unconventional capital allocation policy that either signals an unsustainable dividend policy or a struggle with high leverage.

In the previous article, I offered a comprehensive overview of RILY’s operating segments, honing in on revenue drivers and trends. However, despite this thorough review, there needed to be more discussion of RILY’s assets underpinning their revenue drivers. Moreover, RILY reports $6.6 billion in total assets, creating an image of a robust scale that implies opportunities to leverage its size for more revenue and market share. However, upon closer examination, this perception seems misleading.

This piece attempts to rectify this drawback, offering a comprehensive overview of RILY’s asset accounts, from the largest to the smallest.

Big Asset, Tiny Returns

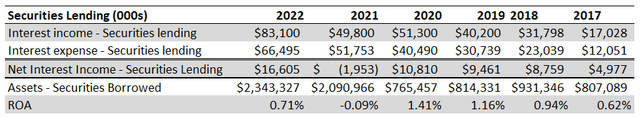

Nearly half of RILY’s $6.6 billion assets fall under the ‘Securities Borrowed’ account. Assets under this account constitute the shares RILY borrows from various financial institutions to support its securities lending operations. For example, if a customer wants to borrow a share for a short position, RILY will procure this stock from another entity before lending it to its customer.

The Securities Lending operations and the corresponding ~3 billion in assets on RILY’s balance sheet have some key characteristics that undermine their value.

Collateralization: RILY maintains a ‘matched book’ ledger to facilitate its securities lending operations while neutralizing exposure to market fluctuations. Assets under the ‘Securities Borrowed’ are collateral to liabilities under the ‘Securities Loaned’ account. Thus, the ~$3 billion assets under the ‘Securities Borrowed’ account is NOT freely available for alternative uses as they’re tied to corresponding liabilities as collateral.

Narrow Margins: For Q1 2023, the revenue from securities lending rounded to an impressive $37.2 million. This is the money that RILY collects from its customers for its securities lending service. However, after accounting for the interest expense to original securities owners, a mere $4.8 million remains as the gross margin. Thus, while RILY reports a robust balance sheet, with Total Assets exceeding $6.6 million, nearly half of this balance is related to low-margined securities-lending and brokerage operations.

Author’s estimates based on RILY’s filings

Limited Indicator of Creditworthiness: This ‘matched book’ structure reduces its relevance as a measure of RILY’s creditworthiness. It’s similar to a brokerage firm permitting its retail investors to engage in margin trading without conducting a credit check. The activity is collateralized, with a balance between assets and liabilities.

These little nuggets of information provide a reality check to the initial awe inspired by the massive scale of RILY’s assets.

The Broken Promise of Extraordinary Returns

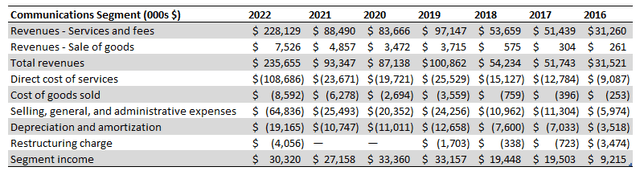

RILY has undertaken a diversification strategy, branching into diverse sectors, from dial-up internet, laptop accessories, and most recently, European Fashion, with the acquisition of Scotch & Soda in May.

This strategy has been marketed to investors as a pathway toward extraordinary returns. For example, commenting on the BR Brands acquisition, RILY stated that it has:

established a brand investment portfolio which aligns with the Company’s strategy of pursuing strong free cash flow investment opportunities to generate accretive recurring revenue for the B. Riley platform.

This pitch suggests that these acquisitions, despite operating in sectors riddled with technological challenges and competitive pressures, can yield significant returns on invested capital. On the surface, this narrative seems appealing, with the image of RILY unearthing discarded assets that are, in fact, valuable gems that promise high returns on invested capital.

However, a closer look at the financial outcomes unveils a contrasting narrative. The company’s diversification efforts, which began with the acquisition of United Online ‘UOL’ in 2016 to the most recent acquisitions, including Targus and Scotch & Soda, generated an EBIT of $220 million. When taking into account interest and tax expense, this total barely offsets the $170 million outlay solely for the United Online acquisition in 2016, not to mention the remaining acquisitions, which in total, amount to more than $830 million, most of which is recorded on the balance sheet as Goodwill and Intangibles, representing 14% of RILY’s total assets.

Author’s estimates based on company filings

Below is a list of some of RILY’s non-core acquisitions, listed along with aggregate acquisition value.

| Target Company | Date | Total Aggregate Value (millions) |

| UOL | Jul-16 | $ 170.0 |

| magicJack VocalTec | Nov-17 | $ 143.5 |

| BR Brands | Oct-19 | $ 116.5 |

| Lingo* | Nov-20 | $ 74.0* |

| Marconi Wireless* | Oct-21 | $ 25.0* |

| Bullseye* | Aug-22 | $ 64.9* |

| Targus | Oct-22 | $ 247.5 |

*Author’s estimates. The Lingo acquisition deal includes additional 200,000 share warrants with a strike price of $26.24 per share, exercisable at various dates.

28% of Total Assets in the Balance

RILY has historically demonstrated a concentrated focus on distressed companies within its investment portfolio, a strategy that has been a cause of concern for many investors. It maintains an inherently high-risk, high-reward portfolio, mandating rigorous scrutiny and appetite for risk.

Unfortunately, RILY operates with a certain level of opacity, keeping public disclosures to a minimum. This amplifies the risk for those attracted to the high-risk, high-reward opportunities it offers.

A case point of RILY’s lack of transparency is its 2014 reverse merger with Great American Group, which brought it to the public markets. Investors were offered only a fleeting glance at RILY’s past, with just a single year’s worth of historical data featured in the prospectus, while typical mergers often include multiple years of performance history. Despite its existence since 1996, I wasn’t able to pin down public records of RILY prior to its merger. This opacity extends to RILY’s investment portfolio.

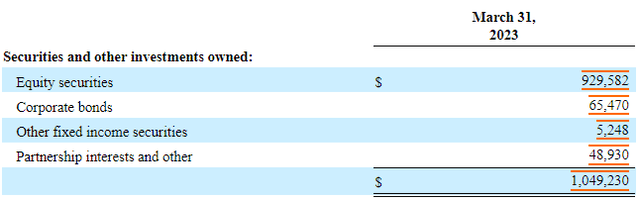

Notwithstanding this obscurity, we can gain some insight into RILY’s investment portfolio from its balance sheet, which shows its portfolio structured around two main accounts.

- Securities and Other Investments Owned: $1.05 billion (15% of total assets)

- Loans Receivables: $0.77 billion (11.5% of total assets)

Securities and Other Investments Owned

The ‘Securities Owned’ account consists of stakes in various asset classes, including publicly-traded stocks, private equity, private debt, corporate loans, and others.

RILY

There isn’t a complete record of RILY’s investment portfolio. The only accessible record is a partial one, found in the Form 13-F filings, which, while helpful, falls short of being comprehensive. This disclosure represents only 38% of the assets under the ‘Securities Owned’ account, allowing us to identify $382 million out of the $1.05 billion reported on the balance sheet statement. Included in this incomplete list are investments in 46 companies, including several SPACs in which RILY is either leading or acting as a book-runner. Below is a list of the top twenty of these 46 companies, which together represent 99% of the $382 million grand total on the 13-F form.

| Company | Value | Ticker | Quant Rating | SA Analysts |

| Babcock & Wilcox Enterprises | $ 165,369,152 | (BW) | SELL | HOLD |

| Alta Equipment Group | $ 95,112,094 | (ALTG) | BUY | — |

| DoubleDown Interactive | $ 30,820,978 | (DDI) | HOLD | — |

| The Arena Group Holdings | $ 19,519,370 | (AREN) | SELL | — |

| Synchronoss Technologies | $ 11,355,669 | (SNCR) | SELL | — |

| Perpetua Resources | $ 7,987,750 | (PPTA) | HOLD | — |

| TransAct Technologies | $ 6,887,198 | (TACT) | STRONG BUY | — |

| B Riley Prin 250 Merger Corp* | $ 6,102,000 | — | — | — |

| Lilium N V | $ 5,995,493 | (LILM) | HOLD | HOLD |

| FaZe Holdings | $ 5,080,749 | (FAZE) | — | — |

| Marchex | $ 4,102,218 | (MCHX) | HOLD | — |

| Quantum | $ 3,485,358 | (QMCO) | SELL | — |

| Diversified Healthcare | $ 3,397,032 | (DHC) | HOLD | HOLD |

| Innovate | $ 3,293,151 | (VATE) | — | BUY |

| NextNav | $ 2,239,712 | (NN) | HOLD | — |

| LifeMD | $ 1,567,477 | (LFMD) | HOLD | HOLD |

| AltEnergy Acquisition Corp* | $ 1,555,213 | (AEAE) | — | — |

| Forest Road Acquisition* | $ 1,366,293 | (FRXB) | — | — |

| Journey Medical | $ 1,216,430 | (DERM) | HOLD | — |

| AST SpaceMobile | $ 1,029,482 | (ASTS) | HOLD | BUY |

*Special Purpose Acquisition Company ‘SPAC’

While some of these investments may be a by-product of RILY’s underwriting activities, the substantial stakes in some of these entities suggest a deliberate strategy to hold a sizable market position in these companies. Notable investments include ownership of around 30% of Babcock & Wilcox Enterprises, 21% of The Arena Group Holdings, 18.5% of Alta Equipment Group, 15% of FaZe Holdings, 14% in Synchronoss Technologies, in addition to stakes ranging between 3 – 11% in several other entities.

Although ‘Securities and Other Investments’ account for only 15% of total assets, fluctuations in this account have historically created significant volatility for RILY’s earnings. Most of the companies are rated ‘Hold’ or ‘Sell’ by Seeking Alpha Quant System, indicating a cautious outlook, with coverage by analysts being notably limited.

Loans Receivables: Strategic Loans

RILY’s loan strategy isn’t just about high yields from financially struggling companies. It’s more sophisticated. RILY guides these debt-ridden firms toward issuing new equity to repay loans. In doing so, and by stepping in as an underwriter, RILY isn’t just getting its loan money back but also pocketing underwriting fees as well.

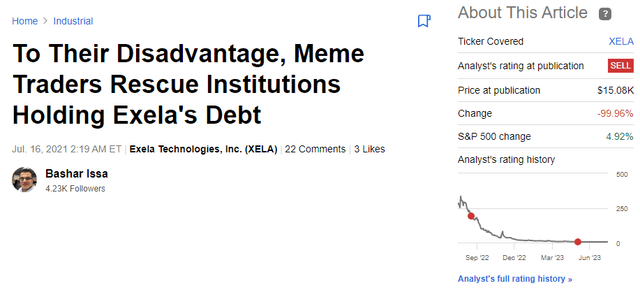

Reflecting back three years ago, I recall writing an article about Exela (XELA), warning common equity holders about dilution risk and what I believe is an elaborate scheme by management to stick its robust debt bill to common equity holders.

Seeking Alpha

At the time, RILY was a small company, and I didn’t put too much thought into its equity underwriter or lenders. All I knew was that XELA amassed huge debt in the back offices of investment bankers slicing and dicing the company before dumping it to the public market through a SPAC deal. Now, with hindsight, I see the bigger picture and realize that XELA wasn’t a one-off incident. It was part of RILY’s strategic business model to provide bridge loans to financially stressed companies before passing the debt to another investor, in this case, equity investors, which has, as predicted, significantly diluted shares.

A similar scenario played out with Greenidge Generation Holdings Inc. (GREE). In March 2022, RILY extended a $26 million promissory note to GREE, secured by a mortgage lien on GREE real estate properties. Despite facing repayment difficulties, GREE was obligated through an amended loan agreement to use 65% of any equity proceeds towards clearing RILY’s debt. At the same time, RILY, acting as the underwriter, collected a 4% fee on the proceeds, along with other changes, on top of the interest income on the debt.

Not all deals are the same, but they share a theme of RILY excreting influence and control on troubled businesses. For example, in 2018, instead of seeking debt repayment, RILY converted its loan to Bebe stores to a 30% equity stake. In November 2020, it converted its loans to Lingo into a 40% stake before acquiring an additional 40%. Another example is RILY’s $60 million debt to Harrow Health, which was brought to light by Wolfpack Research earlier this year. It is worth noting that since Wolfpack’s article, Harrow Health has repaid RILY’s debt in full, in addition to interest. Harrow funded RILY’s debt repayment by borrowing from Oaktree Capital Management, the external manager of Oaktree Specialty Lending (OCSL), and Oaktree Strategic Income (OCSI). RILY still has exposure through a 10.9% $100 million credit facility that expires in 2025, which as of the time of this writing, remains undrawn.

These examples shed light on RILY’s strategic maneuvers: providing loan assistance to struggling companies and transitioning into an equity underwriter role by excreting control and enforcing stringent debt covenants. RILY demands accelerated repayment or encourages additional equity offerings in the event of a covenant breach, thus securing an advantageous position. For this reason, while these loans have attracted the most scrutiny, I believe that RILY’s strategy to mitigate risk assuages some of these fears.

As of Q1 2023, RILY’s balance sheet showed $722 million in loan assets, accounting for approximately 11.7% of total assets. A significant portion of this is related to the W.S Badcock 2021 receivables deal, which entailed the purchase of $531 million in W.S Badcock receivables for $400 million, effectively making RILY a creditor to W.S customers. In 2022, RILY purchased an additional $168 million of W.S receivables. As RILY collects these receivables, a portion is recorded as interest income. As of Q1 2023, RILY reported $324 million in loan assets related to W.S. It is worth noting that earlier this year, RILY purchased a controlling interest in Franchise Group, the parent company of W.S Badcock.

Excluding W.S, the loan portfolio currently consists of 14 companies with a total value of $448 million, with an average loan size of $34 million, according to management.

Prepaid Expenses and Other Assets: 7.5% of Total Assets, with SPACs in the Mix.

Yesterday’s rate hike by the Fed and the expected tightening by the European Central Bank, and possibly other parts of the world, signal continued tightening, although it seems we may be nearing the end of this phase, as many pundits agree. Nonetheless, the monetary policy today is stricter than it was in 2021 when the investment banking sector benefited from ultra-accommodative Fed policies.

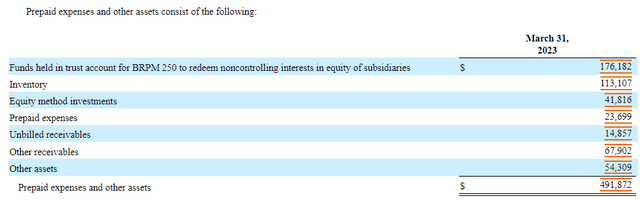

RILY sponsors or serves as the book-runner of several SPACs, many of which have raised capital but are yet to find a target company. The most consequential is B Riley 250 Merger Corp (BRPM), which raised $150 million but has failed to find a target company. Given the controlling interest of RILY in BRPM, its assets are consolidated on the balance sheet under the ‘Prepaid expenses and other assets’ account for Q1 2023 quarterly report as shown below:

RILY

In Q2 2023 quarterly report, the assets of BRPM will be written off from RILY’s balance sheet, given that the deadline for RILY to find a target company has passed. Earlier in May, RILY announced it was redeeming all BRPM shares and paying back $10.15 per share to shareholders. Wolfpack Research tried to cultivate negativity surrounding this matter, asserting that there would be a 176 million decrease in assets in Q2 2023. However, this is only a piece of the bigger picture. As it stands, RILY carries a liability balance of $176 million related to BRPM. Following the redemption of BRPM’s assets, this liability will also be erased, thereby leaving the Net Asset Value “NAV” intact.

RILY is also the bookrunner of multiple SPACs that reached the deadline without finding a target company in Q2 2023. For example, AltEnergy Acquisition Corp, which RILY owns 149,000 shares valued at $1.6 million, passed its deal deadline. AltEnergy will likely redeem RILY’s shares for the exact amount, which will likely be reflected in Q2 or Q3 2023 13-F and the ‘Securities Owned’ account. The same goes for ArrowRoot Acquisition Crop and Deep Medicine Acquisition, in which RILY is both an investor and the bookrunner, assuming no extension for these deadlines.

Other examples include the Anzu Acquisition, whose deadline is on September 30, 2023, and the Forest Road acquisition of December 2023, in which RILY is also the bookrunner and investor.

Leverage

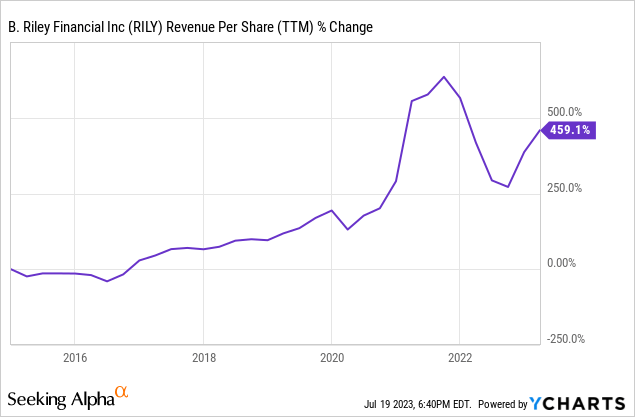

RILY has shown strong historical performance, with its revenue increasing six folds since its IPO. This growth is also reflected in its revenue per-share metrics. However, when we dig deeper, we can’t find clear evidence of organic growth. Take the auction and liquidation business, for example. Since its acquisition in 203, sales have remained relatively within the same range. Instead of driving organic growth, RILY has been boosting its numbers through financial leverage, taking on more debt to fund acquisitions. So, while the company’s finances might look good at first glance, a closer look reveals a different story.

A significant portion of RILY’s debt was invested in risky assets, including industries with narrow economic moat, such as Targus, or enterprises in the declining phase, such as United Online.

RILY’s notes are traded on public exchanges, and their high yield has attracted interest among retail income investors. However, I believe that at this stage, there is some financial risk, given the high-interest burden that currently stands at about $200 million annually.

Playing With Fire: RILY’s Capital Allocation Strategy

Last week, RILY announced that it was raising 115 million through a new equity offering. At the same time, the company also declared a dividend of $1 per share, which would amount to an annual dividend run rate of approximately 120 million or ~$30 million per quarter. These decisions highlight an unusual capital allocation strategy.

On the surface, it appears as if RILY is preparing to fund next year’s dividends through the equity raise, a move that contradicts management’s stated intention of supporting dividends through operations. Yet, even if the leadership succeeds in fulfilling dividend payments through operating cash flow, the capital raise suggests that the team perceives a high level of leverage within the company.

In the face of high leverage, issuing additional shares is a viable solution. Given RILY’s high leverage, the recent decision to raise capital through equity can be interpreted in two ways. It could either signify that the company’s dividend policy is unsustainable or that the company is contending with high leverage.

How I Might Be Wrong

In the most recent reporting periods, RILY recorded losses on its investments. The primary driver was a challenging macroeconomic environment. However, since the latest reporting period through the quarter ended June 2023, many of RILY’s equity portfolio has rebounded, along with the broader market.

For example, RILY’s holdings in Lilium NV, which has been an underperformer in 2022, and Q1 2023, nearly tripled in value in Q2 2023, adding $10 million in capital gains. Similarly, LifeMD shares more than doubled in Q2, adding $2.5 million in capital gains in the period (assuming RILY hasn’t changed number of shares held).

Thus, investors should expect a positive contribution from investments when RILY reports its Q2 results in the coming weeks. More importantly, these dynamics show the complexity of assigning a consistent valuation to RILY, undermining the Sell rating in this analysis.

Summary

Over the past few weeks, I’ve been examining RILY from various angles, diving into the intricate and complex layers of its financial performance and asset quality. The company’s diversification strategy, which promises a high return pathway, hasn’t quite lived up to expectations. For example, the EBIT from RILY’s nearly $1 billion worth of acquisitions in the Communications and Brands segment barely covers the initial 2016 capital outlay for United Online alone. Return ratios fall deeper in the red when adding interest expense on the debt funding these acquisitions.

While RILY’s revenue growth is impressive, shooting up sixfold since its IPO, a closer look shows that this growth is predominantly fuelled by financial leverage and acquisitions rather than organic business expansion.

The company’s recent equity raise suggests that either RILY has reached its peak leverage, with the company now is now looking into the equity market to restore the balance on its sheet, or that its dividend policy is unsustainable.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here