India The New Growth Powerhouse

India is expected to have its moment where it becomes one of the main growth engines of the global economy. India’s rise is because of the following factors; India now has the world’s largest population, many OECD countries are curtailing economic ties with China because of political factors, and economic reasons created by the pandemic. Lastly, they are a democracy like many OECD nations and likely possesses less political risk than China. These factors combine to create an environment for India’s economy to thrive for many years to come.

SMIN – A Great Way To Capture India’s Growth

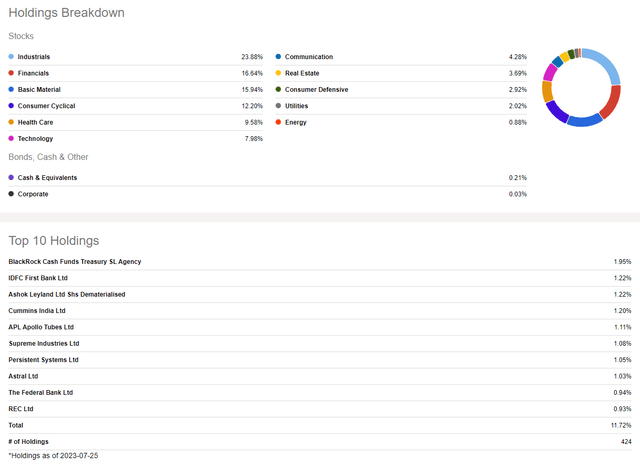

The iShares MSCI India Small-Cap ETF (BATS:SMIN) is an ETF focused on India’s small-cap stocks. The fund has over 400 holdings with no single holding having a weight of 2% or higher. The prospectus states no sector can have a weight above 25%.

Holdings Breakdown (Seeking Alpha)

As you can see, the top 10 holdings make up just under 12% of the total ETF. We see concentration by sector and I believe the sector concentration is favorable for where India is on the growth cycle.

For starters technology makes up less than 8% of the fund. You may think that means the fund is poised to miss out on growth, but this is unlikely. The United States is a highly developed economy. This means solutions and growth come from increases in productivity, which likely are from some sort of technological advance. Growth in the U.S. is usually found in the tech sector. India is in a position to become a key cog of the global economy, so we want high exposure to industrials and basic materials.

Potential Returns

India’s GDP is approximately $3.3 trillion and ranks as the 6th largest in the world. By 2030, it is expected to exceed $10 trillion and be the world’s 3rd largest economy.

A big part of the investment thesis requires India to follow in China’s footsteps. If you had invested in the Shanghai Composite at the start of the new year in January 1997 and sold at the end of the year in 2007, you would have averaged an annual return of just under 19%. Likewise, if India’s GDP grows from 3.3 trillion to 10 trillion and stocks move in conjunction, the CAGR is 17.16%.

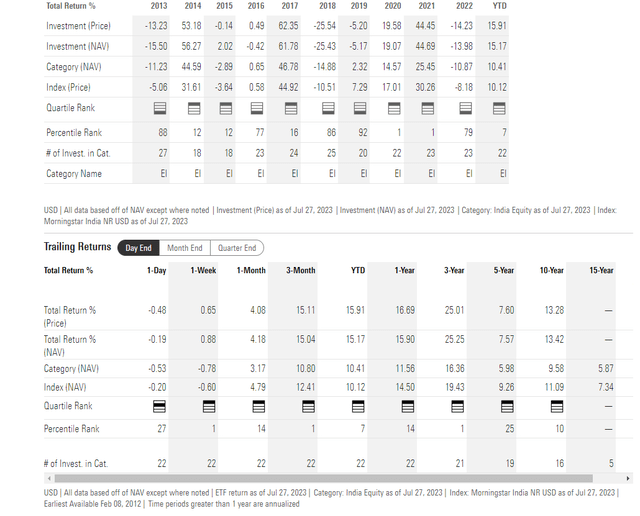

If investing in India produces long-term returns at that level, it will be very hard to do poorly, and doing better could make it the investment of your lifetime. That is part of what makes SMIN so appealing. According to Morningstar, SMIN has outperformed India’s index over the long term. This means if the best is yet to come, SMIN is the most likely ETF to produce the best returns.

SMIN Performance (MorningStar)

Now you might be thinking a technology focused fund would provide better returns. The reason this fund and other funds that focus on these tangible “old school” sectors are likely to be a superior investment is because of where the growth will be. On the technology front, Indian tech companies will have to compete with American big tech and because India is a poorer country, the potential pot is smaller. For example, In India the potential customer base for the iPhone is 3x America’s population, they cannot or will not pay $1000 USD for the newest iPhone. On the flip side, they will need a lot of concrete, steel and other necessities to build all the things that come with modern day life and the shortcuts available are quite limited. One recent example is how India built over 100 million toilets to address a chronic toilet shortage in the country.

According to IMD’s competitiveness rankings India’s infrastructure very poor. Their 2022 infrastructure ranking was 49th in the world out of 63. For perspective, the United States ranked 7th and the top 3 nations were Switzerland, Denmark and Sweden, respectively. Romania ranked 48th and Bulgaria Ranked 51st. Over the rest of this decade, there will be significant spending on upgrading, maintain and creating infrastructure. For the current fiscal year, India has unveiled a budget where they will spend ~$126 billion USD on infrastructure. With a pot of money that big, there is plenty of opportunity for small businesses across India and that may be one of the main reasons SMIN is up almost 16% YTD.

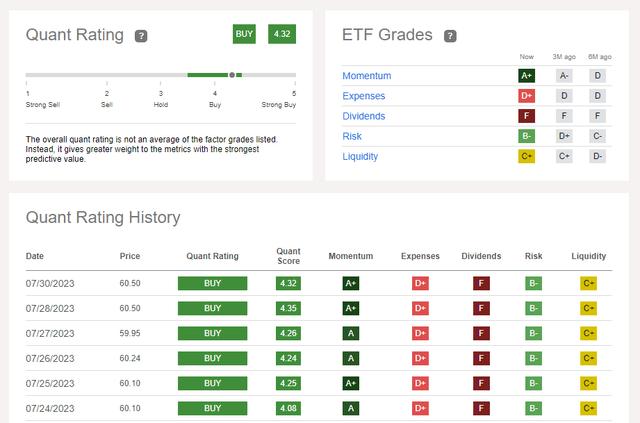

Seeking Alpha’s Quant Ratings

Seeking Alpha’s propriety rating system also shares my opinion that SMIN is a buy.

Quant Rating (Seeking Alpha)

As the image states the quant rating is weighted and we see a few things. The first is that the momentum grade has been maxed out. This means the Quant rating could stall out and not reach the strong buy category. In the past when SMIN had a strong buy rating the momentum rating was an A+ and the dividend grade was a C or higher. The dividend has declined dramatically from prior years and likely indicates the 400+ constituents have cut their dividends, likely as a result of the pandemic.

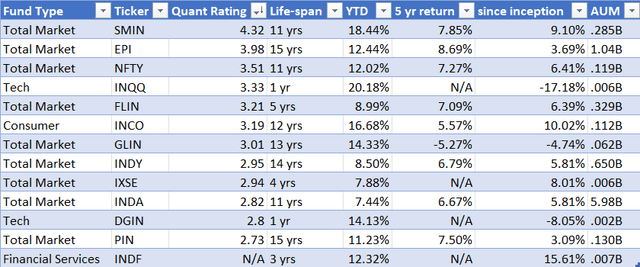

Alternative India ETFs

A look at the ETF universe for India ETFs show the pickings are rather slim. For starters there are a total of 14 ETFs that are focused exclusively on India. One of them is a leveraged ETF and a few are sector specific ETFs. Of the remaining 13 ETFs, 8 have AUM of over 100 mil, and only 3 ETFs have a Seeking Alpha buy rating with SMIN having the highest.

India ETF comparison – sorted by Quant Rating (Seeking Alpha & MorningStar)

As you can see in the chart above SMIN is a top 3 finisher in each return category. The only total market fund that beat SMIN in the 5 year time period is EPI by less than 1%. YTD and since inception SMIN soundly beat EPI. The two Tech ETFs are also extremely new which makes it difficult to gauge their quality and return potential.

Risks – Political Quirks

There are two political forces investors need to be aware of; 1st India’s government is based on a parliamentary system with 6 political parties. There are two political parties that regularly compete for power on the national level; the BJP and INC, while at the regional level, the political party in power may be unrelated. Parliamentary politics is infamous for having elections where no one has a majority and a coalition government cannot take shape. Recent examples of this are in Israel and Belgium. The 2nd political force in India is religion. India has a large Muslim minority population and a Hindu majority population. The complex history and differences in religious beliefs have led to incidents of unrest. The Muslim population is approximately 15% of India, and India is home to the 3rd largest population of Muslims in the world. Potential for unrest can come in many forms, such as internal actors, foreign actors, and it can also be caused by government policy, such as the complex situation involving the region of Kashmir.

Overall, these elements have a short-term risk of harming investments, but I doubt they hold any long-term risk to India’s growth story, meaning any flare-ups in unrest will probably present excellent investment opportunities.

Conclusion

India is poised to grow over the coming decade, and SMIN is quite possibly the best ETF available to profit from India’s expected growth. India’s need for infrastructure is likely to provide excellent opportunities for India’s small caps, and that will allow SMIN to be the best India ETF for the long term.

Read the full article here