Rapid Recall

This is what I said in my previous Arista Networks (NYSE:ANET) analysis, titled Adapting To Changing AI Infrastructure Demand:

[…] Last year, cloud titan customers were pulling forward significant spending. It’s only logical that they moderate their spending and take some time to digest some of their investments. This doesn’t mean the story ends here for Arista, it’s more the case that there’s a bump in the road.[…] The bearish concern is that Arista Networks’ guidance for the upcoming quarter is not aligned with the current high demand for AI infrastructure in the market. More specifically, Arista is experiencing slowing revenue growth rates and lower gross margins.

Indeed, Arista’s cloud titan customers are reducing their spending after a significant increase in the previous year and are now normalizing their revenue growth rates.

All that being said, I argue that Arista Networks, Inc. is very well-positioned for high-demand low latency networking. Furthermore, I believe that paying around 28x forward EPS for Arista is a very fair price.

Essentially, the stock is rallying premarket due to the combination of its cheap valuation plus the fact that demand for Aritsta’s switches isn’t slowing down quite as much as the market had expected.

My views on ANET have been unwavering bullish. I believe that investors are unfairly punishing this stock on the presumption that next year’s growth rates could be in the low single digits.

Why Arista Networks? Why Now?

Arista Networks is a cloud networking solutions company that’s focused on high-speed data transmission. Arista supplies high-performance network switches to cloud giants, hyperscalers, and other cloud computing environments.

Arista Network’s earnings calls are always well-managed and this one was no different. The earnings call had plenty of quotable passages. Here’s one:

Our AI strategy and platforms are resonating well with our early customers. Presently, in tech 2023, we are in the middle of trials for back-end AI networks, leading to pilots in 2024. We expect larger clusters and production deployments in 2025 and beyond.

Simply put, this is the message that investors want to hear. That AI is a focal point for Arista and Arista is running trials that will lead to further AI revenue exposure in 2024 and beyond.

Beyond its compelling narrative, there’s ample to get excited by the Arista’s improved outlook too.

Arista’s Upwards Revised Outlook, A Peak into 2024?

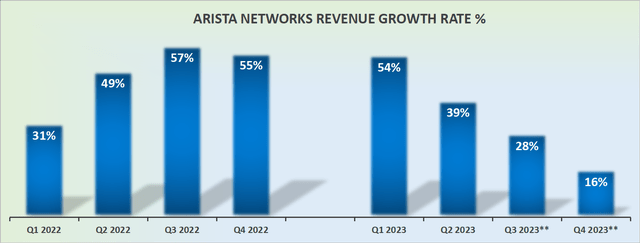

ANET revenue growth rates

The graphic above is a reminder of the challenging hurdle that Arista is up against in H2 2023. Last year’s H2 was sizzling strong, so comparisons this time around were always going to be strenuous.

However, we are now just 5 months from the end of 2023, and Arista felt confident enough with its near-term prospects and visibility to provide some informal Q4 2023 guidance.

The informal guidance points to approximately 16% CAGR. What’s more, I imagine that when Q4 ultimately reports, we could see Arista’s revenues growing by somewhere close to 18% and possibly even 20% CAGR.

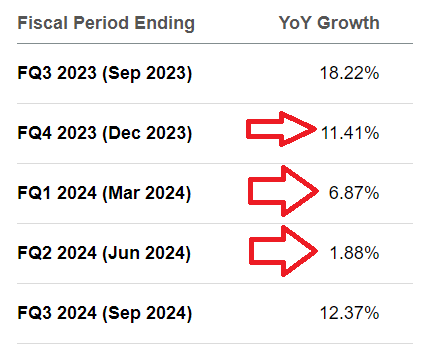

Nevertheless, even if we simply take this more measured and conservative outlook of 16% CAGR, this is still meaningfully higher than what analysts had expected for Arista going into this earnings report:

SA Premium

The implications here are significant. If Q4 2023 could be counted on to grow at around 16% CAGR, against what are very tough comparables, I am naturally drawn to question just how accurate are analysts’ consensus revenue estimates for H1 2024?

To put it concretely, is truly likely that Arista only grows by mid-single digits in H1 2024 as analysts presently expect?

Or is it a more likely scenario that in the upcoming few months, if not sooner, we’ll be seeing analysts delivering bullish reports and upwards revising these revenue estimates? I believe that we’ll be seeing analysts upwards revising their targets, with perhaps positive tidbits starting to surface in the coming hours.

Further Good News, Gross Margins

Services and subscription software contributed 15.2% of revenue, up from 14.9% in Q1.

Given Arista Network’s increased exposure to its Service segment, which carried 79% GAAP gross margins in the quarter, we are seeing these high Service margins being reflected in Arista’s overall higher gross margin profile.

Not only did Arista’s non-GAAP gross expand from 60.3% in Q1 2023 to 61.3% in Q2 2023, but the outlook for Q3 2023 points towards further expansion at 62% non-GAAP gross margins.

For investors, the fact that Arista is delivering improved revenue guidance, together with improved profit margins is just terrific news. Particularly when its stock is not egregiously priced.

Given Arista’s newly updated guidance, I suspect that Arista is priced around 30x this year’s EPS. And given that we are now inching close to the end of 2023, it makes more sense to start to consider 2024’s EPS.

If we were to assume that on the back of Arista’s improved gross margins, together with some sparing buybacks, Arista’s EPS next year could grow by around 11% CAGR, it’s quite possible for Arista to report higher than $6.55 in EPS in 2024.

This leaves the stock today, including the whopping premarket jump, at 27x next year’s EPS. A figure that believe is still an attractive entry point.

The Bottom Line

In my previous analysis of Arista Networks, titled “Adapting To Changing AI Infrastructure Demand,” I discussed the company’s performance and outlook.

The cloud titan customers had significantly increased their spending last year, but now they are moderating their investments, leading to a bump in the road for Arista.

Some bearish concerns revolve around slowing revenue growth rates and lower gross margins. However, I maintain a bullish view on ANET, as it is well-positioned for high-demand low latency networking.

Arista has provided an improved outlook, with informal Q4 2023 guidance pointing to approximately 16% CAGR. The higher exposure to the Service segment is positively impacting the company’s gross margins, with further expansion expected in Q3 2023.

Given the improved revenue guidance and profit margins, I believe the stock is attractively priced at around 27x next year’s EPS, making ANET an appealing entry point even now.

Read the full article here