Summary

Readers may find my previous coverage via this link. My previous rating was a buy as I believed Vivendi (OTCPK:VIVHY) share price did not reflect the business fundamentals intrinsic value due to the pending corporate actions. I am reiterating my buy as I expect the overhang stemmed from any pending corporate actions to ease. The share price is also trading at an attractive level based on my DCF model, which suggests a 44% upside.

Financials / Valuation

1H23 revenues for VIVHY came in at €4.7 billion, just ahead of consensus thanks to strong performance from Canal+ and organic growth at Havas. VIVHY’s organic growth jumped from 2% to 4.3% in 2Q23, with the help of Havas and Canal+. Growth for Canal+ was 4.3%, up from 2% in 1Q23, with international expanding by 2.2%, mainland France by 1.7%, and Studio Canal by a whopping 22%. Media buying was a major factor in the 7% increase in Havas’ net revenues. The company’s EBITA as a whole, at €379 million, was also slightly above consensus, thanks largely to increased profits at Canal+ and Villages.

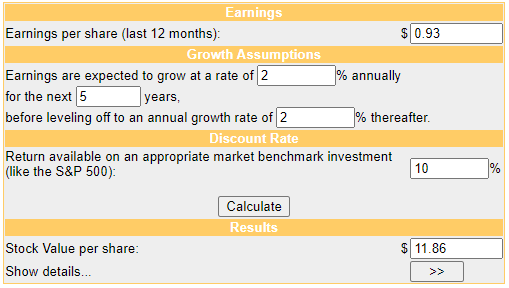

For my valuation model, I aim to show how undervalued the stock is at current levels. Assuming VIVHY only grows at the long-term inflation rate of 2% into perpetuity and at a discount rate of 10%, the stock is worth €11.86, which is around 44% upside.

However, based on my view of the business, VIVHY should be able to grow more than that easily, as seen in the latest results, where organic growth accelerates to mid-single digits. Hence, the upside could far exceed the 44% based on my DCF model.

Moneychimp

Comments

The impending corporate actions are, as I’ve said before, the biggest cloud over VIVHY. Recall that VIVHY has a deal with Lagardere and it needed the approval from the EC, which was contingent on 2 conditions: the sale of 100% share in Editis (VIVHY signed agreement already) and the full sale of Gala magazine. The positive update here is that Prisma Media announced a few days ago that it had entered into a put option agreement with Groupe Figaro for the full sale of the Gala magazine. Despite the ongoing investigation by the EC, management remains confident that these deals will be closed by the end of October 2023. Given that shareholders now have one less thing to fret about, I think this is a huge step toward unlocking the value of VIVHY’s share price.

Aside corporate actions, I like to comment a little more on Canal+ (VIVHY largest profit segment). Pay TV in France grew 1.7% year over year, International grew 1.2% year over year, and StudioCanal grew a whopping 16% year over year, all of which were better than I had anticipated. With management’s renewed emphasis on global expansion highlighted by the recently acquired minority stakes in ViaPlay and Viu and the increased stake in MultiChoice, I expect growth to maintain its positive momentum and possibly even accelerate.

On the other hand, I thought there was a cloud over the company before the news of the VAT increase. It was encouraging to hear that management is in talks with the French tax authorities to find a way to offset any negative effects of a VAT increase (ie having a mix of rates, rather than the full 20%).

Organic growth in the mid-single digit range, up 4.2% in 1H23, for Havas, VIVHY’s second largest profit segment, was also much stronger than I expected. It’s worth noting that robust commercial momentum in health communications and media was a key factor in this expansion. While management acknowledged that it was unlikely that 2Q23’s rapid expansion would be repeated in 2H23, I remained confident that Havas would maintain a healthy rate of growth and saw no significant obstacles to this.

Conclusion

I am reiterating my rating for VIVHY as a buy. The pending corporate actions that were previously a concern seem to be easing, with positive developments in the approval process. The financial results for 1H23 show strong performance, particularly in Canal+ and Havas, with organic growth exceeding expectations. My valuation model suggests a 44% upside, but I believe the actual upside could be even higher due to the company’s potential for further growth.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here