“The drivers of inflation are changing… Domestic price pressures, including from rising wages and still robust profit margins,” are increasingly important: ECB’s Lagarde.

Energy prices have plunged from the peak a year ago, and red-hot food inflation backed off though it remains high, and inflation in some other goods backed off, but inflation in services spiked to a record in the 20 countries that use the euro.

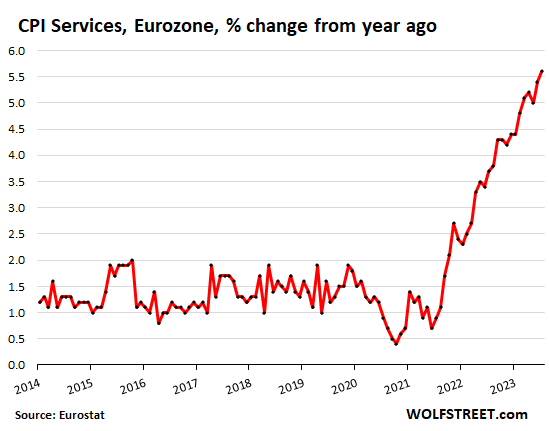

The CPI for services spiked by 5.6% in July, compared to a year ago, up from 5.4% in June and 5.0% in May, another record in the data going back to 1997, according to Eurostat today. And another bad inflation surprise after pundits, following the brief dip in May, had proclaimed the peak of services CPI.

Services are huge. It’s where consumers spend the majority of their money. Many services are essential to modern life, such as housing and related services, healthcare, insurance, broadband and telecommunications, auto repairs, air fares, haircuts, etc. Inflation is notoriously hard to eradicate from services.

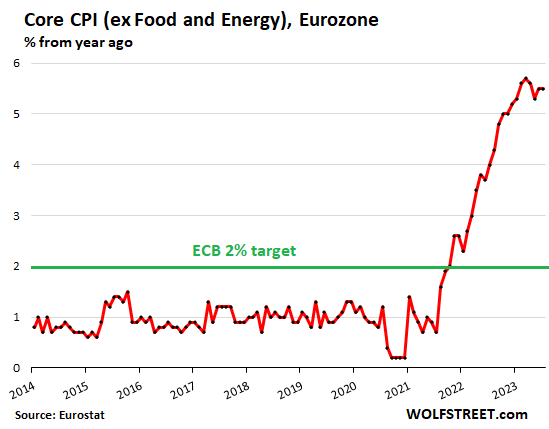

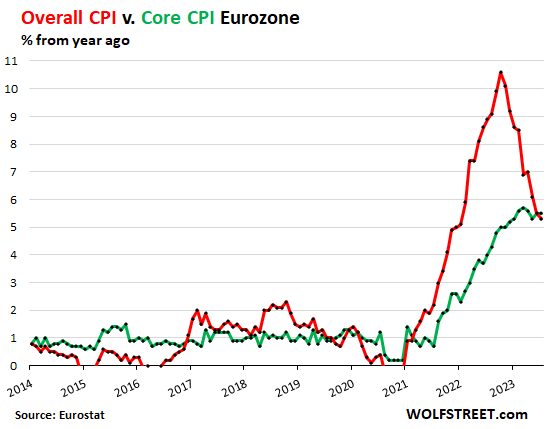

“Core” CPI (without food and energy products that consumers buy) remained at 5.5% in July, same as in June, and up from 5.3% in May. Core CPI had ended last year at 5.2%. And this year, it has gotten worse and stayed worse. But after that dip in May to 5.3%, pundits had come out in force and had proclaimed that core CPI was on the way down.

Core CPI is a sign that underlying inflation, now driven by inflation in services, has turned into a relentless headache.

The ECB’s inflation target is 2% pegged on core CPI. So not any progress here in returning inflation back to target:

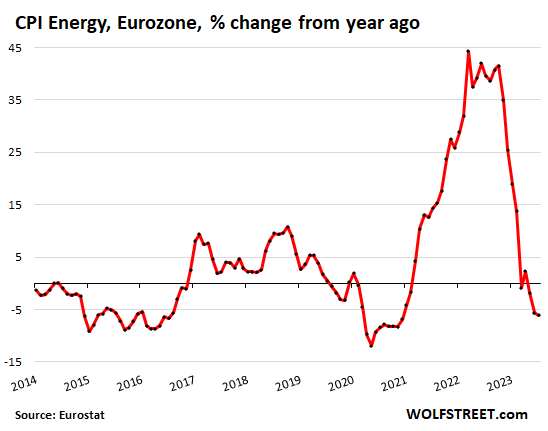

Energy Prices have plunged from the peak last year when the CPI for energy had spiked by 45% year-over-year, and then stayed in that range from March through October 2022. But starting in November, the index has plunged.

In July, the index was down by 6.1% from a year ago. This plunge in energy prices was the big driver behind the much-hyped cooling of the overall CPI. The index includes the energy components that consumers buy: gasoline, diesel, natural gas piped to the home, electricity, heating oil, etc.:

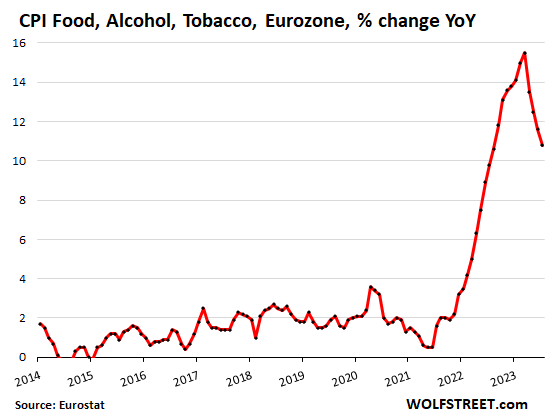

Red-hot food inflation is cooling. The CPI for food, alcohol, and tobacco rose 10.8% in July compared to a year ago. While this is still a dizzying amount of inflation in goods that consumers buy on a daily basis, it has backed off from 15.5% at the peak in March and is going in the right direction:

Overall CPI, driven by the plunge in energy prices, has been cooling off for months. In July, the annual inflation rate, at 5.3%, was down by half from the food-and-energy-driven peak in October 2022 of 10.6%.

So in July, overall CPI (red line) dropped below core CPI (green line). Core CPI represents underlying inflation, and it’s near its all-time high, while overall CPI was pushed down by the year-over-year plunge in energy costs.

But energy prices aren’t plunging forever. On a month-to-month basis, some have already risen, including gasoline. So the days are numbered before energy prices start pushing up overall CPI again.

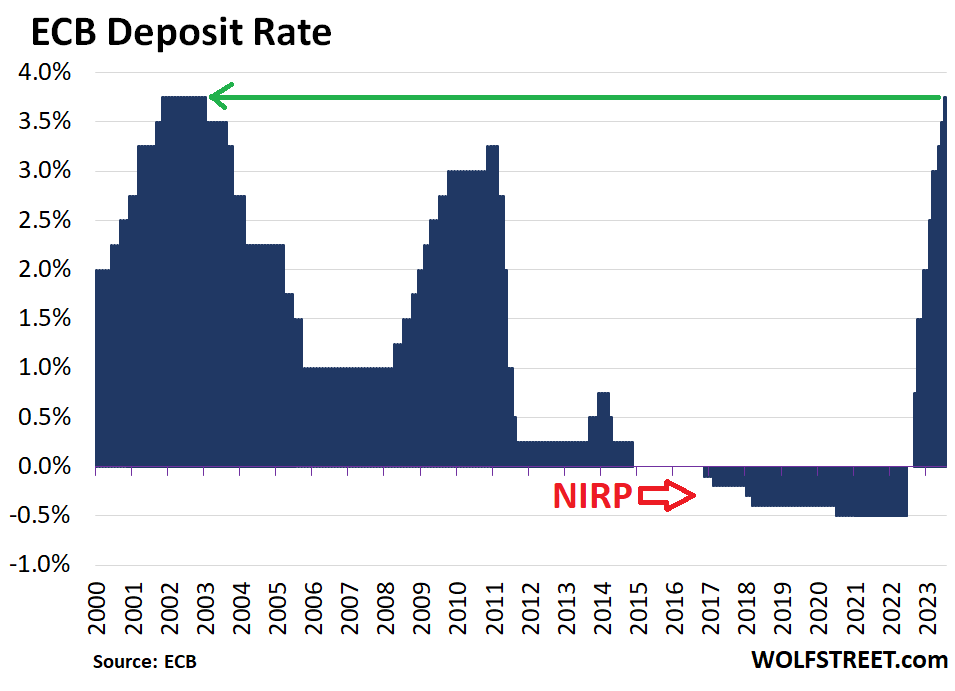

The ECB is fretting about this inflation in services. And it has tightened its ultra-loose monetary policies.

Via its QT, it has shed over €1.6 trillion in assets from its balance sheet, over double the rate of the Fed’s QT.

And it hiked its policy rates by 425 basis points since July 2022, when the deposit rate was still negative (-0.5%), well behind the Fed’s 525 basis points in hikes.

When it hiked by 25 basis points last week on July 27, lifting its deposit rate to 3.75%, the highest since 2002, the ECB said that “underlying inflation remains high overall.” So that “underlying inflation” is captured by core CPI and services CPI. In its press releases, the ECB has started to specifically emphasize services inflation, which has become a relentless headache due to its link to wages.

At the post-meeting press conference, ECB president Cristine Lagarde added:

“The drivers of inflation are changing. External sources of inflation are easing. By contrast, domestic price pressures, including from rising wages and still robust profit margins, are becoming an increasingly important driver of inflation.”

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here